On December 25, 2023, Christmas arrived in the UK. As the most anticipated holiday of the year, UK supermarkets and retailers are expected to launch discount sales promotions prior to Christmas, leading consumers to stock up on goods in large quantities. Consequently, November, leading up to Christmas, is also an eagerly awaited peak season for cross-border traders, and the e-cigarette industry is no exception.

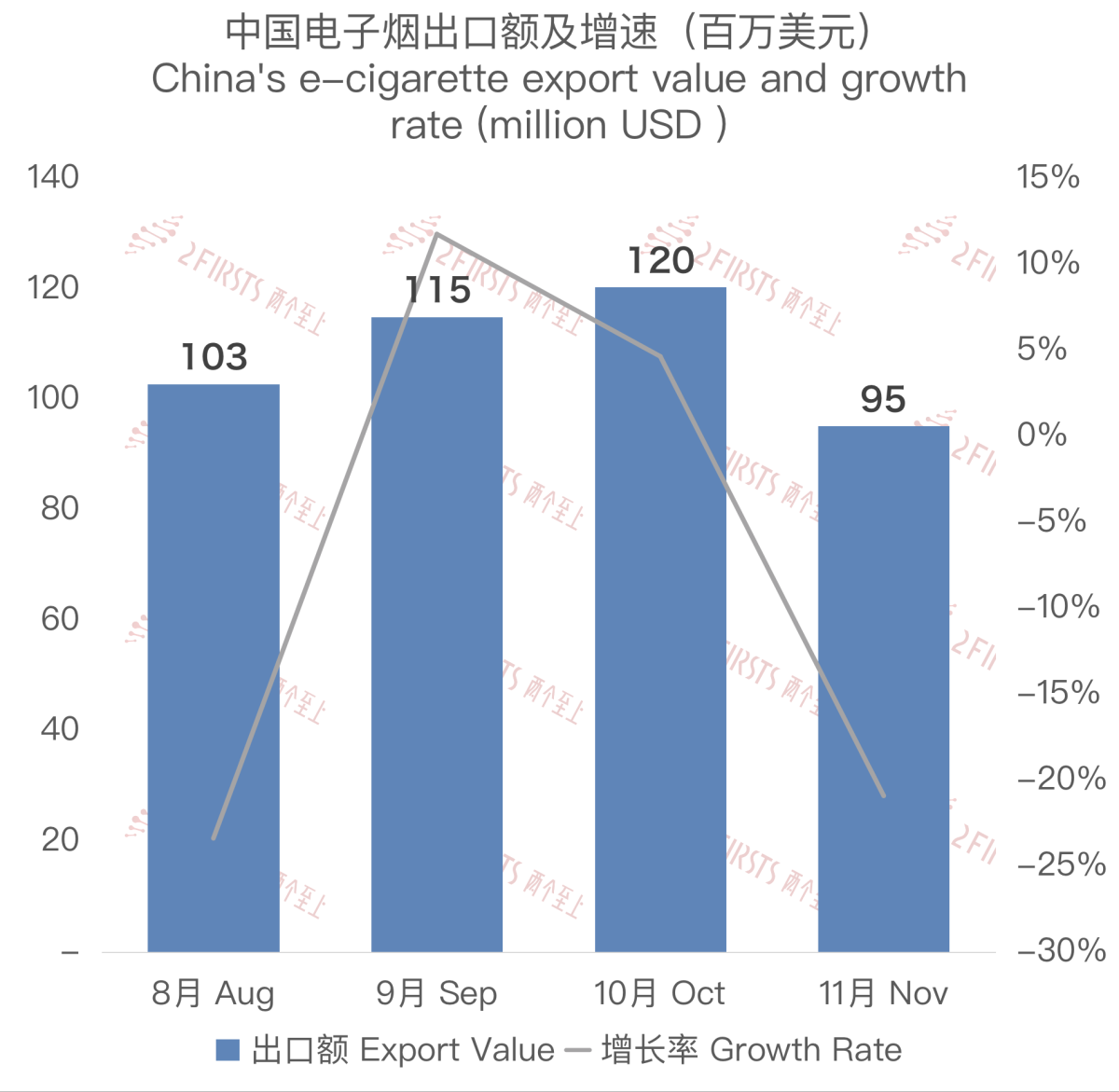

However, according to trade data from the General Administration of Customs of the People's Republic of China, in November 2023, China's exports of e-cigarettes to the UK decreased by 20.89% compared to the previous month, and decreased by 24.06% compared to the same period last year, reaching a new low of only 95.24 million US dollars, the lowest since March. Some e-cigarette industry practitioners in the UK have also reported that the market for e-cigarettes in the country is unusually quiet this Christmas.

According to some industry insiders, the rise in demand for refillable e-cigarettes in the UK may be directly related to rumors of a disposable e-cigarette ban. In September 2023, the French government announced plans to ban disposable e-cigarettes, prompting politicians and social organizations in the UK to propose stricter legislation on disposable e-cigarettes and even call for a ban similar to France's. On October 12th, the UK government released a public consultation that included the option of a complete ban on the sale of disposable e-cigarettes.

Therefore, from September until now, the e-cigarette market in the UK has been shrouded in rumors of a ban on disposable e-cigarettes.

Conservative Stock Inventory by Distributors: Less Opportunities for Small Brands

The rumors of a ban on disposable e-cigarettes have directly impacted the business strategies of British retailers. Zhang Qiang (pseudonym), who has been involved in the e-cigarette industry in the UK for many years, stated that after the spread of these rumors in the British market, local retailers have shown concerns about the potential ban on the sale of disposable e-cigarettes. As a result, everyone has become more cautious and conservative in their approach.

In order to avoid stockpiling, distributors tend to prefer well-known and popular brands when stocking up, such as ELFBAR, Lost Mary, and SKE Crystal (referred to collectively as the "big three" by industry experts in the British e-cigarette industry due to their dominant market position).

On the contrary, due to the time required for cultivating a new brand, distributors are concerned that the government may implement a ban in a few months, causing a decrease in acceptance of new brands and products. Zhang Qiang stated that it takes at least six months for a new brand to achieve success in the UK market.

In addition, besides preferring to choose the "three major brands" when making purchases, distributors also tend to opt for discounted low-priced products to control costs and stimulate market activity.

For instance, in order to attract retailers to make purchases, British leading wholesaler Booker publicly announced in December last year that it would lower the wholesale prices of over 40 products such as ELFBAR, Ske Crystal, Lost Mary, Found Mary, etc., to assist retailers in obtaining profit margins of up to 49%.

Unapparent Transition to Pod-System, Open-System & E-Liquid Surge in Popularity

However, Zhang Qiang pointed out that despite the decrease in activity in the disposable e-cigarette market, market demand has not decreased, but has been filled by other product categories, such as pod-based and open-system products.

In addition, disposable e-cigarettes have been facing environmental pressures in the UK and there are now rumors of a ban on disposable e-cigarettes, which has led distributors to actively seek business opportunities in refillable and open-system products. Several well-known brands of disposable e-cigarettes, such as ELFBAR, Lost Mary, and SKE Crystal, have also launched refillable products in 2023 and have focused on promoting them.

One of the well-known e-cigarette online retailers in the UK is currently running a promotional campaign for the SKE Crystal Plus, a popular refillable e-cigarette device. For a price of £7.99, customers can purchase one complete e-cigarette device with a pod, an additional empty cartridge, and two extra pods.

However, according to Zhang Qiang's observation in the UK market, although brands and distributors are promoting it, overall, reloadable products have not seen significant growth in the UK.

In comparison, open-system products have received positive market feedback in the United Kingdom. Zhang Qiang expressed that, contrary to before, open-system products have gained popularity, particularly OXVA's open system, which has been well-received in the UK.

Zhang Qiang believes that the rise of open-ended products is not only relevant to the reasons mentioned above but also tied to the decline in the UK economy. This is because, all things considered, open-ended products offer better value for money compared to disposable products.

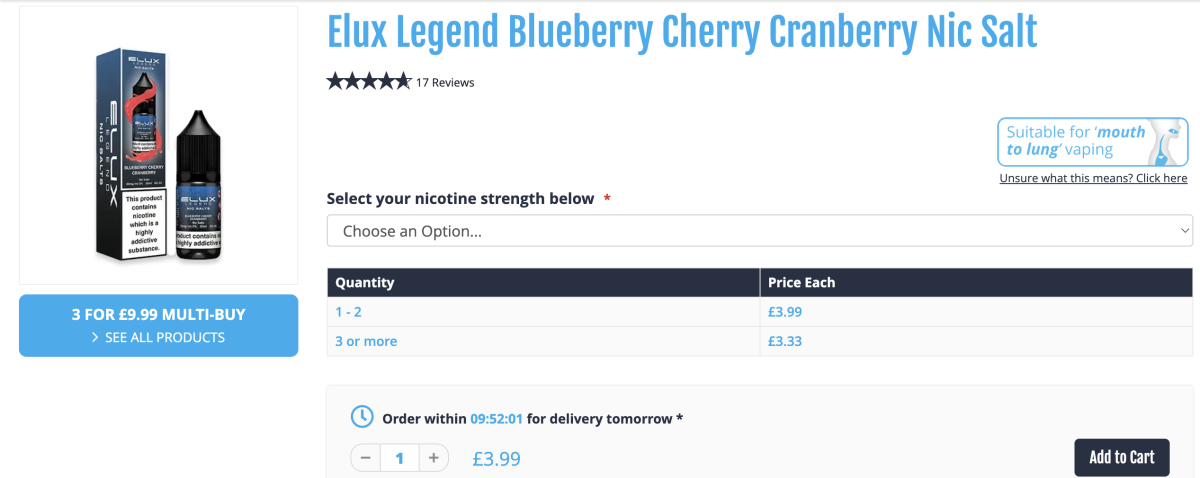

At the same time, Zhang Qiang revealed that the market performance of ELUX's e-liquid brand is also very impressive. It is estimated that this e-liquid can sell 3 million bottles (10ml capacity) per month in the UK. According to 2FIRSTS, ELUX's e-liquid brand, Elux Legend Nic Salt, was launched in the UK in May 2023 and is currently priced at £3.99 per bottle in online stores in the UK.

In addition, several well-known brands, such as blu, ELFBAR, and KIWI, are set to launch their own e-liquid brands in the UK in 2023.

Black Market Unaffected Despite Rumors, Large-Puff Products Sales Rise

It is noteworthy that the aforementioned situation primarily affects the compliant market. In addition, a reliable source involved in the e-cigarette trade in the UK revealed that the rumors of a ban on disposable e-cigarettes have had limited impact on the illegal e-cigarette market, which is predominantly dominated by products with high nicotine content (e-liquid exceeding 2ml).

According to the anonymous source, the sales of large-puff e-cigarette products are increasing due to their ease of purchase and the relatively low number of hits offered by compliance market products. Currently, the most popular large-puff e-cigarette brand in the UK market is HAYATI.

Furthermore, the relatively high policing cost in the UK has resulted in a relatively weak regulation on the illegal e-cigarette market, exacerbating the issues of limited competition and development in the compliant market.

In addition, since June, the UK has been intensifying checks on large consignments of products at airports, which has forced many freight companies to halt their operations. However, recently, insiders in the e-cigarette logistics industry in the UK have reportedly mentioned a relaxation in this enforcement action.

Legislation in the United Kingdom

Currently, the ban on disposable e-cigarettes in the UK is still in the stage of being called for by some regional governments, social organizations, and the public for consultation. It has not been formally proposed for discussion, thus the ban is still an unconfirmed rumor.

The process of establishing a new law in the United Kingdom typically involves eight stages, including the proposal stage, second reading stage, committee stage, report stage, debate stage, consideration by the other house, negotiation, and amendment, ultimately requiring royal assent. The duration of the entire legislative process varies depending on the agenda, political climate, and complexity of the bill. Certain emergency bills may be passed within a shorter timeframe, while more intricate or contentious bills may require more time for completion.

Currently, the government's stance on the ban of disposable e-cigarettes has not been made public, making it difficult to predict the final outcome. However, it is understood that the UK is planning to introduce a new tax in the e-cigarette industry. The new tax plan will be announced by Chancellor Jeremy Hunt during the budget meeting on March 6th. According to the plan, the cost of e-cigarette liquid is expected to increase by at least a quarter, which could lead to a price increase in disposable e-cigarette products.

Stay tuned to 2FIRSTS for the latest updates on the disposable e-cigarette policies in the UK.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com