Special Statement:

This article is for internal research and communication within the industry only and does not recommend any brands, products, or investments.

Minors are prohibited from accessing.

E-liquid to Charging Cable

How Leading Manufacturers Extend Product Lines to Capture Consumers?

2FIRSTS Chalotte Yu

Recently, British e-cigarette brand blu, owned by Imperial Tobacco, launched e-liquid brand called blu liquid in the UK. The product line consists of ten flavors, including mint, blueberry, and green apple. The nicotine content comes in two specifications: 9mg/ml and 18mg/ml, and the price is £3.99.

The blu brand was created by Jason Healy in the United States and was acquired by the American tobacco company Lorillard in 2012. Imperial Tobacco acquired the international rights to blu in 2015 and launched blu2.0 in France in 2022. The introduction of blu liquid now signifies blu's official expansion into its e-liquid line.

E-Liquid Battlefield of Top Manufacturers

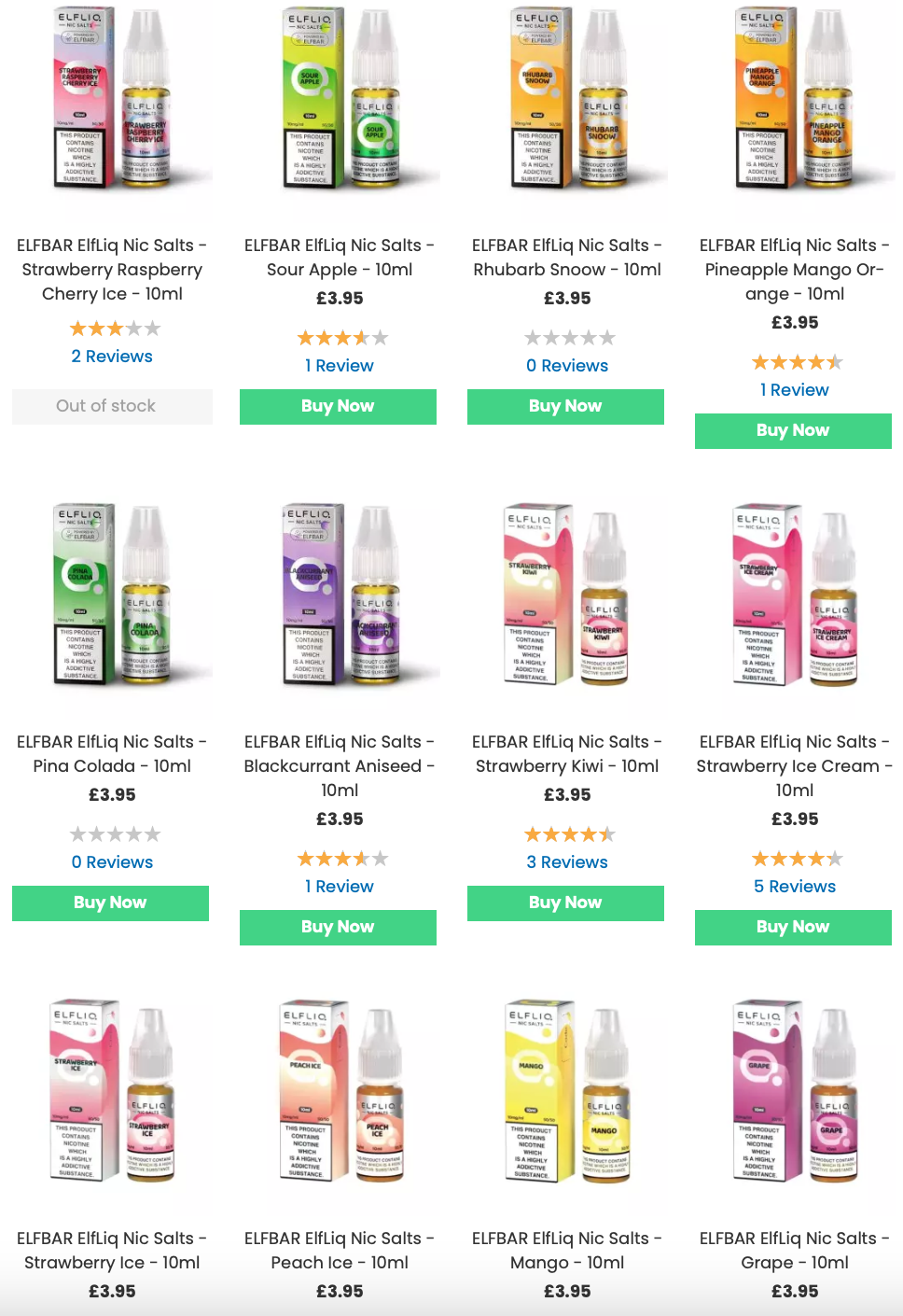

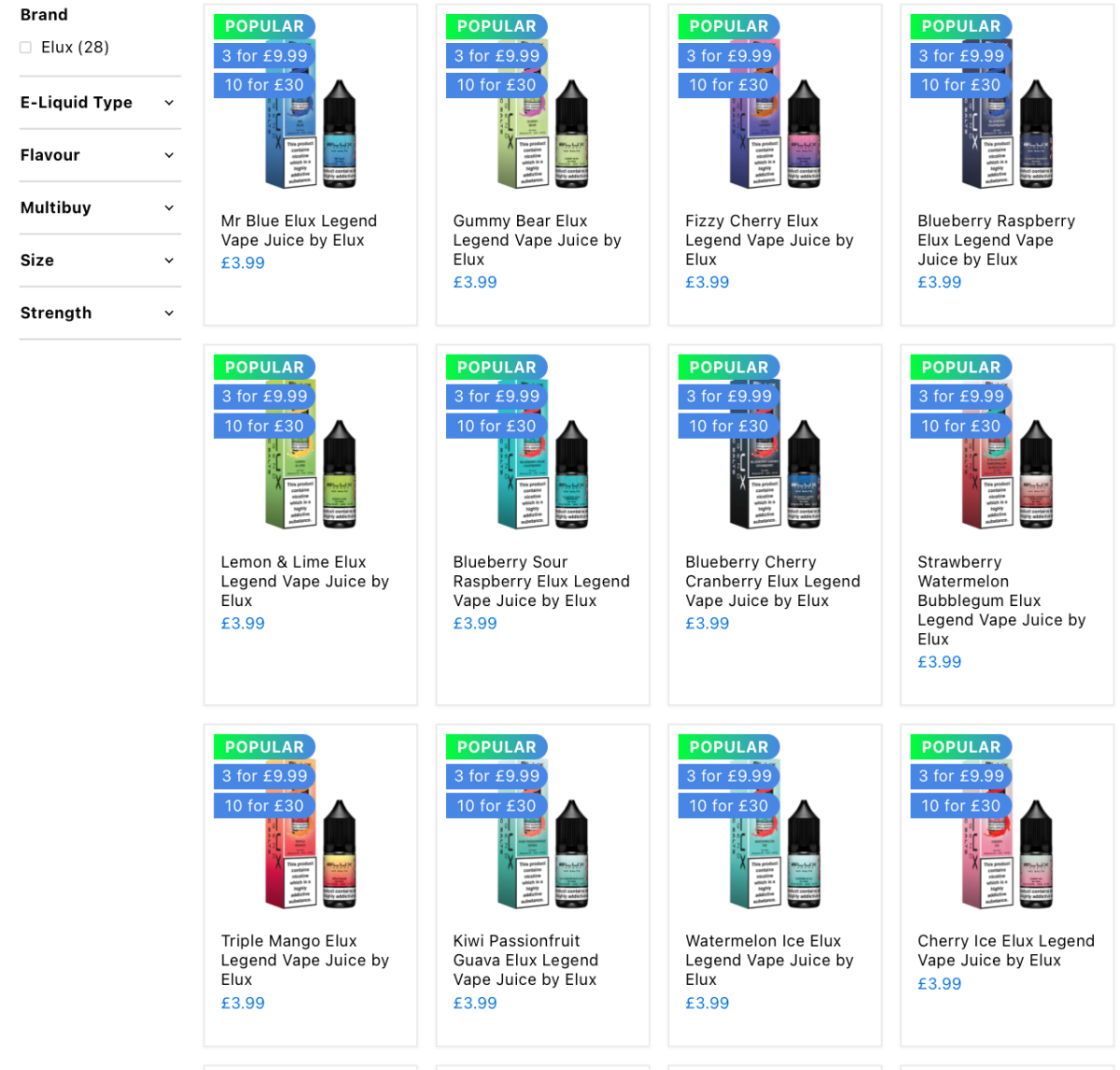

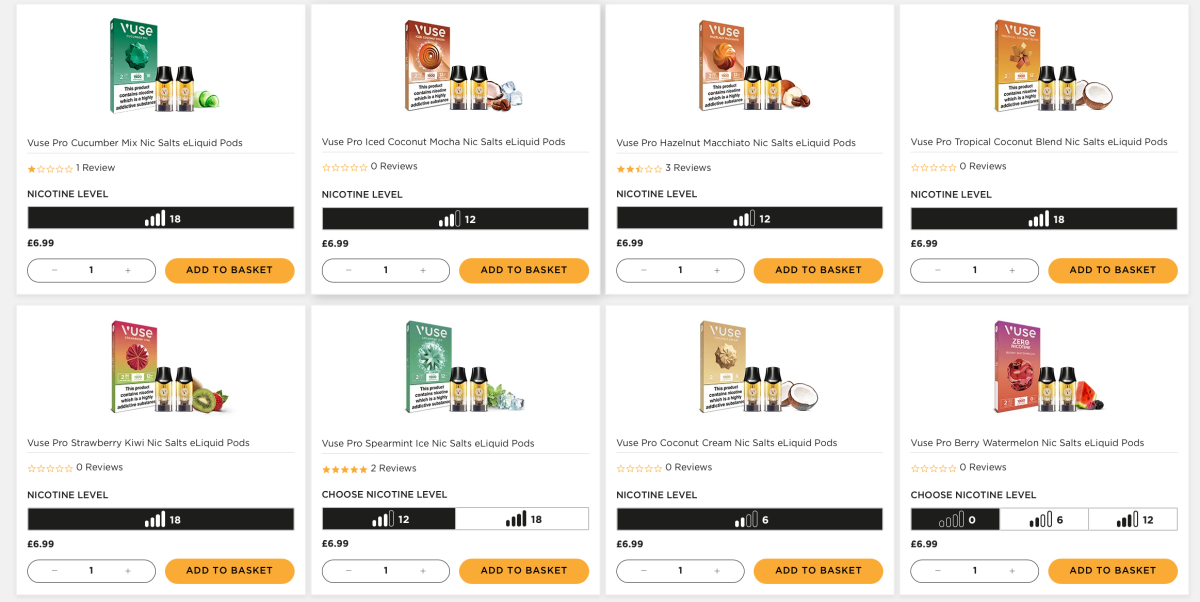

Top brands in the UK market have long been entering the e-liquid sector. Currently, several e-cigarette brands including ELFBAR, VUSE, SKE, and ELUX have introduced their own e-liquid brands. The specifications primarily consist of 10ml bottles, with prices staying relatively stable around £4 (approximately $5.09).

Taking ELFBAR as an example, the online platform offers a total of 27 e-liquid flavors including desserts, fruits, menthol, and tobacco flavors. These e-liquids cater to almost every taste preference and are priced at £3.95 (approximately $5.02) for a 10ml bottle.

E-liquid launched by SKE claims to be "nicotine salt-based" and offers 10 flavors, priced at £3.95 (approximately $5.02) for a 10ml bottle or 3 bottles for £10. Customers can choose between nicotine concentrations of 10mg or 20mg.

The e-liquid introduced in the UK by ELUX in May 2023 is priced at a slightly higher £3.99 (approximately $5.08) for a 10ml bottle on shopping websites, with nicotine concentrations of 10mg or 20mg available. An industry insider familiar with the UK market revealed to 2FIRSTS recently that sales of this e-liquid are estimated to reach 3 million bottles per month in the country.

As for VUSE, a subsidiary of British American Tobacco, its approach appears to be more grand. Its official online store in the UK shows 54 e-liquids available for purchase. These e-liquids are priced at £6.99 (approximately $8.89) for a pack of two, with 1,900 puffs. Customers can choose from five levels of nicotine concentration ranging from 0 to 18mg. A subscription service, starting at £4.29 (for a pack of two), offers to deliver e-liquids to the customers' homes on a monthly basis.

"Family Bucket": "Affordable" Strategy to Capture Minds

Extending product lines has become one of the strategies for brand "public relations image building" and "user mind occupation". This strategy, mockingly referred to as the "family bucket" by consumers, has been proven to be a rational approach in research conducted in other industries, as it reduces consumer choice costs and enhances user loyalty.

This method has long been a tradition in the fast-moving consumer goods (FMCG) sector. To illustrate with recent examples, Tsingtao Beer has launched a bottle opener based on alcoholic beverages, while Dettol, while selling coil disinfection products, has also introduced a liquid portable container under its brand. These measures, gradually expanding the product line to the periphery of coil business, are all aimed at helping users establish preferences for product selection and ultimately capture consumers' minds.

Electronic 3C products, like smartphones and laptops, also create their own closed ecosystems through similar methods. The most typical example is Apple's devices that are integrated with their operating system and cloud services. When users become accustomed to this ecosystem and the cost of switching to another brand increases, their willingness to switch to a different brand decreases when purchasing future products.

Video game consoles work in a similar way: when you only own a Nintendo console, you are less likely to purchase games from Sony. Similarly, if all the game discs you have at home are for the PlayStation platform, the possibility of switching to Nintendo when upgrading your console is also smaller.

The development of e-cigarettes thus far essentially relies on the process of vaporization through technology for human consumption. E-cigarettes, possessing attributes of both "fast-moving consumer goods" and "technological products," seem to have found their destined path.

Of course, the technological barriers of e-cigarettes are not as significant as those of gaming consoles. Basically, there won't be a situation where "Brand A's device cannot be used with Brand B's e-liquid." Brands are continuously introducing their own e-liquid brands, and more importantly, they are aiming to capture the consumers' mindset.

In addition to the psychological aspect, a more practical strategy is to offer price concessions.

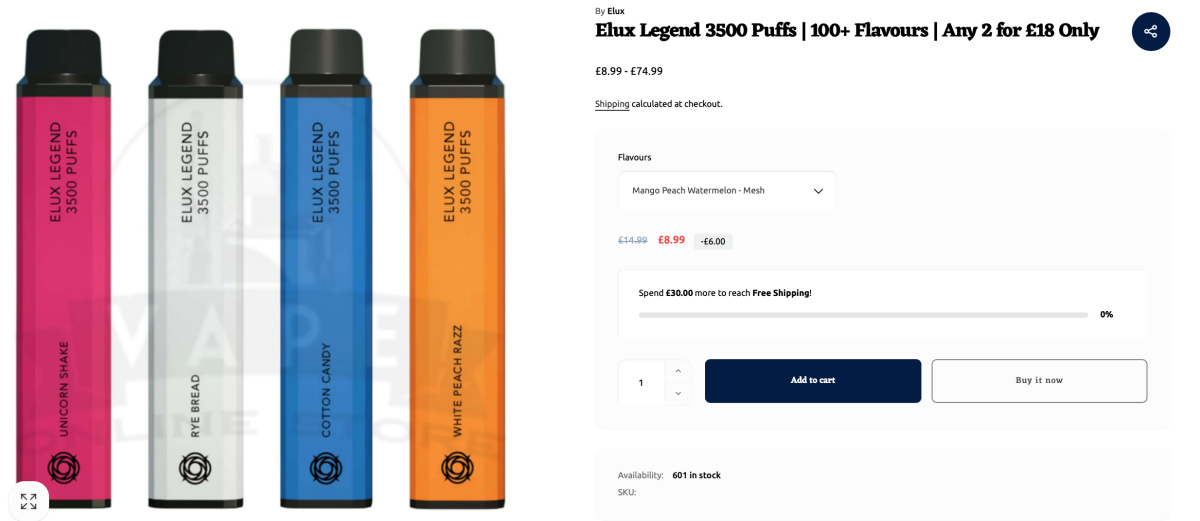

Based on the current industry average for atomization efficiency, the aforementioned brand's self-owned e-liquid lines are priced lower than the local market price for disposable products with a similar number of puffs (such as the ELUX disposable product Elux Legend 3500 Puffs, which is priced at approximately £9, about 2.5 times the price of an equivalent e-liquid quantity).

Overall, the combination of "open system+e-liquid" products is more cost-effective than disposable products. Given the economic downturn and lack of consumer confidence, it is becoming a trend for consumers to opt for cheaper alternatives.

Maintaining Firm Grip on the Leading Position

Marcello Balestra, the head of Set Spa, the exclusive distributor of ELFLIQ, ELFBAR's first official in-house e-liquid brand in Italy, stated that with the product's arrival in Italy in May last year, ELFBAR is getting more environmentally friendly while maintaining its unique features, providing consumers with cost savings.

However, it is difficult to say it's the whole picture. Beyond the marketing aspects, the driving force behind more brands introducing e-liquid products lies in business convenience and benefits.

Ispire announced on January 4th that its factory in Malaysia has successfully obtained ISO certification. According to Michael Wang, the Joint CEO of the company, the Malaysia-based factory will enable Ispire to achieve higher profits in product assembly, reflecting the company's ambition to establish a comprehensive tobacco production line and exert control over its supply chain revenues.

The logical is that as the global market share of e-cigarettes continues to grow, the bargaining power of e-liquid and other suppliers is expected to rise. With the increasing potential for collaboration with other competitors, especially for coil suppliers such as vaporizer coils and e-liquids, the possibility of building their own brands and achieving direct sales is not out of reach.

Not all companies are like Apple and able to effectively control suppliers through a robust vertical management system. However, their approach is worth considering: if businesses can streamline communication with e-liquid manufacturers, reduce production costs, and maximize profits and price competitiveness, there are benefits to be gained. In addition to solidifying their position as key players in the supply chain, brands that own factories will experience tangible advantages as their scale expands.

Not only the large factories mentioned earlier, but also beyond the European market limited to a 2ML restriction, more e-cigarette brands are entering the industry to enhance their overall competitiveness and industry layout. For example, at the VAPE CLUB SHOW 2023 in Russia, SOAK revealed to 2FIRSTS that the company plans to launch a new product line in March 2024, all of which will use e-liquids developed in-house.

In the future, perhaps even disposable e-cigarette brands will join the trend of "open-system devices", where they offer both the device and the e-liquid, bringing them closer to achieving a fully self-contained ecosystem.

Deep Binding and Regulatory Prospects

Regarding the self-owned e-liquid product lines of leading manufacturers, although there is a high probability that they are OEM products, the act of branding the e-liquid at least allows for a strong association between product quality and the brand. This helps to establish a certain "credit system" between producers and consumers in the market, which objectively urges brands to tighten their quality control and achieve positive development.

In March 2023, the FDA proposed the establishment of a traceability system. Whether it is a private label or self-developed, the implementation of a separate e-liquid line by brands can assist stakeholders outside of the producers in effectively monitoring the supply chain, facilitating traceability for consumers, distributors, and regulatory authorities.

Furthermore, there are concerns regarding compliance. Since 2021, the disposable wave has swept across the globe, as evident to all. However, as established e-cigarette players and traditional tobacco companies have entered the disposable market one after another, emerging brands such as ELFBAR, Lost Mary, and SKE Crystal, who have made their fortune with disposable products, have also launched refillable pod products in 2023.

This give-and-take might indirectly reflect a lack of confidence among some manufacturers in the future compliance of disposable products. As of now, disposables entering the European market must comply with a maximum e-liquid capacity of 2ml. However, a standard-sized e-liquid bottle can hold up to 10ml. Moreover, policies regarding disposables are relatively stringent in many countries; for instance, Australia banned the entry of disposables starting January 1, 2024.

How long is the lifecycle of disposable products? Is it the enduring "solution" for the e-cigarette market? What direction will future regulatory policies take? These unknowns urge disposable brands to proactively set an "safety lock" and pave the way for transformation, with e-liquid possibly being a key piece in this strategy.

What's Next after E-liquid?

From a consumer perspective, these products are aimed at individuals seeking cost-effectiveness, those capable of operating vaporization devices to some extent, and players not satisfied with the "all-in-one" disposable e-cigarettes.

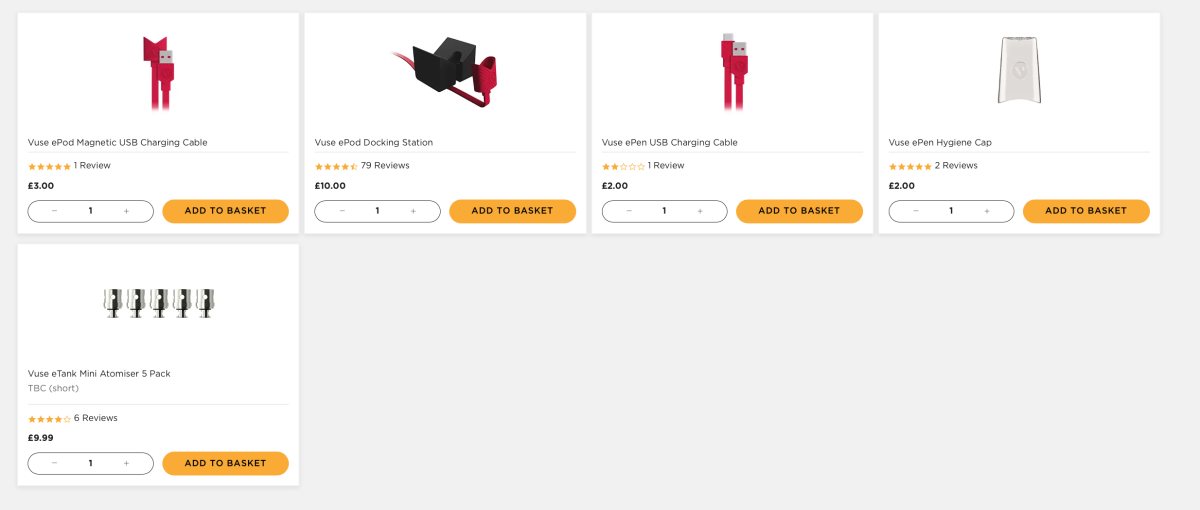

On the official VUSE website's product catalog, there is currently an "Accessories" section, including items such as charging cables, stands, and hygiene mouthpieces.

From a consumer perspective, this is a "one-stop" shopping service; from the brand's perspective, it's a "cross-selling" profit channel. However, these products launched around the goal of providing a "better nicotine intake experience" are gradually moving away from "nicotine (vaporization coil, e-liquid)", and are gradually decoupling from the brand image.

Can this weak relationship be sustained? Or, is it necessary to maintain this weak relationship?

Everything has two sides. Apple, aspiring to build an independent ecosystem, also faces compatibility issues, limiting the conversion of Android users to Apple users. When brands become obsessed with expanding their product lines, will they, at some point in the future, limit their customer base and exclude potential consumers? In the controversy over consumer autonomy, does a similar "all-in-one" strategy risk appearing coercive?

2FIRSTS will continue to report on brands' proprietary e-liquid product lines and more derived products.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com