In March 2024, in an interview with the Financial Times, CEO of British American Tobacco, Tadeu Marroco, denied the idea of relocating the company's listing from London to New York, calling it a "distraction." Prior to this, the top ten shareholders pushing for this change had already divested their holdings in the tobacco company."

Maroko told the Financial Times that changing the listing venue would cause a lot of disruption internally, and he does not believe that any benefits it would bring can outweigh these negative impacts. He also added that there are "many other things" he needs to focus on, including revenue in the United States and new products.

His deliberate mention of the American market in his speech has led some industry observers to speculate that PMI's HNB product IQOS has already begun trial sales in the US this year. With their longtime competitor's entry into the market imminent, what steps will British American Tobacco take in the US? 2FIRSTS has been closely following the capital markets and the latest developments of the company, in an attempt to uncover any clues.

Capital market: Continuously favored by institutional investors.

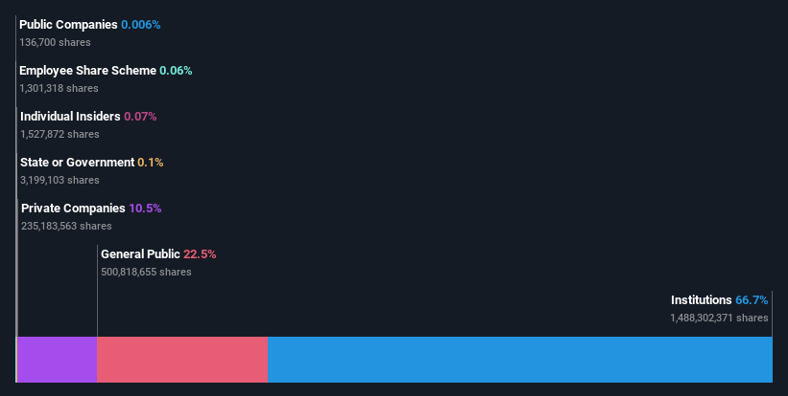

In the past year, the stock price of British American Tobacco (LON.BATS) has fallen by around 21%, dropping from 2872.00GBX (pence) on March 19, 2023 to 2376.00GBX (pence) on March 19, 2024. However, as of now, the top 15 shareholders of British American Tobacco still hold 50% of the company's shares, and there have been significant insider purchases since March.

According to publicly disclosed information, hedge funds do not hold a significant amount of British American Tobacco stocks. Capital Research and Management Company is currently the largest shareholder, holding 14% of the issued shares. The second largest shareholder holds approximately 10% of the outstanding shares, while the third largest shareholder holds 8.6%.

A large stake in British American Tobacco Company means that these institutions have a significant influence on the company's stock price. These organizations investing in the company are usually placing a huge vote of confidence in the company's future. Despite a downturn in stock prices over the past year, it is clear that institutions generally have a positive outlook on the company's future performance.

The delicate relationship between PMI and the tobacco industry: Is there a thawing of tensions or an ongoing battle?

In the opening days of 2024, a major news story in the tobacco industry was the settlement of patent disputes between PMI and BAT in the field of heated tobacco products. On February 2nd, both companies announced on their official websites that they had resolved intellectual property disputes regarding heated tobacco and e-cigarette products.

BAT is facing a challenge in reversing the decline in cigarette sales in its largest market, the United States. A company spokesperson stated that this is mainly due to consumers opting for cheaper brands and new types of tobacco. However, BAT has been behind PMI in the market for new types of tobacco, with the latter experiencing huge success with its heated tobacco product IQOS.

At the same time, Marroco admitted to the media that British American Tobacco "started late in the heated tobacco products field." This is the first time BAT has shown weakness in a public setting. However, he stated that due to the company's strong market share in the United States, the company has the ability to catch up in the future. "We have a large business in the US that can be utilized to sell (new tobacco products).

BAT's goal is for revenue from alternative products such as Vuse vape and Glo heated tobacco devices to account for half of its total revenue by 2035, 11 years from now. However, in 2023, this figure is still at 16%. With PMI now addressing patent issues and entering the U.S. market, BAT must engage in direct competition with PMI in order to achieve its goal in the next 10 years.

Increasing investment in development demonstrates BAT's determination to "fight to the end" in the new tobacco field against PMI. In March 2023, BAT opened an innovation center at its global R&D headquarters in Southampton, which will play a key role in the company's ongoing transformation and the creation of a "better future" vision. The facility cost 30 million pounds and provides nine specially designed technical spaces focused on the development of nicotine pouches, vapes, and other products. Previously in 2021, BAT had already opened innovation centers in Rieti, Italy, and in Shenzhen, China in 2022, investing 300 million pounds annually in research and development of new product categories.

According to the financial report, the cost of research and development spent by BAT in 2023 was approximately £408 million, an increase of about 26% compared to £323 million in 2022, with the majority being invested in harm reduction products.

Russia trims its tobacco business, reduces stake in Indian tobacco: Capital withdrawal and diversified investments in the tobacco industry

British American Tobacco (BAT) recently sold its stake in ITC worth approximately 170 billion Indian rupees. Before the sale, BAT held about 29% of the shares in ITC, making it the largest shareholder. BAT had two representatives on ITC's board of directors, and often was the only shareholder to raise concerns and questions about the company's operations.

CEO Maloco told analysts that the consideration to withdraw funding was mainly driven by cost-effectiveness, as BAT does not need to hold more than 25% of shares in ITC to have strategic influence and veto power.

However, in the past year, BAT also stumbled in selling and divesting. In September 2023, BAT, which had long wanted to exit the Russian market, finally sold its assets to a consortium led by a local management team in Russia, ending an 18-month-long transaction. However, in a transaction update on December 6, CEO Maloko stated that BAT had suffered significant losses in selling its assets in Russia and Belarus, and that the profits BAT had made only represented a small portion of the true value of its business in Russia and Belarus.

After reaching out to BAT's public relations staff in Singapore for more information on any additional divestment plans, no response was received at the time of writing. However, the expected losses from selling off the Russian and Belarusian businesses may prompt British American Tobacco to proceed cautiously in the near future.

Contrary to the shrinking trend in the tobacco industry, BAT's investment department Btomorrow Ventures (BTV) is exploring more investment areas. Since its establishment in 2020, BTV has completed 25 investments, with funds primarily going towards consumer-driven innovative new technologies and sustainable development sectors.

In addition, in 2023, the BAT subsidiary The Water Street Collective Ltd launched a series of proprietary functional beverage brands called Ryde in pilot markets in Australia and Canada; it also signed a joint venture agreement with Charlotte's Web, a subsidiary of the company.

It is worth looking forward to whether BAT will gradually reduce its reliance on the tobacco sector in the capital market through diversified investments.

2FIRSTS will continue to monitor the developments of British and American tobacco companies in the capital markets, as well as the market share of new product types.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com