Key Points

- Chinese vape exports to the U.S. rebounded sharply in October 2025, despite intensified enforcement earlier in the year, highlighting the limits of short-term regulatory suppression, according to reporting by the Washington Examiner.

- Weight-based data and value-based data tell the same story: the surge reflects a concentrated release of delayed shipments rather than a sustained recovery in underlying demand, consistent with a regulation-amplified bullwhip effect identified in prior 2Firsts analysis.

- Risk has not disappeared—it has shifted within the supply chain. With U.S. distributors typically paying deposits of around 10%, inventory accumulation and elongated payment cycles have pushed cash-flow pressure disproportionately onto Chinese manufacturers.

- Inventory pressure in the U.S. market is substantial. Based on 2Firsts field research, total vape inventory across U.S. distributors, house sales channels, and retail outlets is estimated to exceed 160 million units, rising to roughly 240 million units when in-transit and China-held stock are included.

- Inventory stress is beginning to spill beyond the U.S. market. As manufacturers face year-end settlement pressure and liquidity constraints, deeply discounted inventory is increasingly being redirected through cross-regional channels to emerging markets, including Africa, South America, and Central Asia.

Author:Echo Guo,Co-founder&COO, 2Firsts

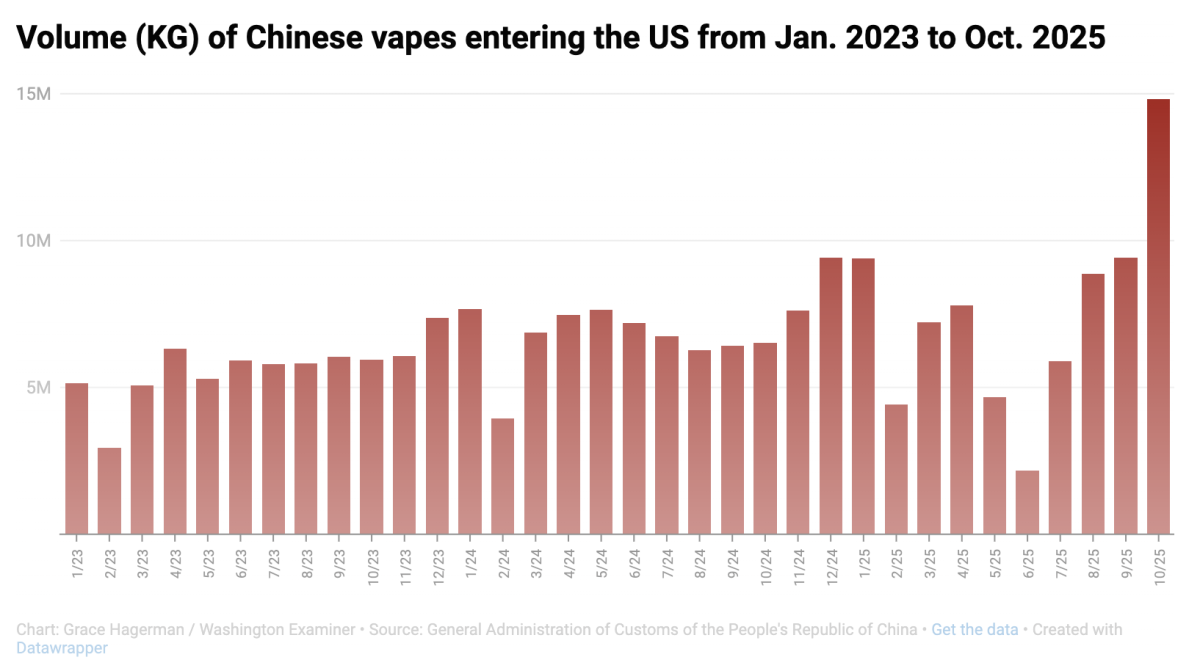

In October 2025, China’s exports of vaping products to the United States rebounded sharply. According to a December 9 report by the Washington Examiner, Chinese vape exports to the U.S. fell to roughly 2.2 million kg in June—during a period of intensified enforcement—but then rose rapidly, reaching approximately 14.8 million kg by October, one of the highest monthly levels on record.

The Washington Examiner framed this rebound against the backdrop of continued enforcement efforts by U.S. authorities and raised a central policy question: why do trade flows appear to be only temporarily suppressed, rather than durably curtailed, even under heightened regulatory pressure?

This article argues, however, that focusing solely on regulatory effectiveness risks missing a more consequential development. Under sustained enforcement pressure, risk has not disappeared. Instead, it has been reshaped and is accumulating within the supply chain.

Two Data Sets, One Underlying Pattern

The Washington Examiner analysis focuses primarily on export volume by weight, highlighting a sharp “collapse-and-rebound” pattern closely aligned with enforcement cycles.

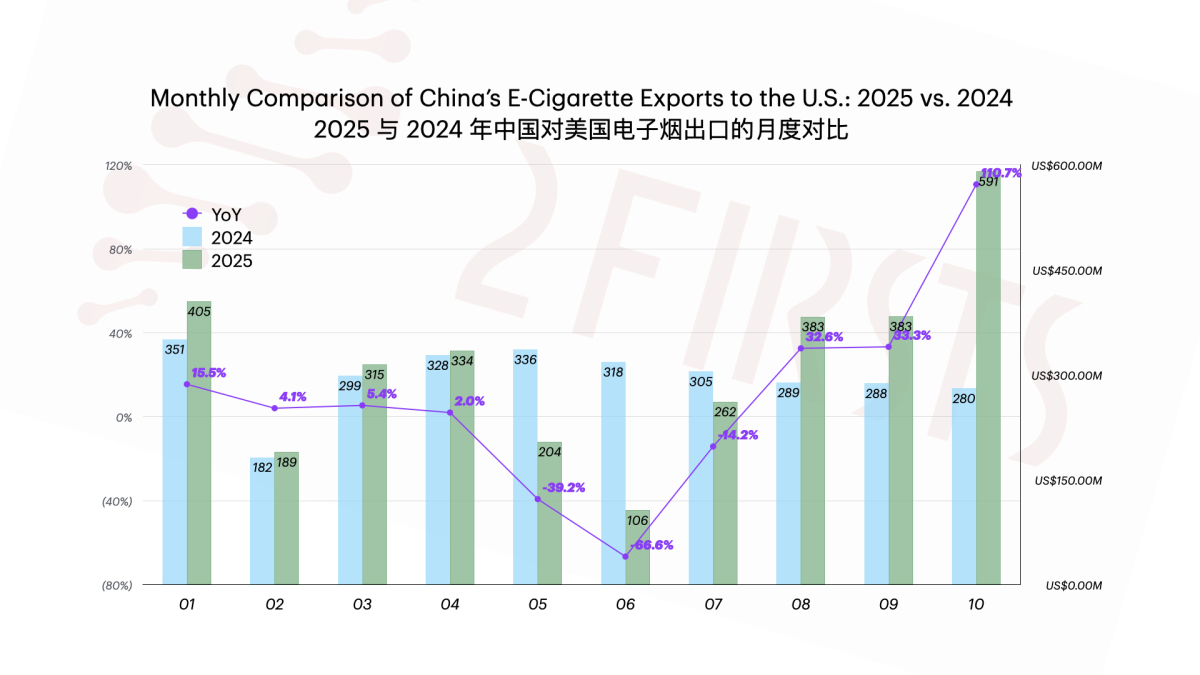

By contrast, earlier analysis by 2Firsts, using export value as a lens, points to a parallel warning signal. In October 2025, China’s vape exports to the U.S. reached approximately $590 million, the highest monthly level on record and more than half of China’s total global vape exports that month.

While weight and value measure different dimensions, both describe the same reality: the surge does not reflect a smooth recovery in demand, but rather a highly concentrated release of delayed shipments. As noted in previous 2Firsts reporting, this pattern resembles a regulation-amplified bullwhip effect—when shipments are temporarily constrained, inventories fall, and once an operational window opens, orders are front-loaded and released in bulk, magnifying volatility.

Where the Risk Ultimately Lands: China’s Supply Chain

The core question raised by the Washington Examiner is why trade volumes rebound after enforcement intensifies.

The more pressing issue, however, is where the risk is now being absorbed.

Under prevailing industry practice, U.S. distributors typically pay only a small deposit—often around 10% of the order value—while manufacturers and upstream suppliers shoulder the bulk of raw material, production, and logistics costs. When enforcement disrupts shipment timing and exports are released in concentrated waves, financial pressure is pushed forward onto the manufacturing side.

At the same time, inventory pressure within the U.S. market has risen markedly. Based on ongoing 2Firsts field research and estimates from veteran U.S. market participants, warehouses across the U.S. distribution system are effectively full. Including distributors, house-sales channels, and retail outlets, existing vape inventory in the U.S. is estimated to exceed 160 million devices, requiring at least three months—often longer—to clear under normal sales conditions.

When products already in transit between China and the U.S., as well as finished goods awaiting shipment in China, are included, total inventory exposure may approach 240 million devices. This suggests that even after a shipment surge, cash-flow recovery remains constrained by inventory digestion rather than shipment volume.

In this context, risk has not been eliminated. It has become increasingly concentrated in manufacturers’ working capital and operational stability—risks that emerge with delay but are far harder to unwind.

Year-End Pressures: Why Manufacturers Are Hoping for Tighter Enforcement

As inventory continues to build up in the U.S. market, a paradoxical mindset has emerged among Chinese vape manufacturers. Based on 2Firsts’ discussions with multiple Chinese producers already facing inventory pressure in the U.S., many firms—even those whose own businesses operate in regulatory gray areas—are now hoping that U.S. authorities will step up enforcement at the border in the near term.

This expectation is not driven by optimism about market prospects, but by immediate cash-flow concerns. Several manufacturers told 2Firsts that if new shipments are temporarily blocked, existing inventory could once again become scarce within the U.S. market, much as it did around June 2025, allowing stock to clear more quickly and payments to be recovered. While these firms recognize that tougher enforcement implies a more restrictive and higher-threshold U.S. market in the long run, in the short term it is viewed as a way to avert liquidity stress.

This mindset is being reinforced by the calendar. December marks the approach of January 2026 and China’s Lunar New Year, a period when manufacturers and supply chains are traditionally expected to settle accounts upstream. With inventories elevated and payments slowing, the timing itself is intensifying financial pressure at the manufacturing end, increasing the likelihood of accelerated liquidation through price cuts.

U.S. Inventory Risk May Spill Over Into Global Markets

At the same time, not all market participants view elevated inventory as purely a risk. 2Firsts research shows that some long-standing, globally active vape traders with access to cross-regional distribution channels have begun developing concrete plans around U.S. inventory.

Their focus is not domestic U.S. sales, but acquiring stock at steep discounts and redirecting it to other markets. One veteran international vape trader, identified here as Mr. F, told 2Firsts that price cuts of 50% or more are entirely plausible under current conditions. He noted that in previous market downturns, some factories liquidated obsolete vape products at prices as low as $0.18 per unit.

In the view of 2Firsts, when inventory pressure, year-end settlement deadlines, and cross-regional distribution capabilities converge, inventory originally concentrated in the U.S. may be absorbed and redirected through pricing mechanisms to other regions, including Africa, South America, and Central Asia—markets that remain in an expansion phase. If U.S. inventories cannot be effectively cleared, the risk associated with releasing such stock as discounted “tail inventory” may no longer remain confined to a single market, but could disrupt pricing and competitive dynamics across multiple emerging markets.

How the China–U.S. Trade Data Gap Took Shape

Before drawing conclusions from short-term movements, it is necessary to revisit a longer-standing structural issue.

As reported by the Washington Examiner, U.S. Census Bureau data show that Chinese vape imports totaled approximately $333 million in 2024, while the same report states that Chinese export records put China’s vape exports to the U.S. at roughly $3.7 billionthat year—a gap of unusual magnitude.

Regarding the above divergence in China–U.S. trade statistics, 2Firsts has learned through prior research and tracking that one contributing factor lies in certain practices within the cross-border logistics process for vaping products, where regulatory avoidance has resulted in a deliberate break in declaration consistency. Specifically, shipments may be accurately declared as e-cigarettes or e-cigarette components at the point of export from China, but prior to entering the U.S. border, accompanying documents may be altered and product descriptions adjusted, leading the same goods to be re-declared as other categories upon import into the United States.

This practice structurally widens the gap between Chinese export and U.S. import statistics and helps explain why weight- and value-based figures have remained misaligned for years. Against this backdrop, U.S. media have previously reported cases of illicit vapes entering the country under false declarations such as toys or consumer electronics.

If this explanation holds, it suggests that the divergence in trade data does not stem from statistical distortions attributable to any single country or market, but rather reflects structural issues embedded in cross-border trade and regulatory mechanisms. In this context, addressing illicit vape trade cannot be achieved by any one party acting alone. Instead, it requires stronger international cooperation—including between China and the United States—particularly in areas such as information sharing, coordinated enforcement, and regulatory alignment, to narrow opportunities for regulatory arbitrage and improve the overall effectiveness of cross-border oversight.

Do Not Let Narrative Obscure the Real Risks

A final note of caution is warranted regarding the way this issue is framed. It is worth noting that some media outlets, including the Washington Examiner, have at times linked—or closely juxtaposed—“illicit vapes” with “China-made” products in their reporting, a narrative approach that can blur important distinctions.

The global e-cigarette supply chain is highly concentrated, with China widely recognized by the industry as the manufacturing center for the vast majority of the world’s vaping products—both compliant and non-compliant. Equating “China-made” products with “illicit vapes” risks oversimplifying what is already a complex regulatory challenge.

Such framing may obscure where regulatory responsibility truly lies, complicate enforcement efforts in practice, and impose unnecessary collateral damage on legitimate businesses and workers in both China and the United States. Addressing the illicit vape market requires precise, enforceable regulatory tools—not politicized labels.

In a highly globalized industry where capital is heavily front-loaded, the greater danger lies in systemic risks that are quietly accumulating but have yet to be fully recognized or priced in.

Read More↓

Special Report | After the Shortage: How the U.S. Vape Market Is Rebuilding Itself

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.