The impending wave of listings among Chinese electronic cigarette companies is no longer a secret. In the latter half of last year, sponsoring companies disclosed to 2FIRSTS that several "mid-sized companies with market values between 2 to 3 billion" were planning to go public; and at the beginning of the new year, 2FIRSTS received news from multiple sources that Imiracle had hired a senior executive with experience at the Shenzhen Stock Exchange, specifically tasked with capitalization matters.

The industry experienced a collective boom in listings around 2019. However, on March 11, 2022, the National Tobacco Monopoly Bureau issued the "Administrative Measures for Electronic Cigarettes," stipulating in Chapter II, Article 8, that Chinese electronic cigarette companies seeking to issue shares to the public and list on the stock market must obtain approval from the State Council's administrative authority for tobacco monopoly, a process known as "prior approval." This regulation increased the difficulty of going public, leading to a decline in the wave of listings, and companies that missed the opportunity temporarily shelved their plans to go public.

Fast forward to the present, the industry and its companies have entered a new stage of capitalization. Companies that did not mature in the previous wave of listings or attempted but failed are now in a state of readiness.

Given the industry's specificity, when preparing for listing, electronic cigarette or broader new tobacco companies face specific questions: What are the purposes and processes of entering the capital market for new tobacco companies? Did they achieve their original goals later? What impact did the leading companies have on the industry after going public? In the eyes of investors, what qualities make a vaporization company worth investing in?

In 2024, will the new tobacco sector usher in a new wave of capitalization?

Previous Wave of Listings

The previous wave of capitalization among Chinese electronic cigarette companies dates back to 2019. The trailblazer was China Tobacco's only international business platform, China Tobacco (Hong Kong), which had electronic cigarette operations.

Established in 2004, China National Tobacco Corporation's wholly-owned subsidiary, China Tobacco International (Hong Kong), submitted its listing application to the Hong Kong Stock Exchange as early as December 31, 2018. It was priced on June 5 and listed on the Hong Kong Stock Exchange on June 12. It opened at HK$4.97, a 1.84% increase against the market trend.

However, China Tobacco's listing was just the beginning. Besides China Tobacco, this wave of listings was mainly driven by capital. Angel investments in that period incubated a series of brands, the most famous of which included RELX and Smoore.

Take RLX Technology as an example. RELX's operating entity, Beijing RLX Technology Co., Ltd., was established in February 2018 and quickly secured 38 million yuan in angel funding, led by Source Code Capital, with IDG Capital and Sequoia Capital China participating. By 2019, it had secured Series A and A+ rounds of funding, with backing from Hillhouse Capital and DST Global, and continued investment from existing shareholder Sequoia Capital China. After the A+ round, RLX Technology was valued at $2.4 billion.

At this stage, RELX was undoubtedly the darling of capital. Backed by these renowned institutions, RELX, which was highly sought after in the primary market, took to the stage of the New York Stock Exchange. On January 22, 2021, RELX officially debuted on the NYSE under the stock code "RLX.US," raising a staggering $1.4 billion, becoming the "first Chinese electronic cigarette brand" in the American market. From establishment to listing, it took only three years. For shareholders, RELX indeed presented a relatively impressive market performance.

The listing of industry leaders like RELX (RLX Technology) had a significant impact on the entire industry. With a 54.3% stake, founder Wang Ying's total value soared to over 160 billion yuan on the first day of listing in 2021, making her the "second female billionaire after Yang Huiyan, the largest shareholder of Country Garden." Earlier, on October 20, 2020, the Hurun Research Institute released the "2020 Hurun Rich List," showing that Smoore founder, 44-year-old Chen Zhiping, ranked 59th with a wealth of 64 billion yuan, becoming the richest person in the electronic cigarette industry. In addition to Chen Zhiping, Smoore had four other founding shareholders listed for the first time.

This kind of "overnight wealth" undoubtedly pushed the entire industry into the spotlight, to the extent that subsequent intense legislation and regulation were not surprising. Companies that originally intended to go public had their plans halted amidst tightened policies.

When regulations were implemented, apart from ensuring that at least part of their business was compliant after listing, listed companies themselves, under tightened market supervision, other unlisted mid-sized and smaller companies were also affected. RELX and Smoore, fortunate enough to catch the "time elevator," were lucky. At least for the original management team, they achieved financial freedom overnight; those who missed the flight are now gearing up for the momentum in 2024.

Reasons for Going Public

Let's return to China Tobacco International (Hong Kong).

This institution serves as the designated overseas platform for capital operations and international business expansion for China Tobacco International. According to the disclosed prospectus, the company's total revenue for the first nine months of 2017 to 2018 was 7.807 billion Hong Kong dollars and 5.077 billion Hong Kong dollars, respectively; with gross profit margins of 6.3% and 5.8%; and profits of 348 million Hong Kong dollars and 222 million Hong Kong dollars, respectively.

Clearly, with a gross profit margin of only 5%, China Tobacco International is not sharing dividends due to good returns; in its prospectus, China Tobacco Hong Kong stated that all sales counterparties in import transactions and procurement counterparties in export transactions must be entities under the China National Tobacco Corporation. Purchases and sales between the company and related parties must comply with the government's pricing system as stipulated in relevant documents, indicating that the relatively closed-loop "China Tobacco ecosystem" has not yet been fully opened. Many observers believe that this listing is intended to enable China Tobacco International (Hong Kong) to better serve as a "transit station," with future development focusing on expanding overseas markets and new tobacco products, potentially becoming a vanguard for China Tobacco in integrating overseas resources.

For investors, this represents a "scarce investment target," with scarcity stemming from the absolute monopoly position of the parent company. There is considerable anticipation for this highly profitable Chinese enterprise to unveil its true potential.

Whether it's the purpose of listing or the mindset of investors, China Tobacco may be an exceptional case that cannot be extrapolated universally; however, it provides insight into the dividend period of the entire industry and the optimism of investors.

If the previous wave of "clustered listings" was indeed driven by optimism in investment, today's wave of capitalization is widely believed to be driven by the expansion needs of companies and the assistance provided by clearer regulations.

The essence of a company going public is primarily driven by the need for expansion and the desire for a larger financing pool. Operating a company requires substantial capital, and when funds are needed, companies typically raise cash through borrowing, selling property, or other assets. However, after going public, companies can increase their fundraising channels. For example, they can publicly issue additional funds through stock offerings for business expansion or development plans, thus diversifying investment risks.

"For example, after a company goes public and acquires brands or factories in the supply chain, it no longer comes out of its own pocket but rather from the company's pocket. This decision-making mentality will be significantly different," a senior industry practitioner at a sponsor institution told 2FIRSTS.

So, the core question for a company considering going public is whether the capital market is beneficial for them.

Taking Smoore and RELX as examples, both went public in July 2020 and January 2021, respectively. After listing, if Smoore International fulfills the commitments in its prospectus, it will raise approximately HK$6.053 billion, with 50% allocated to capacity expansion and 25% to implementing automation production in new production bases. RELX, on the other hand, expanded its specialty stores to over 27,000 within one year of going public.

The reason for such aggressive expansion is the ability to raise capital through stock price appreciation. After going public, companies can attract market attention and increase their stock prices based on their market value and expected appreciation, thereby increasing investment returns and using profits to finance the acquisition of new assets. In 2021, according to Smoore's financial report, the company invested a staggering 671 million yuan in technology and facility reserves; meanwhile, the company's stock price peaked at 90 Hong Kong dollars in January of that year. Even with a revenue decline in 2022, the company still allocated twice the amount invested in research and development as the previous year, totaling 1.372 billion.

In addition to expanding the financing pool, another benefit is raising brand awareness. Unlike private companies, listed companies are required to regularly disclose information such as performance, financial status, announcements, and corporate communications to comply with securities listing rules. They also need to establish a board of directors and management system to increase information transparency. Therefore, banks, trading partners, and shareholders holding stocks tend to have more confidence in listed companies.

Investor confidence is one aspect; on the other hand, going public also enhances the company's visibility, attracting consumers to purchase products or use services and expanding the incremental market. For example, when 2FIRSTS conducted underground market research and attempted to purchase e-cigarettes in the prohibited Hong Kong market, merchants justified selling products flowing into the Hong Kong market through illegal channels as "from a listed company, a big brand."

These reasons for going public generally apply to the majority of companies in various sectors. However, in the e-cigarette industry, there is a very "localized" factor: compliance risk. The high sensitivity of this industry to policies often leads companies to make significant moves, such as selling off, clearing inventory, or withdrawing from the market, shortly before major regulatory measures are implemented. After transitioning from the commodity market to the capital market, these actions also include "rushing to go public," with the core purpose being to avoid a loss of market confidence and to protect the company's valuation.

With fewer sudden "deaths" of cases as products become less differentiated, it can be seen that there will be fewer cases of sudden "deaths." After risk clearance, investors need to bear less risk and have more confidence.

At the same time, the personal wealth of the executive team is another consideration. The listing process of RLX Technology (RLX.US) has been the subject of much speculation in the industry to date. The rumors of preparing for listing had already started at the end of 2020, so the listing on January 22 seemed relatively sudden; just two months later, the industry-upending draft amendment to the "Tobacco Monopoly Law Implementation Regulations" was released. Many observers have suggested that the whole thing was not so much "RELX's bad luck, encountering regulatory tightening just after going public," but rather that RELX was "deliberately rushing to go public before the tightening of regulations," spreading the cost of evaporating market value evenly after listing. As for whether the timing of this choice was intentional or unintentional, the outside world has no way to prove it today, only the individuals involved can confirm it themselves.

Three Options for Going Public

For most Chinese electronic cigarette companies that have reached a certain size and have public fundraising needs, there are typically three potential listing locations: mainland China, Hong Kong, and the United States.

First is the mainland market. When applying for listing domestically, companies have industry selectivity. In China, there are currently no A-share listed companies that have completed listing through direct IPO.

Next is Hong Kong. Hong Kong stocks tend to give relatively high valuations to emerging industries, including the vaporization industry, facilitating shareholders in realizing gains at higher valuations. However, there are concerns about electronic cigarette industry listings on the Hong Kong stock exchange due to the ban on electronic cigarette sales passed in 2021 and implemented the following year. Although it was later proven to have little association with listing risks, it did partly affect confidence.

The process of preparing for listing and actually listing has a time gap. An industry insider told 2FIRSTS, "Many investors still like it, and China has many advantages, so the Hong Kong capital market can be utilized well." Even though it is currently subdued, when it rebounds in the future, perhaps it can leverage the capital market for a comeback.

Listing conditions in the United States are relatively lenient, and there is a vast potential pool of funds to be raised. However, due to geopolitical instability, every move in US-China relations can affect the capital market. Subsequent financing may be affected by constraints from both physical politics and public opinion politics.

Of course, even if listed in Hong Kong or the United States, Chinese electronic cigarette companies operating and licensed domestically need approval from the regulatory authority (China Tobacco) before listing, which poses significant uncertainty.

Additionally, meeting compliance requirements for listing is far more challenging than meeting financial standards for electronic cigarette companies. Companies with overseas brand operations must comply with local laws and regulations. Non-compliance across regions can also affect the listing.

Take Ispire, established in 2022, as an example. The company is headquartered in Los Angeles, California, USA, with 56 full-time employees engaged in various aspects such as research, design, and commercialization of branded electronic cigarettes and cannabis vaporization products. On April 4, 2023, Ispire Technology issued 3 million shares at $7 per share, raising $21 million. The opening price was $8.53, a 21.86% increase over the issue price.

It's worth mentioning that the actual listing entity was established in the Cayman Islands. Its US business is fully compliant to meet all requirements of due diligence by the NYSE: as early as September 9, 2020, the company submitted a PMTA for its Nautilus Prime open-system electronic cigarette product, but did not receive a response from the FDA during the one-year compliance period. Considering the high cost of submitting PMTA, the company did not submit PMTA for other vaporization products, and reluctantly reduced its vaporization business in the US region. Its revenue was $2.5 million in the fiscal year 2021 and $900,000 in 2022, and this part of the business in the US market has ceased.

This is a successful case of "cutting off the arm to save the body" for new tobacco through "curve compliance." However, Imiracle, which has been widely rumored for listing, faces its own challenges and may not be as smooth as Ispire. Considering PMTA, Imiracle's products are theoretically restricted in sales in the United States. Even if it claims that "all brands sold in the United States are from non-regular channels," setting aside the truth, self-verification is an extremely difficult task. If the company's products in the US market are considered in the pre-listing compliance investigation, Imiracle will face significant explanation difficulties.

The size of Imiracle's "non-compliant" business segment is so large that if it insists on divesting, it will involve a very cumbersome restructuring for listing; on the other hand, even if it can "painfully" divest its business and accept a low valuation, the listed portion is smaller than its actual size, which will greatly affect its valuation. Industry analysts fear that Imiracle itself would not be willing to go public at a very low valuation.

Even if Imiracle can achieve this step for listing and reluctantly divest its business and accept a low valuation, it will face practical issues. One of the most significant problems is: if listed with a compliant overseas business, Imiracle still needs to address the issues of related transactions and dependence on the Chinese parent company. Can Imiracle list with a complete and relatively independent compliant business? And with few (at least not noticeable) related transactions with the non-compliant part?

Understanding the company's current compliance responsibilities, providing tailored compliance policies, and designing compliance solutions to meet the requirements of exchanges and securities regulatory commissions—all of these are issues that companies need to address before listing.

Feasibility of Shell Listing

The process of going public is complex and requires a significant amount of money and time for preparation. The immense time and financial costs involved may burden a company, especially when the vaping industry faces additional challenges mentioned above. Therefore, some interested companies, particularly those who wish to raise funds but cannot comply with listing regulations, may engage sponsoring institutions to facilitate the transfer of their business to a listed company through contractual agreements, saving time and money and entering the market at the right time.

This is what is known as a "shell listing." If a company wishes to list on the Hong Kong Stock Exchange, where there are many "penny stocks" (i.e., stocks valued at less than 1 Hong Kong dollar), this approach is relatively common.

According to the Listing Rules of Hong Kong, within 36 months after a change in control or the largest shareholder of a listed company, the Hong Kong Stock Exchange will review the relevant acquisition activities of the listed company to determine whether they constitute a reverse takeover. As long as it is not considered a "reverse takeover," it does not need to be treated as a new listing application, bypassing the procedures for a new listing application and therefore does not require additional approval from the Listing Committee.

Successful cases of Hong Kong-listed companies through mergers and acquisitions include Huabao International Holdings Ltd. (336.HK). Since its shell listing in 2004, the company's controlling shareholder has used the financing advantages of the Hong Kong stock market to actively acquire upstream and downstream enterprises in the fragrance and flavor industry, integrating industry resources and strengthening its leading position in the industry.

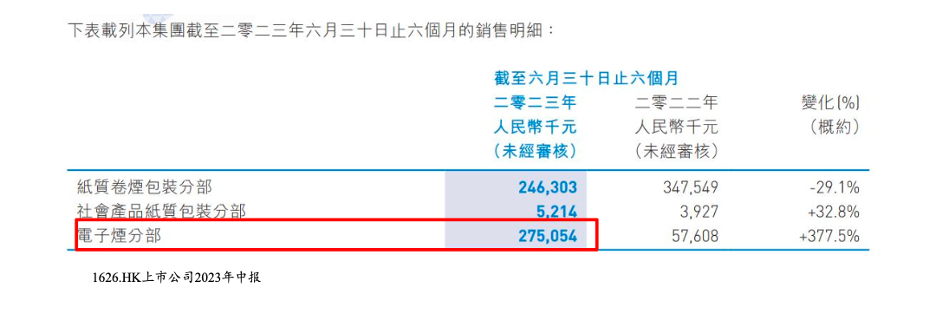

A typical case involving e-cigarettes is Jia Yao Hldgs (1626.HK). In December 2021, the listed company invested 14 million yuan to subscribe to 70% of the shares of a new company (engaged in the e-cigarette business) and established the e-cigarette distribution business based on this. In the first six months of 2023, the sales of the e-cigarette division reached 2,750,540 yuan, surpassing the company's paper cigarette packaging division.

Furthermore, China's A-share listed companies, although there are currently no A-share listed companies that have completed their listing directly through an IPO, have already laid out the e-cigarette industry chain through acquisitions or the establishment of subsidiaries. Examples include Shenzhen Jinjia Color Printing Group Co Ltd (002191.SZ), Xiamen Intretech (002925.SZ), andShanghai Shunho New (002565.SZ). The former two focus on ODM/OEM of new tobacco devices, while the latter has a full industry chain layout for HNB—even though HNB is not legally sold in China.

The fervor for shell listings indirectly proves one thing: even today, everyone still wants to go public—there is a need for listing and a desire for listing. According to industry insiders speaking to 2FIRSTS, and there is a group of companies valued around 20-30 billion yuan with their own brands that meet the value of listing on the Hong Kong Stock Exchange.

When 2FIRSTS asked if they were manufacturing companies, the other party indicated that the profit margin in the manufacturing sector is thin, and in similar financial situations, investors' confidence is not as strong as with brands. "So conversely, if you find that OEM factories have their own brands, then you can see their ambition for the future capitalization."

Opportunities and Risks for the Future

In this industry, prosperity and decline, market value fluctuations, often stem from the invisible hand of regulation, and extremely sensitive at that.

At the time, RELX's rapid listing brought a series of chain reactions. Subsequently, especially in China, the booming e-cigarette market approaching a "loss of control" prompted authorities to become vigilant about the influx of foreign capital, leading to an intensive period of "regulatory landing." Each release of news brought about fluctuations in stock prices.

On March 22, 2021, the Ministry of Industry and Information Technology issued a draft amendment to the "Tobacco Monopoly Law Implementation Regulations," which, for the first time, stipulated that electronic cigarettes must be subject to the relevant provisions of cigarettes. After the news came out, the stock price was directly halved, dropping from a high of $35 to $10. This was followed by a continuous decline.

In the first two quarters of 2022, RELX's revenue and net profit experienced a decline for the first time, attributed to "regulatory changes."

On October 1, 2022, the mandatory national standard for e-cigarettes officially took effect, strictly limiting marketing activities and flavor diversity.

In the second quarter of 2023, revenue was 380 million yuan, a year-on-year decrease of 83.1%.

As of the trading day in February, RELX had fallen from a high of $35 to around $1.5. The entire trajectory of stock price fluctuations reflects the fluctuation of investor confidence in the industry due to the tightening and loosening of policies.

A more severe test is looming: On January 29, the UK announced a ban on disposable e-cigarettes. Before the specific effective date, Smoore (06969.HK) and Shenzhen Yinghe Tech (SZ:300457), who's subsidiary owns brands including SKE, had already plunged in response. Smoore International (06969) opened red and turned green in the morning, with its decline expanding in the afternoon, closing down 3.35% at HK$5.19, with a turnover of HK$44.355 million; Winnow Technology (SZ:300457) opened and fell throughout the day, down 11.33%.

Shenzhen Yinghe Tech Technology's subsidiary owns two major brands, "SKE" and "Sikary," deeply rooted in the UK market. In June 2022, it obtained UK and European TPD product certifications and established a wholly-owned subsidiary in Manchester in March 2023. As for Smoore, it had just launched a disposable e-cigarette product, FEELM 2.0, at the UK E-cigarette Association's annual forum in November 2023, which was intended to open the door to the disposable market in the UK/Europe. The official ban on disposable e-cigarettes by UK regulators means that Smoore's strategy for disposable e-cigarettes in the UK has once again come to nothing.

Even though policy clarity and regulatory certainty have to some extent cleared the risks, the natural sensitivity of the e-cigarette industry to taxation and public health still leaves the future of the entire sector full of unknowns. When such "gray rhinos" arrive, market sentiment is always the most real. Capital has quickly responded, with many "voting with their feet."

The rumored company preparing for listing, Imiracle, its usually low-key founder Zhang Shengwei once said in a public statement, "Face the regulations head-on, don't go around them, and staying true to yourself can work wonders."

For an industry to transition from brute growth to maturity, it is inevitable to move towards increasing compliance. The e-cigarette industry, closely related to public health, exposed to multiple levels of scrutiny, including compliance, financial, and public opinion, is beneficial for consumer rights protection from a positive social externality perspective.

However, on the road to compliance, regulation remains a Damocles' sword hanging overhead. The disposable ban in the UK at the end of January was a long-brewed bomb finally exploding. Whether this will trigger a series of chain reactions remains to be seen. Only time will truly solve the problem.

2FIRSTS will continue to monitor new developments of new tobacco companies in the capital market.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com