Disclaimer:

1.Exclusively published by 2Firsts with the author’s permission.

2.The views expressed in this article are solely those of the author.

Key points:

· The economic consequences of the PECA extend far beyond the creation of a black market. The decision to prohibit rather than regulate has resulted in substantial foregone revenue, deterred investment, and significantly impacted both the potential vaping industry and the established tobacco sector.

· A regulated vaping market, taxed appropriately (perhaps tiered based on nicotine content or product type), could have provided a comparable new source of funds. Instead, India continues its reliance on revenue from traditional, high-harm tobacco products, creating a fiscal inconsistency where a potentially less harmful alternative is banned while the most lethal products remain a key source of state income.

· This inherent conflict – the government acting as both health regulator and beneficiary of tobacco industry profits – raises questions about the motivations behind the ban.

· Modelling studies from other countries project substantial savings in healthcare costs and gains in productive life years if large numbers of smokers switch to vaping. The current ban forecloses this possibility, effectively locking smokers into the most dangerous form of nicotine consumption and perpetuating the associated economic costs.

· A move towards regulation could unlock numerous economic benefits currently suppressed by the ban. It would allow for the creation of a legal, taxable market, generating potentially billions in revenue for the exchequer. It would foster legitimate business activity, attracting investment and creating jobs in manufacturing, distribution and retail.

India's Vape Ban: A Case Study in Unintended Consequences

Economic opportunities are lost as the illicit market is booming, putting users and minors at greater risk

Author: Samrat Chowdhery

A harm reduction advocate based in Mumbai and director of the Association of Vapers India.

Five years after India implemented a nationwide ban on e-cigarettes, the policy intended to curb a potential health crisis has instead fueled a thriving black market, stifled legitimate industry growth, and resulted in significant foregone economic benefits. The 2019 Prohibition of Electronic Cigarettes Act (PECA), which outlawed the production, sale, import and advertising of all vaping products, appears increasingly ineffective, creating a complex web of unintended health and economic consequences and missed opportunities.

The primary and most visible failure of the 2019 ban has been its inability to eliminate demand or supply. Instead, it has driven the entire e-cigarette ecosystem underground, creating a vast, unregulated and untaxed black market. Before the ban, the Indian e-cigarette industry, though nascent, showed significant potential. Estimates placed its value up to $57 million in 2018, with market research firms such as Euromonitor projecting explosive compound annual growth rate at 60%, which would have translated into a current market size of over INR50 billion ($600 million) in a short span. This legitimate economic activity was abruptly halted.

Prohibition Fuels a Multi-Million Dollar Black Market

In its place, an illicit market, described by observers as a “multi-million-dollar industry,” has flourished. The ban effectively cleared the field for unregulated operators, who now cater to persistent and growing consumer demand. Evidence of this thriving trade is abundant. Authorities regularly report seizures of illicit vaping products—between April and November 2024 alone, seizures amounted to approximately INR42 million, and earlier seizures in 2022 reached values like INR680 million in single operations. However, these seizures represent only the tip of the iceberg.

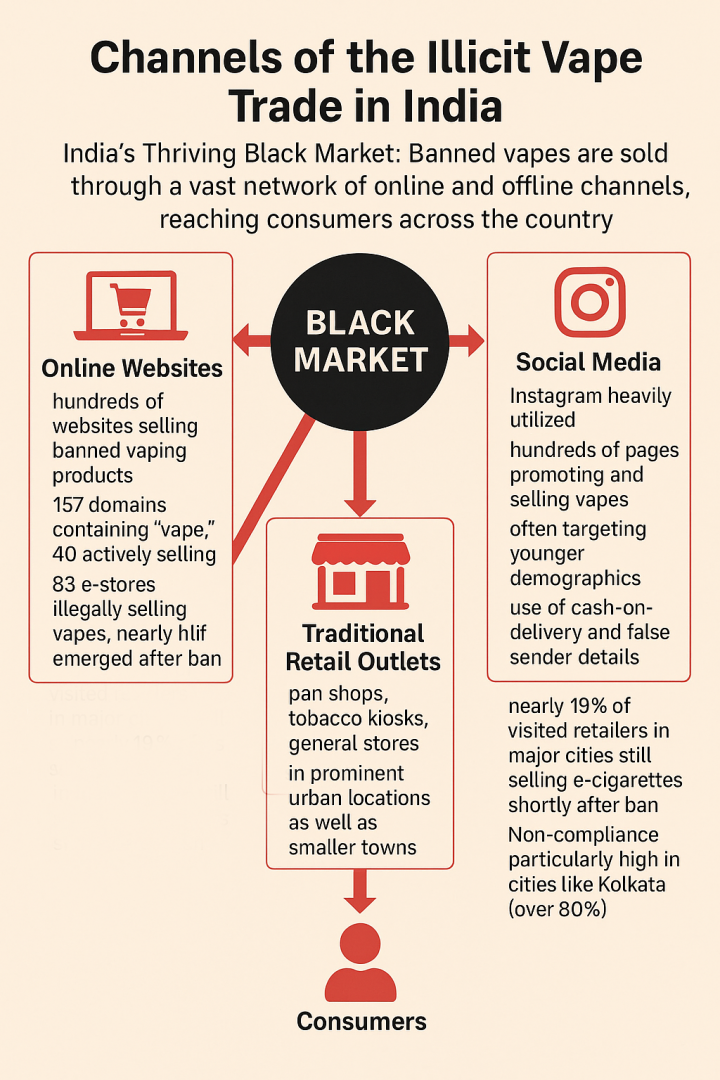

The black market operates through multiple channels. Online sales are rampant, with investigations identifying hundreds of websites and social media pages selling banned vaping products within India. One analysis found at least 157 domains containing the keyword "vape," with 40 actively selling in India. Another identified 83 e-stores illegally selling vapes, nearly half of which emerged after the 2019 ban. Social media platforms like Instagram are heavily utilized, with studies finding hundreds of pages promoting and selling vapes, often targeting younger demographics with trendy branding and influencer marketing, despite platform policies prohibiting such sales. Sellers often use cash-on-delivery and false sender details to evade detection by authorities and courier companies.

Offline availability is equally pervasive. Despite the ban, e-cigarettes are readily available from traditional retail outlets such as pan shops, tobacco kiosks and general stores, in prominent urban locations as well as smaller towns across the country. A compliance survey conducted shortly after the ban found nearly 19% of visited retailers in major cities were still selling e-cigarettes, with non-compliance particularly high in cities like Kolkata (over 80%).

This underground market operates entirely outside any regulatory framework, meaning products are untested, quality control is non-existent, and ingredients are unknown. The prevalence of cheap, high-nicotine disposable vapes raises safety concerns. The lack of age verification mechanisms in these illicit channels also means that minors have easier access to these products than they might in a regulated legal market, directly contradicting one of the primary justifications for the ban.

Economic Fallout: Lost Revenue & Jobs

The economic consequences of the PECA extend far beyond the creation of a black market. The decision to prohibit rather than regulate has resulted in substantial foregone revenue, deterred investment, and significantly impacted both the potential vaping industry and the established tobacco sector.

A major loss is the foregone tax revenue. By banning legal sales, the government eliminated the possibility of levying excise duties and Goods and Services Tax on e-cigarettes. Given the pre-ban market size estimates and high growth projections, this represents a significant missed revenue stream. While specific figures for lost vape tax revenue are not available, the potential can be inferred from the existing tobacco market. Studies estimate that raising taxes on traditional bidis could yield INR36.9 billion annually, while higher cigarette taxes could add INR146.3 billion.

A 2024 economic model projected that tobacco tax increases aimed at reducing consumption could generate an additional INR236.98 billion for the exchequer. A regulated vaping market, taxed appropriately (perhaps tiered based on nicotine content or product type), could have provided a comparable new source of funds. Instead, India continues its reliance on revenue from traditional, high-harm tobacco products, creating a fiscal inconsistency where a potentially less harmful alternative is banned while the most lethal products remain a key source of state income. The U.K.'s regulated vaping market, generating £1.3 billion ($1.75 billion) in sales and contributing £401 million in gross value added in 2021, illustrates the scale of the economic activity India has foregone.

Further, the ban resulted in the loss of existing jobs within the small, pre-ban legal vape sector and prevented the creation of potentially thousands more across the value chain—from manufacturing and logistics to retail and marketing. While precise figures for India are not recorded, international economic analyses suggest a significant multiplier effect; a U.K. study estimated that every 10 direct jobs in the vaping industry support an additional 11.6 jobs in the wider economy. A U.S. study projected over 150,000 job losses from a hypothetical ban on flavored vapes alone.

Applying such multipliers to India's large potential market suggests a substantial number of employment opportunities were lost. This stands in contrast to the large employment footprint of the traditional tobacco sector, estimated to involve 7million to 7.25 million people directly, or up to 45.7 million including indirect employment. While the ban offered short-term protection to these jobs, economic modelling suggests that effective tobacco control leading to reduced smoking could ultimately result in a net increase in overall employment (estimated at 1.36 million jobs over five years) due to averted premature deaths and illnesses boosting productivity.

Conversely, the ban provided an immediate, albeit short-term, advantage to the established domestic cigarette industry. Reports indicate stock prices of domestic cigarette manufacturers saw a noticeable spike following the ban announcement in September 2019, and their market capitalization rose significantly in the subsequent years.

This market protection was arguably bolstered by the government's decision not to increase taxes on cigarettes and other tobacco products for years following the vape ban. This situation is further complicated by the government's own financial interests, holding significant stakes in major tobacco companies. This inherent conflict – the government acting as both health regulator and beneficiary of tobacco industry profits – raises questions about the motivations behind the ban.

The High Cost of Inaction

Beyond the direct economic impact on industry and government revenue, the most significant long-term economic cost associated with the vape ban stems from the perpetuation of the enormous health burden caused by traditional tobacco use. Smoking-related diseases impose a staggering cost on the Indian economy, estimated at INR1.77 trillion approximately 1% of the country's GDP) in 2017-2018. This figure includes direct healthcare expenditures for treating cancers, cardiovascular diseases and respiratory illnesses linked to smoking, as well as indirect costs from lost productivity due to premature death and disability. India loses an estimated 1.35 million lives annually to tobacco-related causes.

Tobacco harm reduction strategies, which involve encouraging smokers who cannot or will not quit nicotine entirely to switch to significantly less harmful alternatives, offer a pathway to mitigate this burden. A substantial body of international scientific evidence, including reviews by Public Health England (now the Office for Health Improvement and Disparities), the Royal College of Physicians (U.K.), and the U.S. National Academies of Sciences, Engineering, and Medicine, concludes that vaping, while not risk-free, is substantially less harmful than smoking combustible cigarettes.

The widely cited estimate is that vaping poses around 5% of the risk of smoking, primarily because it avoids the combustion process that generates thousands of harmful chemicals in cigarette smoke. Rigorous Cochrane Reviews also find high-certainty evidence that nicotine e-cigarettes are more effective for smoking cessation than traditional Nicotine Replacement Therapy like patches and gums. By prohibiting access to these potentially less harmful alternatives, the PECA prevents India from realizing the potential public health and associated economic benefits of harm reduction.

Modelling studies from other countries project substantial savings in healthcare costs and gains in productive life years if large numbers of smokers switch to vaping. A U.K. model estimated potential annual savings of over £500 million if half of smokers switched. A U.S. model projected 6.6 million fewer premature deaths over a decade under optimistic switching scenarios. Applied to India's vast smoking population (over 100 million adults), the potential gains are immense; one analysis estimated that switching just 10% of Indian smokers could save nearly 11 million lives and 88 million life-years. The current ban forecloses this possibility, effectively locking smokers into the most dangerous form of nicotine consumption and perpetuating the associated economic costs.

Despite the mounting evidence of the ban's failures and the significant economic and public health arguments for a policy shift, the Indian government has shown little inclination to reconsider the PECA. Recent actions, including claiming that personal possession of vapes can be penalized (despite the act not explicitly stating so), obstructing independent research into THR products, and issuing directives barring media from publishing content deemed to promote vaping, suggest a doubling-down on the prohibitionist stance.

This policy inertia persists despite international examples from countries like the U.K., New Zealand, Philippines, Sweden and others, which demonstrate that carefully designed regulation can facilitate harm reduction for adult smokers while implementing strong measures to protect youth.

Regulation Will Boost Economy, Save Lives

A move toward regulation could unlock numerous economic benefits currently suppressed by the ban. It would allow for the creation of a legal, taxable market, generating potentially billions in revenue for the exchequer. It would foster legitimate business activity, attracting investment and creating jobs in manufacturing, distribution and retail.

Regulation could also enable India, as the world's second-largest tobacco producer, to explore leveraging its agricultural base for the production of pharmaceutical-grade nicotine for regulated vaping liquids, creating affordable, domestically produced alternatives, particularly relevant for the millions of price-sensitive bidi smokers.

Of course, any regulatory framework would need to be well-enforced, incorporating lessons learned internationally. Key components would include age verification (minimum 21 years), bans on advertising and marketing appealing to youth, carefully calibrated controls on flavors and descriptors, mandatory product safety and quality standards, child-resistant packaging, and a robust retail licensing system with restrictions on sales locations (especially near schools). Taxation would be crucial, needing to be set at a level that discourages youth uptake while ensuring vaping remains a significantly more affordable option than traditional cigarettes to incentivize switching for adult smokers.

India's 2019 e-cigarette ban appears to be a case study in unintended consequences. It has failed to curb use, instead creating a dangerous and uncontrolled illicit market. Economically, it represents a significant missed opportunity for revenue generation, investment and job creation. Most critically, it denies millions of smokers access to a life-saving harm reduction tool, thereby perpetuating a massive public health and economic burden. The situation is exacerbated by the abysmally low spending on tobacco cessation—India spends only 0.07% of its tobacco tax revenue on cessation, and 60% of funds allocated to cessation efforts have gone unspent.

A pragmatic reassessment favoring regulation over ineffective prohibition is essential if India is to address the realities of the current situation and unlock potential long-term economic and health benefits.

Cover image source: ChatGPT