Special Notice:

This article is for internal research and discussion within the industry only, and does not make any brand or product recommendations;

minors are prohibited from accessing.

Recently, on the Japanese e-commerce platform Amazon, 2FIRSTS discovered a heating tobacco product claiming to be GEEK VAPE's new brand, which has launched a heating tobacco device called Fasoul Q1.

According to multiple sources, Fasoul Q1 claims to use 3D hot air flow heating technology, which can provide "360-degree all-around direct heating pod." The device is equipped with a display screen on the side, and its design is quite similar to that of the GEEK BAR PULSE, featuring a square and rounded exterior with a side-mounted display screen.

Compatible with IQOS ILUMApod, Emphasizing "One cigarette, Two inhalations"

According to the product information provided by Amazon, "This is the first product equipped with a full-screen LCD. Due to the difference between the internal heating used by IQOS ILUMA and the external heating used by Fasoul, one pod can be used twice.

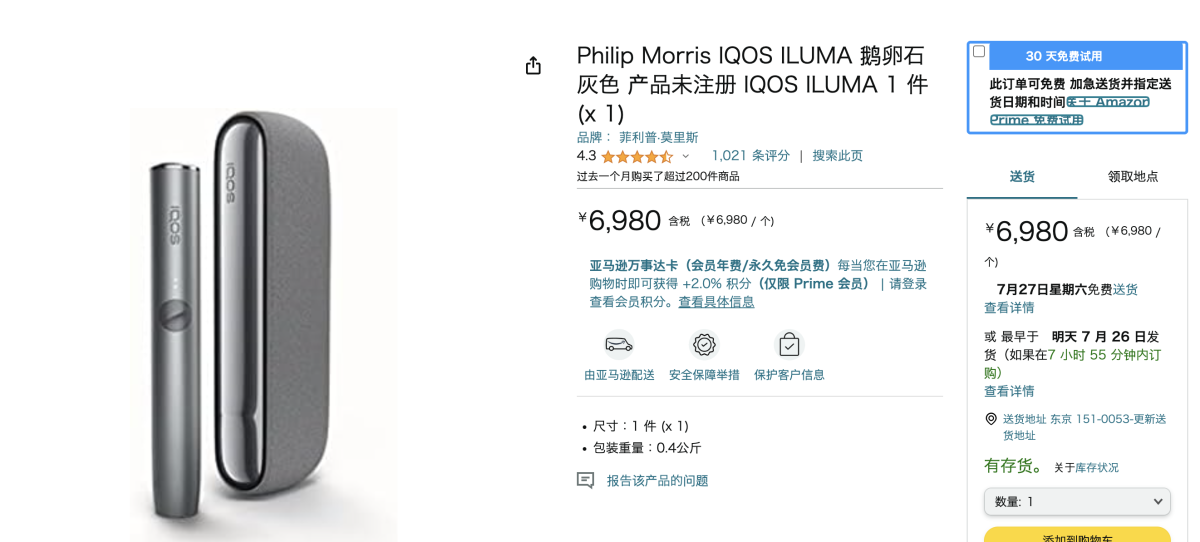

The description specifically notes that Fasoul Q1 is compatible with the dedicated pods for IQOS ILUMA, Terea Stick and Sentia Stick. However, it is also added that the product has not been approved by Philip Morris Products SA, the brand's developer, and does not include nicotine-containing sticks as a standalone device. In purchasing packages recommended by Amazon Japan, it is sold together with the IQOS ILUMA device.

It is worth noting that the Fasoul Q1 adopts a similar design concept to the GEEK BAR PULSE sold in the US market, with a square and rounded appearance paired with a side display screen. When comparing the two devices with screens, it can be seen that the arrangement of the display screen and the displayed information is highly similar.

This product, resembling the GEEK BAR PULSE, is the second heated tobacco device product from this brand.

In September 2023, the brand launched its first product, Fasoul C1, in Japan. In a press release, it stated, "Fasoul C1 will be compatible with IQOS ILUMA, but it is not a product under the IQOS brand. The user experience may differ from the authentic product."

The two products have some differences in their appearance designs, but both have the same selling point. "They can use two pods at a time."

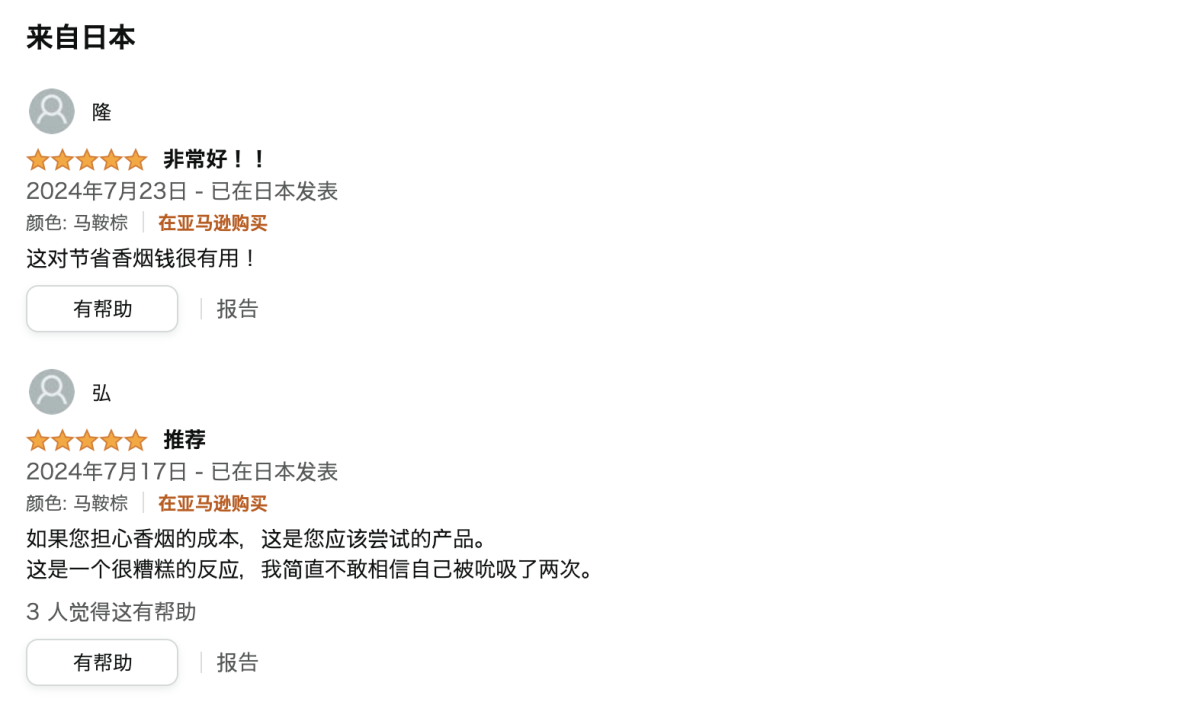

Based on product reviews on the Amazon platform, Fasoul has become a "shadow" or "replacement" for the IQOS ILUMA device. Users can heat up pods inside the IQOS ILUMA and then use Fasoul to heat them up again externally, saving costs and extending the usage time of the pods. This also means that users can directly use Fasoul to heat up pods without having to purchase the more expensive IQOS device.

From the current market situation, Fasoul still has many direct competitors. In Japan's Amazon, similar IQOS derivative accessories are considered small home appliances. If you search with the keyword "イルマ 互換品", you will find that similar products are marketed with the slogan "compatible with iqospod", and these products are cheaper than Philip Morris International (PMI)'s official devices.

Compared to the IQOS ILUMA, the Fasoul Q1 is priced at 2,860 yen (approximately $18.58), while the former is priced at 6,980 yen (approximately $45.36). Just based on price alone, the Fasoul Q1 is less than half the price. In Japan, where heated tobacco products are becoming popular, there is a market for alternative products with willing consumers.

It is worth noting that the Fasoul brand is marketed as "GEEK VAPE's newly developed heated tobacco product" in its introduction. What exactly is the relationship between Fasoul and GEEK VAPE?

In response to this issue, 2FIRSTS contacted insiders from Geekvape's subsidiary, Qishe Intelligent, who expressed to 2FIRSTS that

"In fact, Fasoul is not a brand of Geekvape (GEEK VAPE), but there is a partnership between the two."

According to the insider, Qisi Intelligence is only involved in contract manufacturing for the heated tobacco industry and does not directly participate in the brand's operations in the Japanese market or other matters.

"The Advantages of Bypassing the IQOS Technology Barrier"

Geekvape, the company that provides manufacturing services for Fasoul, has been relatively secretive about its tobacco heating business operations.

Previously, 2FIRSTS had a conversation with the overseas sales manager of the GeekvapeHC division at the e-cigarette exhibition in Moscow. He divided Geekvape's overall business sector, stating that his department is a third business unit that is distinct from GEEK VAPE and GEEK BAR, mainly focusing on research in the HNB product field.

According to its introduction, Geekvape's technological advantage in the HNB product field lies in the use of "3D heating technology." Its advantage is that it provides more even heating to the pod, resulting in a better combustion sensation. This technological advantage allows Geekvape to stand out in the competitive HTB product market, forming a certain differentiation with the main competitor IQOS in the market.

The responsible party stated

"IQOS already has a virtual monopoly, while Geekvape is one of the few companies that can bypass barriers to production equipment."

2FIRSTS and Fasoul's heating element leader, Yang Yangbin, had a discussion regarding the specific technical details of the Fasoul Q1 product.

He stated that the main reason Fasoul Q1 resembles the appearance of GEEK BAR PULSE products is not due to design considerations, but rather to reduce costs. By utilizing the same components as GEEK BAR PULSE during the production process, Fasoul Q1 is able to save a significant amount of costs, making the product more competitive in the market.

In the production process, as output increases, fixed costs are spread over more units of product, resulting in lower average costs per unit. Therefore, in the case of increasing sales, the price of the product can be lowered and ultimately offered to customers at a lower price.

"GEEK BAR PULSE is a superior product, and we have developed it further to lower procurement costs in cases of high demand, thereby allowing us to offer customers lower prices."

Furthermore, he explained that Fasoul's technology differs from that of Philip Morris International (PMI). Yang Yangbin explained that PMI's heated tobacco devices use the method of electromagnetic induction heating, while Fasoul utilizes a circumferential heating technology solution. Compared to the electromagnetic induction heating in the Japanese market, Fasoul's method operates at lower temperatures and provides more precise temperature control.

"Lower temperatures can reduce harmful substances, while also improving the efficiency of tobacco utilization and user experience."

A more Friendly Market for Heated Tobacco Products

Currently, Fasoul has opened accounts on social media platforms such as Instagram and Facebook, and has been regularly updating since June of this year. The content mainly focuses on the details and features of their products, Fasoul C1 and Fasoul Q1.

From the content released, it can be seen that Fasoul's marketing information is mainly targeted at the Japanese market, indicating its emphasis on this market. This also reflects the unique characteristics of the Japanese market.

Although disposable e-cigarette products have become increasingly diverse in the European and American markets, with new products constantly emerging.But in Japan, vape does not belong to mainstream market. Japan's Pharmaceutical Affairs Law classifies all e-cigarette liquids containing nicotine as "medications," and devices for inhaling nicotine (vaporizers) as "medical devices." Therefore, any vapor products available for sale on the market must be completely nicotine-free.

Even large companies like British American Tobacco sell nicotine-free vape products in Japan. For example, in December last year, British American Tobacco Japan launched the nicotine-free vaporizer Vuse Go 700 in Tokyo. These products attract users with a variety of flavors, and even though they cannot produce nicotine addiction, certain flavors also have a certain addictive effect.

In comparison, the Japanese government has shown greater tolerance towards heated tobacco products.

According to the article "Smoking Regulation in Japan: From Etiquette to Rules" published by Cambridge University Press, Philip Morris International's lobbying led officials to establish different regulations for heated tobacco products, considering these products to be "harm reduction" and "smoke-free," making them more socially acceptable.

An official from Japan's Ministry of Health, Labour and Welfare defended the different regulations for traditional cigarettes and heated tobacco products, stating, "For heated tobacco products, ... there is currently no clear scientific evidence of their harmful effects on health."

In addition, heated tobacco products enjoy a lower tax rate in Japan. Although the tax rate has risen in recent years, the tax burden on heated tobacco products is still lower than that on traditional cigarettes. Currently, the tax on heated tobacco products is about 30% lower than the tax on combustible cigarettes.

Policies have paved the way for the development of heated tobacco, and a report from market research firm imarcgroup estimates that the Japanese heated tobacco market size will reach 18.6 billion U.S. dollars in 2023. It is expected that the market size will reach 46.2 billion U.S. dollars by 2032, with a compound annual growth rate (CAGR) of 10.7% from 2024 to 2032.

IQOS Products Account for 70% of the Market Share

2FIRSTS searched on the Japanese Amazon product list found that the best-selling heated tobacco devices, IQOS, almost occupy the top of the list, with the driving force for purchases coming from Philip Morris International's investment in the Japanese market for many years.

IQOS products have been in the Japanese market for 10 years, and the initial market user cultivation started with Philip Morris International's products. In November 2014, Philip Morris International first launched the IQOS heated tobacco product in Nagoya City, Japan.

According to a report released by Philip Morris International, to date, the number of IQOS users in Japan has reached 8.5 million, accounting for about 30% of the global user base of 28.5 million. Heated tobacco devices, including IQOS, Ploom, and Glo, have completely transformed the tobacco market in Japan.

Based on data announced by Philip Morris International at the CAGNY conference in February 2024, in 2023, heated tobacco products accounted for 37.9% of all tobacco sales in Japan. In January 2023, the sales of heated tobacco products exceeded the sales of cigarettes in Tokyo for the first time, accounting for 50.4% of consumer sales.

PMI has stated that by 2023, IQOS will continue to dominate the Heat Not Burn (HTP) product market in Japan, holding a 70.5% share.

A survey conducted by research institute Statista shows:

- IQOS ILUMA was the most popular HTP in Japan from July to August 2023, with over 21.1% of respondents using this product;

- IQOS ILUMA One was the second most popular heated product, accounting for 20.7% of the respondents;

- Following closely was JT's Ploom X with a 19.4% share, and British American Tobacco's Glo Hyper+ with a 12.9% share.

Although Fasoul is currently unable to compete with these international tobacco companies, it can gradually capture a portion of the market. Its relatively low price and unique technology can also attract a segment of consumers, especially those who focus on cost-effectiveness and reuse.

How the heated tobacco market will develop in the future and whether Fasoul can secure a place in the competition with strong rivals like IQOS remains to be seen.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com