On January 29th, the UK government unexpectedly announced a complete ban on disposable e-cigarettes, a decision that has transformed the previously apprehensive British market from months of speculative unease into utter disappointment.

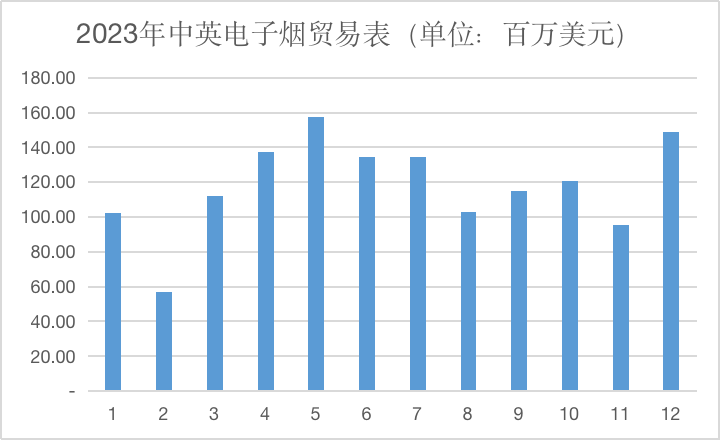

China exported over $1.4 billion worth of e-cigarettes to the UK in 2023, making it the second-largest e-cigarette market after the United States. While there is no precise data on the breakdown of this $1.4 billion, industry experts suggest that disposable e-cigarettes account for the majority of it based on market conditions and widespread feedback from industry practitioners.

The sudden ban undoubtedly poses a serious threat to the Sino-British e-cigarette trade, with the impact primarily expected to be felt by the top brands in the market. In the compliant UK market, there are three brands known as the "Big Three" in the disposable e-cigarette sector due to their dominant market positions. These brands are ELFBAR, LOST MARY (both sister brands under IMiracle (Heaven Gifts)), and SKE Crystal (a brand under Sikary).

What impacts will the major players face and how will they respond in the face of the ban?

"Bigwigs" being the First to Bear the Brunt

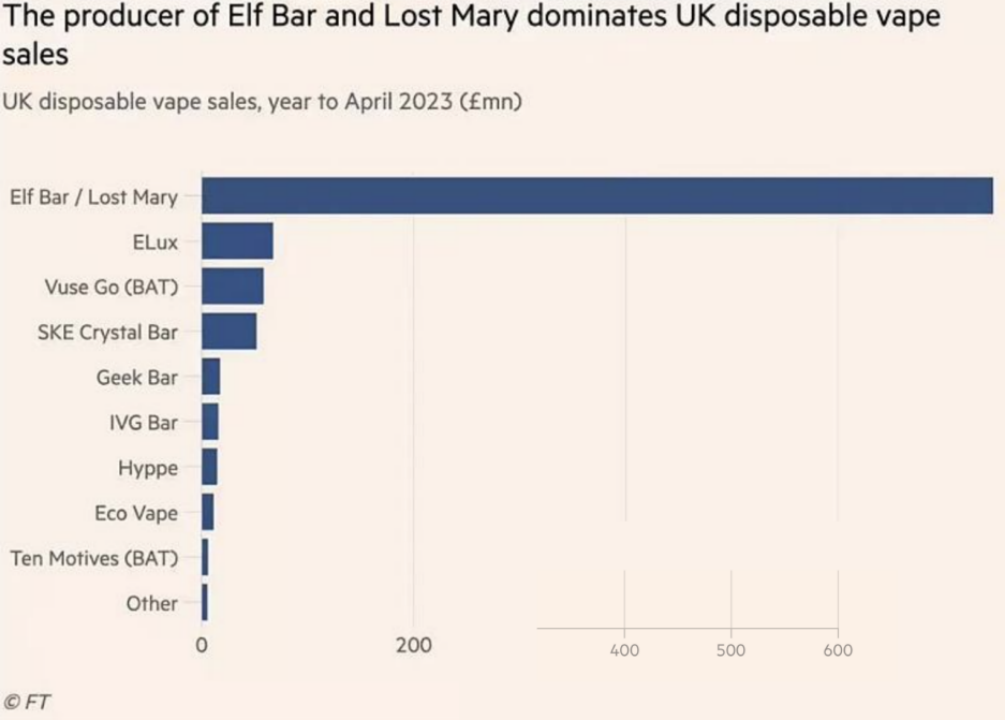

The phenomenon of oligopoly is evident in the e-cigarette market in the UK. According to rankings released by NielsenIQ in January and April 2023, ELFBAR and LOST MARY account for over 50% of disposable e-cigarette sales in the UK, placing them in the first tier and significantly ahead of their competitors. Elux, Vuse, and SKE, on the other hand, belong to the second tier.

In 2023, SKE, as a rising star, achieved astonishing growth in the British market. In the first half of the year, its parent company Sikary generated revenue exceeding 1.4 billion yuan, with a staggering year-on-year increase of 1477%, making it the second-largest e-cigarette brand in the UK market, only trailing behind ELFBAR. In the second half of the year, some industry insiders even believed that SKE had surpassed ELFBAR and become the leading brand in the UK disposable e-cigarette market.

ELFBAR, LOST MARY, and SKE Crystal have firmly dominated the market in the UK before the disposable ban crisis. However, following the rumors of the disposable ban in September last year, the oligopoly effect of the "big three" has become even more significant. According to insiders, in order to avoid excessive inventory, distributors have only been stocking ELFBAR, LOST MARY, and SKE Crystal products.

However, after the ban, the biggest giants will also become the ones suffering the most significant losses.

Several industry insiders believe that, under this impact, SKE's losses could exceed those of ELFBAR and LOST MARY.

Specifically, the United Kingdom is the main battleground for SKE, with the second largest market in the Netherlands having a smaller capacity and unable to support SKE's main revenue – its export volume to China in 2023 is $370 million. As the Netherlands serves as an important transit hub in Europe, this figure also includes the transit trade volume, suggesting that the actual market size in the Netherlands may be much smaller than $370 million.

Moreover, SKE's performance in important markets like the United States, Russia, and Germany has been disappointing. This suggests that SKE heavily relies on the British market for its revenue.

ELFBAR and LOST MARY, as globally renowned brands, hold significant market shares in various markets including the United States, Russia, and Southeast Asia. The British market is just one of their primary markets. Consequently, ELFBAR and LOST MARY are not as reliant on the British market as Sikary is.

Who can Become the Front-Runner?

Perhaps it was the already keenly perceived ambiguity in the UK government's regulatory stance towards disposable e-cigarettes, or perhaps it was a cautious consideration of risks, that prompted the industry giants to embark on an exploration of an alternative track as early as the beginning of 2023.

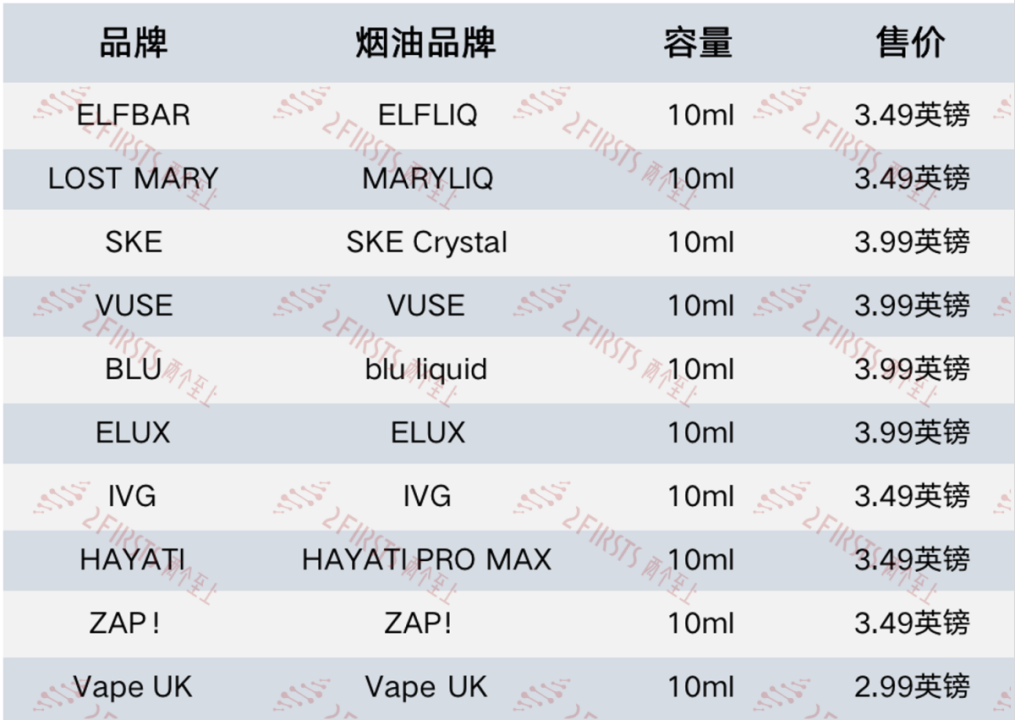

In May 2023, ELFBAR launched its own e-liquid brand, ELFLIQ, in Italy. In June, they introduced a pod system product called ELFA in Spain. In August, ELFA PRO was officially released in the UK. At the e-cigarette exhibition in Birmingham at the end of October, 2FIRSTS noticed that LOST MARY also had pod system products and e-liquid products (MARYLIQ) in their lineup.

In October of the same year, Sikary's magazine-style product SKE Crystal Plus was introduced to the market, along with the release of SKE Crystale-liquid.

It is worth noting that in the second half of 2023, there has been a noticeable trend in the British market where disposable brands such as VUSE and ELUX have entered the e-liquid market in large numbers. Even distributors like E-SHEESH and VAPE.UK have also launched e-liquid products under the same name, venturing into the popular e-liquid sector.

In the new arena, giants are attempting and exploring. However, according to market insiders in the UK, the overall sales of disposable products are not satisfactory.

A person engaged in the ammunition business in the UK told 2FIRSTS that the ELFA PRO does not offer as good value for money as the high-capacity products in the grey market, hence the reluctance of retail stores to sell it, making it unpopular among distributors. Additionally, although the sales figures for the LOST MARY and SKE ammunition products are unknown, according to the person's observation, these two products are also rare in the retail sector.

However, not all products have been consistently underperforming. Despite facing difficulties in retail stores, ELFA PRO successfully entered the UK's supermarket market in September. With the help of this strong distribution platform, ELFA PRO may have a good chance of achieving promising sales performance.

Unlike the sluggish disposable market, the e-liquid market in the UK is booming and presenting an overall growth trend. In this popular market, major players have shown commendable performance in the e-liquid race. However, they have not displayed the same leadership in the disposable market as they have in the e-liquid market, which has been taken over by ELUX, a brand that started off in the disposable segment. According to insiders, ELUX has achieved outstanding sales in e-liquid, with an estimated monthly sales of 3 million bottles (10ml in capacity).

Can the Open-System Trend be Pursued?

When the big players were busy positioning themselves in the bullet exchange business, they may not have anticipated the next promising opportunity emerging in the open track.

According to insiders in the UK e-cigarette market, following the rumors of a ban on disposable e-cigarettes, open systems are gaining momentum and surpassing pod systems in popularity. Additionally, several leading retailers in the UK are primarily introducing and promoting e-liquids and open system devices on their online platforms, with very few retailers promoting pod systems.

OXVA has emerged as the most popular brand in the open pod system market in the UK. While industry giants have been focused on expanding their closed pod system businesses, OXVA has unexpectedly risen to prominence in the UK with its open pod system products.

Robert Sidebottom, CEO of British company ARCUS COMPLIANCE, which specializes in compliance certification, suggested in an interview with 2FIRSTS that Chinese companies should start expanding into open markets. It is evident that just after the announcement of the disposable ban, the open market trend quickly gained momentum. Therefore, can the giants also make arrangements in the open market track?

A well-informed source in the e-cigarette manufacturing field informed 2FIRSTS that disposable companies face certain technological barriers when entering the open-system market due to the relative complexity of open devices. Additionally, the business models of disposable and open-system brands differ. Therefore, for disposable brands to enter the open-system market, it is not an easy task and they do not possess any clear advantages.

However, it is worth noting that the parent company of ELFBAR, IMiracle (Heaven Gifts), is not completely unrelated to the open-system business. Another company, Geekvape (GEEKVAPE), which is associated with IMiracle (Heaven Gifts), mainly operates open-system products. According to insiders, Geekvape was actually acquired by the boss of IMiracle (Heaven Gifts) from the parent company of the aforementioned brand OXVA. Therefore, if ELFBAR intends to enter the open-system track, it may be able to leverage the experience of its affiliated company.

At present, the ban on disposable e-cigarettes has not been officially implemented, and there is still some time before it takes effect. The ultimate direction of the UK e-cigarette market still needs to be verified over time, and 2FIRSTS will continue to monitor the developments in the UK market.

"UK Disposable E-Cigarette Ban" Series Report

Policy Updates

【1】UK Government Announces Ban on Disposable E-Cigarettes

【2】Original Text of UK Government's Disposable Ban Announcement

Market Dynamics

【1】After UK Disposable Ban: Retailers Clearing Stock, Major Distributors Turning to E-liquids and Open-Systems

【2】UK Announces Disposable E-Cigarette Ban: Smoore and Yinghe Technology Stock Prices Decline

Various Perspectives

【1】Black Market or Opportunity? Insiders' Perspectives on UK Disposable Ban

Business Review

【1】Disposable Ban Impact: Is Smoore's Strategic Layout Empty Again?

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com