Key Points

- U.S. e-cigarette oversight is shifting from enforcement campaigns to a system-wide, institutionalized compliance regime.

- Over 7 million illegal products seized nationwide in two months, led by FDA, CBP, and DEA.

- FDA launches compliance push targeting 300,000 retail outlets; 54% of products estimated to be unauthorized.

- States adopt stricter rules: listing systems, packaging bans, origin restrictions, and criminal charges.

- Regulatory reset in the world’s largest vape market raises entry barriers; 2026 seen as turning point.

2Firsts, October 28, 2025 — The U.S. federal and state governments have stepped up regulatory measures on the e-cigarette market over the past two months. A wave of new rules and enforcement actions has emerged, ranging from logistics restrictions and customs seizures to retail product listings and criminal prosecutions.

According to a 2Firsts review of official releases and enforcement records, the regulatory focus is shifting from targeted crackdowns on illegal products in 2024 toward a long-term, system-based framework emphasizing institutionalized and full-chain compliance. As the compliance threshold rises, the U.S. vaping market is undergoing structural realignment.

I. Federal Level: Multi-Agency Enforcement Expands Across the Supply Chain

Since August 2025, several federal agencies have jointly advanced enforcement operations targeting product circulation, customs clearance, and retail compliance. Participating bodies include:

- U.S. Department of Justice (DOJ)

- U.S. Department of Health and Human Services (HHS)

- U.S. Food and Drug Administration (FDA)

- U.S. Customs and Border Protection (CBP)

- U.S. Drug Enforcement Administration (DEA)

- U.S. Postal Service (USPS)

USPS Revokes Exemption, Tightens Logistics Oversight

In mid-August, Reuters reported that the U.S. Postal Service (USPS) revoked Demand Vape’s business-to-business shipping exemption for transporting unauthorized flavored e-cigarette products. Since 2021, USPS has banned mailing of vaping products, allowing only pre-approved B2B shipments. The move signaled renewed federal focus on the logistics front.

FDA–CBP Joint Action: Largest Seizure on Record

On September 10, 2025, the Food and Drug Administration (FDA) and U.S. Customs and Border Protection (CBP) conducted a joint operation in Chicago, seizing nearly 4.7 million unauthorized e-cigarettes valued at approximately US$86.5 million — the largest-ever seizure of its kind.

Following the operation, the U.S. Department of Justice (DOJ) issued warning letters to 37 importers and filed civil injunctions against 12 entities.

Robert F. Kennedy Jr., U.S. Secretary of Health and Human Services, stated earlier that the administration would pursue a “dual-track approach” — cracking down on illegal products while accelerating authorization of adult-oriented alternatives.

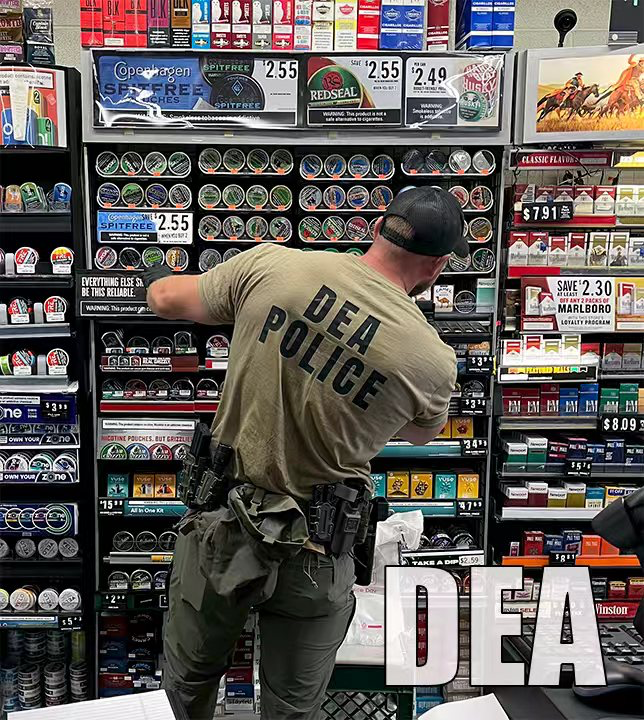

DEA’s “Operation Vape Trail”

Launched on September 15, 2025, the U.S. Drug Enforcement Administration (DEA)’s national “Operation Vape Trail” seized roughly 2.36 million illicit devices and arrested 106 suspects, with several cases linked to THC-containing products and underground supply networks.

It remains unclear whether DEA and FDA seizure data overlap; both sets should be viewed independently.

FDA Retail Compliance Initiative

On September 30, 2025, Dr. Martin A. Makary, Commissioner of the U.S. Food and Drug Administration (FDA), announced a nationwide retail compliance initiative. The agency plans to distribute authorized-product lists and compliance guidance to approximately 300,000 retail outlets — including vape shops, convenience stores, and gas stations.

The FDA estimates that about 54% of vaping products currently sold in the United States remain unauthorized.

Separately, CBP’s Minneapolis–St. Paul office reported the interception of 165,000 illegal devices on September 29, 2025, based on intelligence gathered by field enforcement units.

II. State Level: Divergent Local Policies Advance in Parallel

While federal enforcement intensified, multiple U.S. states introduced new regulations targeting retail compliance, product approvals, and packaging. Local measures varied in scope and focus.

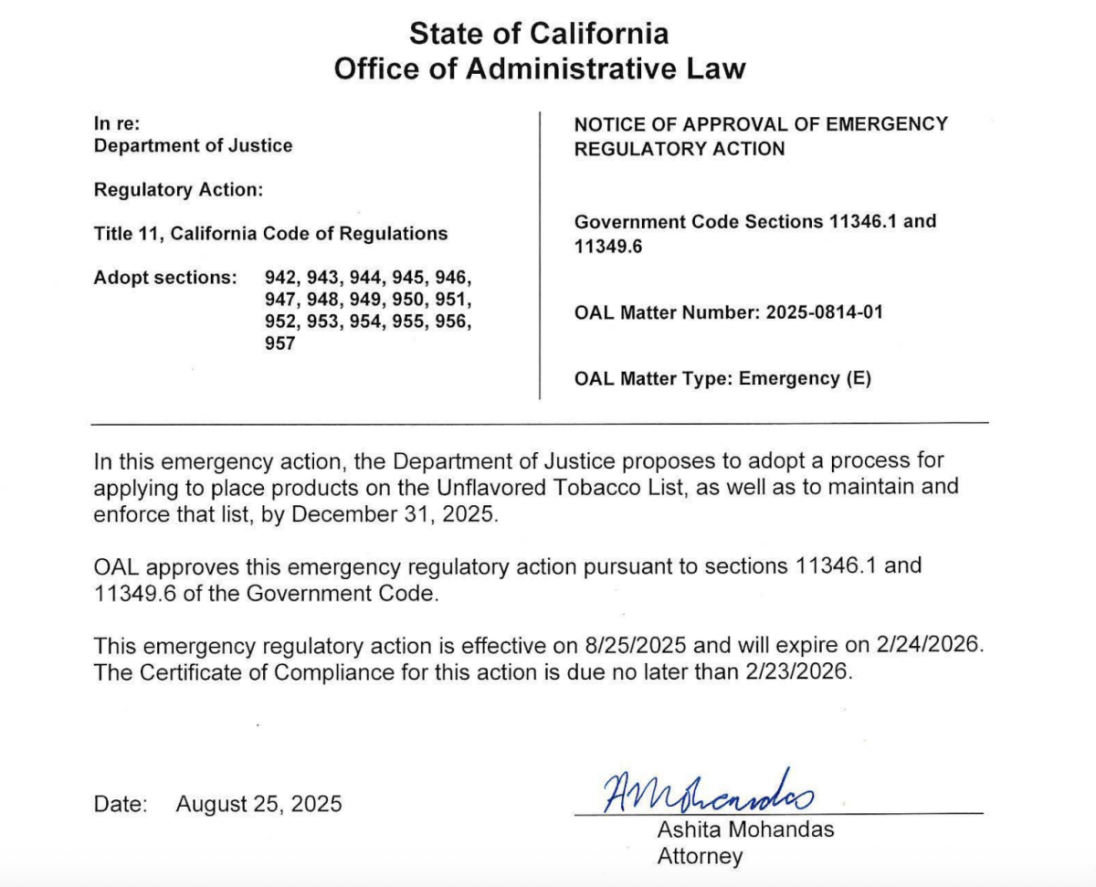

California: Launches “Unflavored Tobacco List”

On August 25, 2025, California’s Office of Administrative Law approved the “Unflavored Tobacco List,” allowing only non-flavored products into retail circulation. The list will be dynamically updated.

Arkansas: Packaging and Flavor Restrictions

Effective September 1, 2025, Arkansas implemented Act 590, allowing sales only of FDA-approved or pending products while banning candy- and cartoon-themed packaging. The rule grants a two-month compliance grace period.

Mississippi: Monthly Product List Enforced

From October 1, 2025, Mississippi’s HB916 established a monthly product list as the basis for legal retail sales. Products removed from the list must be withdrawn within 30–60 days or face fines and confiscation.

Texas: Origin-Based Restrictions

Since September 2025, Texas has barred e-cigarettes containing components “wholly or partly manufactured” in countries deemed foreign adversaries — including China — making origin verification a key compliance focus.

New York: Expanding Criminal Enforcement

On September 3, 2025, New York State launched its largest-ever vaping enforcement campaign, targeting flavored and online sales. Authorities charged 12 companies and over 10 individuals with 38 criminal counts, extending enforcement to upstream distributors.

Wisconsin: Retail Pushback and Legal Challenge

In Wisconsin, retailers have protested new sales restrictions, citing steep revenue drops and frozen inventory. Local trade associations have filed lawsuits questioning the law’s validity.

Georgia: Tax Policy Hearings Signal Future Measures

In early September 2025, Georgia lawmakers held hearings on tobacco tax adjustments, flavor bans, and ingredient disclosure. Though legislative changes are unlikely before 2026, the discussions point to closer ties between fiscal policy and public-health regulation.

III. Outlook: Global Benchmark Market Undergoing Regulatory Reconfiguration

The United States — the world’s largest vaping market — remains a bellwether for global branding, product innovation, and regulatory practice. The wave of federal and state actions in recent months marks a decisive shift from targeted crackdowns to a normalized, system-based regulatory regime.

Illegal-product enforcement, tighter retail controls, and clearer approval pathways are converging into a more predictable compliance landscape.

This evolution is reshaping both market and supply-chain dynamics. Companies now face higher entry costs and greater legal complexity. Consolidation and restructuring are accelerating, and 2026 is expected to be a pivotal year in the U.S. vaping industry’s transition toward full compliance.

Cover image generated by ChatGPT