In early February, British American Tobacco (BAT), Philip Morris International (PMI), and Japan Tobacco International (JTI) each announced their fourth-quarter and full-year financial reports for 2023. They reviewed and disclosed their performance for the year and partially revealed the Annual Operation Plan (AOP) for the upcoming fiscal year.

Based on the financial reports, 2FIRSTS conducted a review and analysis of the performance and future development strategies of these major players in the new tobacco sector in 2023.

IQOS Continues to Lead in New Tobacco

For their respective new tobacco businesses, the big three tobacco companies use different names. BAT refers to it as "New Categories" (NC), including vaporized, heat-not-burn, and oral products; PMI calls it Heated Tobacco Units (HTU); and JTI refers to it as Reduced-Risk Products (RRP).

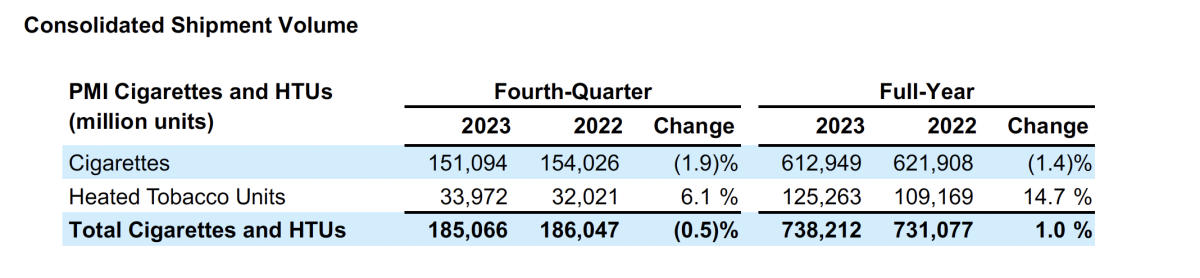

Comparing horizontally, in 2023, PMI's HTU shipments were 125,263m, followed by BAT's NC at 29,741m, and JTI's RRP at 8,800m. PMI's new tobacco volume exceeds the sum of BAT and JTI by three times, demonstrating overwhelming dominance.

The shipments of the new tobacco sectors of the big three tobacco companies all recorded different degrees of increase in 2023. PMI recorded a 14.7% increase, JTI recorded an 11.8% increase, and BAT recorded the lowest increase of 3.8% among the three.

BAT's heated tobacco (HP) recorded a negative growth in reported growth, at -1.3%. This decline was primarily offset by a 7% increase in vaporized products and a 33.6% increase in oral/patch products. Despite the slow growth in shipments, the revenue growth far exceeded this, with NC's organic revenue increasing by 21.0%. The unit profitability is worth noting.

BAT: VUSE Drives Strong Performance in "New Categories"

BAT released its 2023 financial report on February 8, showing a 1.3% decrease in overall revenue for the BAT group, while organic revenue from "New Categories" grew against the wind by 21.0%. According to BAT, this strong momentum was driven by sales of Vuse and Velo.

The performance of new category products in different geographical markets has been remarkable. In BAT's traditional stronghold market of AME (Europe and America), new category reported profits reached £1.67 billion, while the performance in the emerging APMEA (Asia-Pacific and Middle East) market was equally strong, recording £610 million.

In 2023, revenue from non-combustible products accounted for 16.5% of BAT's total revenue. In the financial report, BAT stated that "vaporized e-cigarettes are the fastest-growing smoking alternative, with Vuse being the global market leader in vaporized e-cigarette products, while describing glo as the No.2 in the heated but not burned field; and Velo as the least toxic product in the new category."

In BAT's business, the new category has now become so strong that it subsidizes the weak performance of combustible products. The group expects to deepen its layout of new tobacco in the visible future, especially in its advantageous compliant markets. In the financial report, BAT specifically pointed out that the group "welcomes the U.S. Food and Drug Administration (FDA) and other federal and state government agencies to increase enforcement efforts, take more measures to prevent the illegal sale of flavored disposable e-cigarettes in the United States," urging the FDA and other agencies to expedite the compliance of the U.S. market to maximize its compliance advantages and consolidate market share.

PMI: IQOS to "Trial Launch" in U.S. in 2024

On the other hand, PMI, which also released its financial report on February 8, announced the impressive performance of its new tobacco products. In 2023, PMI's IQOS user base was estimated to be around 28.6 million, an increase of 3.7 million compared to December 2022. The market share of IQOS in the heated tobacco segment increased by 1.2% for the full year, reaching 9.1%. The company's CEO, Jacek Olczak, stated that IQOS's net revenue exceeded Marlboro's in that fiscal year.

However, despite surpassing revenue from traditional combustible tobacco brands, the growth rate of IQOS shipments has begun to slow down after years of rapid growth. For the full year of 2023, PMI's entire heated tobacco segment grew at a rate of 14.7%, compared to 14.9% in 2022, showing overall stability with a slight decline. PMI attributed the slowdown mainly to the EU's ban on flavored heated tobacco, and it anticipates further impact on shipments in 2024.

Nevertheless, Olczak remains optimistic about the future performance of the company's new tobacco products. In a statement, he expressed that the company is "entering 2024 with strong momentum." As of December 31, 2023, PMI's smoke-free products were sold in 84 markets; for the full year, PMI's intangible asset amortization was $0.42 per share, including an agreement reached with Altria regarding the commercialization rights of IQOS in the U.S., which will take effect on May 1, 2024. At that time, IQOS will officially "trial launch" in the United States, approximately ten years after its initial market debut.

How the U.S. market, which has been "educated" by vaporized e-cigarettes for many years, will receive HNB products may be the most closely watched trend in the industry for the coming year.

JT: Plans to Increase Investment in Ploom in the Coming Years

Meanwhile, in a report released on February 13, JT reported that the performance of the JT Group in the past fiscal year reached record levels in all financial indicators. JT attributed its impressive performance to "increased market share in Japan" and "sales growth driven by marketing efforts."

According to the financial report, the growth in market share of Ploom X in Japan drove positive changes in transaction volume over the past year, especially with Ploom continuing to gain market share. The launch of Ploom X ADVANCED in November further enhanced consumer adoption and retention, leading to a continued increase in market share in Japan's increasingly competitive heated tobacco system (HTS) sector, reaching 11.4%.

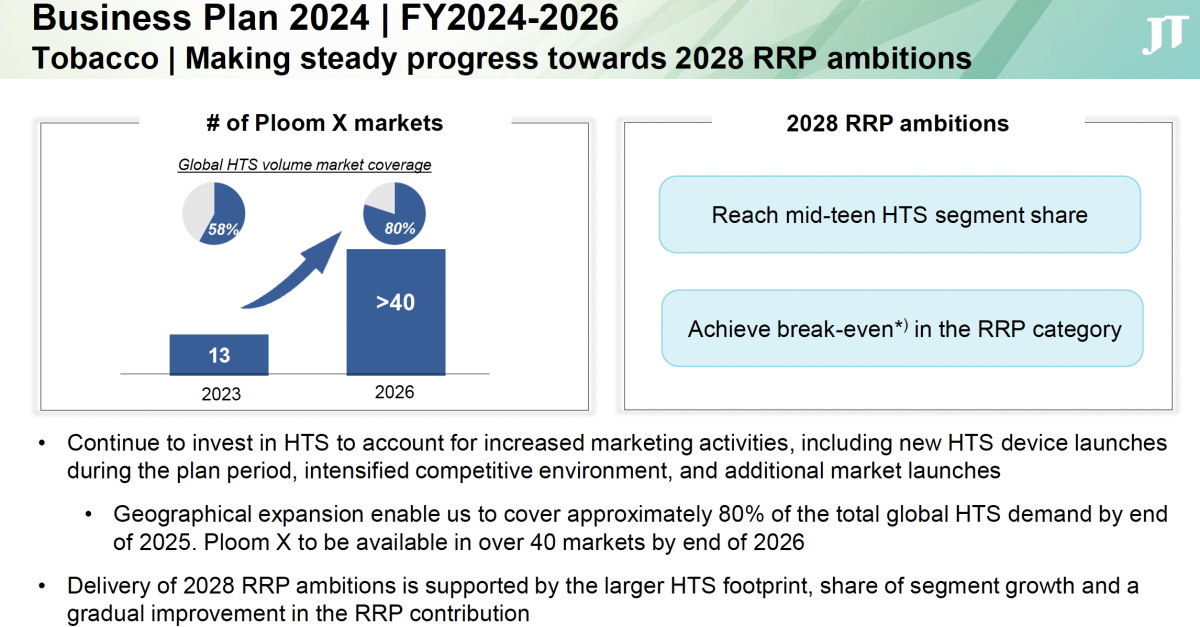

At the same time, JT expanded the geographic coverage of its HNB product, Ploom X, over the past year. By the end of 2023, Ploom X had entered 13 markets. In Japan, the JT Group's market share in the heated tobacco sector reached 11.4% in December 2023.

It is worth noting that among the three major tobacco giants, JTI is the only company to experience an increase in sales of combustible cigarettes. According to Bloomberg, the company manufactured and shipped over 531 billion combustible cigarettes last year. The total sales volume of JTI's Winston and Camel cigarettes increased by 2.3% in 2023. In contrast, PMI's cigarette shipments in 2023 decreased by 1.3% to 613 billion, while BAT's decreased by 8.2% to 555 billion compared to the previous year.

The difference in sales highlights the divergence in JTI's strategy and focus. As PMI and BAT shift more research and marketing resources to alternative products including e-cigarettes, heated tobacco and nicotine pouches, JTI appears more inclined to try to grow market share and sales in traditional cigarettes. But even so, the group teased in its earnings report that it would next increase its investment in "heated tobacco, including Ploom." According to the report, JT aims to cover about 80 percent of total global HTS demand by the end of 2025, and plans to bring Ploom X to more than 40 markets worldwide by the end of 2026.

In response, Bloomberg Intelligence analyst Duncan Fox noted that increased investment in Ploom "makes sense, but if it's to overcome established competition, it may be too late". He said it would take time for this investment to translate and predicted that "JT's operating profit will fall in 2024", while "Ploom will wait until 2028 to become profitable".

2FIRSTS will continue to monitor the latest developments from the major tobacco companies in the new year.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com