Statement

This article is intended for industry researchers only;

This article is intended for industry research purposes only. The manufacturers, brands, and products mentioned in the article are not used for advertising or promotion.

The views quoted in this article represent only the interviewee's perspective.

In 2024, IQOS celebrated its first decade, marking a new stage of development for global heated tobacco products. Not only Philip Morris International (PMI), but also other international tobacco giants, China Tobacco, and China's new tobacco supply chain have increased their efforts in this area. It is foreseeable that 2025 will be a "big year" for the global development of new tobacco products.

In the future, what trends will the global new tobacco industry present? What opportunities and challenges will it face? To answer these questions, 2Firsts connected with Raphael Moreau, a senior consultant from the well-known market research firm Euromonitor International. He shared the organization's perspective with 2Firsts.

Some important analyses and viewpoints by Moreau:

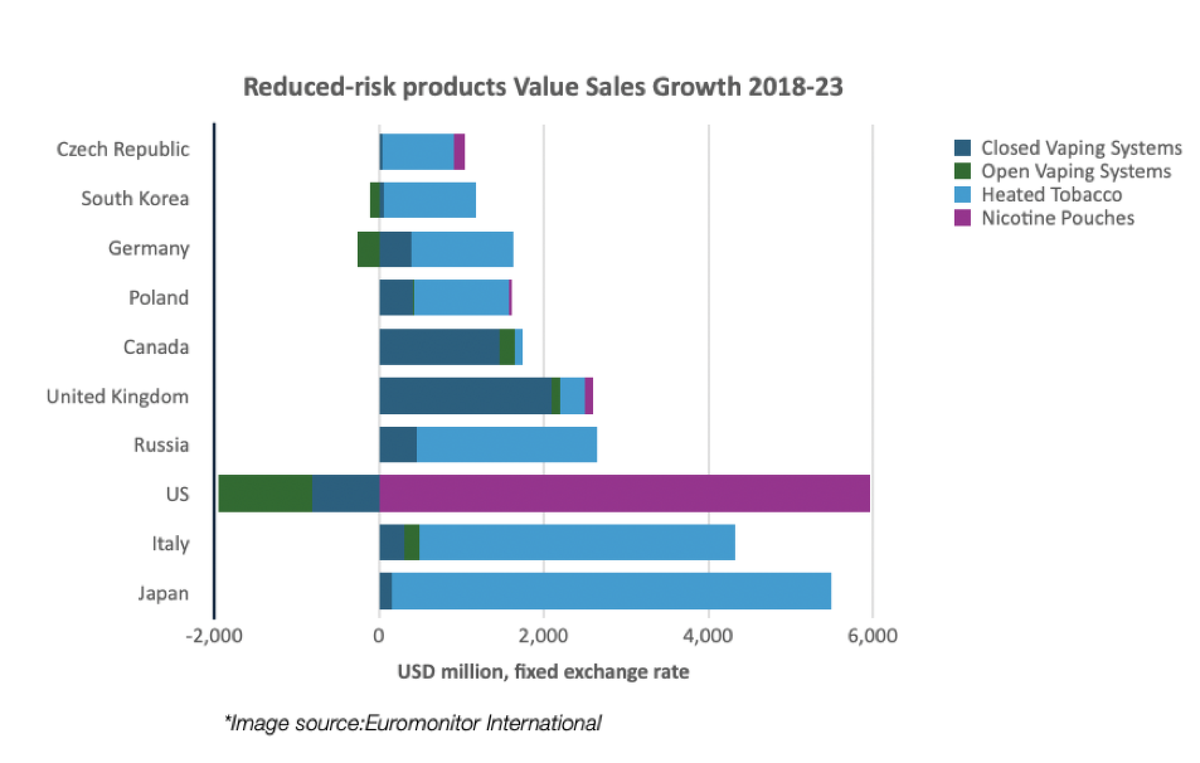

Global: The value sales of heated tobacco products have rapidly surpassed e-cigarette products. In 2023, global sales of heated tobacco reached $34.5 billion, a significant increase from $29.6 billion in 2022. United States: IQOS is expected to be widely promoted nationwide in the United States in the second half of 2025. This will make the U.S. a major driver of global sales growth for heated tobacco products. Europe: Regulatory policies will accelerate the introduction of alternative products (such as tobacco-free heated tobacco sticks) to continuously meet consumer demand through product diversification. Asia: Asia is the cornerstone of innovation for heated tobacco products, with innovations in device functionality and tobacco stick flavors enhancing consumer experiences and driving strong market performance. Competitive landscape: PMI's IQOS still maintains its leading position, but new entrants such as JTI are challenging IQOS's position through pricing strategies. Growth: In developed markets, growth is mainly driven by health-conscious consumers increasingly adopting reduced-risk alternatives. In emerging markets, accessibility has improved through localized production and strategic distribution efforts. Regulation: Increasing taxes and regulatory challenges pose significant obstacles for the future development of heated tobacco products. Companies must balance strategic innovation and regulatory compliance for sustainable development.

IQOS: Redefining the heated tobacco market

As a pioneer in the heated tobacco market, IQOS has become a flagship brand in the reduced harm product category on its tenth anniversary. With strong sales momentum in Europe and Asia and global sales in the billions of dollars, IQOS has successfully changed smoking habits. However, its success is also challenged by complex regulations and increasing competition.

Raphael Moreau, Senior Consultant at Euromonitor International, pointed out, "The sales value of heated tobacco products has rapidly surpassed that of e-cigarettes. In 2023, global sales of heated tobacco reached $34.5 billion, a significant increase from $29.6 billion in 2022." As a market leader, IQOS has made a significant contribution to this growth, providing a viable alternative to traditional cigarettes.

Regional Dynamics: Success and Challenges Coexist

United States: Overcoming Delays, Unlocking New Opportunities.

The United States, as an exception among developed countries, has a lower rate of heated tobacco product use. This is mainly attributed to a patent dispute between British American Tobacco (BAT) and Philip Morris International (PMI) that has lasted for several years, leading to a delay in the commercialization of IQOS until 2024.

Moreau said: "With the settlement reached between the two companies in February 2024, it has paved the way for IQOS to enter the U.S. market, now we just need to wait for full FDA approval." He added: "It is expected that IQOS will be tested in some cities later this year and is poised to be nationally promoted in the second half of 2025. This will make the U.S. a key driver in driving global growth in heated tobacco sales.

This solution not only puts an end to years of delays but also marks a significant turning point for PMI. The US market holds immense potential, providing strategic opportunities for the promotion of innovative tobacco alternatives. As consumer awareness of harm reduction products continues to grow, IQOS is poised to set new industry benchmarks in key markets and drive global expansion.

Europe: Sustaining strong growth amid changing regulations.

Compared to the United States, Europe has a higher acceptance of heated tobacco products. Moreau pointed out, "Heated tobacco has been widely accepted by consumers, especially in Germany, Italy, and Poland." These markets have become the main driving force behind the success in the region.

However, regulatory challenges are changing this landscape. The EU ban on flavored heated tobacco sticks, set to take effect at the end of 2023, may hinder further growth. Moreau emphasized the significance of this policy change, stating, "This ban could stifle growth in this category, especially in markets where flavored products are popular among consumers.

In response to these restrictions, companies are turning to alternative products. PMI's Levia, a smokeless tobacco heating stick, is a prime example of adaptive innovation. The product was first launched in the Czech Republic in 2024 and has since expanded to major markets including Germany. Moreau emphasized the potential impact of these innovations: "Smokeless tobacco heating sticks, such as PMI's Levia, may help maintain growth momentum in the face of regulatory resistance.

This adaptability reflects the resilience of the European heated tobacco industry. Despite regulatory changes presenting undeniable challenges, the continuous evolution of product offerings demonstrates a clear commitment to meeting consumer demand and maintaining the category's growth trajectory.

Asia: The Core Force of Global Innovation.

Asia has become a cornerstone of innovation in heated tobacco products, with notable markets such as Japan and South Korea leading the way. Japan, as the first market for IQOS, launched in Nagoya ten years ago and has continued to drive innovation in this category.

In early 2024, PMI launched its IQOS Iluma i product in Japan, which features advanced characteristics such as a touch screen interface and pause function, further enhancing its appeal. Moreau stated, "Asia is a hotbed of innovation in device functionality and tobacco stick flavors. These advancements are crucial for maintaining high consumer engagement." For example, PMI's exclusive IQOS flavor TEREA Oasis Pearl, which was widely promoted throughout Japan, has been well-received and has boosted sales growth.

Innovation not only enriches consumer experiences, but also drives strong market performance. Moreau pointed out that "by 2023, strong innovation strategies in Japan and South Korea have driven double-digit growth in sales in both regions." This growth trajectory highlights the region's exceptional ability to combine cutting-edge technology with localized consumer preferences, solidifying Asia's position as a global leader in the heated tobacco industry.

With its momentum driven by innovation, Asia is expected to continue shaping the future of heated tobacco products, demonstrating a transformative power that combines technological advancement with market insight, both regionally and globally.

Power struggle over heated tobacco: market leadership, new players and price competition.

The global heated tobacco market is emerging as a battlefield for innovation and competition. Despite facing fierce challenges from both new and existing competitors, PMI is maintaining its leadership position with its IQOS ecosystem.

PMI dominated 71% of the global heated tobacco market in 2023 through its Heets and TEREA brands, further solidifying its global leadership position," noted Moreau. However, he also pointed out that PMI is facing increasingly fierce competition from BAT and its Glo brand.

PMI's brand strategy has played an important role in strengthening its position in the high-end market. Moreau mentioned the company's innovative retail initiatives: "PMI has further enhanced its high-end image by opening exclusive stores in key locations. The minimalist design of these stores aligns perfectly with the concept of Apple stores and complements the stylish aesthetics of IQOS devices.

At the same time, Japan Tobacco Inc. (JTI) is rapidly emerging in the heated tobacco market. Moreau stated, "In Japan, JTI has captured a 13% market share in 2023 with the Ploom devices from the Mevius series, ranking second." Building on their success domestically, JTI launched the Ploom X Advanced in 2024 and entered the European market.

JTI has accelerated its market growth through active marketing and pricing strategies. Moreau explained, "High-profile marketing activities and substantial discounts at sales points have helped JTI challenge PMI's dominant position.

Balancing Growth and Regulation: The Future of Heated Tobacco

Despite intense competition and significant price pressures, the heated tobacco market is expected to maintain strong growth. Moreau forecasts that the compound annual growth rate (CAGR) of the industry will reach 11% from 2023 to 2028.

In developed markets, growth is primarily driven by health-conscious consumers' increasing adoption of reduced-harm alternatives," explained Moreau. "Meanwhile, in emerging markets, accessibility has improved thanks to localized production and strategic distribution efforts.

However, the road ahead is not without challenges. Increased taxes and regulatory challenges are posing significant pressures. Moreau specifically mentioned the EU's ban on flavored tobacco products set to be implemented by the end of 2023, a major regulatory change that could stifle growth in key markets.

According to foreign media reports, a new study suggests that a national ban on e-cigarettes is linked to an increase in cigarette sales. The study, published in the scientific journal "Health Affairs," adds to mounting evidence that banning the sale of e-cigarettes may lead more people to revert back to smoking, which is less safe than using nicotine alternatives.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com