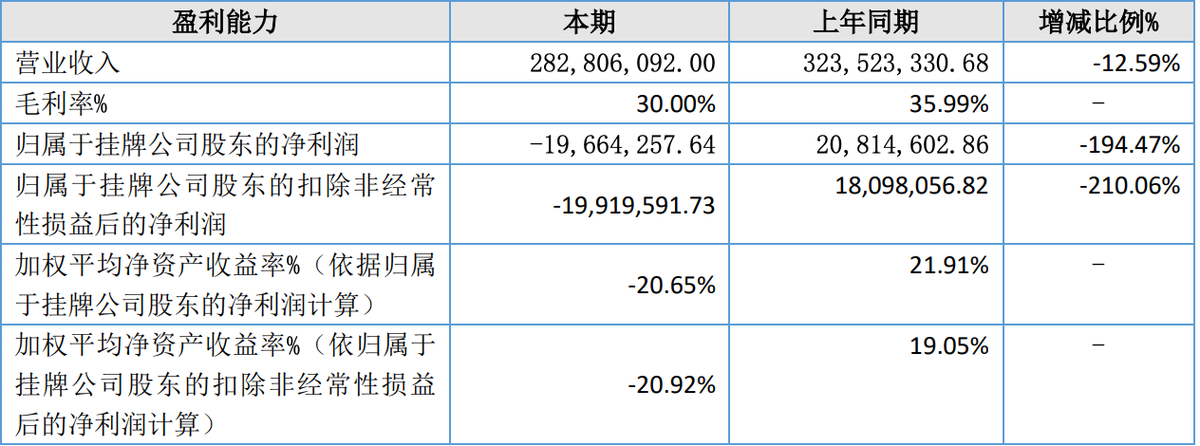

Recently, Itsuwa Co., Ltd. (NEEQ: 833767) in Shenzhen released its annual report for the year 2024. The report reveals that the company achieved a total operating income of 283 million yuan in 2024, a decrease of 12.59% compared to the previous year. The net profit attributable to the listed company's shareholders was -19.66 million yuan, a significant decrease of 194.47% year-on-year.

In the report, Itsuwa explained that the main reason for the decline in performance is the intense competition in the overseas e-cigarette market for homogenized products. Similar products are sold at lower prices in the market, and the company's differentiated advantages are not obvious, leading to a decrease in sales revenue. Additionally, the product structure of the company is more complex than the previous year, causing an increase in the use of labor hours per unit product, resulting in an increase in labor costs that further compress the profit margin. In 2024, the company's main business gross profit margin was 30.00%, a decrease of 5.99 percentage points from the previous year's 35.99%.

Itsuwa has stated that the company will continue to increase its research and development investment, with R&D spending accounting for 9.12% of current operating income in 2024. Research and development products include disposable e-cigarettes, pod-based e-cigarettes, open systems, and the research emphasis is on environmental protection, compliance, modularity, multiple pods, high capacity, and enhanced customer experience. During the reporting period, the company held 135 valid patents, including 8 invention patents.

At the same time, the company actively promotes its own brands of e-cigarettes, such as VAPESOUL and VOOM, targeting different consumer groups. During the reporting period, sales of the company's own brand products accounted for 29.37% of total sales, and it plans to continue expanding sales of its own brand e-cigarettes through 2025.

The report highlights that global regulations on the e-cigarette market are becoming stricter, with many countries implementing policies and tax standards to control e-cigarettes.

Meanwhile, the environmental issues brought by disposable e-cigarettes are increasingly receiving attention. Domestic e-cigarette policies are also becoming more complete, with measures such as market access permits and total quantity management expected to promote supply-demand balance. Overall, the industry is fiercely competitive, and businesses face growing challenges.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com