On April 11th, according to a report by South Korean media outlet Bizwatch, there have been some new developments in the profit margins of major players in the country's electronic cigarette market. PhiMo International Korea saw a 163% increase in operating profit in 2022, while BAT Korea's operating profit decreased by 12%. KT&G has a profit margin of 30% and holds a market share of 84%, making it the top player in the South Korean market.

PMI's operating profit rebounds against market trends.

In 2022, there will be changes in the revenue of KT&G, PMI Korea, and BAT Korea.

KT&G and PMI Korea are the top two players in the South Korean electronic cigarette market, while BAT Korea is facing a growth standstill.

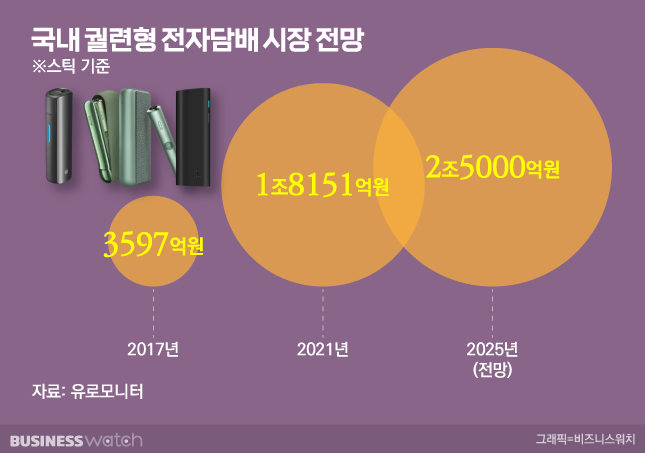

Analysts of the South Korean tobacco industry believe that the future profit lies in the electronic cigarette market as the tobacco industry shifts from traditional cigarettes to electronic ones.

According to industry insiders, in 2022, PMI's South Korean company's sales reached KRW 686.8 billion, representing a 21.5% increase compared to 2021. Operating profit increased by 162.5%, reaching KRW 80.6 billion. The operating profit margin increased from 5.4% in 2021 to 11.7% in 2022.

In 2022, KT&G's revenue was 36.94 trillion Korean won, representing a 5.8% increase from 2021. During this period, operating profit grew by 3.4% to reach 11.23 trillion Korean won, resulting in an operating profit margin of 30.3%.

KT&G's overseas tobacco exports and e-cigarette sales drove the growth, as demand for the domestic tobacco market decreased by 1% in 2022. KT&G's overseas cigarette sales in 2022 amounted to KRW 1.98 trillion, a 47.2% increase from 2021. Additionally, the sales of the company's next-generation product (NGP), with 2022 sales totaling KRW 87.63 billion, grew by 73.9%.

BAT Korea reported a 14.3% increase in revenue for 2022, reaching KRW 539.8 billion. However, the company's operating profit decreased by 12% to KRW 44.6 billion, resulting in a decline in operating profit margin from 10.7% in 2021 to 8.3% in 2022. Additionally, the net profit for 2022 decreased by 33.6%, reaching KRW 28.5 billion.

The market share of electronic cigarettes continues to grow.

Although cigarettes still dominate the South Korean tobacco market with a market share of approximately 85%, electronic cigarettes are rapidly replacing traditional cigarettes and are becoming the driving force behind the future profits of tobacco companies.

According to the "2022 Tobacco Market Trends" report released by the South Korean Ministry of Strategy and Finance, the market share of electronic cigarettes in the domestic tobacco market has been steadily increasing since 2017, rising from 2.2% to 9.6% in 2018, 10.5% in 2019, 10.6% in 2020, 12.4% in 2021, and 14.8% in 2022. After a period of stagnation in 2019 and 2020, the market share has been on the rise since 2021.

Changes in Market Share of E-cigarettes | Image Source: 2FIRSTS

In 2022, KT&G held a market share of 47.5% in convenience stores. Additionally, KT&G's electronic cigarette equipment made up 84% of the market share in the same year.

PMI's South Korean company has been actively targeting the electronic cigarette market, launching a new lineup called "IQOS Illuma One" in February 2023 after introducing iCos Illuma in October 2022.

Although KT&G and PMI compete in the domestic market, they have formed an alliance overseas. In January 2023, KT&G signed a 15-year agreement to provide PMI with smoke-free products in the international market (excluding South Korea). In exchange for marketing, distribution, and sales rights of KT&G e-cigarettes overseas, PMI guarantees a minimum distribution of cigarette units to ensure KT&G's profitability.

On the other hand, as reported, BAT has a market share of approximately 10% in the South Korean e-cigarette market. The company recently launched 'Glo HyperX2' in Korea with the goal of rebounding, but there hasn't been a significant shift in market share yet.

According to a Korean industry insider, "After a period of stagnation, the domestic e-cigarette market has slowly grown since 2022, and the challenge is how to further develop the market.

Related reading:

PMI's South Korean outsourcing factory has invested KRW 300 billion for the production of HNB devices.

Demand for heated tobacco in South Korea is expected to surge by 21% in 2022, while cigarette demand is set to decline by 1.8%.

References:

Last year's cigarette sales report shows that BAT Korea failed to meet its targets.

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.