Disclaimer: 1. This article is limited to industry research and is only for communication among professionals in the field. 2. This article does not involve any investment predictions or recommendations, nor does it include commentary on the capital market. 3. Due to the author's professional abilities, the data and analysis in this article should not be used as a basis for decision-making. All data and information should be based on the public data and announcements of relevant companies.

On August 19th, Smoore International (06969.HK) released its financial report for the first half of 2024. The report revealed that the group achieved sales of approximately RMB 5,037,242 thousand during the review period, representing a decrease of about 1.7% year-on-year. Gross profit was RMB 1,914,597 thousand, up by 3.2% year-on-year, with a net profit of RMB 683,198 thousand, down by 4.8% year-on-year. According to Smoore's mid-year reports for 2023 and 2024, the company's sales revenue has been declining for two consecutive years, with year-on-year decreases of 9.4% and 1.7% respectively.

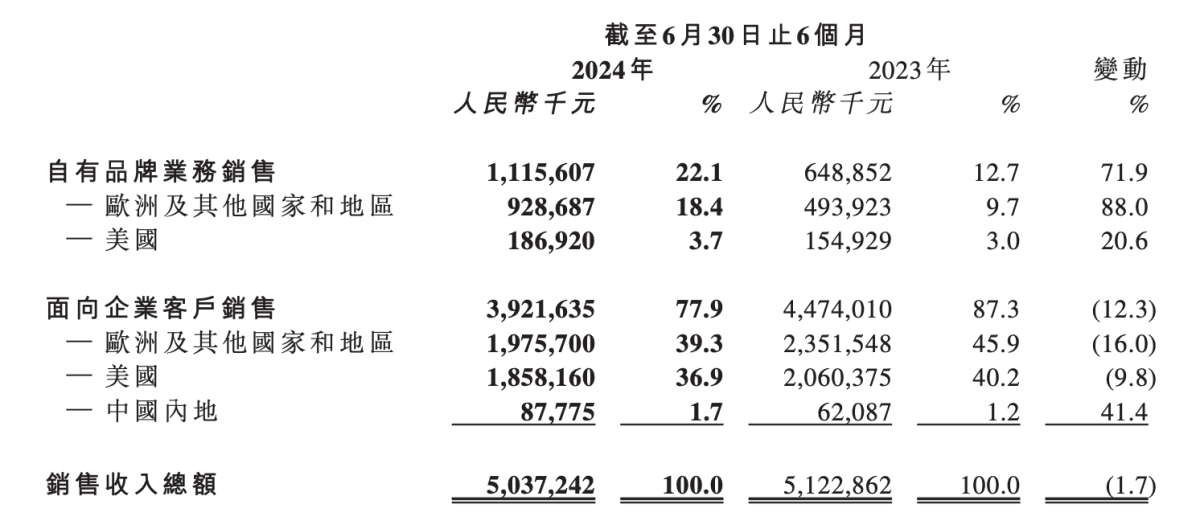

Revenue from corporate clients decreased by 12.3%, while the demand for closed-system exchange products, especially in European markets, saw a MoM growth of 93.2%

According to the report, the company's revenue from sales to corporate clients during the review period was approximately 3,921,635,000 yuan, a decrease of 12.3% year-on-year. It is reported that the company's revenue from sales to corporate clients has been declining for two consecutive years, with the mid-year report for 2023 showing a 12.2% decrease compared to the previous year. The performance of the company's revenue from sales to corporate clients varies greatly in different global markets.

In Europe and other countries and regions, Smoore's enterprise customer sales revenue in the first half of 2024 was approximately RMB 1,975,700 thousand, a year-on-year decrease of 16%, a decrease of nearly RMB 400 million. Smoore's business in Europe and other markets mainly consists of selling closed-system e-cigarette products. With the gradual tightening of regulations on traditional disposable e-cigarette products in Europe, sales of closed-system refillable products saw a year-on-year increase of approximately 22.5% in the second quarter, a significant increase of approximately 93.2% compared to the first quarter. Meanwhile, within the review period, the company's revenue from disposable electronic vapor products decreased by approximately 18.9% year-on-year. The proportion of revenue from Europe and other markets decreased from approximately 45.9% in the same period last year to approximately 39.3% in the review period. It is evident that while there is growth in closed-system refillable products in European markets, it is difficult to offset the decline in revenue from disposable electronic vapor products, leading to an overall decrease in enterprise customer sales revenue in Europe and other markets.

Smoore primarily sells electronic vaporization products and special purpose vaporization products in the US market. The company's sales revenue from enterprise clients in the US market in the first half of the year was approximately RMB 1,858,160, a decrease of about 9.8% compared to the same period last year. Specifically, sales of cartridge-based electronic vaporization products were down year-on-year in the first half of the year, but showed improvement in quarterly trends, with a 6.5% increase in sales in the second quarter compared to the same period last year.

In the domestic market, the company's revenue from corporate clients accounted for a relatively small proportion. In the first half of the year, revenue from corporate clients was approximately RMB 87,775,000, with a year-on-year increase of 41.4%.

In addition, during the review period, the company's proprietary brands experienced rapid growth, with revenue reaching approximately RMB 1,115,607 thousand, a year-on-year increase of about 71.9%. The European and other international markets saw the fastest growth, achieving revenue of approximately RMB 928,687 thousand, a year-on-year increase of about 88.0%. The company's proprietary brand, VAPORESSO, continued to gain market share in the open product category.

Accelerating the development of aerosolized medical treatments has gained recognition from pharmaceutical inspection agencies in Europe and the United States.

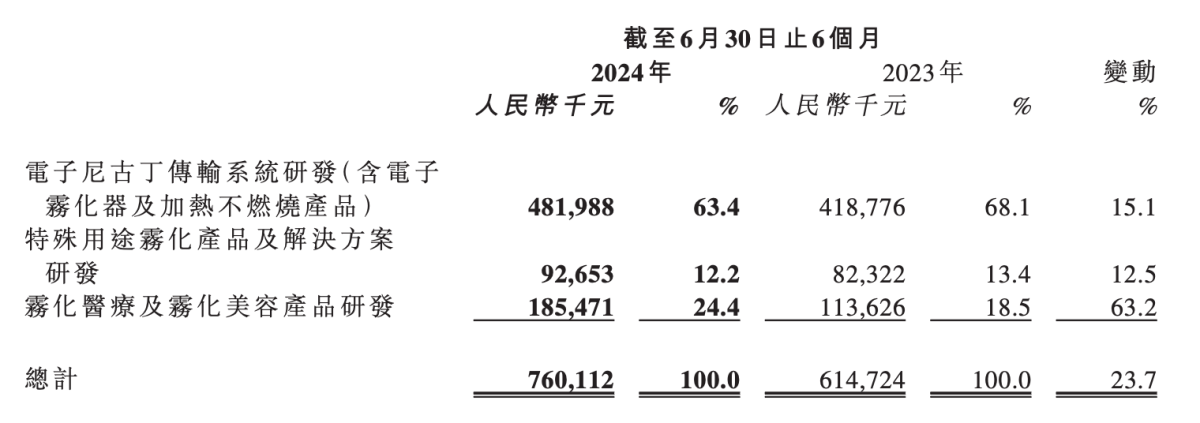

The report shows that the company has completed the development and production layout of several drug delivery devices for asthma and chronic obstructive pulmonary disease (COPD) during the period, as well as the development of over a dozen drug formulations. The formulations and devices have been approved by regulatory agencies in Europe and the United States, and have entered the preclinical or registered production stages respectively.

The report also mentioned that the company's total research and development expenses in the first half of the year were 760,112 thousand yuan, a year-on-year increase of approximately 23.7%, with the main growth coming from the areas of nebulized medical and HNB products.

Internally implementing cost cutting measures, the number of employees has decreased.

In Smoore's mid-year report for 2024, there were multiple references to "cost reduction and efficiency improvement" which appeared four times throughout the report's sections. This is a significant increase compared to the 2023 mid-year report, where it only appeared once.

According to the report, the company's management expenses have significantly decreased to RMB 339,229 thousand due to ongoing cost-cutting measures to increase efficiency. This represents a reduction of approximately 27.2% in administrative expenses.

The company stated that it has 11,225 and 1,771 employees in China (including mainland China and Hong Kong), and other countries and regions, respectively. These numbers are down from 15,468 and 1,307 employees reported in last year's mid-year report, representing a total decrease of 22.5% year-on-year.

2FIRSTS recently communicated with a securities analyst who has been paying close attention to the new tobacco industry and the key term repeatedly mentioned by Smoore, "cost reduction and efficiency improvement.

He stated that Smoore's current cost reduction and efficiency improvement efforts mainly focus on internal management expenses, while sales and research and development expenses have "rigid expenditures due to business expansion needs." "For example, the rapid growth of Smoore's own brand open-system devices has led to an increase in the company's sales expenses.

At the same time, the securities analyst mentioned that...

Traditional disposable e-cigarette products in the European market are currently facing short-term challenges, especially due to policy impacts in the UK and some EU markets. With the continuous introduction of new products and customer acquisition, Smoore's disposable e-cigarette business is expected to resume growth in the second half of the year.

Smoore's replaceable cartridge e-cigarette products saw rapid growth in Q2, especially in Europe and other markets. The company's closed-system replaceable cartridge products showed significant year-on-year and quarter-on-quarter growth in the second quarter. Regulatory policies in Europe and the United States have driven consumer demand for these products, which is more beneficial than detrimental for the company in the long term. Replaceable cartridge e-cigarette products are a strong business segment for Smoore, with relatively high profit margins," he added.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com