On February 6, Philip Morris International (PMI) released its fourth quarter 2024 financial report and full year performance on its official website. The report showed that fourth quarter revenue increased by 7.3% to $9.71 billion, exceeding market expectations of $9.44 billion, compared to $9.05 billion in the same period last year. Organic revenue for the 2024 fiscal year increased by 9.8% to $37.9 billion, higher than the previous fiscal year's $35.25 billion.

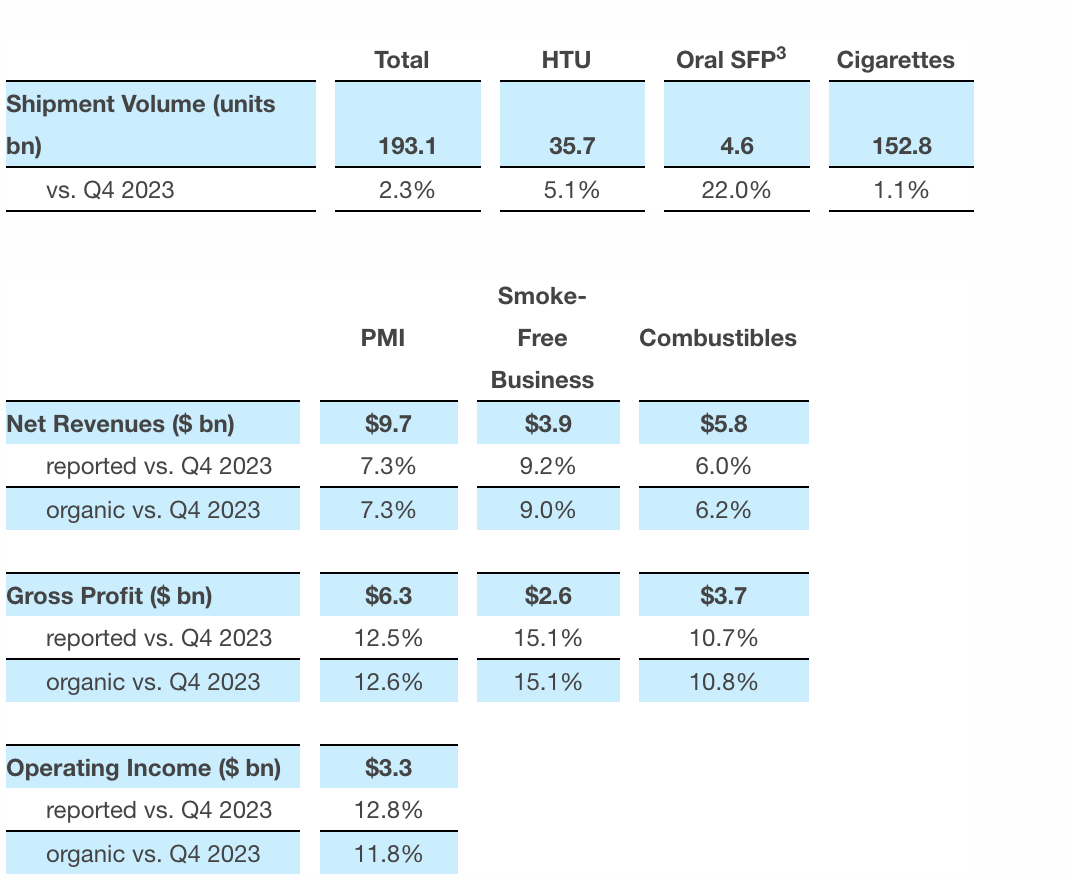

In the fourth quarter, total sales increased by 2.9% to 193.1 billion units, with the sales of heated tobacco pods rising by 5.1% to 35.7 billion units, and sales of oral nicotine products increasing by 22.0% to 4.6 billion bags. Non-smoking product revenue accounted for 40% of total revenue, with gross profit accounting for approximately 42% and sales volume making up 20.9%. The total units (units, bags) of non-smoking business achieved quarterly shipments exceeding 40 billion for the first time, and have been launched in 95 markets, with a user base of 38.6 million, an increase of 5.3 million users compared to December 2023.

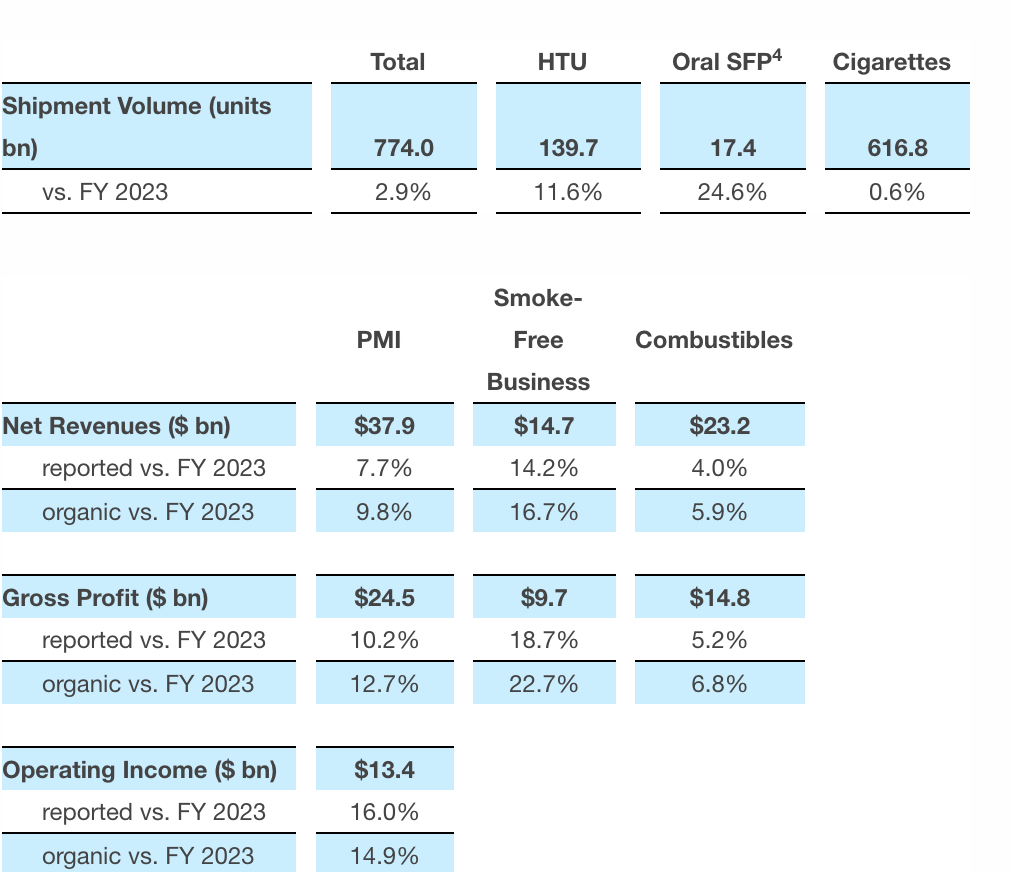

In the 2024 fiscal year, total sales volume increased by 2.9% to 774 billion units (cigarettes, pods), with heated tobacco products growing by 11.6% and oral nicotine products growing by 24.6%.

PMI emphasizes that IQOS continues to be the second-largest nicotine "brand" in the existing market, driving a 0.7% increase in total sales volume in the cigarette and HTU (heated tobacco unit) industry in the fourth quarter; in Japan, the heated tobacco product ILUMA i is driving growth for IQOS, with sales volume in the domestic market increasing by about 13% in the adjusted fourth quarter and full year of 2024; in Europe, IQOS market share increased by 0.9% to 10.6% in the fourth quarter.

VEEV e-cigarettes ranked among the top three in 13 European markets, with the top spot in five markets including Italy, Romania, Czech Republic, Slovakia, and Finland, with an annual shipment volume of 1.7 billion units (including pods), more than doubling compared to 2023. In terms of oral nicotine products, ZYN's strong performance in the United States drove growth, with a 42% increase in shipment volume in the fourth quarter reaching nearly 165 million cans, with over double the volume of nicotine pouches sold outside the US, with significant contributions from Pakistan, South Africa, UK, and Mexico. PMI's nicotine pouches are now available in 37 markets, including recent launches in Italy, Romania, and Thailand.

PMI's CEO Jacek Olczak stated that,

In 2024, it was an exceptional year for PMI. We achieved strong annual performance, driven by the continued growth of IQOS and ZYN, as well as strong performance in combustibles.

Currently, the FDA has approved all ZYN nicotine pouches that we sell in the United States, further proving the compelling scientific evidence supporting smoke-free products. We hope our other pending FDA applications will be expedited. We also hope other countries will follow suit and implement effective tobacco harm reduction measures. This is especially important in places where smoke-free products are banned because they can lead to the continued presence of combustible cigarette consumption.

With strong momentum across all categories, we believe that our smoke-free transition and brand portfolio will continue to deliver excellent performance in 2025 and beyond, creating value for our shareholders.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com