According to a report by Naver on July 17th, the latest data from South Korea's Customs office shows that in 2023, a regulatory loophole regarding synthetic nicotine e-cigarettes led to a loss of personal consumption tax revenue in South Korea of up to 196.4 billion Korean won (approximately $1.4 billion), accounting for 92.2% of the market's circulating products. This phenomenon not only resulted in significant tax losses but could also exacerbate the issue of youth smoking, sparking widespread social concern.

Synthetic nicotine e-cigarettes have become a grey area of tax regulation in South Korea due to not being subject to current tobacco tax laws. According to statistics, only 7.8% of the e-liquid circulating in the South Korean market contains natural nicotine, while 92.2% contains synthetic nicotine. As synthetic nicotine e-cigarettes are not classified under the definition of "tobacco," they are exempt from personal consumption tax, as well as other taxes such as the national health promotion tax, value-added tax, education tax, and waste tax.

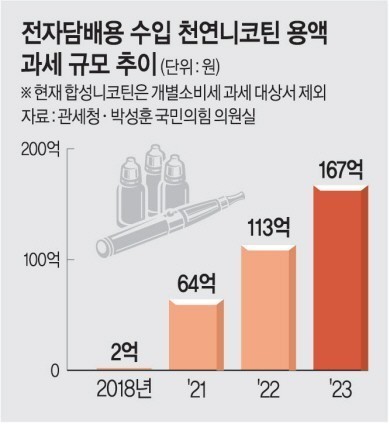

Furthermore, according to statistics from the Korean Health Promotion Institute, the personal consumption tax revenue of liquid e-cigarettes using natural nicotine solution is approximately 166.43 billion Korean won (approximately 120 million US dollars), compared to 2.28 billion won (approximately 16.5 million US dollars) in 2018, showing a 73-fold increase in just 5 years. This data further highlights the rapid growth of the synthetic nicotine e-cigarette market and the potential risks brought by the lack of regulation.

Faced with this regulatory loophole, the South Korean government has not yet implemented specific regulations, but the National Assembly has begun actively preparing legislative work. According to a report by 2FIRSTS on July 15, Park Seong-hoon, a member of the ruling party, has submitted an amendment to the Tobacco Business Act to the National Assembly, aiming to include nicotine liquid in the definition of tobacco in order to address the current legal regulatory gap.

Park Seung-hoon emphasized that although discussions on regulating new tobacco products are still ongoing, concerns over lost tax revenue and social controversies, especially regarding youth smoking issues, have raised widespread attention. He added, "The amendment aims to reduce the rate of youth e-cigarette use and minimize the negative impact of e-cigarettes around schools. We will work to expedite the passage of this bill.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com