According to a report by GMA Integrated News on September 18, the Philippines' Bureau of Internal Revenue (BIR) has now prohibited the sale of e-cigarettes, cigarettes, and heated tobacco products at prices lower than those set by the tax authorities, which include a combination of consumption tax and value-added tax.

On September 16, Bureau of Internal Revenue (BIR) Commissioner Romeo Lumagui Jr. issued Revenue Regulation No. 16-2024, updating the latest floor prices for cigarettes, e-cigarettes, and heated tobacco products.

Ma Guo reminded online sellers, retailers, and distributors of tobacco products that they will face criminal liability if they sell these products below the prescribed minimum price. He emphasized that selling these products below the minimum price is a criminal offense, and sellers will be sentenced to prison.

We are closely monitoring online platforms and physical stores. Do not sell products below the minimum price and immediately remove all posts and products priced below the minimum.

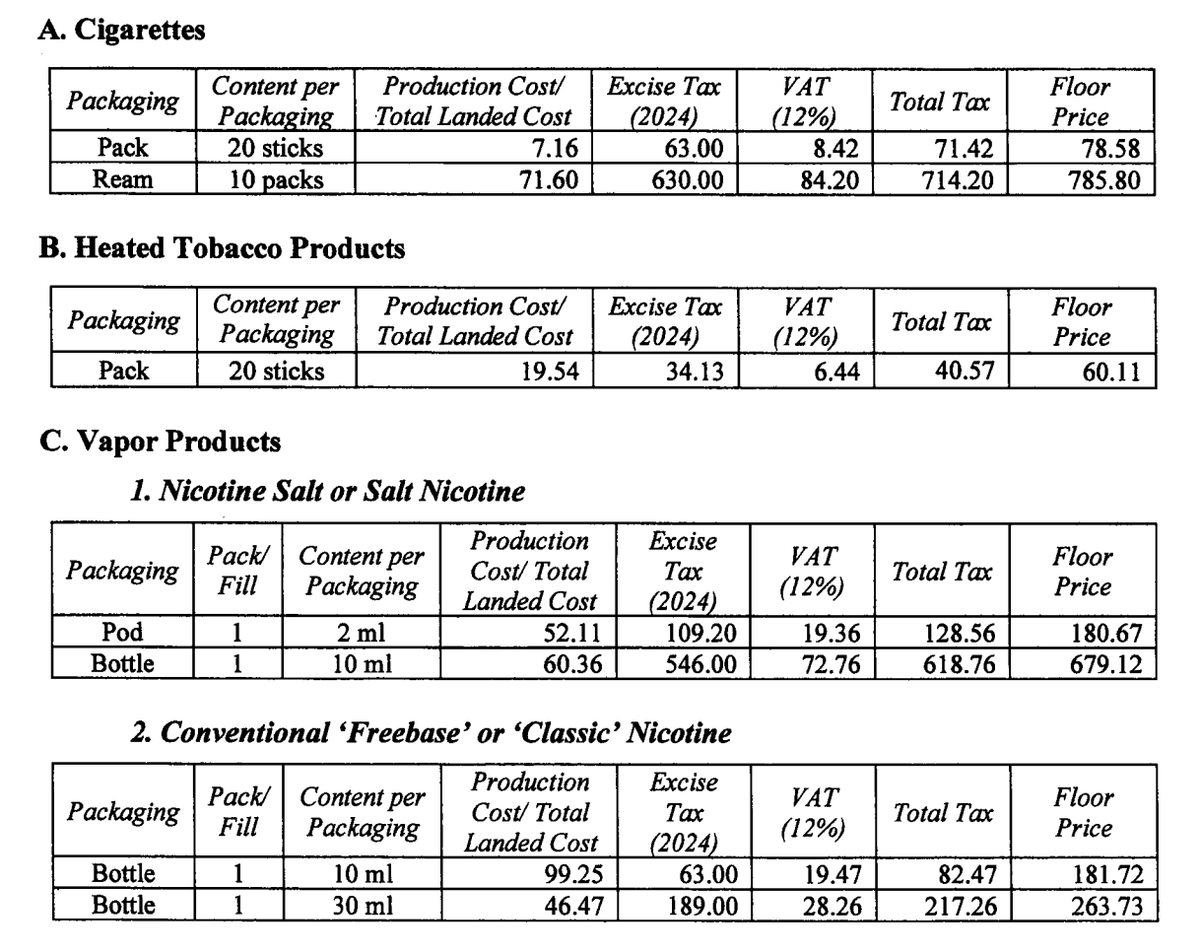

The latest rates for Revenue Regulation No. 16-2024 (RR No. 16-2024) are as follows:

The Bureau of Internal Revenue (BIR) stated that selling tobacco products at a price lower than the legally required comprehensive consumption and value-added tax is prohibited under Section 145 (C) of the amended National Internal Revenue Code (NIRC).

The agency also added that sellers who sell tobacco products below the specified base price "will be subjected to a fine of no less than 10 times the total amount of excise tax and value-added tax payable, but not less than 200,000 pesos (approximately $3,600) and not exceeding 500,000 pesos (approximately $9,000), and will be sentenced to imprisonment for no less than four years but not exceeding six years.

According to Article 263(A) of the revised National Internal Revenue Code, anyone selling heated tobacco products and vaping products at a price lower than the comprehensive consumption tax and value-added tax will be fined an amount equal to ten times the total amount of the consumption tax owed but not less than 200,000 pesos (approximately $3,600), and will also be sentenced to a minimum of four years but not more than six years in prison.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com