Those who have attempted self-help programs know that change is not easy, and this struggle applies to tobacco companies as well. They hope to capitalize on the remnants of their traditional cigarette business to drive sales of e-cigarettes and oral smokeless tobacco (snuff), and strive to create a sustainable future. However, as demonstrated by the ban on disposable e-cigarettes in the UK, the growth potential of alternative nicotine delivery products seems to be limited.

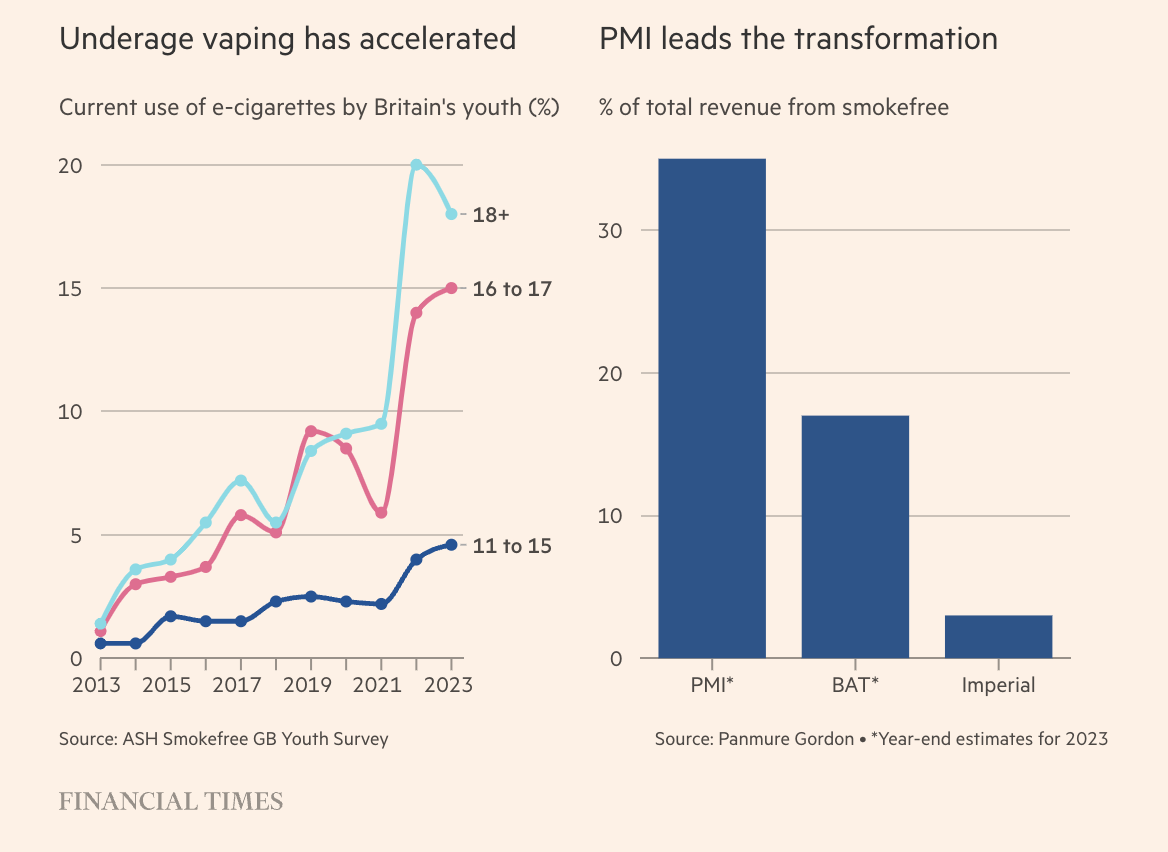

It should be noted that the new policy in the UK is not directly targeting traditional tobacco manufacturers such as British American Tobacco and Imperial Brands. Its focus is on the disposable e-cigarette market, which is valued at £1.3 billion and predominantly dominated by Chinese imports known for their diverse flavors such as colorful and bubblegum. According to data from Action on Smoking and Health (ASH), this market is growing rapidly and is expected to account for 31% of the entire e-cigarette market by 2023, compared to just 2% in 2021.

Tobacco companies focusing on non-disposable e-cigarettes may see the ban as having a positive impact on their smokeless business. Despite a decrease in sales of devices with fewer colors, their market position is expected to remain unchanged. These companies may also hope to shift the demand towards other smokeless products, such as "modern oral," a new form of snuff. Similar to the Renaissance, Philip Morris acquired Swedish Match and its Zyn nicotine pouch products in 2022, with sales in this category predicted to double in the United States by 2030.

However, this hopeful prospect overlooks a key issue. The actions taken by the UK indicate that regulatory authorities are highly sensitive to the rise of alternative nicotine delivery methods, especially if they begin to attract "never smokers." Therefore, pursuing growth in these categories is a complex balancing act.

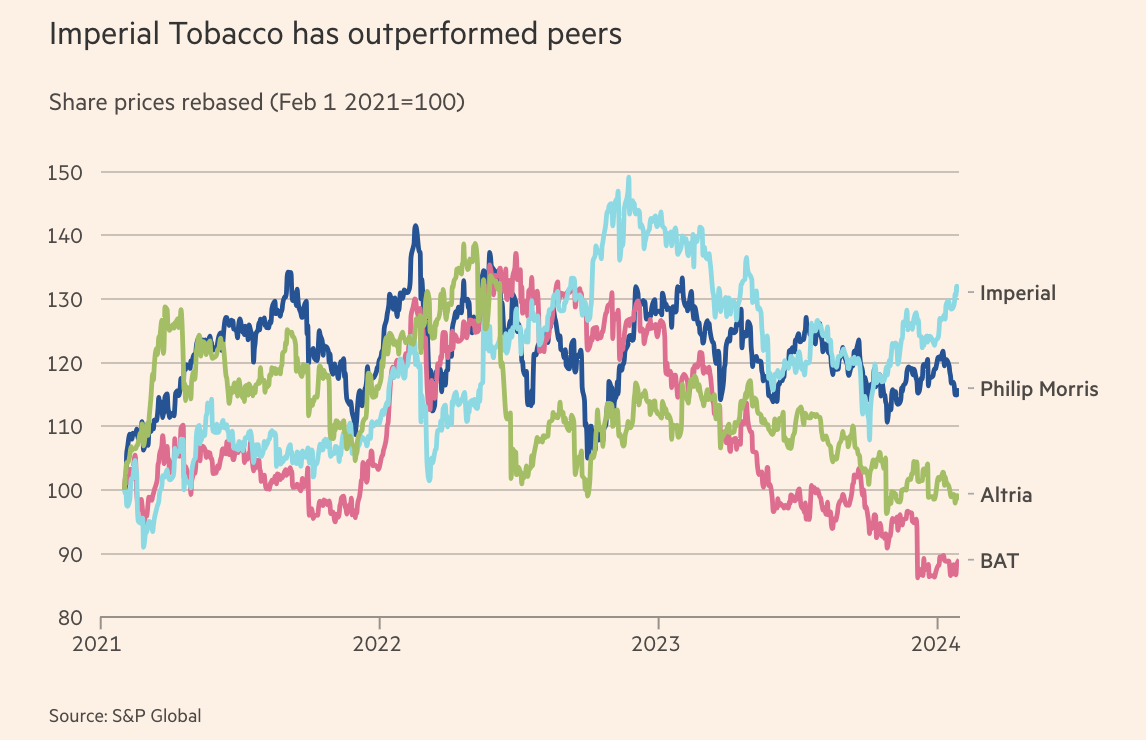

Investors may not necessarily pay a long-term price for this outlook. According to Panmure Gordon, Philip Morris leads the way in the smokeless sector, with 35% of its revenue coming from this area. Despite its forward price-to-earnings ratio of 15 times, double the valuation multiple of its British counterparts, its stock price has consistently lagged behind Imperial Brands over the past three years, with little to no alternative products. Instead, Philip Morris is more inclined to return cash to its shareholders.

Taking the UK as an example, if all regulatory bodies agree that there is no favorable way of smoking, then Imperial Tobacco Company's strategy may be the most suitable for this declining industry.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com