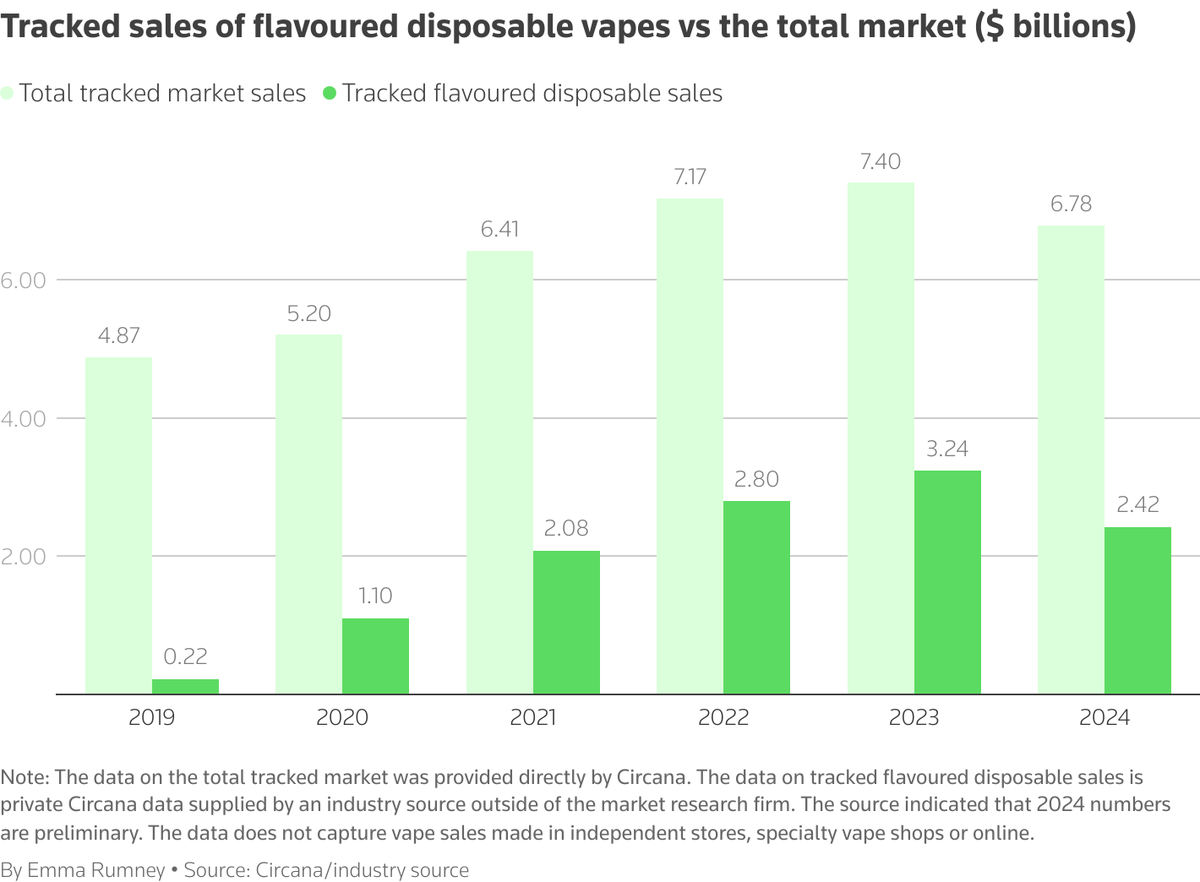

According to a report by Reuters on February 24th, private retail sales data reviewed by Reuters showed that the unauthorized flavored disposable e-cigarette sales in the United States reached approximately $2.4 billion in 2024, accounting for 35% of total e-cigarette sales through channels such as convenience stores and supermarkets.

According to data from market research firm Circana, the market share of illegal e-cigarettes in 2024 has decreased compared to $3.2 billion in 2023 and $2.8 billion in 2022. Circana stated that they cannot confirm or comment on these figures as they have not been made public.

Circana's data tracks around 11,000 unauthorized disposable e-cigarette flavor products in the market, distributed across hundreds of brands, with flavors including "cookie and cloud" and "magic cotton candy". This highlights the size of the illegal e-cigarette market in the United States, which is inundated with unauthorized products.

Circana estimates that the entire e-cigarette market, including authorized and non-disposable e-cigarettes, will have a market value of $6.8 billion by 2024. This suggests that flavored disposable e-cigarettes will make up approximately 35% of Circana's tracked market. The company's data only tracks sales through specific channels such as convenience stores and does not include online sales, independent stores, and specialty e-cigarette retailers.

Data show that since 2023, sales of disposable e-cigarettes have decreased by 25%. Industry insiders say that the 2024 data from Circana is preliminary, as their data on disposable e-cigarettes has been revised upwards in the past. British American Tobacco (BAT) and Altria have both stated that the e-cigarette market in the United States is expanding. Altria CEO Billy Gifford stated during a meeting on February 19 that they expect the US e-cigarette market to grow by 30% in 2024, driven entirely by illegal products.

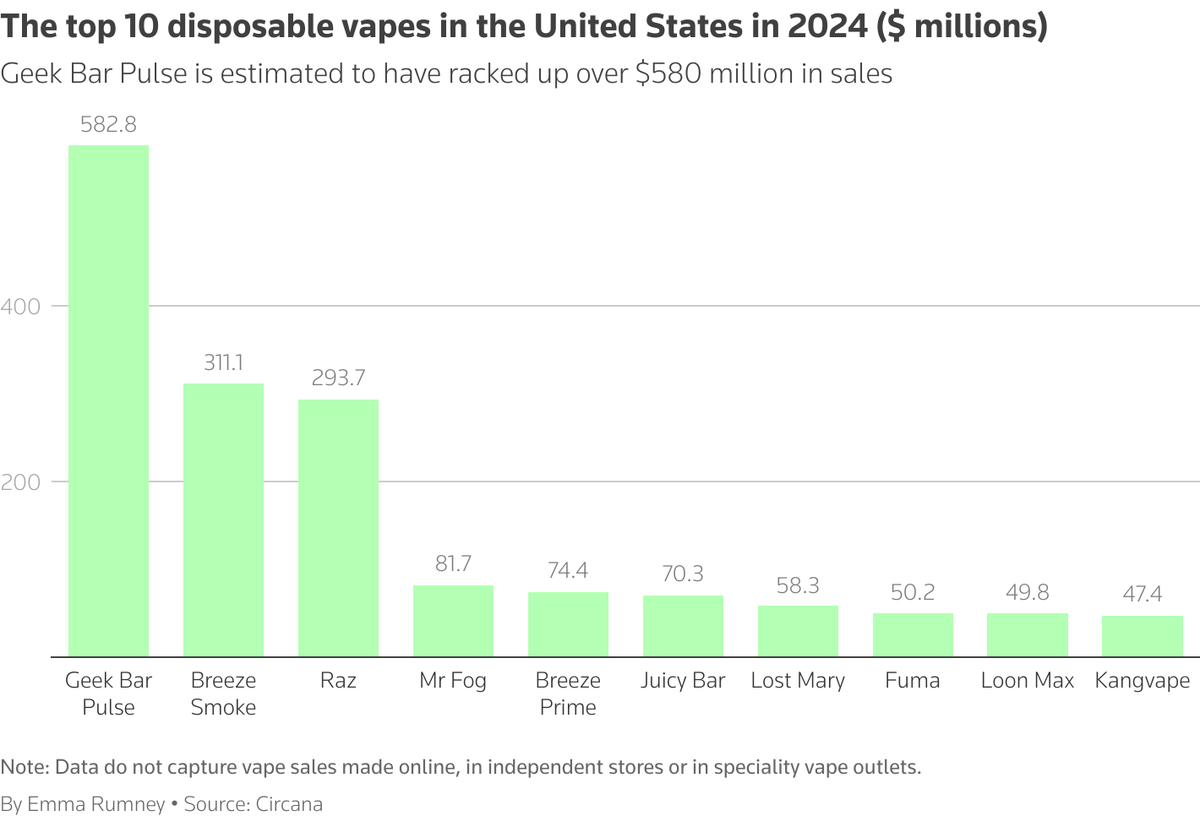

Data indicates that the FDA's crackdown has started to show results. Prior bestselling brands ESCOBAR and ELFBAR have dropped out of the top ten best-selling devices list in 2024 after the FDA prevented their imports in 2023. However, other brands have quickly taken their place.

The following is the projected retail revenue for the top 10 disposable e-cigarette devices in the United States in 2024 (these figures do not include online sales, independent stores, or sales from professional e-cigarette retailers).

Geek Bar Pulse: 5.828 billion dollars.

Breeze Smoke has raised 3.111 billion US dollars.

Raz: $2.937 billion

Mr. Fog: 81.7 million dollars.

Breeze Prime: $74.4 million

Juicy Bar has raised $70.3 million.

Lost Mary: $58.3 million

Fuma: $50.2 million

Loon Max: $49.8 million.

Kangvape has raised $47.4 million dollars.

Among them, Geek Bar Pulse, Breeze Smoke, and Raz respectively rank in the top three on the list.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com