The Independent British Vape Trade Association (IBVTA) recently held the successful IBVTA 24 Forum at the Birmingham Conference Centre. The Forum brought together a wide range of industry experts, policy makers and representatives from regulatory and enforcement agencies.

Liam Humberstone, Chairman of the UK Independent British Vape Trade Association and a member of the British Standards Institution (BSI), gave a speech at a forum presenting growth data on the disposable e-cigarette market in the UK and discussing issues of market dynamics and compliance. As an audience member at the event, I have summarised his speech and views in the text below.

Sales of disposable e-cigarettes in the market reached £670 million in 2022

Humberstone noted that the market for disposable e-cigarettes has grown significantly in recent years.

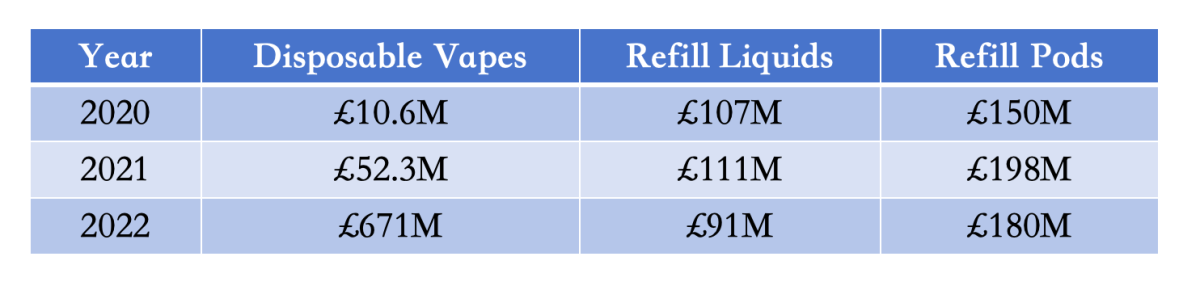

He shared market data on disposable e-cigarettes in the UK with the audience, illustrating the growth in sales of disposable e-cigarettes, refillable e-liquids and refillable pods in recent years.

According to the data, sales of disposable e-cigarettes will increase from £10.6m in 2020 to £671m in 2022, while sales of e-liquids and pods will also see significant growth. Humberstone believes that the rapid growth in refill e-liquid and pod sales is indicative of an increase in the length of time e-cigarettes are used, as well as consumers having more options to choose from.

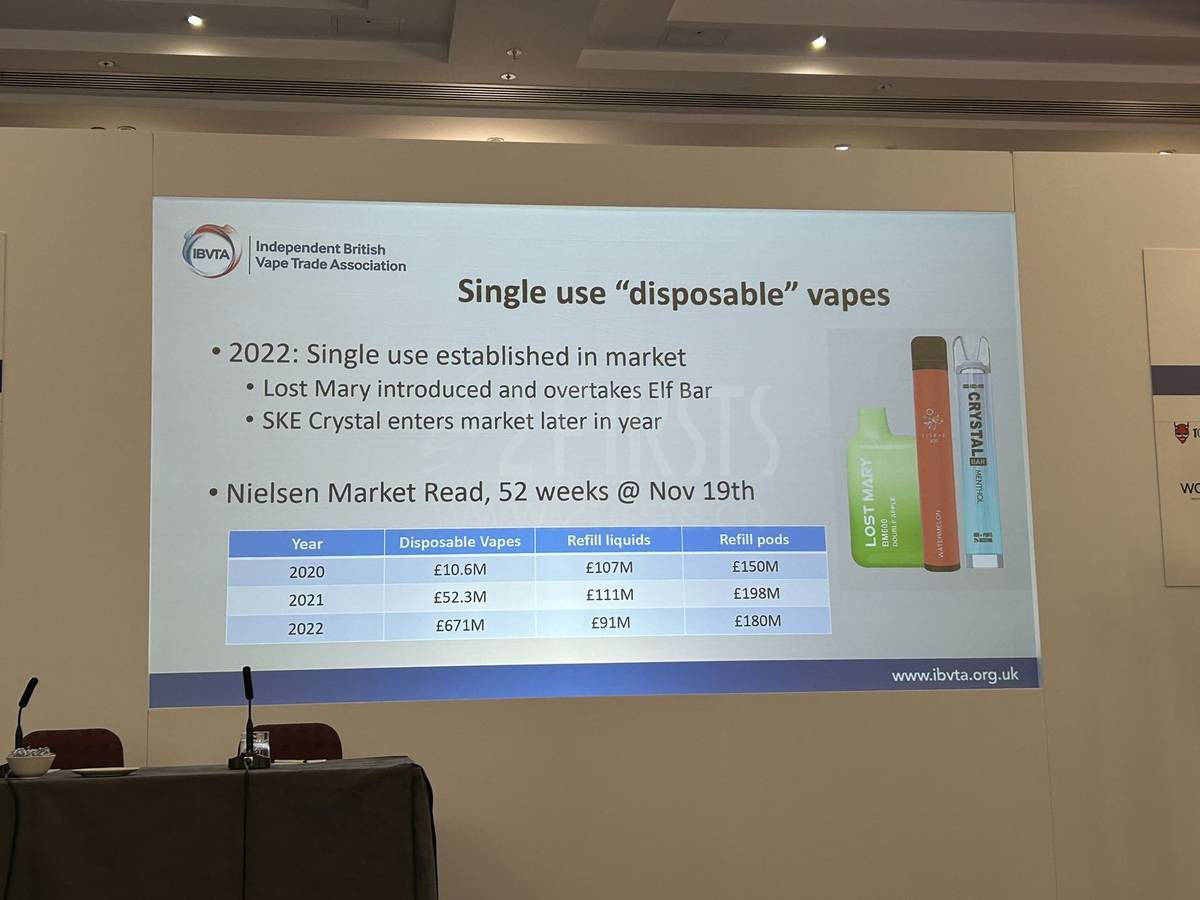

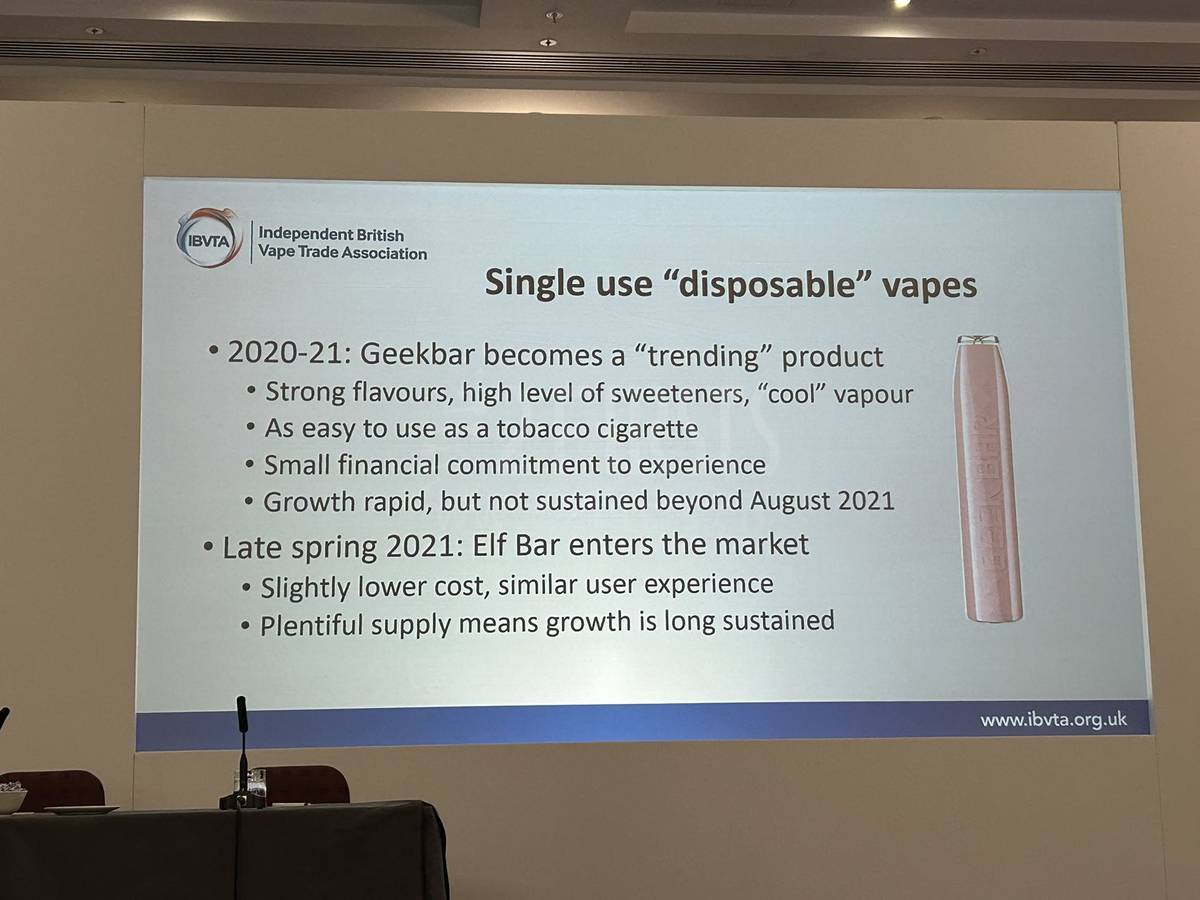

Meanwhile, Humberstone noted the dynamic nature of the disposable e-cigarette market over the past few years and the market performance of competing brands.

- From 2020 to 2021, GEEKBAR experienced significant growth due to its unique flavours and sweet vapour, becoming a "trending" product.

- In late spring 2021, ELFBAR entered the market with ample supply and continued to grow for a period.

- In 2022, disposable e-cigarettes further consolidated their market presence. The launch of the LOST MARY brand attracted attention and overtook ELFBAR that year.

- At the end of the same year, SKE Crystal also entered the market, giving consumers even more product choice.

The ban on disposable e-cigarettes creates uncertainty in the market

In his speech, Humberstone pointed out that despite the wide variety of pre-filled pod products on the market, the UK government's announced ban on disposable e-cigarettes has created further uncertainty in the market, making some innovative products no longer viable.

On the same day as his speech, Huw Irranca-Davies, Welsh Minister for Climate Change and Rural Affairs, confirmed in a written statement that the Environmental Protection (Disposable E-Cigarettes) (Wales) Regulations 2024 will come into force next year. The revised regulations, which will ban the use of disposable e-cigarettes from June 2025, aim to tackle plastic pollution and reduce environmental harm.

Humberstone noted that the Tobacco and Vaping Products Act could have a restrictive effect on non-specialist retailers, while tax policies remain in draft form. These policies could have a negative impact on the legal market while unintentionally fueling the black market, particularly in the 10ml e-liquid sector.

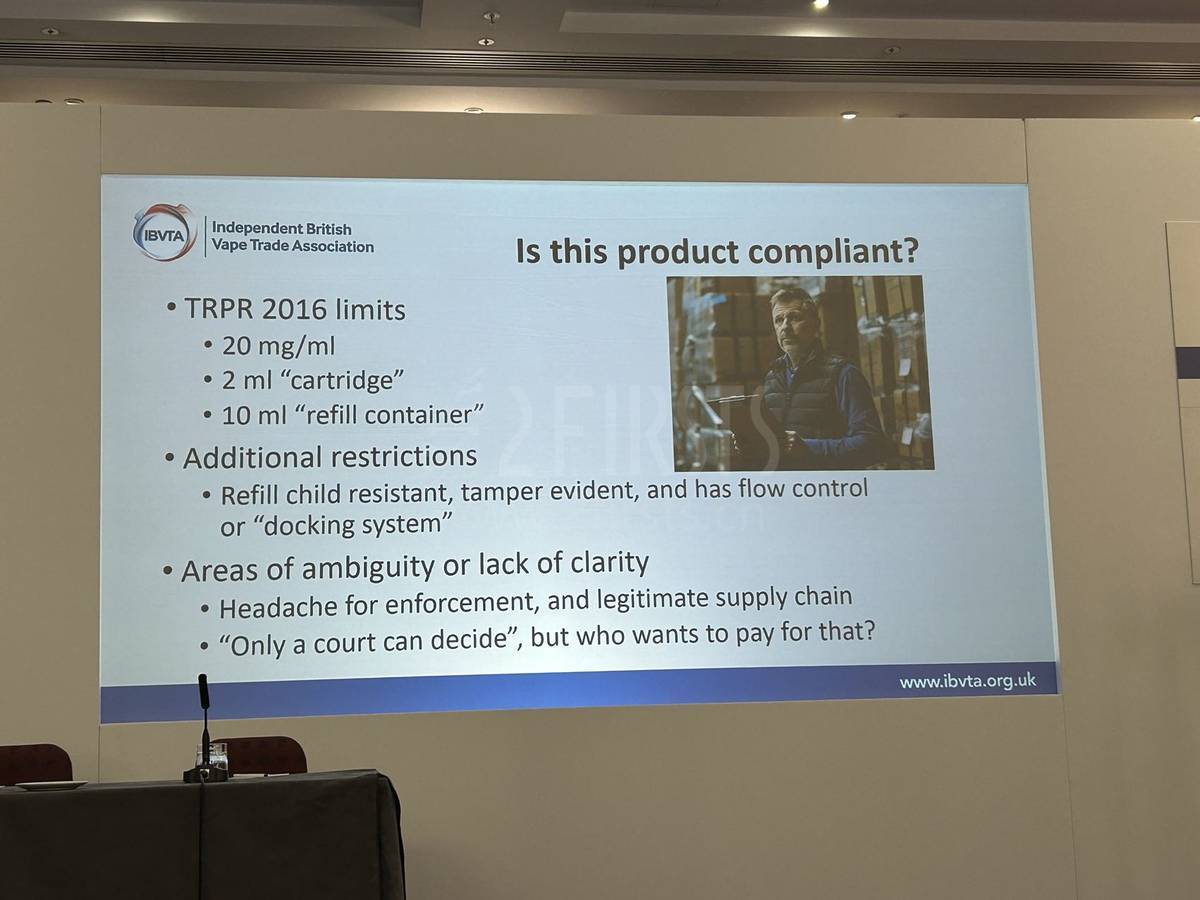

In terms of specific regulations, Humberstone explained that the **Tobacco Products Directive 2016 (TRPR 2016) imposes clear restrictions on nicotine concentration, pod volume and refill container specifications for e-cigarettes. It also requires refills to be child-resistant, tamper-evident and include flow control or docking systems. However, these regulations are fraught with uncertainty and lack of clarity, creating challenges for enforcement and the legitimate supply chain. In practice, this can lead to costly legal complications.

In his speech, Humberstone mentioned that in response to this regulatory environment, some brands are adopting a strategy of "market opportunism", using cash transactions and informal market sales to gain a competitive advantage by breaching UK regulations. To highlight this point in his presentation, he showed brands such as GEEKBAR, HAYATI, ELUX and FUMOT.

"They're even importing these products from regions where the 2ml e-liquid limit doesn't apply. The market needs more sustainable products to address this issue," Humberstone said at the end of his speech.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com