BAT Rosmans, the South Korean subsidiary of British American Tobacco, announced on January 15th that its e-cigarette product "Vuse Go 800" will now be available nationwide. This expansion includes distribution to 30,000 convenience stores and tobacco shops in Seoul and other regions.

In mid-July 2023, VUSE made its initial entry into the e-cigarette market in South Korea. Six months later, the brand once again pushed for the expansion of its sales network, now covering the entire nation.

VUSE's actions are not isolated incidents. Since 2023, many Chinese disposable brands have entered the South Korean market. Among them, ELFBAR entered the market in early February and signed an exclusive distribution agreement with well-known South Korean distributor Setopia. Meanwhile, renowned brands such as LOST MARY and ELUX have entered the South Korean market, reshaping the previously dominant market competition pattern led by open systems.

The emergence of these renowned disposable brands in the Korean market has garnered significant attention from industry insiders in the e-cigarette business. Such a development has prompted speculation among industry experts on whether this signifies the rise of the disposable e-cigarette market in South Korea.

On January 15th, 2FIRSTS held in-depth discussions with several key figures in the South Korean e-cigarette industry to gain insights into the status quo of the South Korean e-cigarette market.

Disposable Grows, Who will Take the Crown?

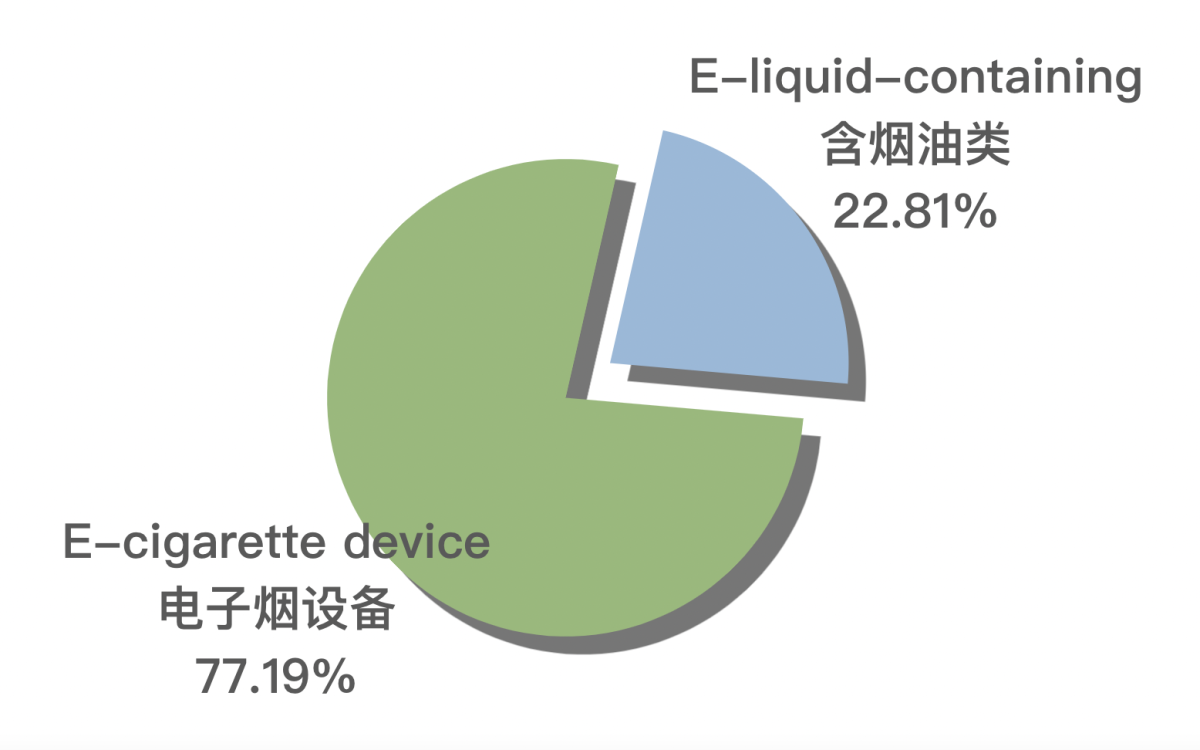

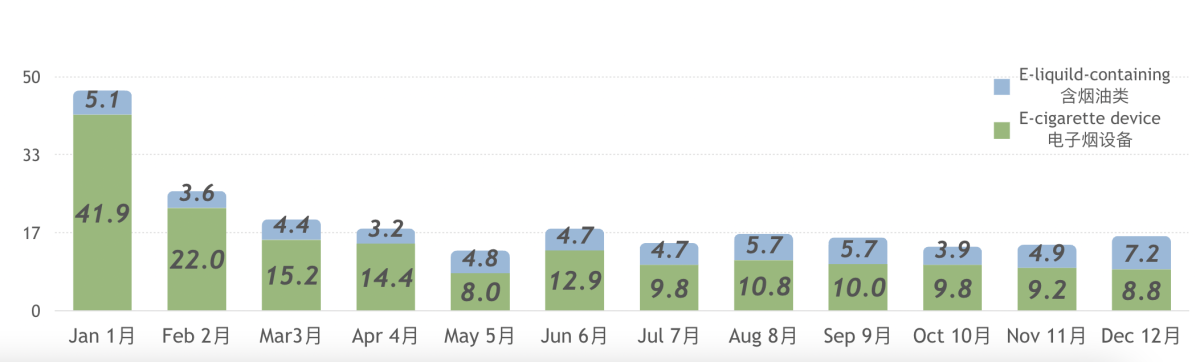

According to publicly available data from South Korean customs, in 2023, South Korea imported a total of $200 million worth of e-cigarettes, with e-cigarette devices (including HNB devices and open-system devices) accounting for over 77%. E-liquid-containing products (closed-system e-cigarettes, including disposable and pod-system, although the latter has been performing poorly in the Korean market) made up 23%, or approximately $57.8 million, and have been steadily increasing month by month. Specifically, in December, e-liquid-containing products saw a 47% increase compared to the previous month, reaching $7.2 million. This data trend aligns with the earlier mentioned entry of disposable e-cigarette brands into the Korean market.

However, this data does not fully reflect the true size of the e-cigarette market in South Korea. A professional with years of experience in the e-cigarette industry in South Korea revealed that due to the exceptionally strict nicotine product testing requirements imposed by the South Korean customs, most disposable e-cigarettes entering the country are actually semi-finished products that require subsequent processing such as oil injection in South Korea. Therefore, the actual annual market share of the disposable market in South Korea far exceeds the $57.8 million shown in the import data.

In contrast to mainstream markets like Europe and the United States, the e-cigarette market in South Korea is driven by factors such as high e-liquid taxes, leading to a dominance of cost-effective open systems, and has fostered a well-developed e-liquid industry. South Korean market features a wide variety of e-liquid types, and many specialty stores solely focused on selling e-liquid products without delving into the equipment business, which is relatively uncommon in other markets like Europe and the United States.

However, recently many specialty stores have begun selling devices and e-liquids together, and some stores have even introduced disposable products. Industry insiders say that two years ago, due to the high profits of Korean e-liquids, retailers only needed to focus on the e-liquid business to obtain substantial income. However, in the past two years, the influx of e-liquid companies has reduced the profits of e-liquids, squeezing the survival space of existing e-liquid companies and causing a decrease in the average price and profit of open system e-cigarettes. Faced with intense market competition, these companies have had to actively expand their product lines and introduce closed system e-cigarette businesses, especially disposable ones, to meet the diverse demands of the market.

Industry insiders have pointed out that the market is currently in the early stage, characterized by a lack of a clear market leader. Among several brands that entered the Korean market in 2023, ELFBAR stood out with exceptional performance. In comparison, VUSE performed average, while MONS, which seems to have been acquired by YUEKE, has consistently maintained a strong performance since its earlier entry into the market.

Overall, the disposable e-cigarette market in South Korea, despite showing some signs of growth, has not experienced a large-scale boom. An industry insider with deep knowledge of the South Korean e-cigarette market explains this phenomenon. He points out that the main reason for this is that many e-cigarette products arrive in South Korea in a semi-finished state and are then assembled and filled locally. However, the labor costs in South Korea are quite expensive, which leads to a significant reduction in retail profits.

Take a 10ml product as an example, which includes costs such as labor, e-liquid, equipment, packaging, and distribution. In the past, a $1 e-cigarette could be sold for $5, with importers and wholesalers only paying for distribution costs, while retail stores could enjoy a profit margin of up to 100%, allowing intermediaries to receive substantial profits.

The situation has now changed. Taking the example of an e-cigarette priced at 13,800 Korean Won (approximately 10 US dollars), with an export price of 3 US dollars and a cost of 2 US dollars for assembly in South Korea, plus an additional 2-3 US dollars for circulation profit, retail stores only obtain a profit of around 3 US dollars. It has led to a lack of interest from retail stores in selling disposable e-cigarettes, thus limiting the large-scale development of the disposable market.

Over-Regulation Hampers Market Development

In 2022, the population of South Korea was recorded at 51.63 million. According to statistics, in 2020, approximately 19.2% of the total population in South Korea were smokers. The industry widely believes that the e-cigarette market in South Korea holds significant potential.

A source involved in brand representation in the e-cigarette market in South Korea has disclosed that Korean consumers have a very high acceptance of e-cigarette products, and the average spending per customer on e-cigarettes in Korea is quite high. Considering these conditions, the South Korean market is a lucrative market.

However, the performance of the South Korean market is far below the expectations of industry insiders. The market has shown weak performance, described by the aforementioned individuals as "tasteless and regrettable". One of the reasons for this situation is excessive regulation of the e-cigarette industry in the South Korean market.

Due to South Korea's unique e-liquid tax regulations, high taxes are only imposed on natural nicotine while synthetic nicotine remains untaxed. As a result, the majority of e-liquids in South Korea have opted for synthetic nicotine to avoid the hefty taxes. Additionally, there are also instances where natural nicotine is falsely labeled as synthetic nicotine.

In response, the South Korean customs authorities have been actively advancing technological innovations to enhance their ability to detect natural nicotine disguised as synthetic nicotine.

However, there are still numerous cases of "misjudgment". The insider revealed that while most Chinese manufacturers exporting products containing e-liquid to South Korea use synthetic nicotine, frequent "misjudgment" shows up due to customs' technical limitations in nicotine identification. He shared his own experience as an example, mentioning that a batch of synthetic nicotine products he had once had were mistakenly identified as natural nicotine during customs inspection, leading to a three-month seizure of the goods.

Not only are customs strict in their enforcement, but the aforementioned sources point out that there are five major departments in South Korea (including customs, police department, food and drug administration, national complaints center, and tax bureau) that have an "unfriendly" stance towards e-cigarettes. Specifically, from customs clearance to retail, these products undergo rigorous inspections and are subject to enforcement by these five departments on a rotating basis. E-cigarette companies are faced with inspections from at least one department almost every month in this changing enforcement environment. This constant stream of enforcement poses significant challenges for e-cigarette businesses.

On October 26, 2023, according to South Korean media reports, the local government has uncovered 39 companies suspected of evading e-liquid taxes, involving a staggering amount of 175.5 billion Korean won (approximately 130 million US dollars). This revelation has sent shockwaves throughout the entire e-cigarette industry in South Korea. Industry insiders speculate that this amount may even exceed the current scale of the entire South Korean e-cigarette market.

However, the South Korean government seems to have recognized the deficiencies of this tax method and it is possible that it will impose taxes on synthetic nicotine in 2024. The relevant bill is currently under discussion.

Entry of Financial Magnates: Pros and Cons

In the South Korean e-cigarette market, the main sales channels can be categorized into three types: convenience stores, specialized VAPE SHOPS, and emerging "amateur" channels, such as clothing stores.

According to industry insiders, some large companies led by conglomerates are gradually venturing into the e-cigarette business due to limited growth in industries such as Korean clothing and entertainment. However, these corporations are currently in the stage of researching and developing new products and negotiating with the government, and have not achieved a large-scale operation.

The entry of conglomerates will disrupt the established landscape of the South Korean market. Practitioners generally believe that the foray of South Korean conglomerates into the e-cigarette industry has both pros and cons. On the positive side, their superior negotiating power with the government may potentially lead to tax reductions and relaxed regulations on the e-cigarette industry, facilitating its robust growth. However, the involvement of conglomerates may result in the closure of small businesses, leading to a concentrated industry.

An industry professional with years of experience in open systems expressed optimism for the future of the e-cigarette market in South Korea. They believe that the market holds immense potential and is poised for growth. The entry of well-known disposable e-cigarette brands and conglomerates is expected to inject new vitality into the lackluster market and reshape the existing market landscape.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com