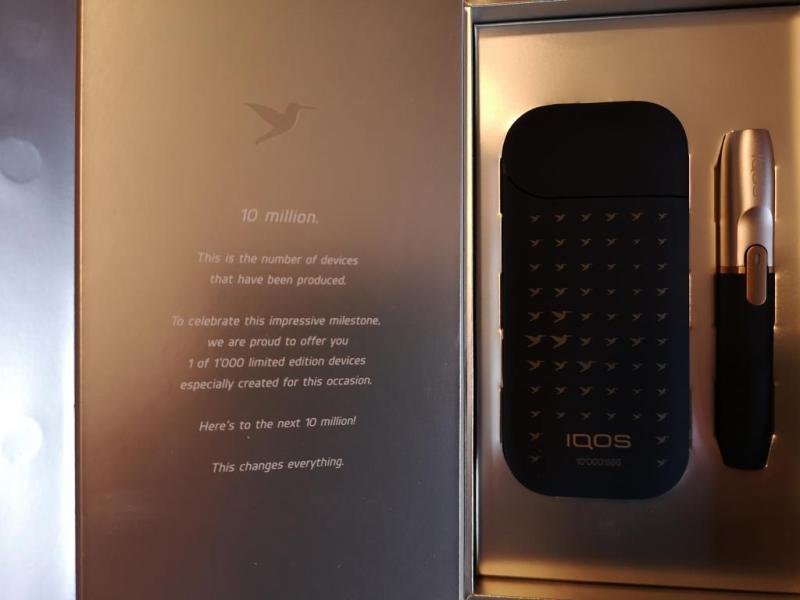

Philip Morris International (PMI) marked the 10th anniversary of its flagship heated tobacco product, IQOS, with a global event in Tokyo on October 19th. Within 10 years of its 2014 launch, IQOS' net sales surpassed those of Marlboro, making it the number one international nicotine brand and accelerating the decline of cigarettes in many countries, according to PMI's official website. As of 30 September 2024, PMI's smoke-free products were available in 92 markets and are used by 36.5 million adults around the world. Moreover, smoke-free products generate 38% of PMI’s US$10 billion quarterly revenue base.

Recognizing this milestone, 2Firsts spoke with Cem Ozguven, a former global leader of Finance, Strategy, Business Development & Planning and Commercial, Reduced-Risk Products at PMI, who played a key role in IQOS' s journey from development to commercialization. Now the founder of Tobacco Insider, a specialized consultancy firm advising large institutional investors on the tobacco industry and its transformation, Cem Ozguven reflects on the key breakthroughs of IQOS and offers insights into the future of heated tobacco.

Key insights for PMI and IQOS from Cem Ozguven:

- Major breakthroughs: Achieving an aerosol with taste and satisfaction comparable to conventional cigarettes was a pivotal technological milestone. PMI's investment in miniaturizing the tobacco heating device, powered by advanced battery and chip technology, combined with specially designed tobacco sticks, rendered the aspired consumer experience possible. The success in Nagoya pilot market marked a turning point, proving the market potential of IQOS and providing PMI the confidence to roll it out first nationwide in Japan and then globally.

- Technology evolution: PMI has moved from circumferential heating to internal blade heating to induction heating technology (ILUMA), with each upgrade improving the user experience. In terms of consumables, the portfolio expanded from traditional tobacco and menthol flavors to different taste dimensions, complex flavors and new structural components, like capsule. In the future, heated devices may evolve into aerosol delivery systems which extract different active substances from various substrate forms.

- Global market performance: PMI plans to sell 140 billion IQOS tobacco sticks worldwide, capturing around 5% of the global market share. The category reached substantial penetration rates in markets like Japan and South Korea , while the acceptance remains lower in the UK and France. These differences are driven by factors such as availability of alternative products, consumer preferences and profile, and regulatory environment in different markets, among others.

- Regulatory landscape:IQOS tobacco sticks are classified as tobacco products and must broadly comply with similar regulations as cigarettes. However, tax regime plays a critical role in determining the financial returns. Tobacco companies must invest heavily in R&D and marketing while encouraging consumer adoption through price incentives. Some countries are now moving towards aligning the tax rates of heated tobacco products with those of conventional cigarettes, impacting the growth prospects and financial returns.

- Vision for a smoke-free future:Transformation to smoke-free products is a marathon, not a sprint. Although PMI is a decade ahead of its competitors in the transformation, even such a head start does not guarantee that PMI will be the eventual winner. The race is still wide open. Tobacco, once known for its stability, is now an ever-evolving industry.

2Firsts: Could you share with us the role you played in the development of IQOS and when you first became involved?

Cem Ozguven: I joined PMI's Next Generation Products unit in 2008, where I led the Finance, Strategy, Business Development & Planning function at the global level. With more than a decade in various global leadership roles, I had the opportunity to drive the IQOS journey, from product development to global roll-out, and play a key role in every stage of PMI’s transformation to smokefree products.

2Firsts: From your perspective, what was the most challenging or exciting part of bringing IQOS to market?

Cem Ozguven: When building something from scratch, a future global phenomenon from humble beginnings, dealing with the ambiguity, with a long list of critical unknowns, is the most challenging part. But, this was also the part I enjoyed the most because ambiguity allows different interpretations and lets your imagination run wild. For instance, in 2008, I built an analytical model that projects the financial implications of PMI's transformation to Reduced-Risk Products – which includes a bottom-up projection of category and overall industry evolution in all major markets across the world. Presumably, this is the first RRP projection model built in the world. Think about the amount of imagination and extreme levels of foresight that goes into such a model.

2Firsts: What technological breakthroughs or market successes were most critical during the development of IQOS?

Cem Ozguven: If I need to single out one technological milestone, I would say that achieving a heated tobacco aerosol that is rated as close to or at par with combustible cigarettes in terms of taste and satisfaction. Heated tobacco development has a long history that dates back to the 1980s. It is not really a new idea. There have been unsuccessful market tests in the US, Japan and Switzerland in the 1990s and 2000s with the early generation of heated tobacco products. The technology was not ready then – in terms of both electronics and tobacco substrate development.

What PMI achieved in 2010s, through heavy R&D spending, is a miniaturized heated tobacco device built on sophisticated battery and chip technology and, from blending to flavor additions, from structural product design to the manufacturing processes, a first-of-its-kind tobacco stick. The well-engineered combination of these two, the device and the tobacco stick, resulted in an aerosol that a large number of smokers find pleasant to inhale - maybe - 200 times a day. Many of PMI’s competitors are still struggling to get there even today.

As far as one significant commercial milestone, I would say the success of the Nagoya test market comes to mind. Sustained consumer interest is the ultimate test for a novel product. After years of internal development and testing, the Nagoya test market was the moment of truth for PMI, a company that was founded in 1847.

The Nagoya test market changed the destiny of a then 167-year old company. Compared to the typical test market success criteria commonly used in the Tobacco Industry, which deems any marginal share improvement as success, IQOS delivered beyond imaginable results in Nagoya. PMI's strategy was confirmed; the company was on the right path. Our 2008 excel sheet was becoming real! Nagoya gave PMI first the confidence to extend nationwide in Japan and then the confidence to go all in with RRPs. Think about it as a moment when a company decides to stop selling the product it has sold for the last 167 years and start selling something else. Isn't that somewhat impressive?

2Firsts: IQOS has seen multiple iterations and upgrades over the years. What do you consider the most important innovations, and where is the technology heading?

Cem Ozguven: On the device side, there are two types of developments: incremental and fundamental. The latter is mostly associated with a major change in the aerosolization method. For instance, PMI sequentially moved from circumstantial heating in 2000s to internal blade heating in the 2010s to induction heating with ILUMA in the 2020s. Each of these moves resulted in a step change in terms of sensorial delivery, consumer experience and product appeal. Incremental developments are mostly associated with the look & feel and non-core features of the device with no change in internals.

On the consumable side, it all started with a few tobacco and menthol variants. Today, we observe an ongoing expansion to different flavor dimensions and systems, such as aromatic tastes, fifty shades of menthol, mixed tastes, capsules, etc. as well as a continuous proliferation of consumable variants as a result of endless exploratory work. Actually, we now see heated “tobacco” products with no tobacco, but only flavors. While avoiding to be overly specific on the direction of future technology due to confidentiality reasons, I believe we will observe heated tobacco devices evolve into aerosol delivery systems regardless of which substrate that aerosol is extracted from, let it be solid, slurry, powder, or liquid, and regardless of what psychoactive substance they deliver, let it be nicotine or not.

2Firsts: How has IQOS performed in different global markets? Which regions have embraced it the most and where has it faced more resistance?

Cem Ozguven: PMI plans to sell 7 billion packs of IQOS this year, which equates to 140 billion sticks. The global tobacco market is 2.7 trillion sticks, excluding China, and IQOS has around 5% share of the total cigarette and heated tobacco market. Even if we exclude the markets where heated tobacco is banned, such as Turkey, India and Brazil, IQOS still holds less than 10%. Despite generating over $10 billion in sales, IQOS hasn't yet taken over the global market.

Adoption varies widely across the markets: Japan, Korea, Italy, Poland and parts of Central Europe have high penetration rates (close to or above 20%), while the UK, France and Spain have been slower to adopt. Factors such as the availability of alternative nicotine products (e.g. vaping), smoker preferences, demographics, technology adoption, purchasing power and regulatory frameworks all influence how quickly heated tobacco products like IQOS are adopted in different regions.

2Firsts: Could you provide us with an overview of the regulatory landscape for heated tobacco products and the challenges related to taxation?

Cem Ozguven: IQOS sticks are broadly classified as tobacco products and are subject to similar regulations as cigarettes, although there are some exceptions, such as health warnings and restrictions on smoke-free environments. However, excise tax benefit versus cigarettes is the most important financial factor for heated tobacco products. The cost of developing and manufacturing these products is high and price incentives are often needed to encourage smokers to switch.

However, countries, such as Japan and Germany, are already leading the way in the harmonization of heated tobacco and cigarette taxation. Obviously, excise increase is not good news for the category which could face a slow-down in growth if the tax is fully passed on to the consumers. Or, a significant deterioration in financials if the tax is fully absorbed.

2Firsts: Finally, what are your thoughts on PMI's vision for a "smoke-free future"?

Cem Ozguven: At the first glance, it seems like a bold, maybe even a silly, endeavour for the world’s largest publicly-traded “smoke” seller. However, I see it as though PMI is admitting the inescapable and trying to take its destiny in its own hands. In the 21st century, it is absurd for humans to continue to burn a plant and inhale its smoke. Maybe, it is time to move on from this ancient ritual. Although PMI missed its ambition to be a predominantly smokefree business in 2025, it is still 10 years ahead of its closest competitor in this transformation.

Obviously, the speed of transformation depends on many factors beyond internal ambitions set; these factors include technological advancements that enable the development of products with a broader appeal, consumer readiness, regulatory frameworks, geopolitical developments, shareholder and stakeholder expectations or reactions, etc. Thereby, the transformation will not be uniform across the world and among the tobacco companies.

Nevertheless, “the species that are most responsive to change survive”, says Darwin. The Tobacco Industry is changing and whoever resists this change or cannot respond to this change will eventually cease to exist. Transformation is not optional for the Tobacco Industry. It is a necessary means for survival and a pathway to prosperity for those who survive.

One last word: Similar to the evolution of species, smoke-free transformation is a long process. It is a marathon, not a sprint. Although PMI has a major head start, the race is still wide open. What got PMI to where they are today won’t necessarily get them to the finish line first. Think about the mobile phone industry. Who remembers Motorola, Ericsson or Nokia today?

2Firsts: Thank you for sharing your perspective on IQOS and heated tobacco with us.

Cem Ozguven: My pleasure. Thank you for having me.