The volatile markets we witnessed in 2022 remind us of the importance of stability for investors. Retirees or others seeking dividends may want to consider investing in tobacco giant Altria Group (MO 0.92%) to stabilize their portfolio and put some money in their pockets.

This stock only dropped 4% in 2022 and paid a generous dividend yield of 8.5% to investors. As Wall Street enters 2023 with some uncertainty, the reliability of such a high yield may be more attractive to investors.

Altria may not be a suitable stock for everyone, but this is why those who hold it can sleep well at night knowing their investment is generating reliable dividend income.

During this period, the stock price fell by 32% as a result of Altria's disastrous failure after acquiring a stake in the e-cigarette company Juul for approximately $13 billion in 2018 and subsequently seeing its value evaporate due to regulatory scrutiny.

However, that was then; now, the stock of Altria reflects that mistake, with a price-to-earnings ratio (P/E) just above 9, significantly lower than the median P/E of the stock over the past decade (P/E of 17). This doesn't mean that the stock price can't still go down, but the discount on Altria's long-term fundamentals may provide a safety margin - bad news has already been factored in.

This may be one of the reasons why Altria is holding steady this year. I suspect that if the stock were traded at a higher valuation - for example, above its ten-year average - it would fall further in this bear market.

An 8.5% reliable dividend yield.

Since the 1960s, Americans have known that cigarettes are harmful to your health, but Altria has continued to make more money. In 2012, Altria shipped 136 billion units of tobacco products, while in 2021 they only shipped 95 billion units. However, the operating profit from tobacco products grew from $6.2 billion to $10.4 billion. This highlights Altria's pricing power due to the addictive nature of their products.

For years, these rising prices have supported Altria's financial health, making it a dividend king that has seen 52 consecutive years of increases.

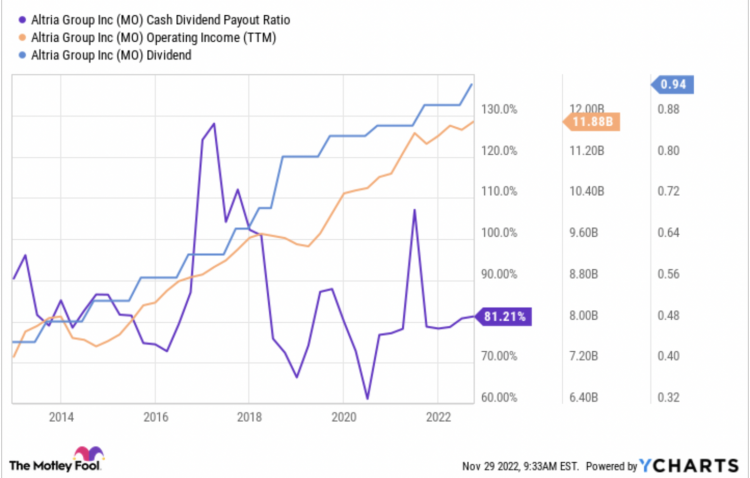

YCharts provides data on the cash dividend payout ratio for MO.

Investors may be worried about the 81% dividend payout ratio, but they should not be overly concerned. Altria's business does not require a lot of capital; it can distribute the majority of profits to shareholders and still operate successfully. While the business may not be exciting, it has proven to be very effective in generating cash for investors.

Resting in an emergency situation.

It appears reasonable to assume that Altria's rinse-and-repeat model of raising prices will not be effective forever, and the management seems to understand this, as evidenced by their investments in Juul and Cronos Group in an attempt to diversify their business. Altria is still working towards creating a future beyond cigarettes, and investors should monitor their progress over the long term. However, if necessary, the company has significant leverage to generate additional cash.

Altria owns a 10% stake in global brewer AB InBev, which, based on today's stock price, is valued at approximately $11 billion. If Altria were to sell this stake, the resulting cash would be roughly one-eighth of Altria's market value, providing ample funds for stock buybacks or debt repayment. Altria could almost entirely pay off the debt it incurred when investing in Juul.

2FIRSTS will continue to track and report on this issue, with updates available on the "2FIRSTSAPP". Scan the QR code below to download the app.

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.