Special Note:

This article is translated by 2Firsts from the original Chinese text. Please refer to the Chinese version for accuracy.

This article has been authorized for reprint by UBS Global Research.

The entire article represents the views and position of UBS Global Research only.

The original title of this article is "E-cigarettes: Beneficiaries of the underestimated wave of going abroad.

China is the major producer of e-cigarette products globally, and UBS predicts that its strong growth will continue to disrupt the global tobacco industry landscape. The market may be overly concerned about potential regulatory restrictions on e-cigarettes in the short term, while underestimating the strong growth opportunities that exports could bring to some Chinese manufacturers.

How do e-cigarettes affect the global tobacco industry?

Based on the UBS tobacco transformation model, we estimate that the global retail sales of e-cigarettes will reach $35 billion in 2023 (equivalent to 11.6% of total nicotine sales), with a retail volume of 132 billion equivalent cigarettes (equivalent to 5.7% of total nicotine sales).

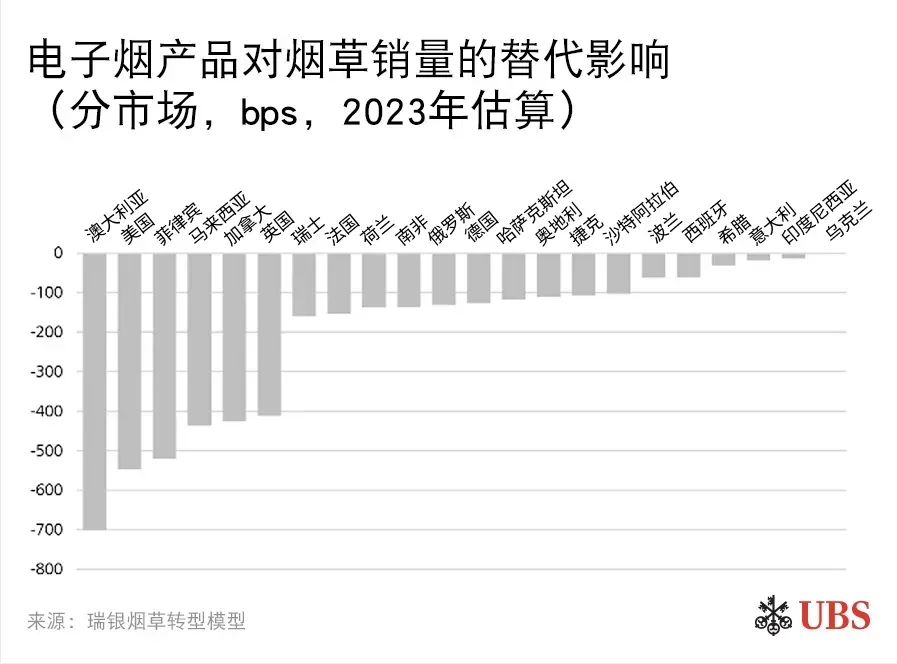

More importantly, non-tobacco companies hold an 85% market share in the e-cigarette market due to their flexibility, rapid innovation, and lower prices/profit margins. Considering that nearly seven out of ten e-cigarette users also smoke (or have smoked in the past), we expect the e-cigarette to substitute for tobacco sales by an average of -1 percentage point annually in the next three years, leading to a decline of approximately 3 percentage points in global tobacco companies' nicotine market share. The growth of e-cigarettes may continue to impact global tobacco companies.

We believe that the penetration of e-cigarettes is driven by three key factors:

- The price differential with cigarettes (consumers tending to downgrade consumption, turning to e-cigarette products),

- Traditional tobacco use rates (negatively correlated), and

- Heated tobacco penetration rates (another form of nicotine alternative)

It indicates that in the short term, we predict the e-cigarette sales CAGR from 2023-2028 to be 10.2% (revenue CAGR of 8.9%). By 2028, e-cigarettes are projected to account for 9.7% of the top 40 nicotine total sales. The e-cigarette category is particularly strong in the markets of the UK, US, and Canada, collectively representing around 66% of global e-cigarette sales figures.

Can Chinese manufacturers with agility further increase their market share?

The e-cigarette category has seen accelerated growth since 2021, primarily driven by another non-tobacco innovation - disposable e-cigarettes. Despite tobacco companies ramping up their e-cigarette business, we believe they will struggle to compete with the agile Chinese manufacturers, leading to a continued decline in market share (currently around 15%). Especially as we have observed non-tobacco companies lowering prices by as much as 50% (per milliliter/consumer).

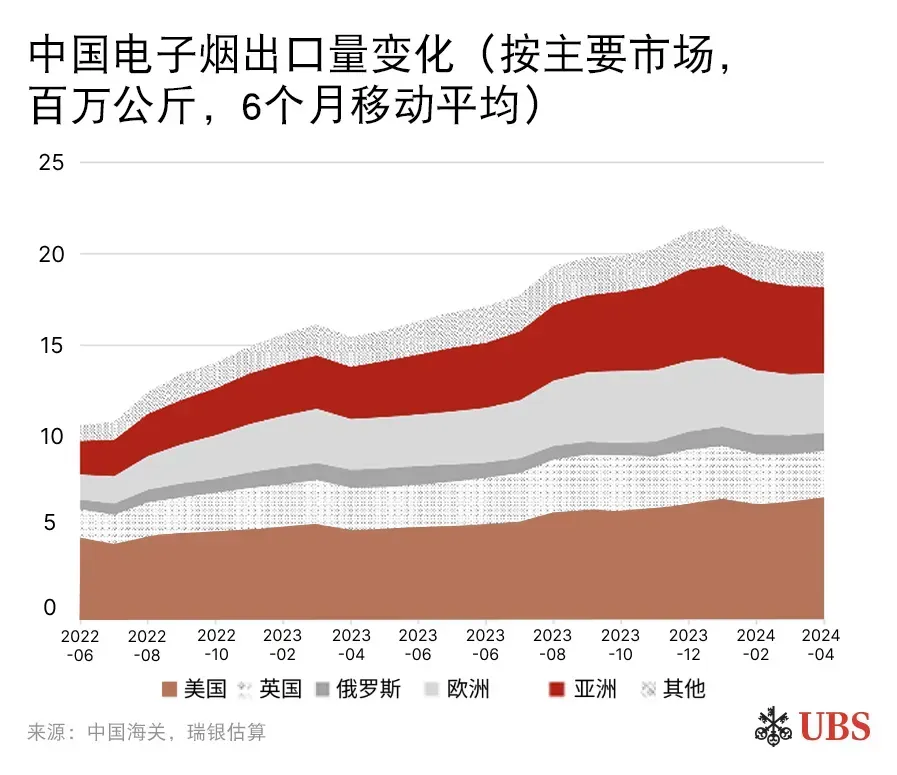

The majority of e-cigarette products are manufactured in China. We have introduced data on the export volume of Chinese e-cigarettes to track the development of this category. Chinese e-cigarette exports have been strong, with a 23% increase in export volume in April 2024 (6-month moving average), including a 32% acceleration in exports to the United States.

Given that the proportion of large e-liquid capacity products in the disposable e-cigarette market has increased (with e-liquid capacity reaching up to 20ml, compared to the previous 2ml), we believe that the above-mentioned consumption growth rate may be underestimated. We expect the consumption growth rate to be approximately double the export volume growth rate.

What is the magnitude of the risks of regulatory restrictions?

Many regions or countries are seeking to tighten regulations on e-cigarettes (including banning disposable products, flavor restrictions, taxation, and complete bans), for reasons such as youth use of e-cigarettes, limited control over e-cigarette marketing and ingredients, and government decreases in tobacco tax revenue. The World Health Organization is also strongly urging "emergency action" to control e-cigarettes.

However, our analysis suggests that the potential impact may be limited, as:

Ban has given rise to a grey/illegal market where vendors adapt flexibly to the complexities of regulatory enforcement (such as the continuous growth of grey/illegal cigarette trade).

We have noticed that the United States is increasing regulations through state laws, but research shows that only about 30% of users are turning to legal e-cigarettes (with about 45% turning to the grey/illegal market). Similar approaches like import bans in Australia or other ways to curb the growth of e-cigarettes are potential paths to consider.

What is the impact on the industry level?

We believe that China's independent e-cigarette manufacturers are the main beneficiaries, as they operate their businesses with agility and flexibility, and are willing to engage in price competition and accept lower profit margins. Therefore, we expect non-tobacco companies to continue to dominate the global e-cigarette category, accounting for approximately 90% of e-cigarette market sales/volume and 85% of sales revenue. Investors may have underestimated their growth opportunities.

The tobacco industry has shown strong stock performance this year (outperforming the essential consumer goods sector by 9%), possibly reflecting market expectations of interest rate cuts and declining yields, as well as increased investor interest in tobacco. However, we believe that the industry may face negative impacts from slowing tobacco sales growth trends and a potential slowdown in the growth of next-generation products.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com