Participants of the company

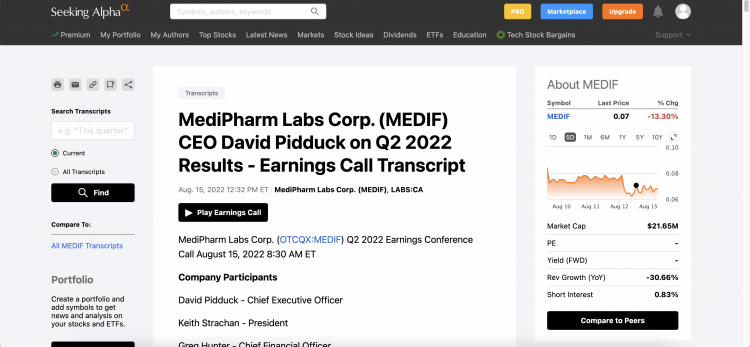

David Pidduck - CEO (Chief Executive Officer)

Keith Stralka - President.

Greg Hunter - Chief Financial Officer

Participants in a phone conference call.

Remy Smith - Global Alliance Partner.

Tamy Chen is a representative of BMO Capital Markets.

Operator.

Ladies and gentlemen, thank you for your support and welcome to the MediPharm Labs Q2 2022 financial performance conference call. Please note that today's meeting is being recorded.

请参考本公司的风险因素和管理讨论与分析,以及加拿大证券监管机构提交的其他文件。请注意,在本次电话会议中,公司代表的前瞻性陈述仅适用于当时发表的状态,并基于公司管理层在该时段内所掌握的信息。该公司不承担更新任何前瞻性陈述所需的义务。因此,我们建议投资者不要将其作为放弃适当的调查和分析的依据。

Now, I am going to transfer the call to the CEO of MediPharm, David Pidduck. Please continue.

David Pidcock

Good morning, thank you for joining the 2022 financial performance conference call for MediPharm Labs. With us on the call today are Keith Strachan, the president of MediPharm, and Greg Hunter, the chief financial officer. I will be discussing some of our strategic achievements and growth opportunities before handing the call over to Keith and Greg for a more detailed update on quarterly performance. Thank you to our operator for facilitating this call.

In April, I joined MediPharm from the pharmaceutical industry because I recognized the significant emerging opportunity with drugs containing cannabinoids and saw MediPharm as the most pharmacy-like organization in the industry. As a team, we are relentlessly focused on leveraging our established platform to increase revenue. In order to deliver on our commitments for revenue growth, we are executing several priority initiatives to streamline our operations and ensure profitability of our revenue.

Regarding our manufacturing footprint, we have recently announced the sale of MediPharm Labs Australia - a pure cannabis concentrate. With our increased production capacity in Canada and our recent acquisition of the GMP pharmaceutical license, the Australian facility will continue to service the local market and the European Union. Our Canadian site currently provides services to all Canadian jurisdictions which is currently the most meaningful. The sale is expected to be completed within the next 60 days and will generate at least AUD 6.9 million in revenue. Apart from injecting cash, this change will also help alleviate the challenge of adjusting our workforce annually.

Given our strong balance sheet, we see opportunities to execute value-enhancing and opportunistic M&A in the current environment, built on MediPharm's unique capabilities in the pharmaceutical, global, and Canadian segments. We will be prudent in both balance sheet and equity aspects, actively seeking transactions that build on our strengths while delivering returns for shareholders. The recent IP acquisition from Shelter Cannabis is an example of a creative transaction that adds value for shareholders. With our manufacturing capabilities, personnel, established channels, and sales channels, we can seamlessly leverage the right transactions and use them to drive us closer to profitability. Compared to many smaller players, our strong balance sheet gives us an advantage in the current market.

并且他们正在尽可能地快速加入这个市场。但是,MediPharm 已经建立了 GMP 认证工厂,并拥有完备的设施和工艺流程,这是我们在行业内的优势之一。我们通过制定严格的质量标准和流程,从而使我们在制造和供应高质量、可预测的大麻素和健康产品方面具有竞争优势。我们相信,这将使我们在未来发展中获得成功。

In the United States, the FDA has approved new drugs in both novel and generic forms, for which manufacturers will require GMP API in order to scale up production. Epidiolex is currently the only FDA-approved CBD drug, made with API from natural sources. MediPharm is one of only two commercial-scale natural extractors in North America with natural CBD API as the drug master file. Epidiolex is a $900 million drug annually. Our research and development team has been working for years to enable us to participate in this market as a potential API supplier.

In Germany, the current coalition government has made the legalization of marijuana a top priority. With over 90 million inhabitants, this will create a new health sub-market for non-smoking forms of consumption. Germany's long-tail opportunity is further validated as we see one of the world's largest marijuana companies, Curaleaf, make another acquisition in the EU last week. As for MediPharm, we have already established ourselves in Germany and have been selling medical marijuana products since February 2021. Their health authorities have accepted our GMP import license and we have 12 extract products registered in medical plans, with four new products set to be launched by the end of the year.

According to data from Prohibition Partners, extracts accounted for 35% of medical cannabis sales in Germany as of April 2021. These are just some examples of upcoming opportunities. The future of global opportunities requires stricter GMP quality expertise and processes. Newer countries that start with medical cannabis typically have very strict approval procedures. We are proud to have obtained approval from countries such as Brazil, and we will launch two products starting in the third quarter of this year. As the global cannabis market develops, MediPharm's GMP and pharmaceutical methods provide a unique advantage for gaining new global medical and health cannabis opportunities.

I will now transfer the call to Keith.

Keith Strachan

Thank you, David. In the second quarter, we faced challenging overall sales performance. However, as we shifted our business portfolio in Canada towards B2C sales instead of B2B and overall sales, we have continued to see an improvement in our adjusted gross margin.

MediPharm continues to maintain its leadership position in the health sector in Canada. In Q2, we were the second-largest producer of cannabis oil in the country, with a 12% market share, which increased to 15% in July. The category leader holds a market share of 40%, indicating substantial room for growth. We possess the capability to gain an upper hand in this sector given our quality, expertise, and differentiated product line.

Our award-winning portfolio of oil products and other offerings is driven by innovation. Recently, we introduced 30 CBD products, including rechargeable and disposable e-cigarettes as well as three-in-one flavor e-cigarettes. By 2022, we had launched 14 new unique SKUs, a 75% increase compared to the same period in 2021. Our entry into the domestic flower products market under the Shelter brand was delayed slightly with delivery slated for mid-May rather than April. Initial indicators suggest strong demand for flower and pre-roll products. However, with only five weeks of sales in the second quarter, we will provide a complete breakdown of performance for this product line after the third quarter.

In the second quarter, our international revenue decreased compared to the first quarter, but we continued to make strong progress. International revenue will continue to grow on a quarterly basis until our business reaches scale. Our main clients continue to see sustained growth, and we expect to deliver a large amount of replenishment orders to them in the second half of 2022. In Brazil, the medical cannabis market is estimated to be worth $110 million by 2025, and MediPharm was established for success in this market. In 2022, we successfully completed the challenging product authorization process for two difficult SKU products. We are currently the only Canadian producer to have successfully completed this process.

Ladies and gentlemen, that concludes the MediPharm Labs Q2 2022 financial performance conference call. Thank you for joining us. You may now disconnect.

Statement:

This article compiles information from third-party sources and is intended for industry professionals to share and learn from.

This article does not represent the views of 2FIRSTS and 2FIRSTS cannot confirm the authenticity or accuracy of the article's content. The translation of this article is solely for the purpose of industry communication and research.

Due to limitations in our compiling abilities, the translated article may differ in expression compared to the original. Please refer to the original text for accuracy.

2FIRSTS fully aligns with the Chinese government on all domestic, Hong Kong/Macau/Taiwan-related, and foreign statements and positions.

The compilation of information belongs to the original media and author with copyright ownership. If there is any infringement, please contact us for removal.

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.