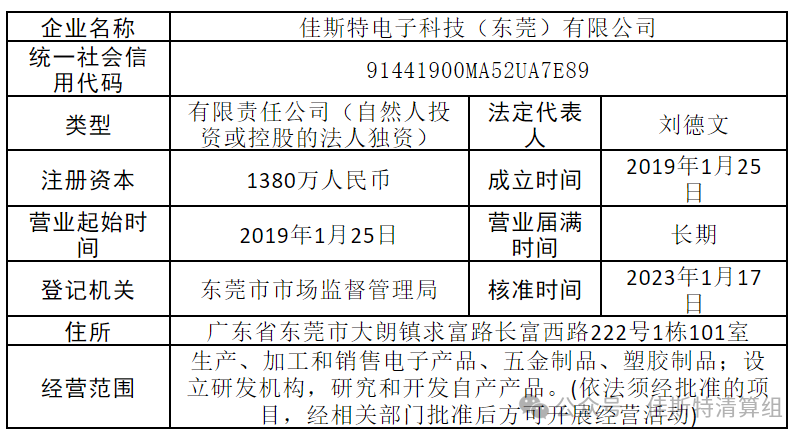

On June 26, the JSTE liquidation team released a public announcement seeking potential investors for the restructuring of JSTE Electronics Technology (Dongguan) Co., Ltd. The team is carrying out the necessary legal procedures and work in accordance with the asset evaluation of JSTE. Based on the evaluation, the team believes that it is possible for JSTE to undergo restructuring.

The liquidation team stated that in order to safeguard the legitimate rights and interests of all creditors of JSTE Company, promote the effective integration of resources of JSTE Company, revitalize company assets, and maximize the value of corporate assets, they are now publicly recruiting potential investors for reorganization nationwide (excluding foreign investors).

The full text of the announcement is as follows:

JSTE Electronics Technology (Dongguan) Co., Ltd. is a manufacturer with over ten years of experience in e-cigarette production. Over the past decade, JSTE has served as an advanced research and development manufacturing base, providing assurance for the rapid growth of one of the top ten e-cigarette brands in the world, JUSTFOG. They offer high-quality, safe, and reliable open system products. With superb technology and a strict quality control system, JSTE prioritizes quality in both management and technology. This commitment has provided strong support in earning the trust and recognition of their users.

JSTE Company will primarily focus on providing OEM and ODM services for open, disposable, and pod system e-cigarettes. It will offer customizable solutions based on the client's needs and requirements, including research and development, design, production, and packaging, in order to achieve the production of their unique e-cigarette products.

In July 2022, the e-cigarette production company obtained a license to operate. The factory implements a strict quality management system to ensure that all materials and components meet relevant regulations and standards. The company has obtained certifications for ISO9001 quality management system, ISO14001 environmental management system, and ISO45001 occupational health and safety management system. After more than a decade of experience, the team's overall competence is at a high level in the industry.

JSTE Company has excellent production capabilities for e-cigarettes, with a factory (office) area of 7,729 square meters and supporting dormitory area of 6,600 square meters. It has a 100,000-level GMP production workshop, 4 standardized atomization workshops, over 20 automated assembly lines, and over 120 testing equipment facilities. The annual production capacity is 50 million sets, and the supply chain system and quality management system meet the regulatory requirements of the target market countries.

Scale advantage: the unique stand-alone building, with security management, and soft and hard furnishings costing over 8 million RMB.

Technological and design advantages: Over 30 effective e-cigarette patents.

Corporate Culture and Talent Advantage: The company has a strong corporate culture that can unite forces, work together, and achieve excellent results. The core personnel of the company have been working for over 8 years. At present, the core backbone is still participating in the company's related work.

Management and Production Advantage: Team has undergone training in lean production, 6S management, marketing methods, and other related skills.

Quality Assurance: The complete testing equipment in the laboratory ensures quality control and protection.

II. Explanation of JSTE Company's Assets and Liabilities

As of the settlement date, the May asset data for JSTE Company in 2024 shows a total of 75,199.99 million yuan in assets on the financial statements at the end of May.

The main high-quality assets are as follows:

- Tobacco monopoly production enterprise license (e-cigarette processing enterprise).

- Inside and outside walls of the factory building, factory air conditioning piping, e-cigarette production assembly line, laboratory, experimental equipment, ERP financial software and other computer hardware and software fixed assets (original value 9.24 million, net value 5.22 million). These assets cannot be dismantled and disposed of separately, otherwise their value would be very low.

- The factory is equipped with modern office facilities such as meeting rooms and renovated offices, with an initial investment of 8 million and an estimated net worth of 6 million.

- Intangible assets include 20 valid patents, 2 tobacco trademarks in 34 categories, certification as a high-tech enterprise (eligible for a 15% tax reduction based on local policies), and certifications for supply chain and quality management systems.

- The inventory value of raw materials, finished products, and semi-finished products for disposable e-cigarettes is approximately 47 million yuan (Note: Special products may be sold off at market prices, which could be lower than the cost price).

Note 1: With the above asset conditions, the system capable of immediately resuming production and operation, supply chain guarantee, mature management, research and development, production team, the original customer channel resources, and order resources can be maintained. Note 2: The liquidation asset evaluation and liquidation audit work of JSTE Company are proceeding orderly, and the final data is subject to the liquidation audit and liquidation evaluation report.

Debt data for the month of May before the settlement date.

- Outstanding payments to external suppliers: approximately 46 million yuan.

- External Financial Liabilities: Two banks are owed approximately 7 million yuan in financial liabilities.

- Employee claims: In May, the total amount of employee claims was 1.23 million RMB. On June 3rd, 1.04 million RMB was paid out on the liquidation reference date, with the remaining unaccounted for and unpaid employee salaries to be uniformly paid in a subsequent "Asset Disposal Plan".

III. Restructuring the investor investment model

Potential investors in the restructuring can choose to participate in the investment through the following individual or combined methods, as detailed below:

Assets and equity acquisition: Intending to restructure, investors can negotiate the comprehensive acquisition of JSTE company assets.

Debt investment: Investors interested in restructuring can choose to invest through receivables (including foreign debt) or other agreed-upon legal methods of debt.

Other methods: The intended restructuring investment and liquidation group, along with other relevant parties, reach a consensus on the restructuring investment method through legal negotiations.

Additional explanation: In order to enhance the acquisition value of JSTE Company's high-quality asset package, the liquidation team can separate the liabilities of JSTE Company through methods such as company segregation with the consent of creditors, making it easier for restructuring investors to acquire the company as a whole.

Fourth, purpose of recruitment.

The purpose of this recruitment of investors is to resolve company risks by providing funds and industry support through pre-restructuring programs. This is in order to legally protect the legitimate rights and interests of all stakeholders including suppliers, employees, and financial institutions. The goal is to comprehensively optimize the company's asset and liability structure, effectively integrate industry resources, achieve industrial transformation and upgrading, and ultimately create a high-quality company with a sound governance structure, excellent asset quality, reasonable asset-liability structure, sustainable operational and profitability capacity.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com