According to a recent report from the Korean Economic Daily, the board of directors of Philip Morris International (PMI) consists of 11 external directors, all of whom are current senior executives at global companies. On the other hand, among the six external directors of KT&G, the Korean Tobacco company, only the representative director from SK Materials and the current chairman, Ren Min-kyu, are senior executives at a large corporation.

KT&G's external directors include chairs of industry associations unrelated to the company, representatives of small entertainment companies and advertising agencies. One of the members is even the president of an advertising agency with less than 10 employees. However, KT&G is unable to legally engage in advertising activities.

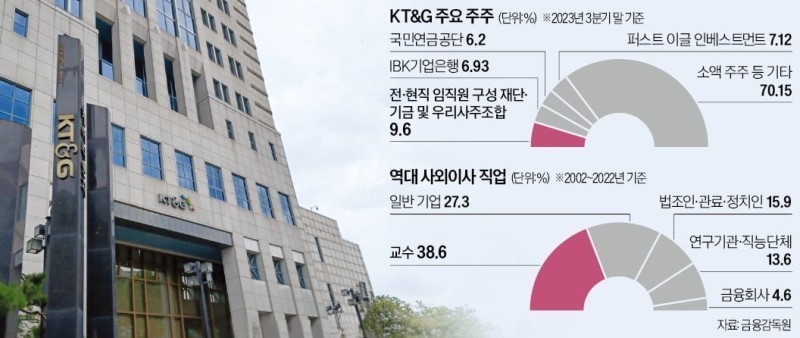

One prominent issue is the lack of professionalism among the external directors of KT&G. According to a survey by the Korean Economic News, out of the 44 external directors who have served or have previously served at KT&G since its privatization in 2001, the majority, 17 individuals, were professors, while only 12 were entrepreneurs. In contrast, the proportion of corporate executives at Philip Morris International is noticeably higher.

Due to a lack of expertise, the board of directors at KT&G failed to provide advance warning on several significant issues, such as the recent controversial "crisis of unrecoverable deposits in the US.

Industry insiders stated that during the KT&G board meeting in December 2021, a proposal concerning the suspension of sales of products by its US subsidiary was brought up. Surprisingly, none of the external directors at the time pointed out the potential risk of not being able to refund deposits.

In addition, external directors have not raised concerns about KT&G's establishment of a management system predominantly composed of executives with a background in civil service. It is understood that since 2001, KT&G has distributed approximately 11 million KT&G shares and around 100 billion yuan in cash to various funds and stock associations consisting of current and former employees, transferring ownership without charge, thereby becoming the largest shareholder (based on common stock, accounting for 9.6%).

In this situation, appointing external directors is equivalent to handing over voting rights to the company, significantly impacting the "government official-turned-CEO" model.

Critics in the industry have condemned KT&G for appointing non-experts as external directors, essentially demanding that they serve as mere "solicitors" who are expected to vote in favor of the company's proposed agenda.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com