Special Statement:

This article is for internal research and communication within the industry only and does not recommend any brands, products, or investments.

Minors are prohibited from accessing.

Global Annual Brand Article Series 2023

Reassessing Smoore

-- How did Smoore miss the wave of disposable products? What are the real challenges facing Smoore during its downturn?

2FIRSTS

"Enhancing sales capabilities, improving manufacturing capacity, seizing current market opportunities, and achieving quality growth. Integrating upstream and downstream resources, strengthening technological research and development, focusing on major clients, and becoming an electronic cigarette manufacturer with the 'highest quality'".

The above passage is from a group paper titled "Smoore's Corporate Competitive Strategy and Implementation," published in the fall of 2014 by the China Europe International Business School EMBA. One of the authors is Chen Zhiping, who is currently the Chairman of the Board of Directors of Smoore International Holdings Limited (hereinafter referred to as "Smoore").

Published nine years ago, this paper elaborately discusses the competitive strategic choices of Smoore. While this paper was being written, on the other side of the ocean, a company was brewing a brand-new technology—nicotine salt. A year later, Juul emerged, ushering in a new era of global e-cigarette. Riding on this wave of industry dividends, Smoore seized major clients, advanced manufacturing, and ceramic coil R&D as its dual wings, achieving rapid growth. In July 2020, Smoore went public on the Hong Kong Stock Exchange. Just six months after going public, its market value exceeded HKD 550 billion.

Subsequently came a significant turning point. In less than three years, Smoore's market value plummeted to below 40 billion Hong Kong dollars.

Externally, Smoore's current strategy seems to still align with Chen's paper from 2014, showing no major changes. However, in terms of stock price and market value, Smoore is evidently at a low point. So, why does the strategy that once propelled Smoore to glory appear to be "malfunctioning" in the past three years?

If Smoore's strategy hasn't changed, another possibility arises: the Dynasty has changed.

Counter-Trend Fall

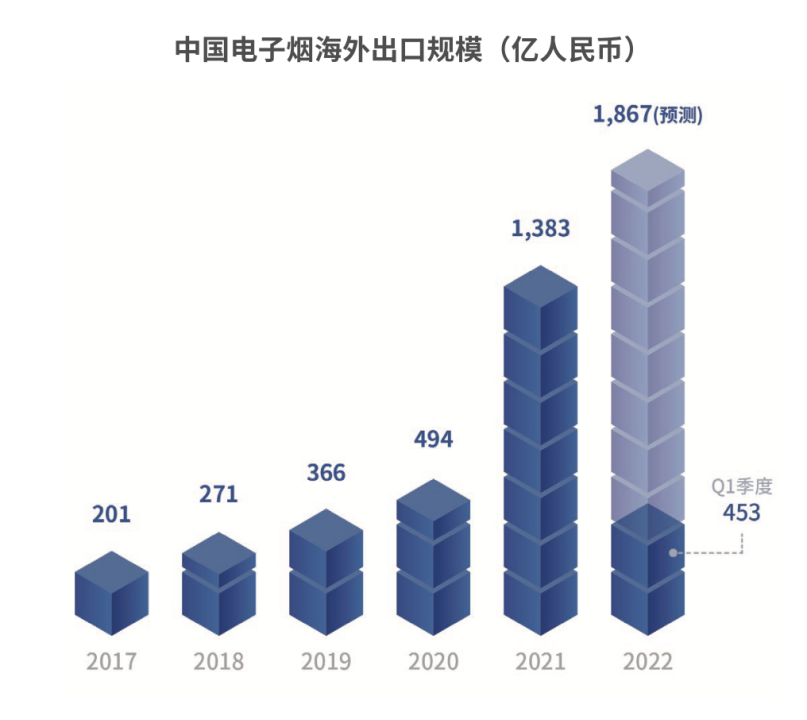

According to the "2022 Blue Book of E-cigarette Industry Export," the export scale of China's electronic cigarettes was 49.4 billion RMB in 2020, reaching 138.3 billion RMB in 2021. It is estimated that the export scale of electronic cigarettes will reach 186.7 billion RMB in 2022, with a year-on-year growth rate of 180% in 2021 and 35% in 2022. This substantial growth is largely attributed to the outbreak of disposable products.

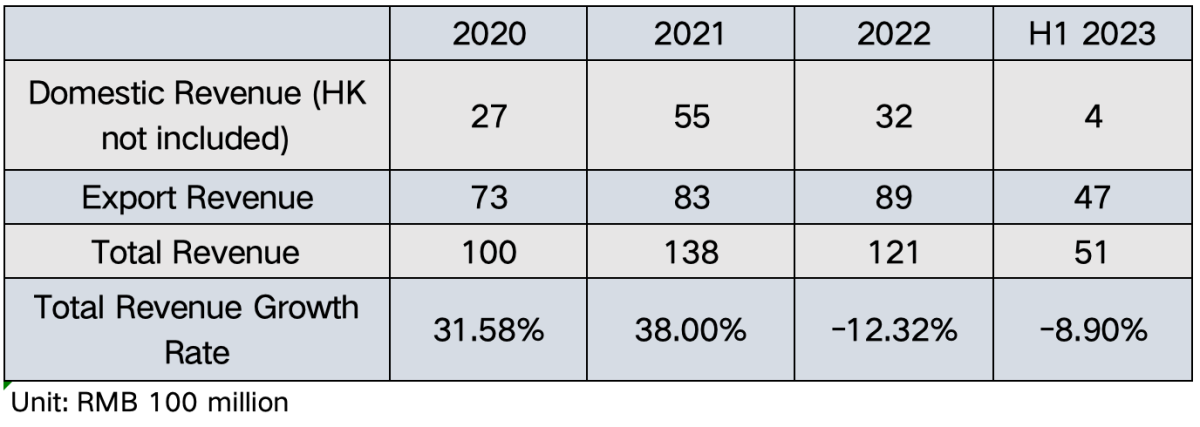

However, Smoore's total revenue growth rates for the first half of 2021, 2022, and 2023 were 38%, -12.32%, and -9.4%, respectively.

From the above data, it can be observed that starting from 2021, the global market experienced a new growth cycle driven by the surge in disposable products. However, Smoore, in this global trend, is facing the challenge of a decline amongst the bull market of vaping.

Missed Opportunity in Disposable Product Boom

The global disposable market exploded in 2021, driving rapid growth worldwide (a 180% YoY increase, according to the "E-cigarette Export Blue Book"). In 2022 and 2023, the primary drivers and competition in the global market have revolved entirely around a wave of new disposable products. In this "super cycle," several e-cigarette brands quickly rose to prominence. For example, ELFBAR (owned by "iMiracle"), entering the "20 billion RMB club," and HQD (owned by "HQD"), entering the "3 billion RMB club" (editor's note: as these companies are not publicly listed, and revenue data is based on market rumors, serving only as a description of their scale, not representing actual revenue).

Another notable reference is SKE, as per Yinghe Technology (SKE's parent company) 2023 semi-annual financial report, showing SKE's revenue surpassing 14 billion yuan, a staggering 1477.33% YoY growth.

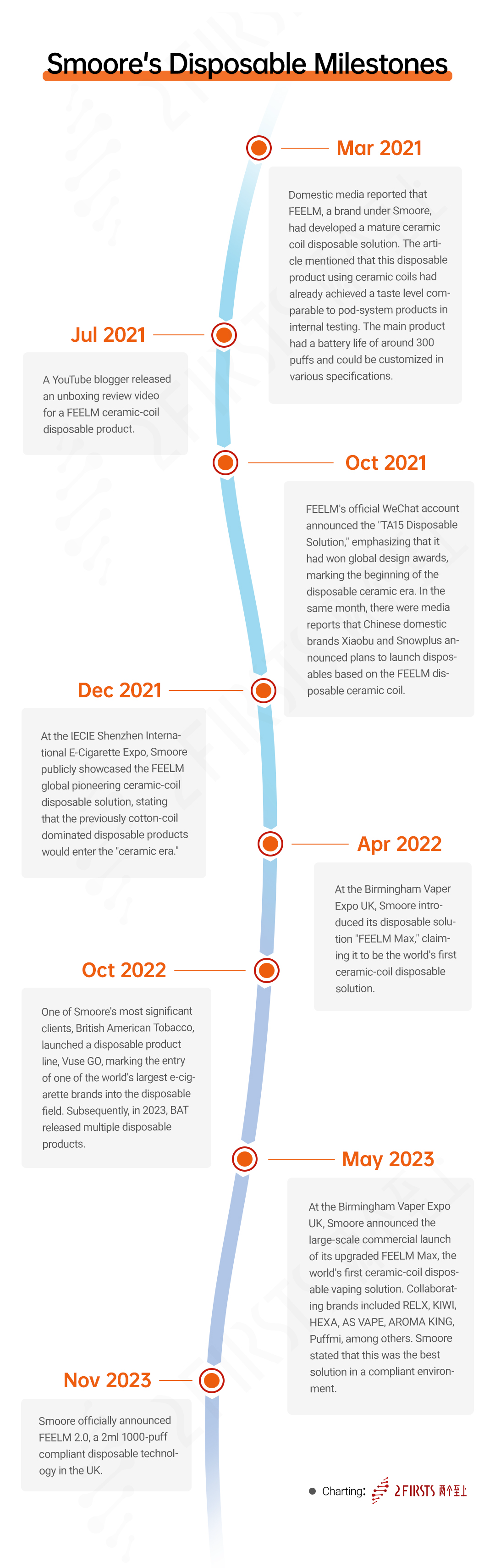

Contrastingly, looking back at FEELM's disposable development trajectory, 2021 was primarily focused on technological reserves, with disposable products not taking center stage. In 2021, the emphasis was on introducing "FEELM AIR." It wasn't until 2022 that FEELM MAX was launched, signifying disposable products becoming a formal "focus." By 2023, based on over a year of technological research and development, FEELM identified its strategy in the disposable arena as "technology + compliance." The launch of FEELM MAX to FEELM 2.0 signals this strategic shift.

This approach is not wrong, but it was a step behind. The consequences of "temporarily" missing the disposable product trend are reflected in FEELM's revenue. Although FEELM has faced challenges in growth over the last two years, influenced by factors in the domestic Chinese market, the missed opportunity in disposable products is a more significant factor.

Crisis: Not an Industrial Flagship Anymore

There are multiple factors that contribute to the rise and fall of share prices and market capitalization, and it is not appropriate to use them directly to evaluate the long-term value of a company. Missing the chance of disposables can be seen as a problem with business decisions, and Smoore has made strategic adjustments accordingly. So what is the real crisis facing Smoore?

"The Vaping Technology Leader - Committed to being the world's leading provider of vaping technology solutions." This quote is from the official website of Smoore.

At least until 2021, FEELM achieved such a vision. In the era when traditional "cotton coils" (using cotton as the atomization coil material) dominated, FEELM focused on the research and development of ceramic coils (under the technical brand FEELM), pioneering a ceramic coil solution with some performance indicators surpassing traditional cotton coils. The maturity of ceramic coils became a crucial technological driving force propelling the Chinese e-cigarette market forward. A large number of e-cigarettes based on FEELM's ceramic coil technology quickly emerged and grew, with RELX being the most typical. In the international market, VUSE from British American Tobacco also adopted FEELM's ceramic coils. At that time, driven by both domestic and international brands, FEELM successfully led the global vaping market. Some e-cigarette brands would imprint FEELM on their packaging as a product highlight. This approach is similar to the "Intel inside" stickers seen on computers in the traditional PC era.

After the rise of ceramic coil, the vaping industry has formed 2 parties, cotton coil-ism and ceramic coil-ism, so far inconclusive, but the competition between the two technology routes, forcing the continuous upgrading of technology, both cotton coil or ceramic coil manufacturers, are continuing to carry out research and development of technology. It can be said that the research and development and promotion of ceramic coil by Smoore has objectively accelerated the upgrading of global vaping technology, including cotton coil. This is exactly the value of "Leader".

However, in the three years from 2021 to the end of 2023, it will be difficult for Smoore to be a "leader" in the global wave of disposable products.

Smoore's delayed response to the disposable product trend in 2021 and its subsequent failure to lead global development in the following two years are hard for it to swallow: The world's most influential brands are not its customers, the global wave of disposable innovation does not come from Smoore, and even the biggest controversy and public opinion in the global vaping industry has nothing to do with Smoore.

It wasn't until the end of 2023 with the launch of FEELM 2.0 that Smoore demonstrated a clear competitive strategy and product development direction in the disposable product sector. It cannot be denied that perhaps in the near future, Smoore will catch up with the wave of disposable products and regain the path to leadership, but the loss of leadership over the past three years is enough to warrant attention.

In the history of business development, the loss of the leader position is often the biggest crisis of an enterprise. It does not mean that the enterprise is not good, but it signals that the enterprise is out of time. The most frequently cited cases in business schools are Kodak cameras and Nokia cell phones. The rise of Pinduoduo, a bargain e-commerce platform, and its overtaking of Alibaba in market capitalization for the first time is a similar example.

After losing the its leading position, it becomes extremely difficult to get it back. This is because the loss of leadership is often the result of a series of problems in strategy, culture, organization, etc., and it is not easy to solve these problems. For Smoore, regaining the leader status will not be an easy task.

So why did Smoore lose its leadership position? Missing out on the wave of disposable products is only scratching the surface. The deeper reason lies in Smoore's previous success.

Good is the enemy of great.

—— "Good to Great" by Jim Collins

Rise of Disposables Undermined Smoore's Past Plot to Success

It is not difficult to see from past history that the birth of a new product can change the fate of a company, can change the habits of consumers in the market, and can even lead to the transformation of an entire industry.

—— Smoore's Corporate Competitive Strategy and Implementation

The rise of disposable products has led to a revolution in the entire global vaping industry, from the supply chain and channels to consumer behavior.

On the production end, compared to the traditional FEELM flagship category—closed pod-system products, disposable products significantly reduce production complexity and process requirements due to their simple product form. This not only weakened FEELM's advantage in high-quality manufacturing to some extent but also, faced with many small and medium-sized factories adopting a "low-cost manufacturing" strategy and lowering product quality requirements, FEELM lost its cost advantage.

The ceramic coil route also faced challenges. A practitioner in the e-cigarette industry told 2Firsts, "The biggest advantage of cotton coils is their ability to easily produce sweetness and fragrance, better matching the taste required for disposable products. Therefore, the majority of disposable e-cigarette products on the market use cotton coils, especially in the United States, one of the world's largest e-cigarette markets." In the long-term focus on ceramic coils, FEELM, constrained by the "coil route dispute," could only start with a disposable vaporizing solution for ceramic coils, and progress was somewhat affected.

On the channel end, the emergence of disposable products significantly expanded the channels for e-cigarettes. In the era of mod and open systems, due to the limitations of device complexity, e-cigarettes mainly existed in formats such as specialty e-cigarette stores, brand-exclusive stores, and digital chain stores. These channels were limited to the development of large brands due to high marketing and maintenance costs. However, due to the simple form and low cost of disposable products, they can penetrate any channel and terminal, significantly reducing channel costs. This provides an opportunity for small brands and new brands to enter, contributing to the global market's outbreak of brands and the succession of leading brands. However, due to the aforementioned supply chain factors, many of these emerging leading brands and new brands did not choose FEELM. In other words, the transformation of channels indirectly promoted the growth of FEELM's competitors.

On the consumption side, the popularity of disposable products has pushed e-cigarettes back to FMCG, and their consumption attributes are close to cigarettes. Disposable products, although there are still many problems in terms of quality and other aspects, but the convenience of its consumption has realized a qualitative leap, e-cigarettes since its birth 20 years ago, has never been so easy to use. Once upon a time, the use of e-cigarettes due to the complexity of the use of E-cigarettes, but also gave birth to the rise of many players communities. Today, e-cigarettes are as easy to buy as cigarettes, and in terms of ease of use, they even surpass traditional cigarettes.

The inherent technological differentiation of disposable products is obliterated by the simplicity of their construction as opposed to the vastly improved convenience.2023 For consumers, the biggest innovation in e-cigarettes is the addition of a display (see 2FIRSTS' special report, "Screens Gone Viral"). Product homogenization and the invisibility of technological differences reduce the competitiveness of technology-driven companies. Until significant technological leaps are made and consumer-perceivable differentiation is realized, pure technological R&D can hardly be reflected in product competitiveness. That is, one of the factors that make it difficult to translate the deep investment in R&D into competitiveness.

R&D Failures

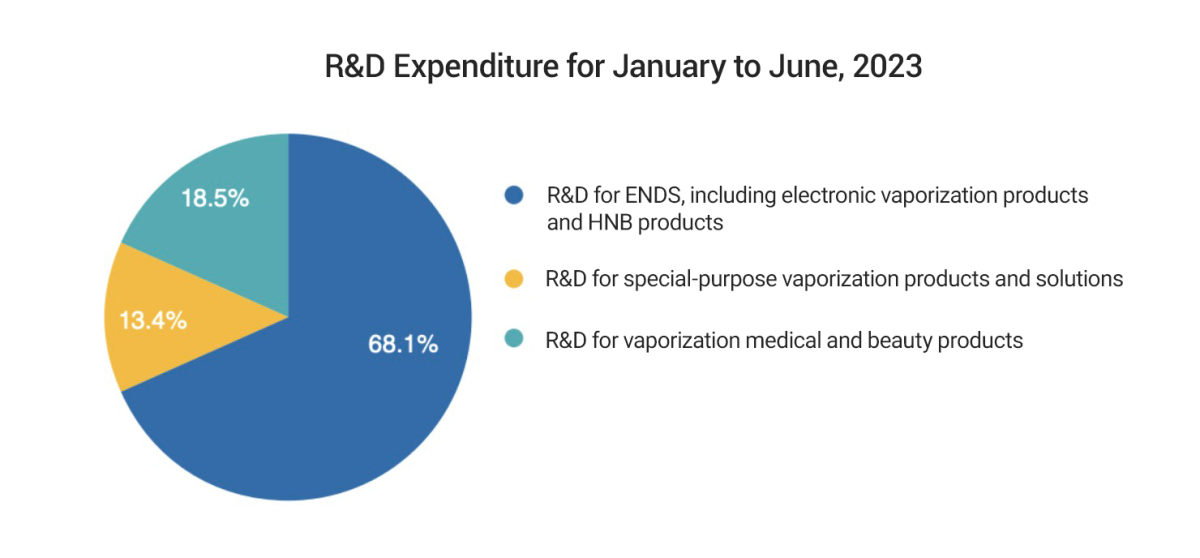

In stark contrast to Smoore's declining stock price and revenue, its research and development expenses have continued to climb.

The financial report shows that in 2022, Smoore's annual R&D expenses invested 1.372 billion RMB, up 104% year-on-year from 671 million in 2021; in the first half of 2023, Smoore's R&D investment has reached 615 million yuan, an increase of 1.8% year-on-year, and the proportion of the total revenue has also risen to 12%.

According to the criteria for high-tech enterprises, enterprises with sales revenue of 200 million yuan or more in the previous year are qualified as high-tech enterprises if their R&D expenses account for no less than 3%. And the R&D expense ratio of Smoore is 4 times of the standard of high-tech enterprise.

However, why hasn't high R&D supported Smoore's leadership in the current wave of disposables?

The main factor is that the research and development of Smoore's has failed to capitalize on the trend of transforming e-cigarettes into FMCG products. If e-cigarettes still have the attributes of a technological product in the open and closed pod system stage, then for the disposable category, e-cigarettes have completely become FMCG. For a long time to come, e-cigarettes will still have high-tech components and great potential for technology development. However, in terms of product attributes, the rise of disposable products clearly declares that e-cigarettes are not high-tech products. For a typical cell phone, electric car such as high-tech products, the value of its products in the high value-added technology, technology research and development is the coil of long-term competitiveness of enterprises. And as a FMCG attribute of e-cigarettes, the most important competitiveness will be channels and brands. And at the product level, convenience, ease of use, low cost, these factors are usually more important than technical parameters.

Compare this to the release of two generations of FEELM MAX at the two Birmingham e-cigarette shows in 2022 and 2023 by Smoore. At the time of its release in 2022, its main selling point was still to emphasize the advantages over cotton wicks, as well as the parameter improvements in puff count, taste, and consistency. These data, for B-side customers, may be very convincing, but for a disposable e-cigarette consumer, the perception will be greatly reduced, and far less direct than adding a display.

The release of 2023, in addition to the product itself, but also mentioned "to build automated production lines, promote the scale of commercialization" plan. If the goal of this program is to significantly reduce production costs through automated production lines, to provide users with more competitively priced products, then it can be said that the research and development of Smoore has begun to enter the era of "fast-moving consumer goods".

"Pitfalls" of Key Account Strategies

Emphasis on major customers is a top priority of Smoore's competitive strategy. "The company as soon as possible to become a strong comprehensive strength of the e-cigarette factory to match the needs of international tobacco companies will become the goal of the next period of time", the above paper has such a statement. Looking back, it was the close cooperation with major customers such as British American Tobacco, Japan Tobacco International and RELX that pushed Smoore to its first peak. A detail is that the peak of the stock price after the listing of Smoore was realized at the time of the listing of RELX.

But the crisis is also here. As a manufacturer, Smoore's leadership of the industry needs to be channeled through its major customers. If a major customer fails to lead the market for whatever reason, then Smoore's leadership will be lost. This has been the case for the past three years. International customers are constrained by internal decision-making mechanisms and compliance restrictions, making it difficult for them to respond quickly to the wave of disposable products and "show their strength"; domestic customers such as RELX have also failed to capitalize on the wave of disposable products overseas (see 2FIRSTS' feature article, "RELX Stalling"). Large customers in the past three years of frustration, but also caused the fact that Smoore in the past three years in the global market "low profile".

The risks for large customers go beyond that. When e-cigarettes enter the era of FMCG, the requirements of large customers on the upstream supply chain will also be adjusted. Smoore's advantage in ceramic atomizer patents can constitute a short-term binding with customers, but in the long run, large customers will inevitably have higher requirements in terms of low cost and supply stability. This on the one hand will prompt the large customers to further control the procurement cost, at the same time in the supply chain security point of view, will also retain the "alternative supply chain" strategy. In the long run, the game between Smoore and its major customers, although it is still a long period of time is mainly cooperation, but the potential game will not disappear.

The relationship between Smoore and its international customers can be likened to that between Foxconn and Apple. However, Foxconn has established an extremely close cooperation with Apple due to the extremely high technological content and process difficulty of the products it manufactures. This mutual dependence is difficult to build on disposable e-cigarettes such as FMCG. Even in the face of close partners like Foxconn, Apple has plans for 'infidelity,' as evidenced by its support for Luxshare Precision.

For Smoore, the big customer strategy will face increasingly significant challenges in the future.

Reclaiming Leadership

Not leading doesn't mean not being good. The market is not only for leaders. However, reflecting on "leadership" will always remind companies to avoid misjudging trends and falling behind the times.

In the above mentioned paper, Smoore has defined four companies as "real rivals", namely KIMREE, JSB, Joyetech and FirstUnion. At present, these former rivals are not the biggest threat, but the real rivals come from out of sight.

Within the vaping industry, by virtue of its advantage in the branding end, iMiracle has not only completed its sweep of the global market, but also achieved backward integration and built a supply chain system with it as the chain master, covering the fields of vape oil, manufacturing and so on. Based on a variety of business interests, this system is difficult to integrate with the Smoore. Outside the vaping industry, BYD Electronics and other electronic foundry companies also maintain a "focus" on the e-cigarette industry. If we can not maintain the role of the leader, then the future of the competition faced by Smoore will become more and more intense.

How to take back the leader status? Perhaps the answer can be found in the nature of e-cigarettes. The essence of e-cigarettes as a tobacco FMCG product is to provide tobacco consumers with a safer and more convenient way to ingest nicotine.

The change from nicotine salts in 2015 to the wave of disposable products in 2021 was a significant improvement in the dimension of "convenience", which led to great commercial success. The future of e-cigarettes will continue to evolve in the dimensions of safety, convenience and nicotine intake, and safety will be extended to include product safety and external safety.

Centering change around the nature of e-cigarettes and focusing on the experience and benefits of tobacco consumers and stakeholders will be at the heart of e-cigarette change. "User-first" has a special meaning in the e-cigarette sector. It can be said that the above mentioned on the disposable wave of mistakes, as well as R&D failure, the essence of the user's neglect and arrogance, which is the same as Alibaba was overtaken by Pinduoduo and lost the leading position in e-commerce. And take back the leading position, the first thing is to re-recognize the user, re-value the user.

One detail is that while the wave of disposability has swept the globe and is approaching the age of the "rat race", Smoore's focus is still on the cotton vs. ceramic coil route. Until 2021, this could be used as a strategy to promote ceramic coils. But when times have changed so much, the debate seems out of place.

Smoore's major clients' concerns are majorly "coilized", but in the era of disposable products, e-cigarette users don't care. For a throwaway product, good appearance, comfortable taste, low cost, and easy availability are sufficient.

Lead the user, lead the customer, lead the market.

Editorial team: Leona Zhu, Yuna Hou, Jesse Ren, Sophia Lv (English), Ellesmere Zhu (English)

Afterword

Smoore is a typical representative of the global atomization industry's development. Researching Smoore is like using a ruler to measure the tremendous changes in the global industry over the past three years. Beneath the complex and varied phenomena, the study reveals the trends and contours of industry development. The derived reflections and discussions have positive implications for the industry's future development, product research and development directions, and corporate governance.

The analysis of challenges and considerations of issues faced by Smoore in the article should be objectively viewed in the context of the global industrial development history. Regardless of the current difficulties, the long-term is upheld by Smoore's founder and team, along with their emphasis on research and development, representing valuable insights needed for the global industry's development.

As a fast-moving consumer product, centralization from the supply chain to the brand end is the trend. The emergence and growth of well-managed, dynamic, and compliance-abiding large enterprises are signs of the industry maturing. We welcome the emergence of such enterprises, including Smoore.

Editorial Contact: info@2firsts.com

Scan the QR code and voice your opinion. We will select some of the best comments to share on the 2FIRSTS website.

Reference

【1】https://cn.2firsts.com/news/detail?id=465

【2】https://cn.2firsts.com/news/detail?id=4236

【3】https://fuwu.most.gov.cn/html/jcxtml/20181205/2848.html?tab=sqtj

【7】https://baijiahao.baidu.com/s?id=1779906450896219051&wfr=spider&for=pc

【8】https://www.163.com/dy/article/GN7M9J6R055299VE.html

【9】https://baijiahao.baidu.com/s?id=1707669265368218846&wfr=spider&for=pc

【10】https://cn.2firsts.com/news/detail?id=6353

【11】https://cn.2firsts.com/news/detail?id=4592

【12】https://xueqiu.com/4972206386/205518676

【13】https://m.thepaper.cn/baijiahao_10944157

【14】https://baijiahao.baidu.com/s?id=1783803098072444233&wfr=spider&for=pc