Privately held Juul Labs Inc. leads the U.S. electronic cigarette market, competing against other notable players in the industry such as Turning Point Brands, Inc. (NYSE: TPB) and Philip Morris International Inc. (NYSE: PM). With an increasing number of young people using electronic cigarettes and other related products, regulatory agencies in the United States are taking measures to limit potential health risks associated with the use of these items.

On Tuesday, Juul Labs agreed to pay $438.5 million in compensation to settle an investigation into allegations of promoting e-cigarettes among young people in the United States. The company has been accused of using advertising and fruity flavors to attract young people. In this regard, Connecticut Attorney General and Democrat William Tong stated, "Juul's cavalier advertising campaign has created a new generation of nicotine addicts.

The company has been instructed to cease displaying individuals under the age of 35 in its advertisements, among other marketing activities. In addition, the company has been prohibited from selling its branded products to schoolchildren in over 30 states in the United States.

The aforementioned implementation of settlement payments and various restrictions will have an impact on Juul Labs. It is worth noting that this event may potentially result in an increase in business for other e-cigarette manufacturers or set an example for others to conduct due diligence when promoting their products.

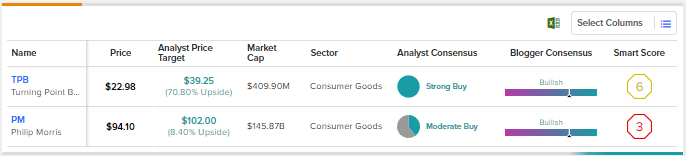

Below are charts for two publicly traded electronic cigarette stocks, Turning Point and Philips Morris.

The Pirate Bay" - A popular online platform for sharing copyrighted material, commonly used for illegal downloading of movies, music, and software.

This company, valued at $409.9 million, primarily manufactures and distributes tobacco products. It also sells electronic cigarettes and other vaping products, such as vaporizers and e-liquids, through its NewGen product division. This division is also dedicated to developing alternative vaping products.

In the second quarter of 2022, the revenue of NewGen's product division decreased by 45.1% year-on-year due to tightening regulatory conditions.

According to TipRanks' risk analysis tool, the company is facing 10 risks from the legal and regulatory categories and 7 risks from sales capability categories. The total number of identified risks for the stock is 46.

The Prime Minister

According to TipRanks, the company has a consensus rating of hold, based on two buy ratings and three hold ratings. Financial bloggers are bullish on the stock, with an 87% positive outlook, compared to the industry average of 65%. Analysts and bloggers both seem to have a cautiously optimistic attitude toward this stock. For potential investors, taking a wait-and-see approach may be a wise idea at this time.

The average target price for PM stocks is $102, which is only 8.4% higher than the current level.

Statement

This article is compiled from third-party information and is intended for industry exchange and learning purposes only.

This article does not represent the views of 2FIRSTS. 2FIRSTS is also unable to confirm the truthfulness and accuracy of the content of the article. The compilation of this article is solely intended for communication and research within the industry.

Due to limitations in the translator's proficiency, the translated article may not accurately reflect the original text. Please refer to the original text for accuracy.

2FIRSTS maintains complete alignment with the Chinese government regarding any domestic, Hong Kong, Macau, Taiwan, and foreign-related statements and positions.

The ownership of compiled information belongs to the original media outlet and author. If there is any copyright infringement, please contact us for deletion.

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.