Recently, Altria Group, Inc. released its performance report for the second quarter and first half of 2024. In the second quarter, the shipment volume of on! nicotine pouches reached 41.2 million cans, an increase of 37.3% compared to the same period last year. Additionally, the total shipment volume of NJOY consumables and devices in the second quarter reached 14.3 million units.

2FIRSTS analyzed the market performance of Altria's nicotine pouch and NJOY over the past year, aiming to provide in-depth insights into their prospects in the smokeless tobacco/e-cigarette market.

Sales Volume of Nicotine Pouches Continues to Rise in Q4

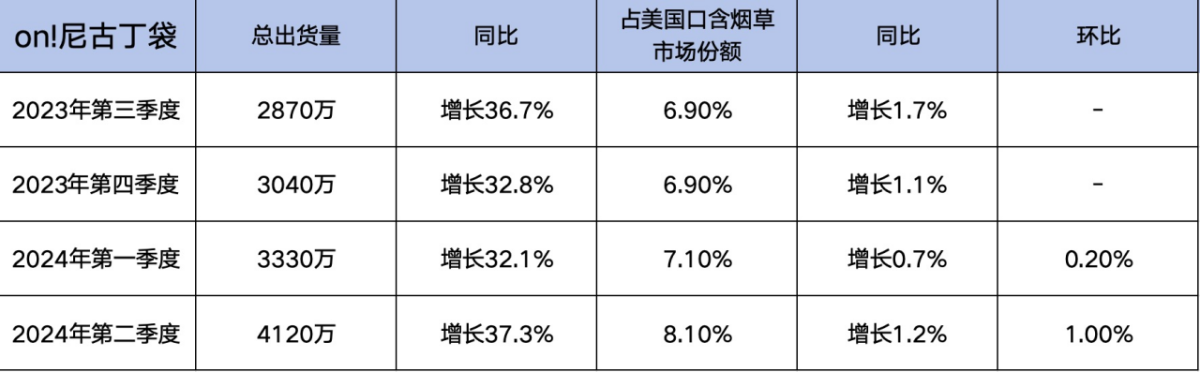

The performance report for the second quarter and first half of 2024 from Altria Group indicates that the on! nicotine pouch, as a smokeless nicotine product, has seen consecutive growth in both shipments and market share in the U.S. oral tobacco market for four consecutive quarters.

In particular, in the second quarter of this year, the total shipment volume of ON! nicotine pouches reached 41.2 million cans, an increase of 37.3% compared to the same period last year. They held a market share of 8.10% in the U.S. oral tobacco market, with a growth rate of 1.20% compared to the previous year.

In the first quarter of this year, ON! Nicotine pouches' total shipment volume reached 33.3 million cans, a YoY increase of 32.1%; occupying a 7.10% market share in the U.S. oral tobacco market, with a YoY growth rate of 0.70%.

Looking back at the fourth quarter of 2023, the total shipment volume of on! nicotine pouches was 30.4 million cans, an increase of 32.8% year-on-year. The market share was 6.90%, with a year-on-year growth rate of 1.10%.

In the third quarter of 2023, the total shipment volume of ON! nicotine pouches was 28.7 million cans, a year-on-year increase of 36.7%, with a market share of 6.90%, representing a year-on-year growth rate of 1.70%.

Up until the first half of 2024, the shipping volume of on! nicotine pouches has increased by 35% year-on-year.

Over the past four quarters, the shipment volume of ON! nicotine pouches has maintained a year-on-year growth rate of over 30%, and its overall market share has also been on the rise. Although the market share of the product in the U.S. smokeless tobacco market saw a decrease in the first quarter of this year compared to the same period last year, in the second quarter, both the shipment volume, year-on-year growth rate, and market share of ON! nicotine pouches reached their highest point in two years.

2FIRSTS compared the market performance of On! nicotine pouches with ZYN, a nicotine pouch under the Phillip Morris International (PMI) brand, over the past year.

From the third quarter of 2023 to the first half of 2024, ZYN nicotine pouches have achieved four consecutive quarters of growth in the US market. Although the year-on-year and quarter-on-quarter growth rates decreased in the second quarter of 2024, the overall growth momentum remains strong. By the first half of 2024, the shipment volume of ZYN nicotine pouches has increased by 63.5% year-on-year.

Nicotine pouches, as a smokeless nicotine product, have gained high acceptance among American consumers, and this type of product has already achieved a significant market share in the American market.

NJOY Retail Market Share Reached 5.50%

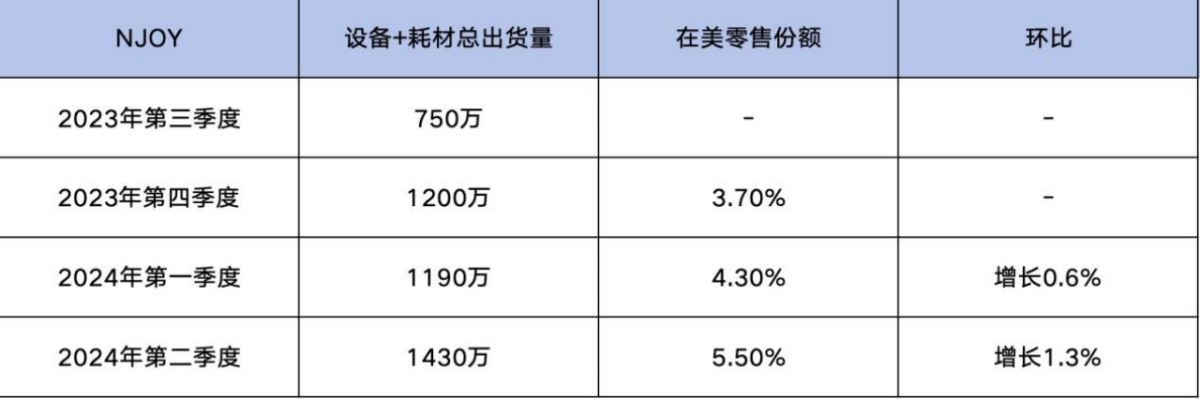

On June 1, 2023, Altria Group completed its acquisition of NJOY, achieving growth in sales by strengthening NJOY's global supply chain, filling retail inventory gaps, and expanding distribution channels.

Specifically, in the third quarter of 2023, NJOY's total shipment of devices and consumables reached 7.5 million units. By the fourth quarter of 2023, the shipment volume increased to 12 million units, representing a 60% quarter-on-quarter growth. At the same time, NJOY's market share in the United States rose to 3.70%.

In the first quarter of 2024, NJOY's shipment volume of devices and consumables slightly increased to 11.9 million units, representing a 0.6% increase from the previous quarter. The retail market share also further increased to 4.30%.

In the second quarter of 2024, the shipping volume significantly increased to 14.3 million units, a sequential growth of 1.3%, with a retail market share reaching 5.50% and a continued growth in market share.

According to the data, NJOY maintained growth in shipments from the fourth quarter of 2023 to the second quarter of 2024, while steadily increasing its retail market share in the U.S. e-cigarette market.

Altria Group's second quarter and first half performance report also showed that in the first half of 2024, the group's net revenue decreased by 3.6% to $11.8 billion, with revenue excluding excise taxes decreasing by 2.0% to $10 billion. The main reason for the decline in revenue was a decrease in revenue from the smokeable products segment, but this was partially offset by an increase in revenue from the oral tobacco products segment.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com