In early February, British American Tobacco (BAT), Philip Morris International (PMI), and Japan Tobacco International (JTI) each released their financial reports for the fourth quarter and full year of 2023. The reports included a review and disclosure of their performance for the year, as well as a partial unveiling of the Annual Operation Plan for the upcoming fiscal year.

Based on the financial reports, 2FIRSTS conducted a review and analysis of the performance and future development strategies of three international tobacco companies in the new tobacco sector in 2023.

IQOS Continues to Lead in Shipment Volume of NTPs, BAT Demonstrates Outstanding Profitability

Three international tobacco companies have given different names to their new tobacco businesses. For example, BAT refers to it as "New categories" (NC), which includes vaping, HNB, and oral products; while PMI calls it Heated Tobacco Units (HTU) and JTI refers to it as "Reduced-Risk Products" (RRP).

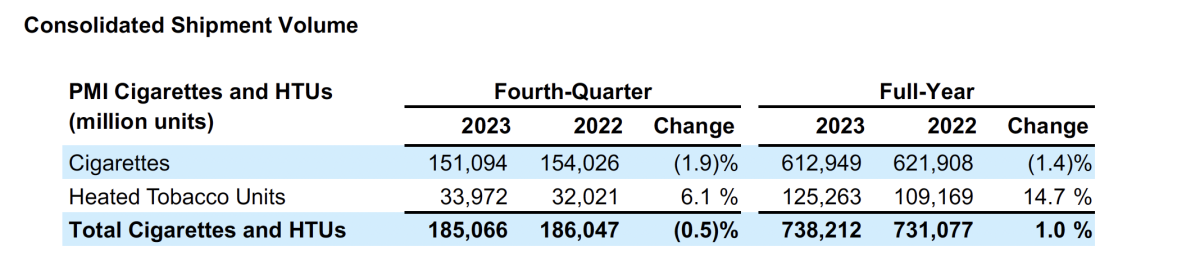

In a comparative analysis of three international tobacco companies, in 2023, the unit shipments of PMI were 125.2 billion, surpassing those of BAT at 29.7 billion and JTI at 8.8 billion. PMI's new tobacco product volume is three times greater than the combined total of BAT and JTI, giving it a significant competitive advantage.

The new tobacco segment of three international tobacco companies saw varying increases in shipments in 2023. PMI recorded a 14.7% increase, JTI recorded an 11.8% increase, and BAT recorded the smallest increase of 3.8% among the three.

Noteworthy is the decrease in BAT's heated tobacco products (HTP) recorded report, at -1.3%. The growth was mainly driven by aerosol products (7%) and oral/dissolvable products (33.6%); despite slow growth in shipment volume, the increase in revenue far exceeded this, with NC's organic revenue growth reaching 21.0%. The unit profitability is worth noting.

BAT: VUSE Drives "New Category", Calling for U.S. to Strengthen Compliant Markets

BAT released its 2023 financial report on February 8, showing a 1.3% overall decrease in revenue for the BAT group, offset by a 21.0% increase in organic revenue from "new categories." According to BAT, this strong momentum was driven by sales of Vuse and Velo.

The new category products performed well in different regional markets. In the traditionally strong BAT market of Europe and America (AME), the profits from the new category reached £1.67 billion. Meanwhile, the emerging markets in Asia Pacific, Middle East, and Africa (APMEA) also showed strong performance, with profits reaching £610 million.

In 2023, revenue from non-combustible products now accounts for 16.5% of BAT Group's income. In their financial report, BAT stated that "vape is the fastest-growing smoking alternative, with Vuse leading the global market for vape products, and described glo as the No.2 player in the HNB sector." Velo was labeled as "the least harmful product in the new category."

In the business of BAT, new categories have now become strong enough to offset the lackluster performance of the combustible segment. The group is expected to deepen its new tobacco layout in the foreseeable future, especially in its strategically advantageous compliant markets. In its financial report, BAT specifically pointed out that the group "welcomes the increased enforcement efforts by the US Food and Drug Administration (FDA) and other federal and state government agencies, taking more measures to prevent the illegal sale of flavored disposable e-cigarettes in the United States," urging the FDA and other agencies to accelerate market compliance in the United States to maximize its compliance advantage and strengthen market share.

PMI: Sluggish Growth in Shipments of IQOS, which will Undergo Test Run in U.S. in 2024

On the other hand, PMI, which also released its financial report on February 8, announced the impressive performance of its new tobacco products. In 2023, PMI's IQOS user base is estimated to be around 28.6 million, an increase of 3.7 million compared to December 2022. IQOS's market share in the HNB market increased by 1.2% for the full year, reaching 9.1%. CEO Jacek Olczak stated that IQOS's net revenue has exceeded that of classic cigarette brand Marlboro in this fiscal year.

However, even though income has surpassed, the shipment growth of IQOS has begun to slow down after years of rapid growth, causing concern among observers. Throughout the year 2023, the entire heated tobacco segment of PMI saw a growth rate of 14.7%, compared to 14.9% in 2022, showing a slight overall decline; PMI stated that the slowdown is mainly due to the EU's ban on flavored heated tobacco, and they forecast that shipment volumes in 2024 will be further impacted.

However, Alzack remains optimistic about the future performance of the group's new tobacco products. In a statement, he said the company is "entering 2024 with strong momentum." As of December 31, 2023, PMI's smoke-free products were being sold in 84 markets. In the past year, the amortization of intangible assets acquired by PMI amounted to $0.42 per share, including the agreement reached with Altria on the commercialization rights of IQOS in the United States, which will come into effect on May 1, 2024. By then, IQOS will also officially "test the waters" in the United States about a decade after its initial launch.

The American market, which has been "educated" by vaping for many years, is now eagerly anticipating how it will receive HNB products, making it one of the most closely watched trends in the industry for the coming year.

JT: Increased Investment in Ploom and Continued Expansion of International Market for HTPs

At the same time, JT, which released its financial report later on February 13, reported that in the past fiscal year 2023, JT Group's performance reached record levels across all financial indicators. JT attributed its outstanding performance to "growth in market share in Japan" and "marketing efforts driving sales growth".

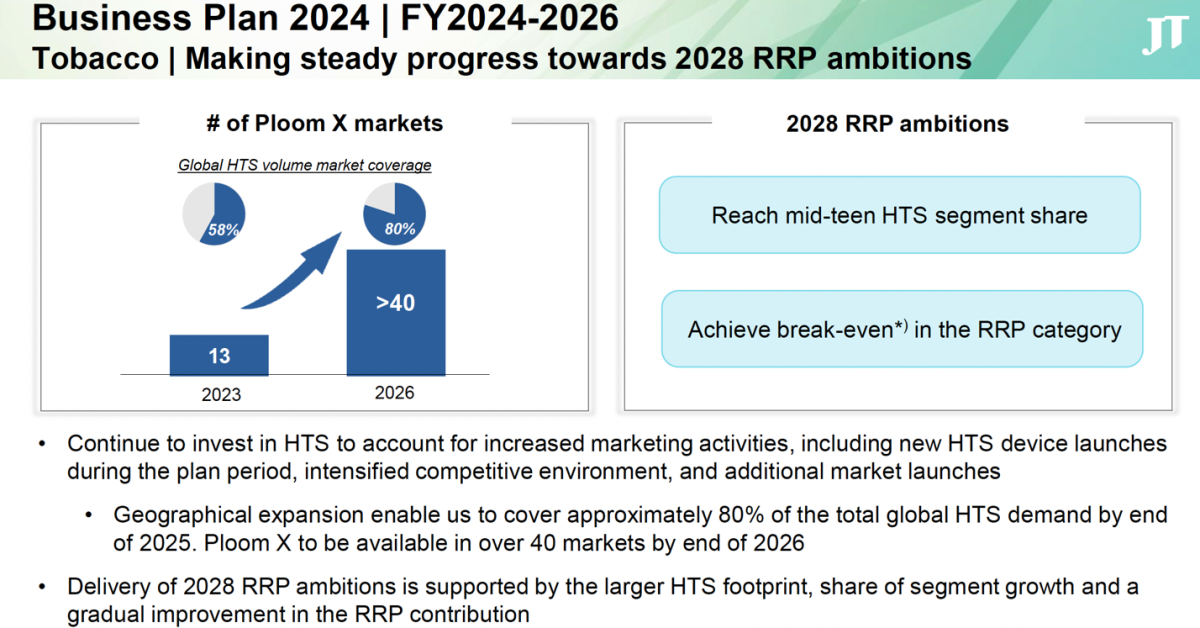

According to the financial report, over the past year, positive changes in trading volume have been driven by the growth in market share of Ploom X in Japan, especially as Ploom continues to increase its market share. The release of the Ploom X ADVANCED in November further enhanced consumer adoption and retention, leading to a continued increase in market share in the increasingly competitive field of heated tobacco systems (HTS) in Japan, reaching 11.4%.

Meanwhile, over the past year, JT has continuously expanded the geographical coverage of its HNB product Ploom X. By the end of 2023, Ploom X had entered 13 markets; in Japan, JT Group's market share in the heated tobacco segment reached 11.4% in December 2023.

It is worth noting that among the three major international tobacco companies, JTI is the only company that saw an increase in sales of combustible cigarettes. According to Bloomberg, the company manufactured and shipped over 531 billion combustible cigarettes last year, with a total sales volume increase of 2.3% for JTI's Winston and Camel brands in 2023. In comparison, PMI's cigarette shipments in 2023 were 613 billion, a decrease of 1.3% from the previous year; while BAT's shipments were 555 billion, an 8.2% decrease from 2022.

The difference in sales highlights the strategic and priority differences within JTI. While PMI and BAT are directing more research and marketing resources towards alternative products including e-cigarettes, heated tobacco, and nicotine pouches, JTI appears to be more focused on trying to increase market share and sales in traditional cigarettes. However, the group still announced in its financial report that it will increase investments in heated tobacco, including Ploom. According to the financial report, JT's target is to cover approximately 80% of global HTS demand by the end of 2025, and they plan to introduce Ploom X into over 40 markets globally by the end of 2026.

In response, Duncan Fox, an analyst at the Bloomberg Intelligence, pointed out that increasing investment in Ploom "is reasonable, but if it is to overcome established competition, it may be too late." He mentioned that the conversion of this investment will take time and projected that "JT's operating profit will decline in 2024," while "Ploom will not achieve profitability until 2028."

2FIRSTS will continue to monitor the latest developments from major tobacco companies in the new year.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com