Special Statement:

2Firsts has been authorized by the source media (WeChat public account "HuoXingLiaoRan") to reprint;

The entire article represents the views and position of HuoXingLiaoRan only.

Compared to the widespread consumption and continuous expansion of slim and regular cigarettes, the development of short cigarettes has always lacked sufficient momentum in mainstream, popularity, and scale. In particular, in recent years, the short cigarette market seems to have hit a bottleneck, with the market size hovering around 500,000 boxes, and the wholesale price per box falling below 40,000 yuan. Now, short cigarettes seem to have become synonymous with "difficult to sell" in the eyes of retailers. So, where should the development of short cigarettes go from here? In this issue, we will take the "Furongwang" brand of short cigarettes as an example and analyze it thoroughly.

The "Furongwang" yellow series, built around "Furongwang", has achieved great success with the "Furongwang (hard slim, hard medium)" brands surpassing sales of over 100,000 boxes each last year. They have become leaders in the same price range. However, the market performance of "Furong King (hard 75mm)" has been mediocre. Therefore, it is worth delving into consumer logic and creating a new benchmark for the short cigarette market.

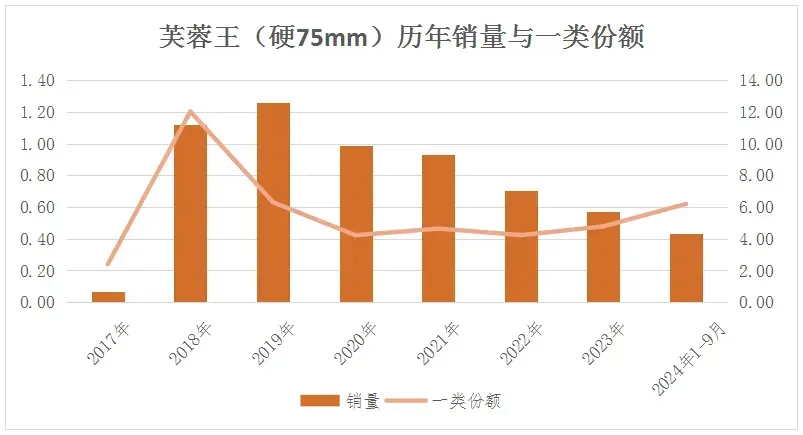

"Furongwang (hard 75mm)" was released in 2017, with sales of 693 boxes in its debut year. Sales quickly surpassed 10,000 boxes in 2018, climbing to the fifth spot among short cigarette brands in 2019. However, sales started to decline in 2020, continuing to shrink until 2023 with a 19.08% year-on-year decrease. The sales data for 2024 is even worse.

Why do short cigarettes not smell as good anymore? Let's explore this from four different perspectives.

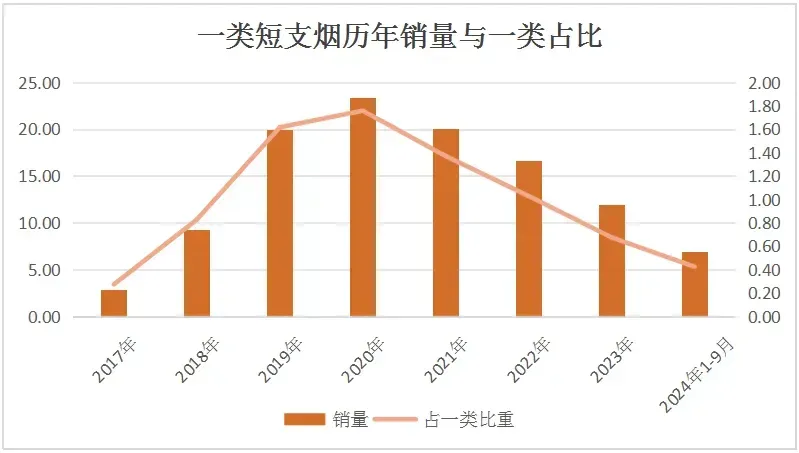

Firstly, the total space is small. In 2023, the national sales volume of a certain type of short cigarettes was only 119,400 boxes, a year-on-year decrease of 28.40%, accounting for only 0.68% of the total sales of this type of cigarettes. Meanwhile, the sales volume of slender cigarettes increased by 19.07% year-on-year, accounting for 19.08% of the total sales of this type of cigarettes, and the sales volume of medium cigarettes increased by 19.26% year-on-year, accounting for 12.36% of the total sales of this type of cigarettes. Thin cigarettes and medium cigarettes are far ahead.

Secondly, there is the trend of market development. The sales of Class I short cigarettes nationwide showed a significant increase from 2016 to 2020, but began to sharply decline in 2021. In 2023, the sales volume decreased by 28.40% compared to the previous year, indicating a accelerated contraction in the market. In the first quarter of 2024, the national sales volume of Class I short cigarettes decreased by 35.46% year-on-year, which can be described as dismal.

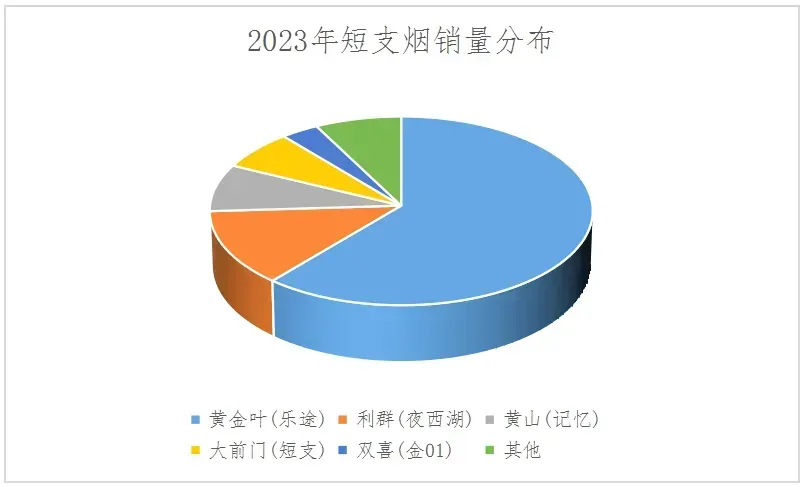

Thirdly, the main product categories. The top three selling product categories in 2023 are "Liqun (Night West Lake)", "Daqianmen (Short)" and "Baisha (Hard and Tianxia Zunxiang)". "Zhonghua (Gold Short)" ranks fifth, with a decrease of 29%. "Yuxi (108)" is sixth, with sales only one-fifth of what they were in 2018.

The fourth is the second category of short-term support. In 2023, sales decreased by 6.35% year-on-year. "Golden Leaf (Letu)" stood out, with sales increasing by 10.13% year-on-year. Following that, both "Huangshan (Memory)" and "Double Happiness (Gold 01)" saw sales declines of over 40% annually.

Therefore, what are the consumer logics behind this?

Market feedback on "Furongwang (hard 75mm)" suggests that first, it has a high level of acceptance in terms of taste, being smooth and comfortable. Second, its packaging lacks distinction, closely resembling that of Huangwang with no unique features like hidden patterns. Third, the product lacks high visibility in the market, with the Furongwang yellow series having many specifications and not being heavily promoted.

Analysis of short cigarette consumption behavior: First, it is driven by a desire for novelty and self-expression; Second, it is motivated by concerns for health, only taking a few puffs.

Analysis of the dilemma of short cigarettes: First, they are only shorter in appearance, without any actual benefits (so-called high-speed rail cigarettes are just a concept and a gimmick); second, due to their short length, smokers cannot take several puffs, resulting in lower satisfaction than regular cigarettes and making them less cost-effective, which is not well received by veteran smokers; third, they lack the health and fashion sense of slim cigarettes, failing to appeal to younger adults. Short cigarettes are "three unlike".

Conclusion

The problem has been identified, but where is the solution? In the next issue, we will delve into how to find new breakthroughs for short cigarettes and regain consumer trust.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com