The 2024 Asia International New Tobacco Industry Expo (ANTY EXPO) officially opened at the Malaysia International Exhibition and Convention Centre (MIECC). As the official media partner of ANTY EXPO, the 2Firsts team has arrived at the exhibition site and set up a special interview room (booth number: H30) to provide industry professionals with firsthand market insights and trend analysis. Industry insiders are welcome to come and exchange industry updates.

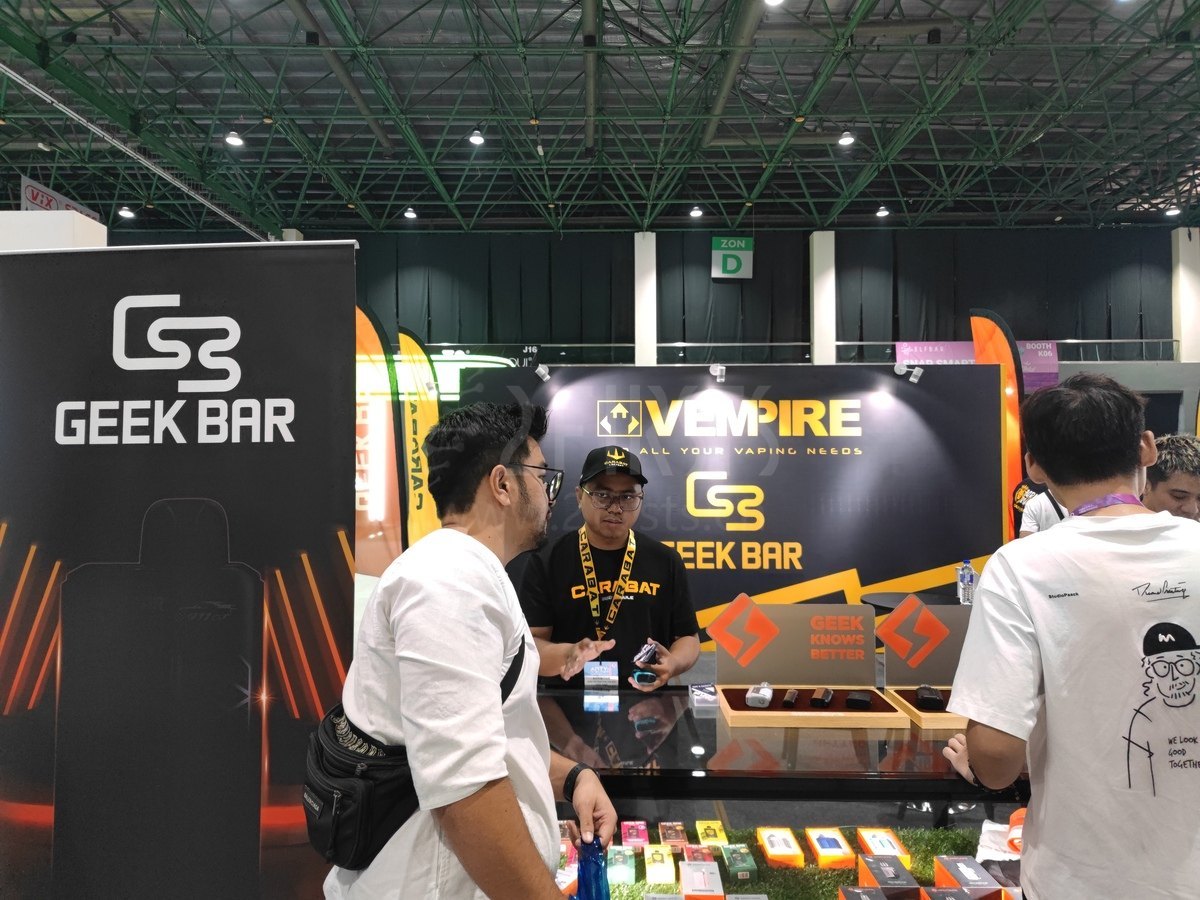

With the rapid rise of pod system products on a global scale, the Malaysian market is also experiencing a wave of transformation. At the ANTY EXPO trade show in September 2024, 2Firsts engaged in discussions with VEMPIRE, a leading e-cigarette retailer in Malaysia. During the exchange, CEO Daphenie Tan shared insights on how to gain an advantage in fierce competition through localization strategies and address the increasingly complex market regulatory challenges.

More consumers are turning to pod systems

According to Daphenie, VEMPIRE has been established for 11 years, with 65 retail stores in Malaysia and 5 in Indonesia. They have their own brands such as Akso and Carabat, as well as acting as agents for popular brands like Geekbar and Smok, distributing these products exclusively through their own channels.

She pointed out that disposable e-cigarette products were once popular in the Malaysian market, but this trend is quickly changing. Daphenie noted that more and more consumers are turning to pod systems, these products are becoming the mainstream in the market due to their reusable nature and higher value for money.

Consumers are increasingly favoring disposable products, both in small and large sizes, which are very popular," he added.

Malaysian consumers have different taste preferences compared to markets in Europe, America, or China.

Daphenie mentioned that the majority of e-cigarette users in the Malaysian local market are Malays, who prefer e-liquids with a strong throat hit and intense flavor, while products with a weaker ice sensation are more in line with local demand. This has made localized flavor development a key focus in VEMPIRE's strategy.

Daphenie revealed that their collaborating brand Smok will be launching a new pod system in September, while Geekbar is set to release a new product in October. Daphenie stated that VEMPIRE will not directly use their e-liquid flavors from other regions, but will work closely with local mixologists to ensure that these products cater to the tastes of Malaysian consumers.

We collaborate with local oil blenders to customize flavors specifically for the Malaysian market. The localized flavors will be more distinct, and we will not use flavors that have been prepared for other regions," Daphenie said.

Unchanged strong brand and dual promotion strategy

From the perspective of retail channels, she stated that brands such as Nanostix and Vapetape still enjoy high levels of recognition among consumers in the Malaysian e-cigarette market.

At the same time, VEMPIRE's own brand Akso has also performed well. Especially Akso, since entering the Malaysian market 6 years ago, has built up a stable customer base.

When talking about marketing strategies, the CEO mentioned that VEMPIRE has adopted a combination of online and offline marketing techniques in order to maximize brand exposure.

In Malaysia, we are conducting both online and offline promotions simultaneously to ensure that our products reach a wide range of consumers," explained the CEO.

Optimistic about regulation

VEMPIRE's long-term plan extends beyond Malaysia to further expand into other Southeast Asian countries, such as Indonesia.

Despite being confident in the market outlook, the CEO also expressed concerns regarding the upcoming regulatory policies in Malaysia. Currently, the government has not established clear regulations, with expectations that relevant policies will be announced in October. This uncertainty has had some impact on the market, but respondents have stated that the company will adapt flexibly according to the government's guidance.

However, Daphenie is optimistic about the prospects of the e-cigarette market in Malaysia, especially compared to other countries, as Malaysia's tax policies are relatively moderate.

Our tax system is still acceptable, compared to other countries, Malaysia's market still has a lot of growth potential," she said.

Advice for Chinese manufacturers

When asked about how new brands should enter the Malaysian market, she replied that she hopes all brands entering Malaysia will comply with tax and market regulations, avoiding market disruptions from non-compliant products flooding the market.

Daphenie said, "I hope all brands can enter the Malaysian market in compliance with regulations, so as to ensure the healthy development of the market.

At the same time, she also mentioned some market irregularities, especially factories dumping unsold products into the Malaysian market, which undoubtedly affects the overall image of the market. The interviewee called on brands to focus on product quality and avoid unethical behavior.

Don't throw unsellable goods into Malaysia. The factories sell goods they can't sell by throwing them into Malaysia for sale.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com