Disclaimer:

1. This article solely addresses issues of e-cigarette regulation and commerce, intended for readers within the global next-generation tobacco industry.

2. The content does not analyze or comment on political or diplomatic matters. Nothing herein may be cited for political or diplomatic purposes.

3. Opinions and remarks from individuals referenced in this article are conveyed objectively and do not reflect the views of 2Firsts. No judgment is made on their perspectives in other domains.

4. Statements related to politics and diplomacy are based on official declarations.

【2Firsts】On November 25, newly elected U.S. President Donald Trump announced sweeping tariff increases on goods from Mexico, Canada, and China via his Truth Social platform. Trump pledged to implement these measures from his first day in office, proposing a 25% tariff on all products from Mexico and Canada and an additional 10% tariff on Chinese imports. This comes on top of the existing 25% tariffs introduced during his prior term. During his campaign, Trump even floated a tariff rate as high as 60% on all Chinese goods.

Reflecting on his previous tenure (2017–2021), Trump frequently used tariffs to recalibrate U.S. trade dynamics. Under Section 301 tariffs, duties ranging from 7.5% to 25% were imposed on over $300 billion worth of Chinese goods, including e-cigarette devices and components.

As China produces over 90% of the world’s e-cigarettes and the U.S. represents the largest market, the bilateral trade in e-cigarettes holds global significance. If Trump’s proposed tariff hikes materialize, what would be their impact on U.S.-China trade? Beyond tariffs, how might compliance challenges and industry migration reshape the future of this critical supply chain? 2Firsts consulted with industry insiders to explore these pressing questions.

The Tariff Game: Gray Markets and Strategic Evasion

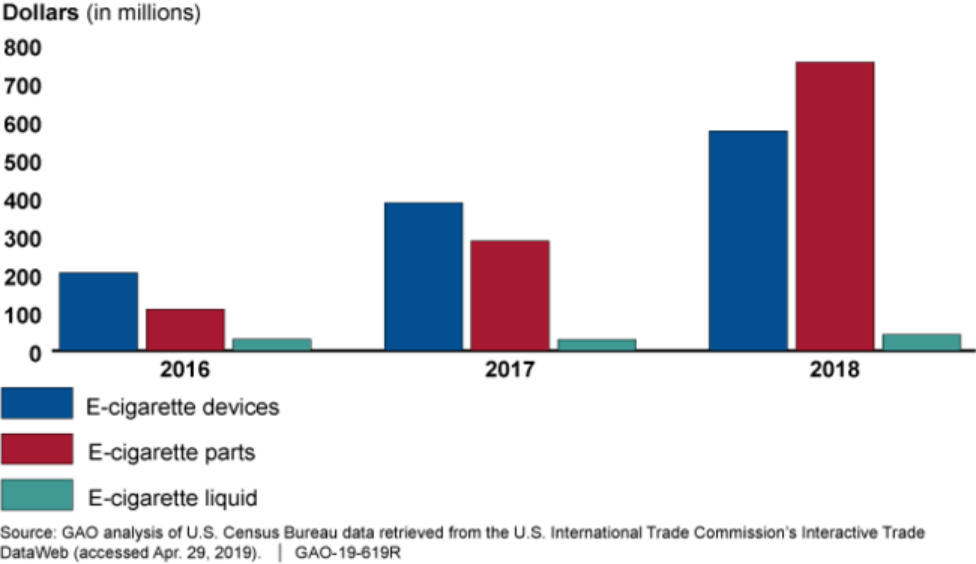

In 2018, the U.S.-China trade standoff dominated headlines, culminating in the Phase One Trade Agreement signed in January 2020. Under the deal, the U.S. agreed to halve tariffs on $120 billion worth of Chinese goods, reducing them to 7.5% within 30 days. However, the 25% tariffs imposed earlier on $250 billion worth of imports, including e-cigarette devices and components, remained unchanged.

A veteran e-cigarette logistics professional, identified as Mr. A, told 2Firsts that e-cigarette products exported from China to the U.S. currently face a total declared tariff rate of 27.86%, comprising an original tariff of 2.86% and an additional 25% imposed under the Trump administration.

He candidly remarked, “The previous 25% tariff hike by the Trump administration didn’t significantly impact us overall.”

According to Mr. A, following the last round of tariff increases, many companies in the industry turned to “grey customs” channels to ship goods into the U.S. market. He noted that if subject to the official U.S. tariff rates for e-cigarettes, the added logistics and cost burdens would ultimately be passed on to consumers at the market’s endpoint.

Under Trump’s recent remarks advocating an additional 10% tariff, categorized as “Additional Tariffs,” the total duty on e-cigarette products would climb to 37.86%—comprising an original tariff of 2.86%, a previously imposed 25% tariff, and the new 10% levy.

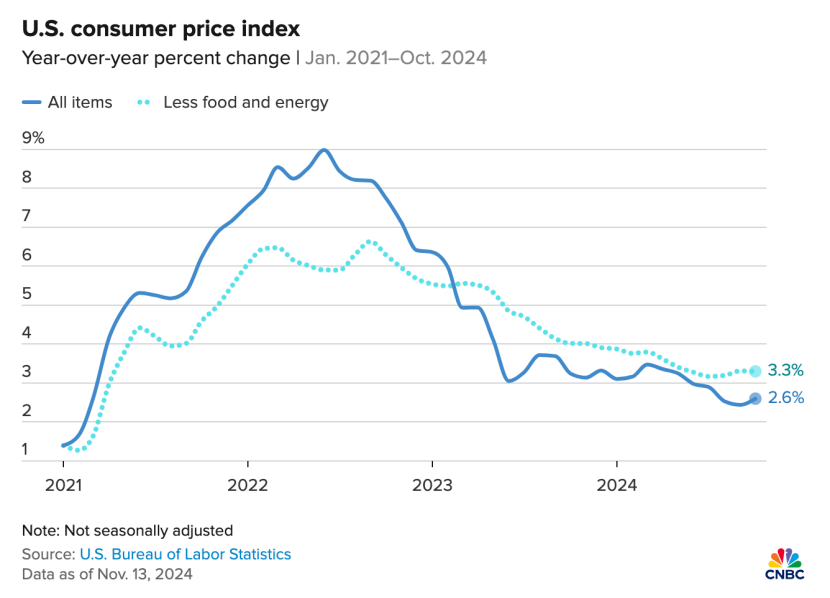

Mr. A noted, “If Trump were to implement his proposal of a 60% tariff on all Chinese goods, it would only exacerbate inflation within the U.S.”

According to China Daily, research indicates that since 2018, the significant tariffs levied on certain Chinese goods have seen U.S. import agents and wholesalers absorb over 90% of the added costs. These increased expenses have been passed down the supply chain, culminating in higher prices for downstream producers and end consumers.

“The cost ultimately falls on consumers,” said Mr. A, a seasoned logistics expert. “Higher tariffs increase the overall expense, and naturally, U.S. retail prices rise as a result.”

Shifting Manufacturing Hubs to Sidestep Tariffs

Mr. A observed that if the U.S. continues to significantly increase tariffs and enforce them strictly, leading e-cigarette manufacturers could face substantial impacts, potentially prompting a shift of operations to Southeast Asia. He noted a growing trend of companies from Shenzhen relocating production facilities to Indonesia, Vietnam, and Malaysia.

Publicly available data confirms that several notable e-cigarette manufacturers have already established factories in Indonesia, including Smoore, Mason Vap, Hive Workshop, Geekvape, and Jinjia.

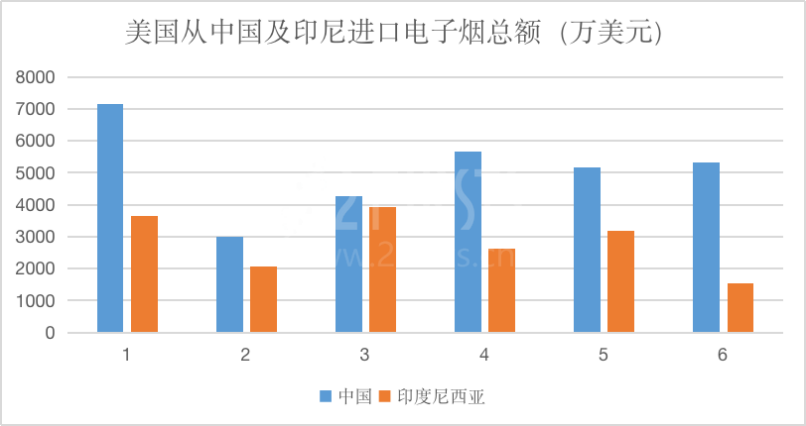

According to data released in June 2023 by the United States International Trade Commission (USITC), imports of e-cigarettes from China accounted for only 63.7% of the U.S. total during the first half of 2023, while imports from Indonesia represented over 35%. This shift has made Indonesia the second-largest supplier of e-cigarettes to the U.S. market. The reestablishment of Indonesia’s most-favored-nation (MFN) trading status in 2020 has further bolstered its competitiveness, as e-cigarette kits exported from Indonesia to the U.S. are subject to a mere 2.6% import duty.

However, offshoring manufacturing is not without its risks. As U.S.-China trade tensions escalate, some countries have expressed reluctance to become intermediaries for Chinese manufacturing. On December 2024, Malaysia’s Deputy Minister of Investment, Trade, and Industry, Liew Chin Tong, stated that Malaysia has urged Chinese companies to refrain from using the country as a relabeling hub to circumvent U.S. tariffs.

Logistics: From Air to Sea, Exploring Strategies to Mitigate High Tariff Impact

B, a seasoned expert in the logistics industry, shared with 2Firsts that based on historical trends during Trump’s presidency, tariff hikes are an almost certain outcome. This is expected to directly increase the logistics costs for U.S.-bound e-cigarettes. Despite the added tariffs, most e-cigarette companies will likely continue using “grey clearance” methods to enter the U.S. market. The expanded scale of grey clearance could, however, lead to increased inspection rates.

B also noted a tightening of U.S. customs regulations on small imports: “For example, shipments labeled as cross-border e-commerce cargo originating from Hong Kong now face clearance difficulties, with customs scrutiny becoming more stringent.”

Regarding common strategies in the logistics industry, B explained, “We offer clients multimodal transport solutions to reduce costs. For instance, using Matson express ships to transport e-cigarettes. Once shipped, they arrive at the port in 12 days and reach overseas warehouses in 15 days. The transportation cost is only a third of that for air freight.”

When asked if e-cigarette shipments to the U.S. could be rerouted through other countries or regions to minimize tariffs, B was skeptical. “Most grey-cleared e-cigarettes are shipped via South Korea, but this doesn’t reduce tariffs,” he noted.

“U.S. customs knows that 90% of e-cigarettes originate from China. Changing transit regions doesn’t make a difference. Ultimately, adjustments to transportation routes depend on the customs clearance resources of individual logistics companies.”

E-Cigarette “Made in America” Remains Unlikely in the Short Term

“Make America Great Again” remains the centerpiece of Donald Trump’s political messaging, and a cornerstone of this strategy is promoting the reshoring of manufacturing industries to the U.S.

On taxation, Trump has pledged to further reduce corporate tax rates for domestically manufactured products to 15%. In 2017, his administration already slashed this rate from 35% to 21%.

Despite these efforts, Mr.B, an industry insider, told 2Firsts that shifting e-cigarette production to the U.S. remains implausible. “China’s e-cigarette industry operates within a highly concentrated ecosystem with fully integrated supply chains. This results in the world’s lowest R&D and production costs for e-cigarettes,” he explained. “Relocating manufacturing is extremely challenging, especially as the frequent policy shifts in the U.S. deter Chinese companies from committing to local production.”

Mr.B expressed greater optimism regarding Southeast Asia as a viable alternative for manufacturing facilities. “Southeast Asia can produce inexpensive e-cigarettes, but when it comes to design, functionality, taste, and packaging, only China can deliver the premium quality that stands out,” he noted.

“Our core competitive advantage is leading in total cost efficiency,” Mr.B concluded.

Small Players Navigate the U.S. E-Cigarette Market: Tariffs vs. Regulation

Mr. C, an experienced distributor operating in North and Latin American e-cigarette markets, shared insights with 2Firsts about the challenges facing the industry. According to him, while tariffs on small consumer goods like e-cigarettes are unlikely to increase in the short term, regulatory scrutiny, especially for companies focused on compliance, is set to intensify.

As a self-identified “small player,” Mr. C believes that tariff changes won’t significantly impact his operations.

“Higher tariffs might hit the top brands that focus heavily on compliance,” he said. “But for small players like us, it doesn’t make much of a difference.”

Explaining further, Mr. C remarked, “Our margins are slim—just half or a yuan per unit (about 0.075-0.15 USD). As long as our products are cheaper than traditional cigarettes, there’s always room for us in the market.”

However, he expressed deeper concerns about the disorganized competition in the U.S. market. The increasingly saturated landscape, coupled with mounting regulatory requirements, poses a significant challenge for smaller operators trying to navigate this space.

Mr. C’s concerns about the U.S. e-cigarette market extend beyond tariffs to what he describes as chaotic competition. The intensifying “race to the bottom” has made survival increasingly difficult for small and mid-sized companies. Lengthy payment terms, sometimes exceeding a month, have only exacerbated the financial strain on smaller players.

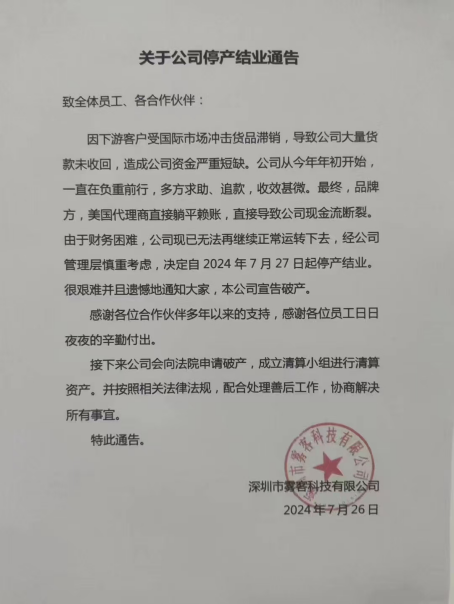

For instance, on July 30, Shenzhen Wuke Technology Co., Ltd. issued a “Notice of Production Suspension and Closure.” The notice stated, “Due to unsold inventory caused by downstream customers being impacted by international market fluctuations and a large amount of uncollected payments, the company is facing severe financial shortages… Brand owners and U.S. agents have outright defaulted on payments, leading directly to a cash flow crisis.” As a result, the company announced its closure and will enter bankruptcy proceedings.

While some companies have recently opted to scale back resources allocated to the U.S. market or even exit entirely, thereby easing market competition, the persistent issue of extended payment terms continues to burden cash-strapped small businesses. This “payment term model” effectively compounds existing financial pressures, making survival increasingly difficult for smaller players.

A veteran in the U.S. e-cigarette market told 2Firsts that standard payment terms in the industry typically range from one to three months. “Ironically, the better your relationship with a client, the longer the payment term might extend,” he noted. However, he admitted that for familiar clients, his business now largely insists on cash payments for e-cigarette transactions.

Mr. C further advised small businesses to concentrate their efforts under the current conditions. He suggested lowering costs and reallocating resources to target markets in Latin America or the Middle East, where opportunities might be more viable.

“To enter the U.S. market, you either need an established and robust distribution network there or a deeply rooted partnership with a local distributor. Otherwise, it’s a matter of pouring money and technical expertise into the effort. For smaller players like us, the barriers are simply insurmountable,” Mr. C remarked.

The U.S. Market Faces Another Round of Reshuffling

Recent export trade data reveals that in October, China’s e-cigarette exports totaled approximately $890 million, with the United States remaining the largest destination market. Exports to the U.S. accounted for $280 million, representing 31% of the total.

Since the start of 2024, the regulatory environment for the U.S. e-cigarette market has undergone significant changes.

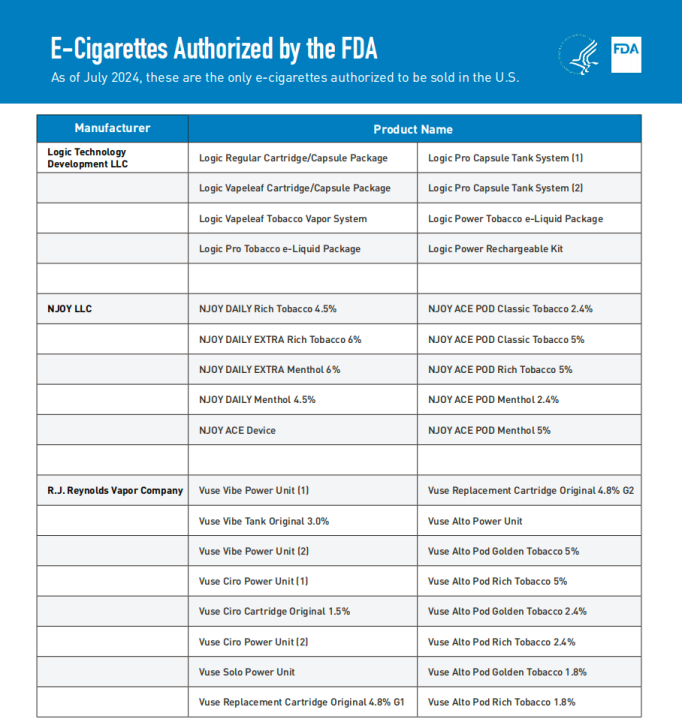

In June 2024, the FDA granted marketing authorization for four menthol-flavored e-cigarette products under Altria’s NJOY brand. This marked the first time the FDA approved non-tobacco-flavored e-cigarettes.

In the same month, the FDA announced a partnership with the Department of Justice (DOJ) to establish a multi-agency task force aimed at cracking down on unauthorized disposable e-cigarettes imported from China, particularly fruit-flavored products.

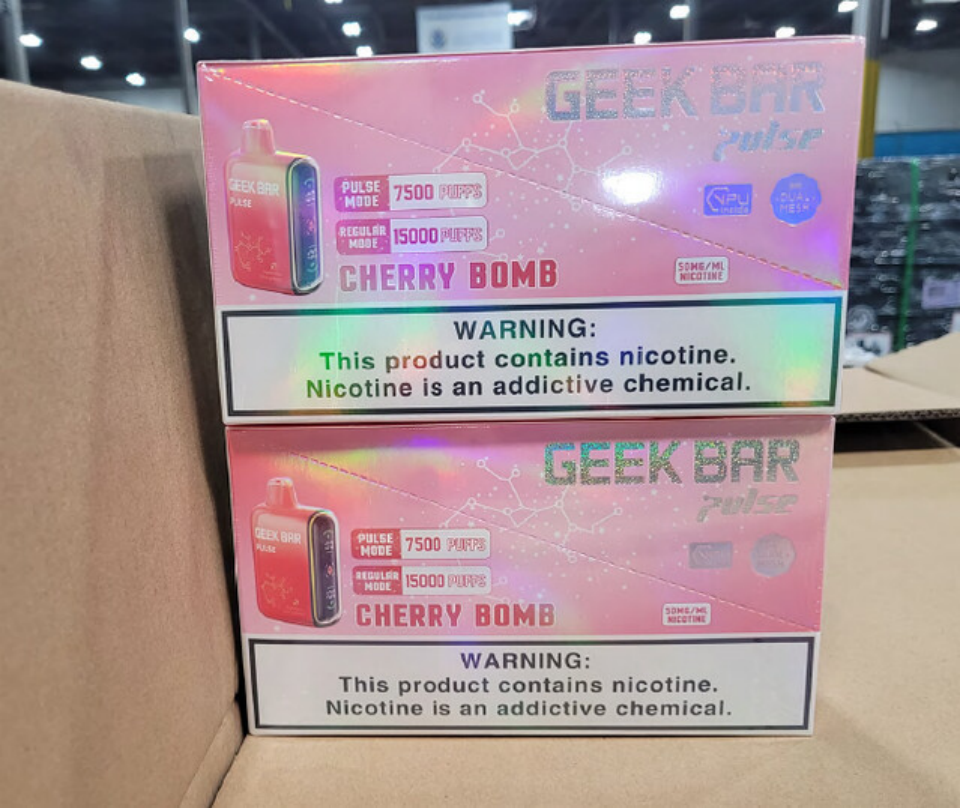

By October, the FDA and U.S. Customs and Border Protection (CBP) jointly seized unauthorized e-cigarette products valued at $76 million. This operation, the largest of its kind to date, targeted imports from China, including brands like GEEKBAR. Additionally, the FDA issued multiple warning letters concerning smartphone-style e-cigarettes sold in the U.S. market.

Despite increasing regulatory scrutiny, the U.S. market for Next-Generation Products(NGPs) remains a magnet for industry attention and investment.

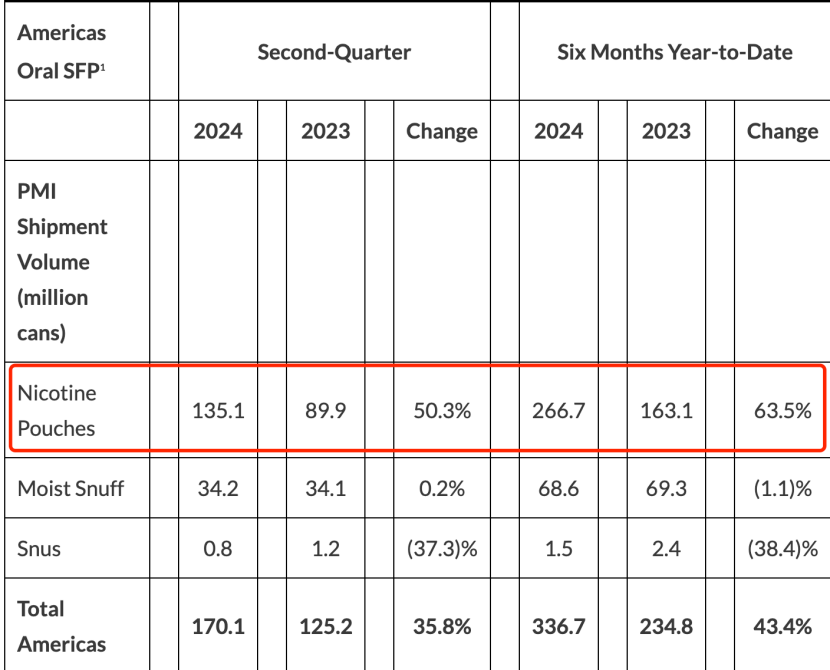

Global giants like Philip Morris International (PMI), British American Tobacco (BAT), and Altria have been accelerating their shift toward alternative tobacco products in recent years. PMI’s Q2 financial report revealed a 50.3% year-on-year increase in U.S. shipments of ZYN nicotine pouches, reaching a remarkable 1.351 billion units. The company is also advancing plans to reintroduce its heated tobacco product, IQOS, into the U.S. market with a pilot launch slated for Austin, Texas.

Amid this environment of both regulation and opportunity, a few leading firms are ramping up efforts to stay ahead, such as expediting PMTA applications and expanding overseas manufacturing. However, many companies remain cautious. As one industry insider, referred to as Mr. A, observed: “Everyone is waiting. Once the leaders falter, that’s when others will step up.”

A similar perspective is shared by SKY, a veteran investor in the e-cigarette sector. SKY highlighted that a new wave of tariffs would likely trigger a reshuffling of the industry.

“The real fear isn’t just higher tariffs—it’s the increased enforcement budget for U.S. Customs, which could lead to rampant seizures. Chinese firms are more afraid of confiscations than tariffs. Given the current prevalence of gray-market channels, an industry shakeout seems almost inevitable,” SKY remarked.

For Chinese e-cigarette companies that rely on low-cost competition as their core advantage, the dual pressures of rising tariff costs and compliance risks are becoming increasingly apparent. Their true competitors, however, are the international tobacco giants with deeper financial resources and economies of scale—enabling them to weather cost increases with far greater resilience.

A former industry player who exited the U.S. market offered his perspective: “We all knew tariffs were a predictable risk, but they also represent a reshuffling of the deck. The real question is, who can outlast the storm and emerge as the ultimate survivor?”

In the ocean’s depths, as a whale reaches the end of its life, its body gradually sinks into the dark abyss. Despite the harsh, sunless conditions of the deep sea, the whale’s demise becomes a rare source of nourishment for marine life. Over time, a unique ecosystem forms around the fallen whale, transforming the barren seafloor into a thriving habitat.

“In the U.S. market, there are smaller Chinese brands with strong local teams lying in wait,” said Mr. A. “They’re all hoping for their moment—when ‘the fall of one whale gives rise to life for many.’”

Cover Image Source: ChatGPT

For the latest updates on the U.S. e-cigarette market, stay tuned to www.2Firsts.com.

Regarding this article, if you have any additional comments on the content, industry insights or related information, please feel free to contact us via email: info@2firsts.com

*This article is an original article of 2FIRSTS Technology Co., Ltd. The copyright and license rights belong to the company. Any entity or individual shall make link and credit 2FIRSTS when taking actions to copy, reprint or distribute the original article. The company retains the right to pursue its legal responsibility.