Editor's note: Previously, 2FIRSTS had reprinted a partial report from a British anti-smoking and health action organization ("British Study: Nearly 5.6 million adults use e-cigarettes, usage rates at record high"). After obtaining the original report, 2FIRSTS has summarized the key points within it.

On August 12th, the UK anti-smoking and health organization Action on Smoking and Health (ASH) released its latest survey report on "Smoke-free Britain". The report analyzes the changing behaviors and attitudes of adults (those aged 18 and older) in the UK towards e-cigarettes.

According to a report, 11% of adults in the UK are currently using e-cigarettes, marking the highest usage rate on record with a total of 5.6 million people. The key points of the report compiled by 2FIRSTS are as follows:

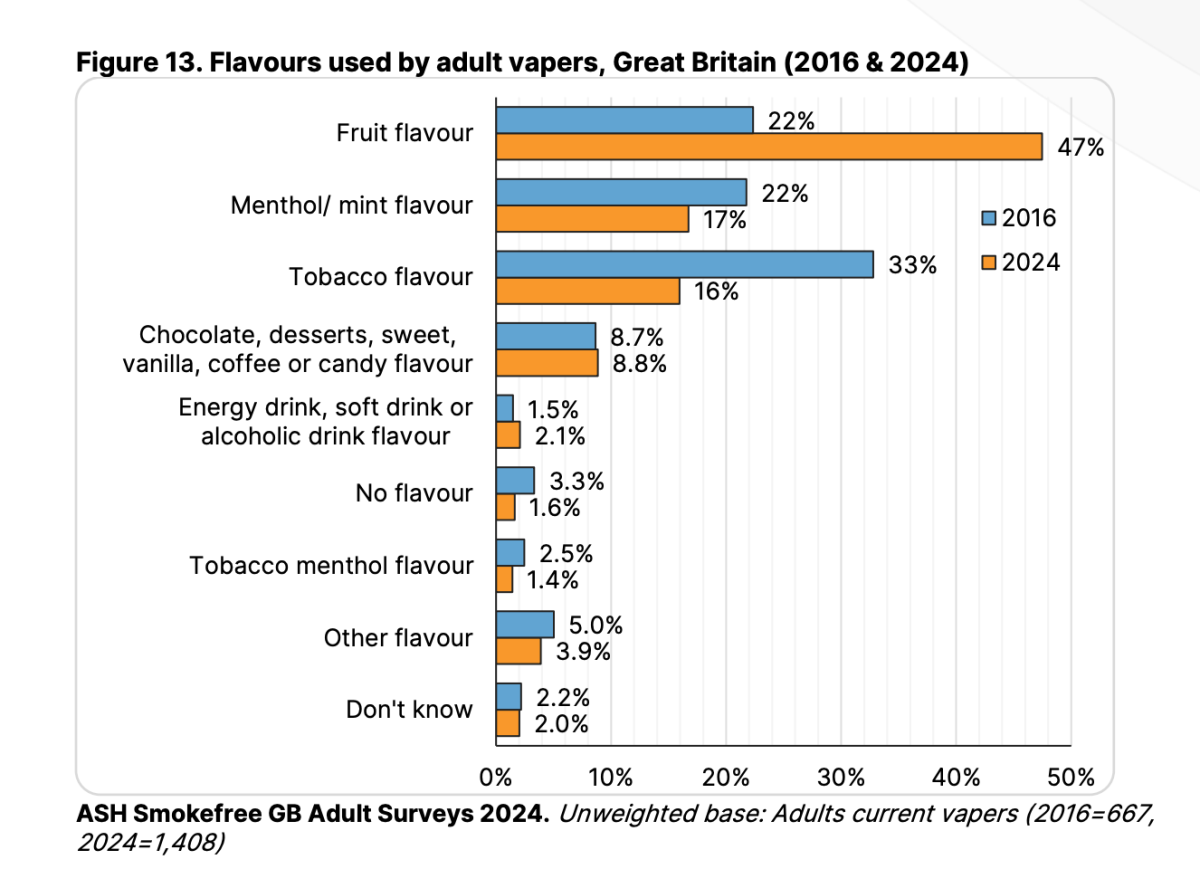

Fruit-flavored e-cigarettes are the most popular.

According to a survey conducted by ASH, fruit-flavored e-cigarettes are the most popular among adult residents of the UK in 2024, followed by mint/mint menthol and tobacco flavors.

Looking at the specifics, e-cigarettes with fruit flavors accounted for 47% of the market, ranking first, while mint/mint flavor and tobacco flavor accounted for 17% and 16% respectively. This data not only indicates the popularity of fruit-flavored e-cigarettes, but also reflects a shift in e-cigarette flavor preferences among the British population. In 2016, tobacco-flavored e-cigarettes were the most popular, accounting for 33% of the market.

In addition, the preference differences among different user groups when choosing e-cigarette flavors may be related to their smoking history and personal taste.

According to ASH's report, fruit flavors are equally popular among current traditional cigarette users (49%) and smokers trying to quit (45%). Among e-cigarette users who have never used traditional cigarettes, the majority (61%) prefer fruit-flavored e-cigarettes.

Traditional cigarette quitters are more likely to choose mint/mint flavor e-cigarettes, with 22% of quitters selecting this flavor. Dual users who use both traditional cigarettes and e-cigarettes are more likely to choose tobacco-flavored e-cigarettes, making up 23% of this group.

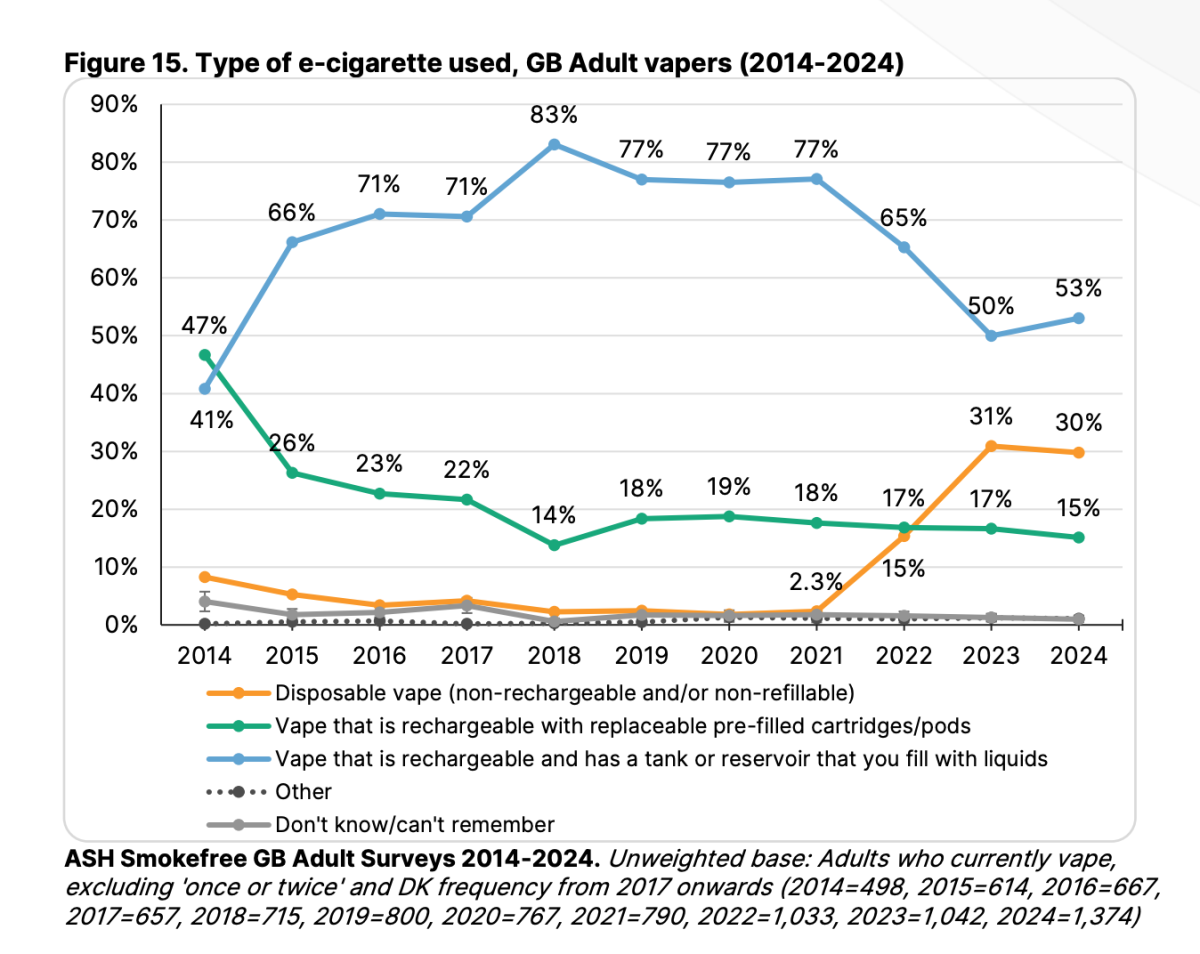

The usage rate of disposable e-cigarettes is leveling off.

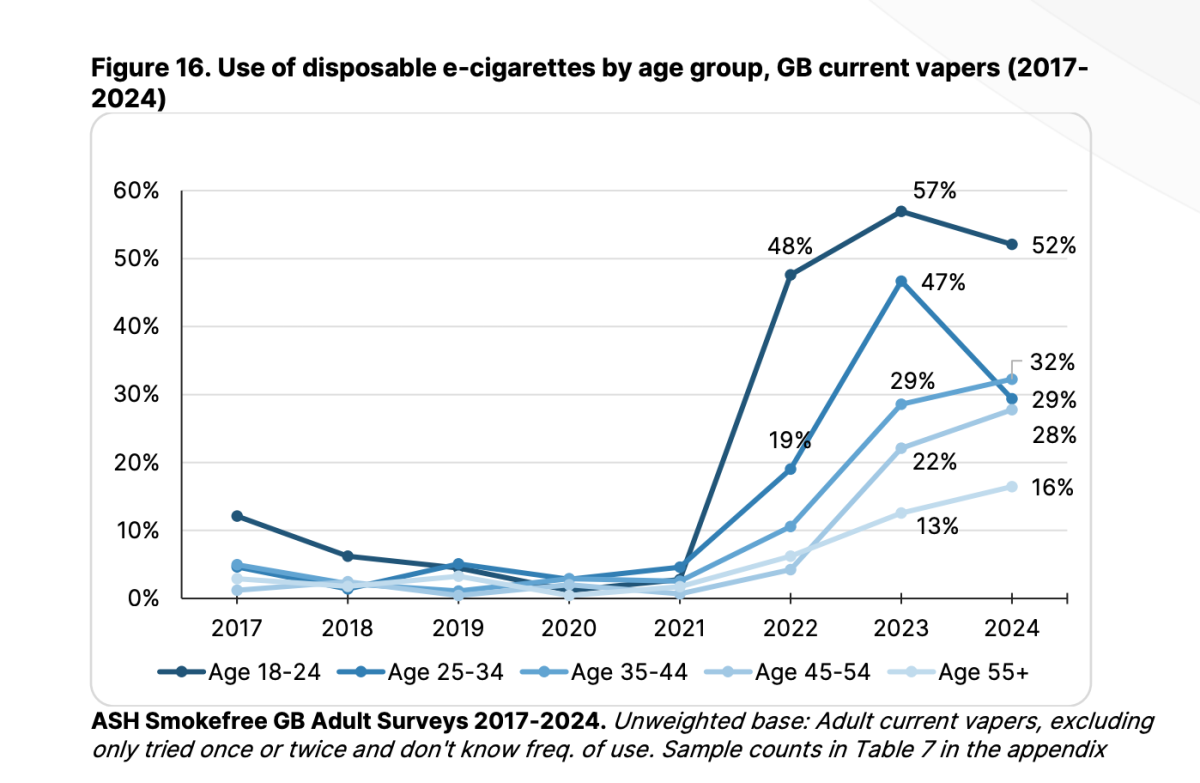

Although the use of disposable e-cigarettes stabilized in 2024, their popularity among young people remains relatively high. Data shows that disposable e-cigarettes account for 30% of the market share, while open-system and pod system devices account for 53% and 15%, respectively.

According to the table, from 2021 to 2023, the popularity of disposable e-cigarettes has rapidly increased, with e-cigarette users growing from 2.3% to 31%. Since 2023, this proportion has remained stable at 30%.

A survey has found that two-thirds (66%) of e-cigarette users say they only use one type of e-cigarette device.

In 2024, over half (52%) of adults aged 18 to 24 use disposable e-cigarettes as their primary device. According to ASH, convenience and price are important factors when choosing a device type. The most common reasons for choosing disposable e-cigarettes are convenience (32%) and the ability to get the desired flavor (21%).

In a study conducted by ASH on brand preferences for disposable e-cigarettes among primary users, data showed that the most popular brand was Elf Bar, accounting for 52% of users. Following closely behind were Lost Mary at 40% and Crystal Bar at 35%.

The popularity and usage rate of nicotine pouches are steadily increasing.

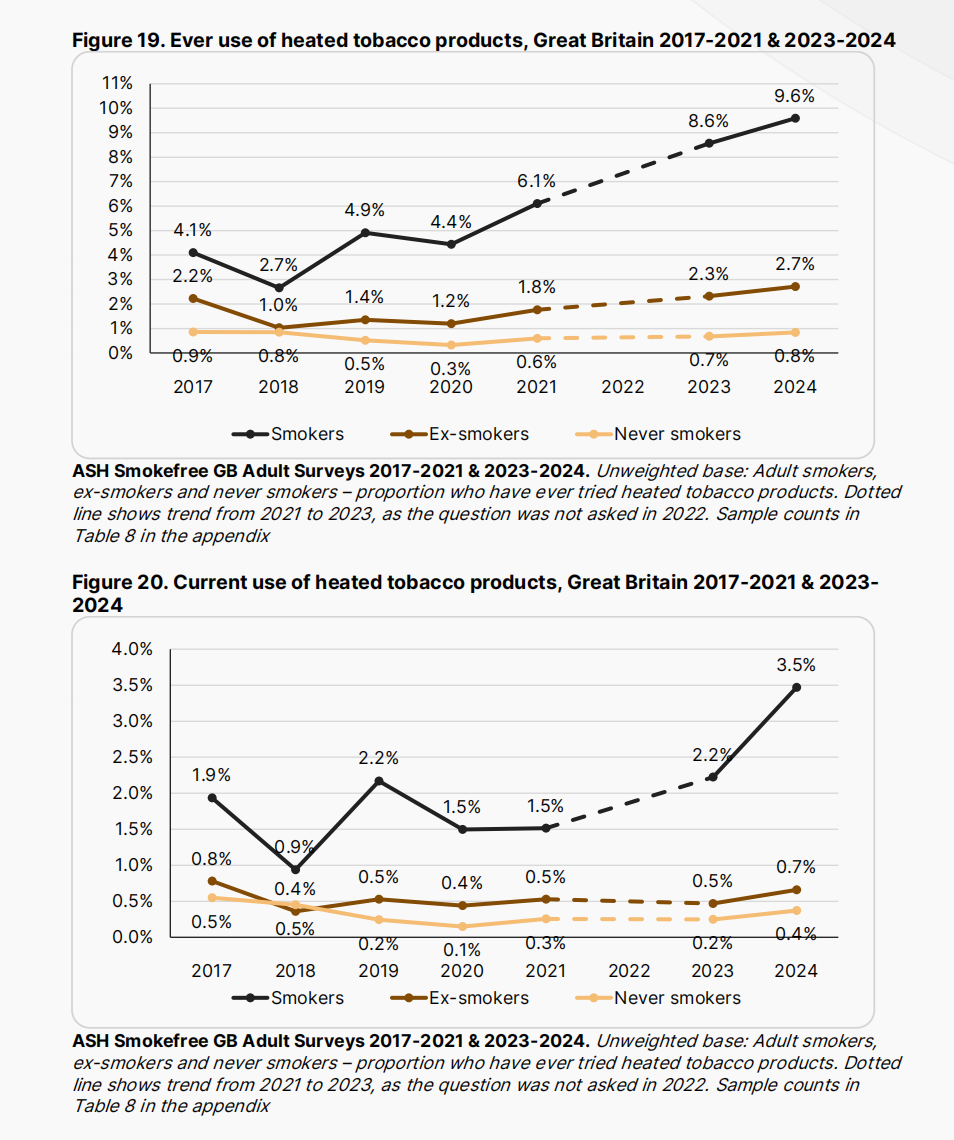

A report shows that the popularity and usage of heated tobacco products and nicotine pouches as e-cigarette alternatives are gradually increasing, possibly due to marketing campaigns. ASH believes that this emerging trend of alternative products could have an impact on public health policies and e-cigarette regulatory measures.

In terms of heated tobacco products, since the launch of IQOS in 2017, the awareness and usage rates of heated tobacco products have gradually increased. By 2024, 37% of smokers reported having heard of these products, with 9.6% having tried them.

Nicotine pouches (such as ZYN and Nordic Spirit) are more widely recognized by the public compared to heated tobacco products. Data shows that by 2024, 61% of smokers have heard of these products, 3.3% of smokers currently use nicotine pouches, and 17% of smokers have tried them before.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com