Key Points

- Q3 2025 Results:Net revenue: $6.072 billion (-3.0% YoY), Adjusted EPS: $1.45 (+3.6% YoY).

- 2025 Guidance:Adjusted EPS forecast narrowed to $5.37–$5.45 (+3.5%–5.0%).

- Shareholder Returns:$5.912 billion returned to shareholders (dividends + stock repurchases), with an expanded repurchase program of $2 billion.

- NJOY Update:NJOY ACE will not return to the U.S. market in 2025 due to ITC injunction.

- on! Growth:on! brand shipments up 14.8% YoY, with the launch of on!PLUS in three U.S. states.

2Firsts, October 31, 2025 — Altria Group, Inc. announces its third-quarter and nine-month financial results for 2025.

Q3 2025 Net Revenue: $6.072 billion, a 3.0% decrease year-on-year

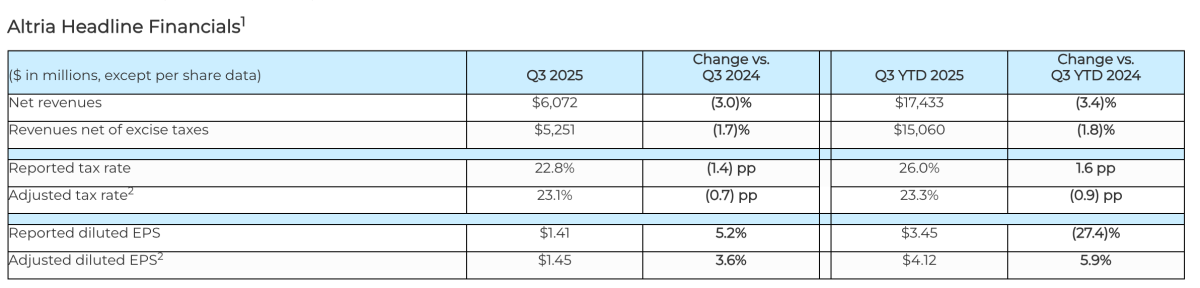

In Q3 2025, Altria reported net revenues of $6.072 billion, a 3.0% decrease from the previous year, and net revenues after excise taxes of $5.251 billion, down 1.7% year-on-year. Adjusted diluted earnings per share (EPS) for Q3 were $1.45, a 3.6% increase, with a year-to-date adjusted EPS of $4.12, up 5.9%, exceeding market expectations.

For the full year 2025, the company has narrowed its adjusted diluted EPS guidance to $5.37 to $5.45, representing a 3.5% to 5.0% year-on-year growth, reflecting the stability of core business growth. The Q3 adjusted tax rate decreased to 23.1%, a 0.7 percentage point improvement, further boosting profitability.

Shareholder Returns: $5.912 billion returned to shareholders in the first nine months

The company returned $5.912 billion to shareholders in the first nine months, including $5 billion in dividends and $712 million in share repurchases. The Board of Directors has approved an expansion of its existing repurchase program from $1 billion to $2 billion, extending the expiration date to December 31, 2026.

NJOY Business: No market re-entry in 2025

Due to the impact of the ITC injunction, the sale of NJOY ACE in the U.S. market was suspended as of March 31, 2025. The company recorded pre-tax net expenditures of $96 million related to NJOY, including $71 million for the injunction and $25 million for changes in acquisition or contingent payment expenses. The guidance confirms that NJOY ACE will not return to the U.S. market in 2025. Additionally, the company recorded a $873 million goodwill impairment for its e-cigarette business, optimizing its asset structure.

Nicotine Pouch Business: on!PLUS launched in three U.S. states

Under the "Beyond Smoking" strategy, on! nicotine pouch brand shipments increased by 14.8% in the first nine months, capturing 16.6% of the nicotine pouch market share. Helix, its subsidiary, recently launched on!PLUS in Florida, North Carolina, and Texas, offering mint, wintergreen, and tobacco flavors in 6mg, 9mg, and 12mg nicotine strengths.

While traditional moist snuff declined, the on! series continued to drive growth, with adjusted operating profit for oral tobacco up by 3.3%, and profit margins increasing to 69.0%, a 1.8 percentage point improvement year-on-year.

International Strategic Partnership: MOU with KT&G

Altria signed a non-binding global collaboration memorandum of understanding (MOU) with KT&G, aiming to jointly develop international modern oral nicotine products, expand the U.S. non-nicotine product market, and improve operational efficiency in traditional tobacco.

Heating Tobacco Products: Ploom progressing with FDA approval

The joint venture Horizon, a collaboration between Altria and Japan Tobacco, has submitted combined premarket tobacco product and modified risk tobacco product applications to the FDA for Ploom and Marlboro heated tobacco sticks. If approved, Ploom will complement Altria’s smoke-free product portfolio.

Looking Ahead: Focusing on Core Businesses and Strategic Transformation

Altria will continue to rely on the profitability of its traditional tobacco business to invest in research and market development for smoke-free products. The company aims to finalize its collaboration with KT&G, and expects its on!PLUS market promotion, Ploom’s regulatory approval, and international collaboration projects to support growth in 2026 and beyond.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com