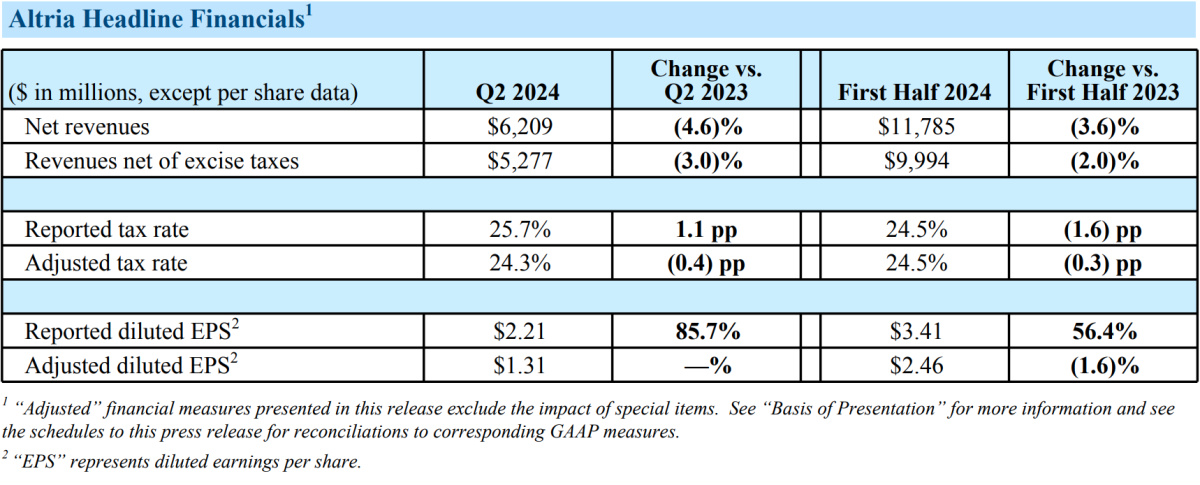

On July 31, Altria Group, Inc. released its performance report for the second quarter and first half of 2024 on its official website. According to the report, net income for the second quarter was $6.209 billion, a decrease of 4.6% year-on-year, with revenue after excise tax decreasing by 3% to $5.28 billion. For the first half of the year, net income decreased by 3.6% to $11.8 billion, with revenue after excise tax decreasing by 2.0% to $10 billion. The main reason for the decline in revenue was a decrease in income from the combustible products division, although an increase in revenue from oral tobacco products partially offset this impact.

Due to financial constraints, consumers are turning to cheaper alternatives or e-cigarettes, putting pressure on demand for expensive brands. The company's total cigarette shipments in the second quarter dropped by 13%.

In the second quarter, NJOY's consumables shipment volume increased by 14.7% month-on-month to 12.5 million units, while equipment shipment volume increased by 80.0% to 1.8 million units. The product's retail share in the US multi-channel and convenience store channels increased by 1.3% month-on-month to 5.5%. In the first half of the year, NJOY's consumables shipment volume was 23.4 million units and equipment shipment volume was 2.8 million units, with the product's retail share in the US multi-channel and convenience store channels at 4.8%.

In June 2024, NJOY's four menthol-flavored e-cigarette products were granted market authorization by the FDA, including NJOY ACE Pod Menthol 2.4% and 5%, NJOY DAILY Menthol 4.5%, and NJOY DAILY Extra Menthol 6%. NJOY is the first and only company to receive FDA authorization for menthol-flavored e-cigarette products.

In addition, in the second quarter of the year, net revenue from oral tobacco products increased by 4.6%, with a 4.1% increase in net revenue for the first half of the year.

In the second quarter of this year, the market share of on! nicotine pouches in the oral tobacco products category in the United States was 8.1%, an increase of 1.2% from last year and a 1% increase from the previous quarter. The product's market share in the nicotine pouch category was 19.4%, a decrease of 4.2% compared to last year but an increase of 1.8% from the previous quarter. In the first half of the year, on! nicotine pouches held a total market share of 7.6% in the oral tobacco products category in the United States, an increase of 0.9% from last year. The nicotine pouch category accounted for 40.9% of the oral tobacco products category in the United States, an increase of 12.9% from last year, while the product's market share in the nicotine pouch category decreased by 5.4% compared to last year.

Here are the key points distilled from the report:

- In the first half of 2024, the adjusted diluted EPS decreased by 1.6%, in line with the company's weighted expectations for growth in the second half of the year;

- The full-year forecast for adjusted diluted EPS in 2024 narrowed to a range of $5.07 to $5.15, expecting a year-over-year increase of 2.5% to 4.0%, based on the 2023 figure of $4.95;

- The company's adjusted earnings per share were $1.31, lower than the expected $1.35;

- Through stock buybacks and dividends, the company returned over $5.8 billion in value to shareholders in the first half of 2024.

CEO of Aochiya, Billy Gifford, stated that,

As we pursue the vision of guiding adult smokers responsibly towards a smoke-free future, the momentum of Achiea continues to strengthen.

In the second quarter, our company's innovative smoke-free products achieved strong market share and sales performance. We also reached significant milestones that we believe lay the foundation for future success. NJOY received FDA approval for the first and only menthol-flavored e-cigarette product on the market, and we submitted PMTA applications for NJOY ACE 2.0 and on! PLUS to the FDA.

Despite facing challenging operating conditions, our traditional tobacco business has remained resilient. Our high cash generating business has supported our continued investments in innovative products, and in the first half of this year, we returned over $5.8 billion in value to shareholders through stock buybacks and dividends.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com