Key Points

● China–U.S. e-cigarette shipping costs have surged since late July 2025, with sea freight rates increasing by over 200% and air freight prices rising three- to five-fold.

● The recently introduced “Special Port Service Fee” for U.S. vessels added a new cost factor, but high inspection rates in the U.S. remain the primary driver of logistics price hikes.

● Air cargo inspections now reach up to 50%, and sea freight inspections stand at 5–7%, leading logistics companies to shift toward smaller batch shipments to manage risk.

● Since mid-2024, the FDA and CBP have intensified joint enforcement, expanding inspections beyond ports to warehouses and distributors, significantly raising compliance risks for exporters.

By 2Firsts | October 15, 2025 | Shenzhen —Since early 2025, the logistics of exporting e-cigarettes from China to the United States have drawn growing attention across the industry. According to information obtained by 2Firsts from logistics providers, sea freight rates on the China–U.S. route have continued to rise since late July, while air freight costs and inspection risks have surged in parallel.

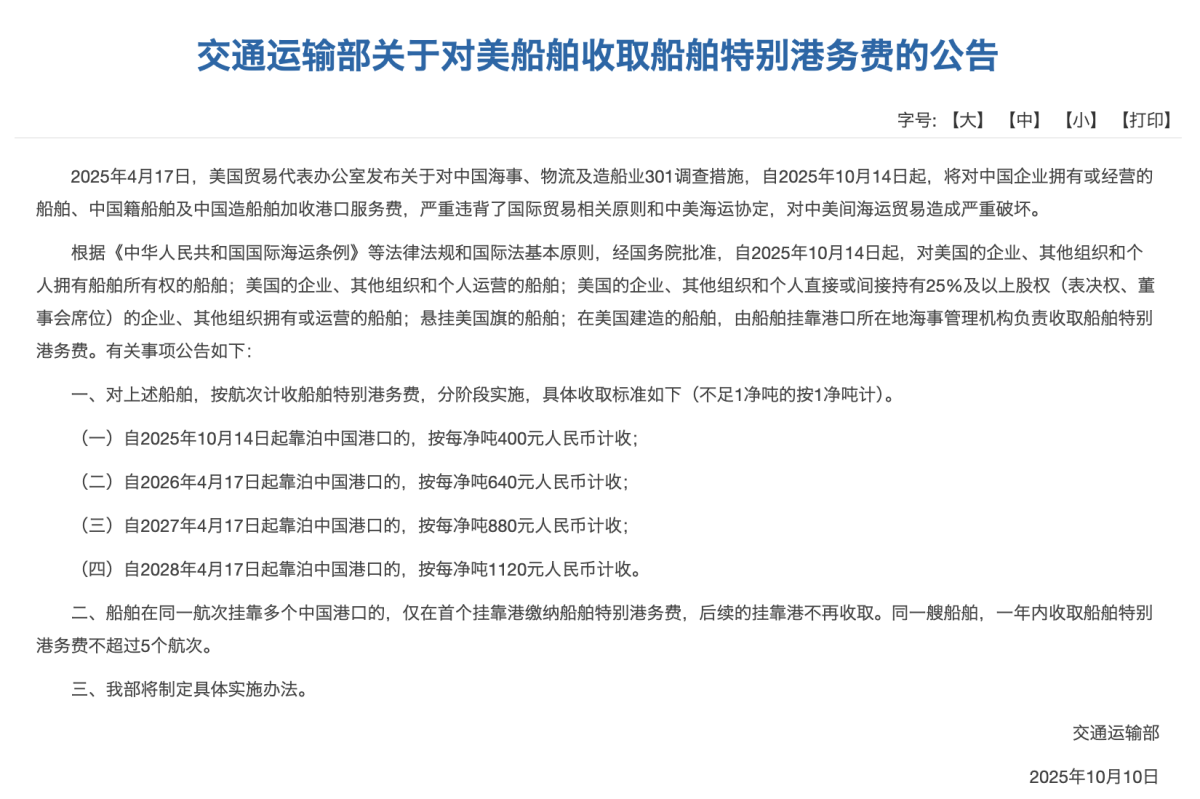

On October 10, China’s Ministry of Transport issued a notice introducing a “Special Port Service Fee” for U.S.-flagged vessels, effective October 14, 2025. The fee will be phased in over several years, adding a new cost factor to transpacific logistics.

To understand the latest dynamics in China–U.S. e-cigarette shipping, 2Firsts spoke with several logistics professionals.

Special Port Fee Adds New Cost Variable—but Not the Main Driver

The Notice on the Special Port Service Fee for U.S. Ships specifies the following rates based on net tonnage:

● From October 14, 2025: RMB 400 per net ton

● From April 17, 2026: RMB 640 per net ton

● From April 17, 2027: RMB 880 per net ton

● From April 17, 2028: RMB 1,120 per net ton

A logistics company told 2Firsts that following the announcement, Matson — a key fast-ship operator for e-cigarette cargo — raised its freight rates. A veteran logistics professional, referred to as “A,” said:

“Since the port fee was announced, the fast-ship rate for e-cigarettes has gone up by RMB 5 per kilogram — that’s RMB 5,000 per ton.”

In contrast, other e-commerce cargo saw more modest increases:

“For general goods, a container’s rate rose by about US$1,000, which translates to around RMB 0.6 per kilogram.”

This means the e-cigarette rate increase is over eight times higher than that for other types of cargo.

Another logistics company confirmed that quotes were broadly adjusted in response to the new port fee, with average sea freight for e-cigarettes rising by around RMB 1 per kilogram — though exact increases vary by route, delivery time, and insurance terms.

Sea Freight Prices Triple in Three Months, Risk Premiums Drive Surge

Despite the new port fee, most industry sources agree that the main driver of freight inflation is the elevated inspection rate in the U.S. rather than the new government charge.

“The special port fee is just a small part of the increase. What’s really pushing up the cost is the growing inspection risk,” said one logistics operator.

Since late July, sea freight rates for e-cigarettes exported to the U.S. have surged and are now at their highest levels this year.

“Before June, sea freight was just over RMB 10 per kilogram. Since July, it’s jumped to RMB 45–50. That’s more than a 200% increase — nearly the same as historical air freight levels.”

Air Freight Prices Spike, Logistics Firms Shift to Smaller Batches

On the air freight side, A noted that prices have risen to RMB 95–150 per kilogram (insurance included) since May — 3 to 5 times higher than the RMB 30–40 range seen before April ended.

“Air freight is under intense scrutiny. We can’t take too many orders. Our clients still want air, but if something goes wrong, the loss is too much.”

His company currently compensates clients at RMB 200/kg for goods, and with freight included, the potential loss per kilogram is RMB 300 — three times the shipping price.

“Even with insurance included, if a shipment is inspected, we still end up losing money.”

As a result, many logistics providers have scaled back their air freight operations, only handling small batches of cargo.

At A’s company, air freight now accounts for less than 15% of its e-cigarette business, while sea freight makes up nearly 80%.

U.S. Crackdown on Illicit E-cigarettes Drives Up Inspection Rate and Freight Costs

A told 2Firsts that the sustained rise in logistics costs is primarily linked to the persistently high inspection rate at U.S. ports since late April.

“Warehousing and port fees abroad are already high. When inspections rise and it’s hard to return seized goods, everyone has no choice but to raise prices.”

According to him, sea freight inspections have risen to 5–7%, up from 1–2% before June, while air freight inspections are far more intense, reaching 40–50%.

These enforcement efforts reflect broader U.S. regulatory trends. According to previous 2Firsts interviews with the FDA and related international media reports, only 39 e-cigarette products have been granted FDA marketing authorization to date, accounting for less than 20% of the U.S. e-cigarette market. Most of the popular products currently sold in the U.S. have not received full regulatory clearance.

Moreover, some tobacco companies have criticized the FDA for its slow pace in product review, which they argue hampers the path to lawful commercialization.

Since mid-2024, the FDA has intensified joint enforcement actions in coordination with the Customs and Border Protection (CBP) and other federal agencies, targeting the sale and import of unauthorized e-cigarettes.

“FDA, CDP, and Customs are working together. Inspections have expanded beyond ports to include overseas warehouses and even distributor facilities,” A added.

Larger warehouses now face higher inspection risks. Once flagged, goods are often difficult to return and more likely to be confiscated, significantly increasing the overall risk.

Under such conditions, many logistics firms have shifted to a “batch-and-clear” model — shipping in smaller volumes and clearing each shipment before moving the next, in order to minimize large-scale losses.

However, despite the high shipping costs, demand for e-cigarette exports remains strong.

A stated that the company has not seen any decline in orders; instead, they continue to grow. “Right now, we hesitate to take on many shipments for fear of potential issues and losses. There’s no shortage of orders—what’s lacking are the ones we can accept with peace of mind.”

2Firsts will continue to monitor developments in e-cigarette logistics between China and the United States, as well as trends in the U.S. e-cigarette market.