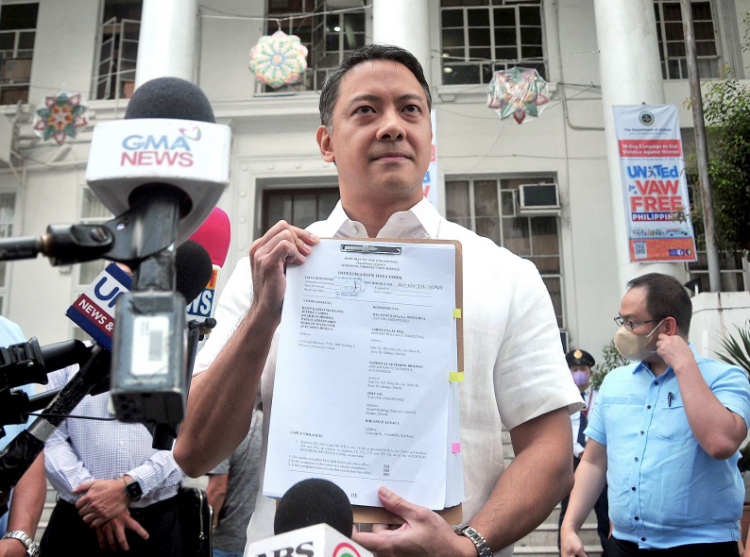

The Bureau of Internal Revenue (BIR) filed criminal charges of alleged tax evasion and related offenses on Tuesday against a Binondo trader suspected of smuggling electronic cigarette products into the country in front of the Department of Justice (DOJ).

Commissioner Romeo Lumagui led a tax assessment of Wei Feng Bao, Christina Poa, Sandoval Severino Briones, Jimmy Go, and Bibiano Lesaca totaling up to 1.2 billion Philippine pesos (approximately 150 million yuan) for the Bureau of Internal Revenue.

This is the first case of tax evasion that was filed during the presidency of Ferdinand R. Marcos Jr. Police officer Lumagui warns that the government will crack down on traders who do not properly pay their taxes.

This refers to the raid we conducted last month on individuals who were found to be in possession of electronic cigarette products that were not properly taxed," said Luma Gui in a statement to the media.

These five individuals are facing charges of violating the Republic Act No. 111346 or the Increase in Tobacco Product Excise Tax Law, which imposes a consumption tax on heated tobacco products and vaping products, and increases penalties for non-compliance with consumption tax regulations and the 1997 National Internal Revenue Code.

I hope this serves as another warning for those who think they can continue evading taxes. We are taking matters into our own hands and focusing on our work. It's something we take very seriously," Lumagui said.

Authorities seized between 50,000 to 100,000 e-cigarettes, 899 boxes containing 175,050 untaxed taxable items, and 61,400 bottles of flavored juice with an estimated worth of 15 million to 30 million pesos (approximately 1.89 million to 3.79 million yuan).

When using an electronic cigarette, the juice is heated and produces an aerosol for users to inhale.

Earlier, the Bureau of Internal Revenue estimated that the government loses approximately 1.4 billion Philippine pesos (around 177 million yuan) in revenue annually due to the smuggling of electronic cigarettes.

The popularity and widespread use of electronic cigarettes as a smoking alternative has tempted many illegal traders to import and sell them. As a warning, they should acquire these products through proper and legal channels and ensure full compliance with regulatory requirements. Otherwise, their illegal products will be confiscated, and criminal charges will be filed against them.

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.