The province of British Columbia has introduced a 13% tax on electronic cigarettes, which will come into effect on January 1st next year, raising the tax rate from 7% to 20%. The tax hike will apply to all electronic cigarette products and devices, as well as their accessories, regardless of whether they contain nicotine or cannabis products. The Ministry of Finance emphasized that British Columbia is the first Canadian province to implement such a tax.

After taxes, a pack of cigarettes priced at $15.99 will cost an additional 7%, or $1.12 per pack. "We are aligning with other provinces," said Selina Robinson, the Finance Minister of British Columbia.

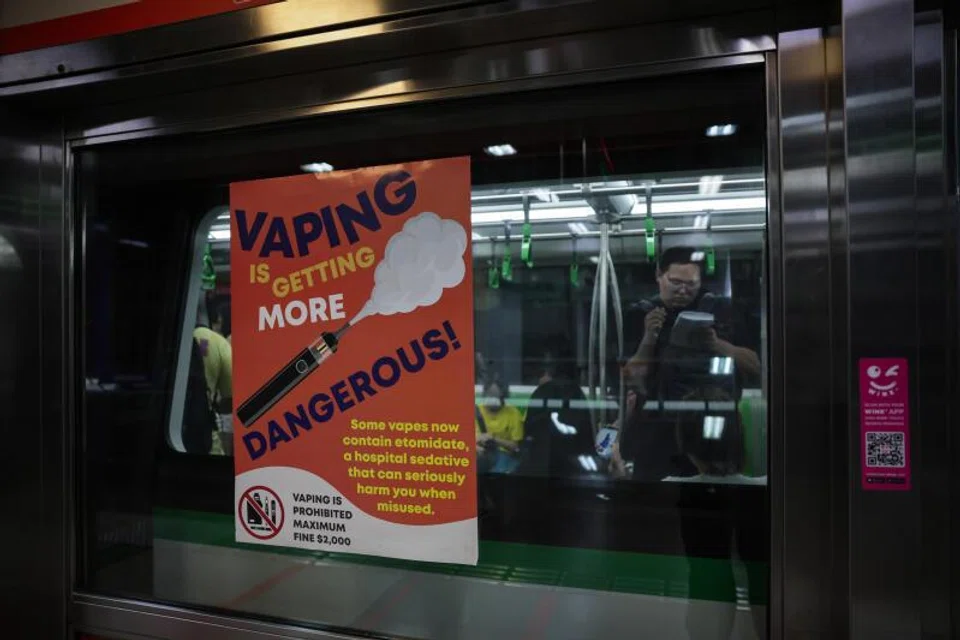

Meanwhile, a nationwide consumption tax is set to take effect, with tobacco control experts warning that this could be a major public health mistake. In a focused episode of RegWatch, researchers in tobacco control, Dr. Kenneth Warner and Cliff Douglas discuss the available data on electronic cigarette taxes and why the tax set to be imposed in Canada may lead to a public health disaster.

According to a study conducted by professors Abigail Friedman from Yale University and Michael Pesko from Georgia State University, as well as several public health and anti-smoking experts' predictions, implementing taxes on e-cigarettes will lead to an increase in smoking rates and result in serious unintended consequences.

A study called "Young Adults' Responses to Tobacco and E-cigarette Taxation" investigated the impact of an e-cigarette tax increase on the smoking and vaping behavior of young consumers aged 18 to 25. Consistent with experts' arguments and predictions in the field, the researchers found that while higher e-cigarette taxes would lead to a decrease in e-cigarette usage, they would also lead to an increase in smoking rates.

According to the author's report, increasing the tax on electronic cigarettes by one dollar would significantly reduce the number of times young people use them daily, while also increasing the number of recent smokers. The researchers ultimately concluded that "higher taxes on electronic nicotine delivery systems (ENDS) are associated with reduced ENDS use, but also with increased smoking rates among the 18-25 age group.

Statement:

This article was compiled from third-party information and is intended for industry-related discussions and learning purposes only.

This article does not represent the views of 2FIRSTS and they cannot confirm the authenticity or accuracy of the content. The translation of this article is solely intended for industry communication and research purposes.

Due to limitations in translation abilities, the translated article may not accurately reflect the original wording. Please refer to the original article for accuracy.

2FIRSTS aligns completely with the Chinese government regarding any domestic, Hong Kong, Macau, Taiwan, and foreign-related statements and positions.

The copyright of compiled information belongs to the original media and author. If there is any infringement, please contact us for removal.

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.