On September 19th, the InterTabac officially opened in Germany. As the official media partner, 2Firsts arrived at the event and had a discussion with Pablo Cano Trilla, the Head of Legal Analysis from ECigIntelligence.

TobaccoIntelligence is a professional tobacco consulting company based in Spain, with a sister company focused on the e-cigarette industry called ECigIntelligence. Both are independent brands operated by the same parent company, Tamarind Intelligence. At the industry conference during this expo, Pablo represented ECigIntelligence and delivered a speech titled "Legal Challenges, Prospects and Future Projections in the Evolving Nicotine and Novel Tobacco Sectors."

After the speech, Pablo discussed with 2Firsts that globally, there is a growing trend of reducing harm from tobacco, leading to increasingly strict regulations on new tobacco products. He pointed out that brands need to be prepared to face this pressure, especially in the area of nicotine pouches.

He emphasized that the most likely scenario is that nicotine pouches are not going to be banned, but this is not something that should be discarded.

NGPs face strict regulation, nicotine pouches may be banned

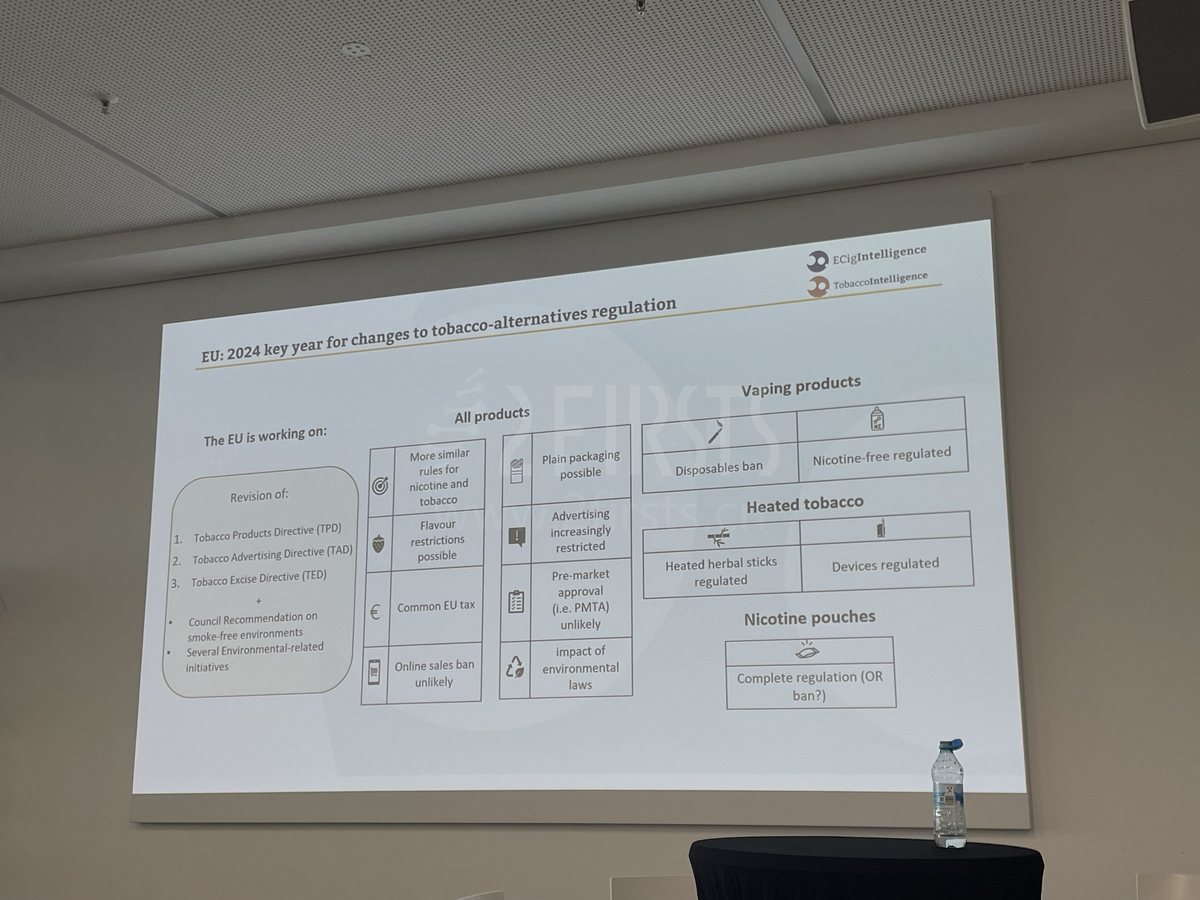

As the head of legal analysis at a professional tobacco consulting company, Pablo states that 2024 will be a crucial turning point for EU regulation of new tobacco products, particularly in the regulation of emerging products such as nicotine pouches. Pablo anticipates that the revised Tobacco Products Directive (TPD) will introduce more uniform rules, covering pre-market approval, advertising restrictions, and environmental regulations for products like nicotine pouches.

He emphasized that nicotine pouches have become a new target for regulation. Whether they will be banned or not remains uncertain. Nicotine pouch manufacturers and sellers need to closely monitor policy changes to ensure their products meet new regulatory requirements and adapt to the constantly evolving market environment.

Furthermore, Pablo told 2Firsts that European policymakers are paying particular attention to the regulation of e-vapor products (EVP), with a decreasing demand for disposable e-cigarettes in the European market (especially in the UK, Germany, and France) and a shift towards refillable products becoming the new mainstream. He mentioned that policies such as flavor bans for disposable products not only affect the European market but may also have a ripple effect on other regions, such as Brazil in Latin America.

Taste preferences for nicotine pouches vary between Europe and US, with potential in the Latin America

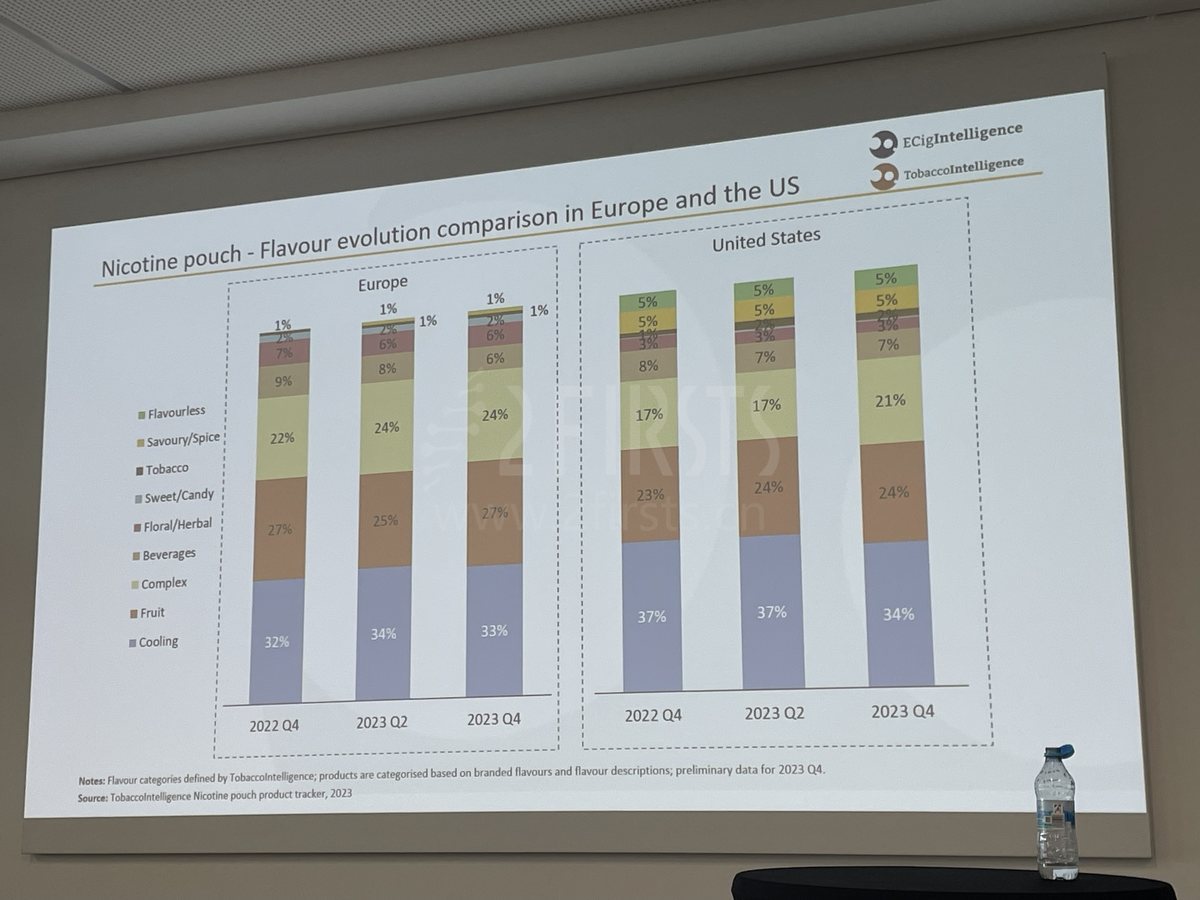

Pablo mentioned to 2Firsts that there are certain differences between the European and American markets in terms of nicotine pouch flavor preferences.

For example, in the fourth quarter of 2023, he pointed out that consumers in Europe and America both prefer nicotine pouch products with a cool sensation flavor.

In Europe, consumers have a greater preference for nicotine pouches in "fruit" and "mixed" flavors. In the fourth quarter of 2023, the market share of "fruit" nicotine pouches reached 27%, while "mixed" flavors reached 24%.

In the emerging e-cigarette market, Pablo believes that Latin America has tremendous market potential. Despite Southeast Asia being a hot spot in the industry, increasingly strict regulations have made its market prospects less clear. Additionally, the launch of proprietary brand products by China Tobacco (CNTC) at the trade show demonstrates China's significant position in the global tobacco industry, warranting industry attention.

Prediction: HTP, EVP, and OND facing different opportunities

Pablo predicts that HNB tobacco products (HTP), e-cigarette vapor products (EVP), and nicotine pouches (OND) will face different growth opportunities in 2025.

He believes that HNB products will experience rapid growth, especially in markets such as the Middle East and North America, as well as in European countries such as Italy, and Spain.

According to forecasts from Pablo, e-cigarette vapor products have huge market potential in Latin America. Nicotine pouches have become very popular in European and American markets, especially the brand represented by ZYN has achieved significant success in the US market.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com