Special Announcement:

This article is intended solely for industry research and exchange, and does not endorse or recommend any brands or products. Access is prohibited for minors.

TPE24 is about to open, and 2FIRSTS has deployed personnel to visit the offline e-cigarette market in the United States. In 2024, California, as the largest state in the U.S. economy and also a major consumer of e-cigarettes, saw significant changes in its offline e-cigarette market. What changes occurred after the flavor ban was implemented one year ago? What position does disposable e-cigarettes hold? Which e-cigarette products stood out? How did legalized cannabis products enter the fray and change the ecosystem?

Policies from above, Countermeasures from below

On December 21, 2022, the flavored tobacco ban in California officially came into effect. This ban prohibits retailers from selling flavored tobacco products, including menthol cigarettes and tobacco product additives.

- E-cigarettes or e-cigarette devices that contain or sell flavored liquids or elements;

- Flavored e-liquids or pods;

- Ingredients, components, or accessories of tobacco products that are sold or used together with flavored components;

- Flavored mini cigars or cigars, smokeless tobacco, loose-leaf cigarettes, or rolling papers.

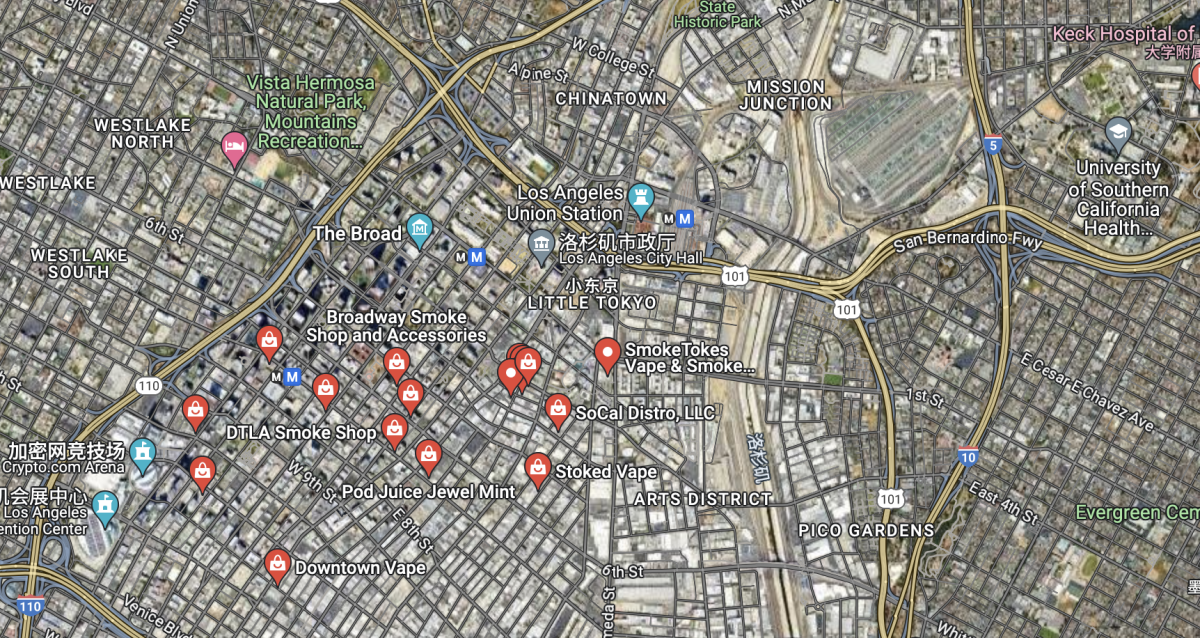

On January 23, 2024, one year after the implementation of the law, 2FIRSTS staff visited a block near the Los Angeles City Hall, where, according to locals, many wholesale e-cigarette vendors cater to corporate customers.

In a conversation with the first e-cigarette wholesaler, staff members disclosed that due to the customs seizing new products, they are currently only able to sell their existing inventory. Their flagship flavor series is Flum Pebble, with the best-selling flavors being Berrymelon Ice, Blueberry Mint, and Greenapple Watermelon. Among these flavors, the cooling sensation of the "Ice" variant continues to have a widely accepted appeal.

2FIRSTS has discovered that despite the ban on flavored products in California, it seems to not be a major concern for this business, even though it has caused some fluctuations in their operations.

A shopkeeper stated that the flavor ban only prohibits fruit flavors such as apple and lemon, but he mentioned clever ways to circumvent it. For instance, giving flavors Spanish names or using numerical codes to correspond to flavors. When asked about the potential restrictions, the shopkeeper told 2FIRSTS, "Whatever the rules may be, you will always find a loophole."

This seems to explain why seasoning products, despite being officially banned, continue to exist in the market. It is the demand from the market that drives businesses to trade these products. The business owners emphasize that they can at least earn three months of income by finding ways to avoid regulatory measures from being implemented, starting from their formulation.

He also expressed that law enforcement may become stricter in the future, but currently, in the offline market of Los Angeles, the enforcement measures mainly involve confiscating relevant goods and have not yet involved fines. In other words, the losses for store owners are primarily concentrated in the cost of the goods themselves, without having to bear any additional economic losses.

Adjust to Market-Oriented Strategy

The ban on flavored e-cigarettes has had a significant impact on the market, forcing some businesses to make strategic adjustments. As a result, certain stores have chosen to no longer sell disposable e-cigarettes and instead focus on open-system or refillable e-cigarette products. Others have decided to solely sell devices and no longer offer e-liquids or disposables. It is worth noting that at one particular store called 2FIRSTS, 80% of the products were SMOK. Additionally, there is even a store that has completely stopped selling e-cigarettes and now concentrates on selling other products such as hookahs.

According to this tobacco vendor, they have reported a decline in sales of flavored disposable e-cigarettes since the flavor ban was implemented. However, they emphasize that the tobacco category itself offers various choices beyond just e-cigarettes.

We sell everything related to tobacco, so it doesn't matter. We can simply choose not to sell disposables if need be. We can still sell pod-system and open-system products for now.

Turning to Marijuana

In 1996, California embarked on the process of legalizing medical marijuana. Then, in November 2016, California voters approved Proposition 64, also known as the Adult Use of Marijuana Act, with 57% of the vote, thereby legalizing recreational marijuana use.

The California Department of Tax and Fee Administration (CDTFA) has reported the marijuana tax revenue for the third quarter of 2023, with total earnings reaching $269.3 million. Out of this, $156.9 million was generated from marijuana excise tax, while $112.4 million came from sales tax on marijuana-related businesses.

This has also impacted consumers' attitudes towards e-cigarettes. With the increasingly stringent regulations on e-cigarettes, many businesses have reported a shift in personnel from the e-cigarette industry to the cannabis industry, including CBD, THC, and other marijuana-related products.

A store owner who switched from selling e-cigarettes to cannabis expressed, "Since we can now legally consume cannabis, who cares about e-cigarette flavors? Banning flavors will only make CBD e-cigarettes more popular." In their store, the front shelves are filled with cannabis products, while e-cigarettes are placed at the back of the store's storage.

Battleground for Chinese Manufacturers

During our visit to various shops, 2FIRSTS found that many store owners mistook their employees as salespeople for e-cigarette brands. According to one shop owner, the day before, his store was visited by three groups of Chinese people who were promoting different e-cigarette brands. Just this morning, when 2FIRSTS arrived at his store, the e-cigarette salespeople had just left.

The overall data for e-cigarette market in California is yet to be released, but a recent report by renowned research institution WSPM has disclosed the brand market shares for the second quarter of 2023. The top five brands in California during this period were FLUM, ELFBAR, LOST MARY, FUNKY REPUBLIC, and EB DESIGN.

California, located on the West Coast of the United States, has been the most economically powerful state in the country for the past few decades. According to a report by Bloomberg in 2022, California is expected to surpass Germany and become the fourth-largest economy in the world. Bloomberg commented, "It continues to lead in terms of GDP growth, corporate market value, renewable energy, and other aspects compared to other states in the US and other countries."

The significance of California cannot be overlooked as it becomes the first destination for numerous e-cigarette brands to dominate the West Coast. Los Angeles, as an economic hub, gathers a large number of e-cigarette wholesalers who firmly hold the local distribution network resources.

During our investigation, it was observed that numerous shop entrances were marked with signs stating "wholesale only" and "at least 1000$." These indications suggest that the primary clientele of these establishments are distributors and e-cigarette stores capable of making bulk purchases.

The future development of the e-cigarette market in California worths keeping an eye on. 2FIRSTS will continue its exploration of the offline market in the United States, focusing on new trends and directions. Following the conclusion of the TPE 2024, 2FIRSTS will host a sharing event on TPE and American market on February 6th. 2FIRSTS Global Executive Editor-in-Chief, Yuna Hou, and the American team will share the latest discoveries from the exhibition and delve into product trends, policy directions, and more. For more information and registration, please scan the QR code below to contact 2FIRSTS staff.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com