The Philippine Bureau of Customs Intelligence and Investigation Service seized a shipment of unregistered e-cigarette products on the evening of February 29th, with an estimated value of 4 billion pesos (approximately 510 million RMB, 70 million USD). The products were found to lack the necessary authorization certificates and were from the brand Flava.

As early as 2022, media outlets began using the term "Philippine region sales leader" when reporting on Flava. From its origins in the Philippines to the recent controversy, what are the flagship product lines of this brand? Where do its suppliers come from? 2FIRSTS conducted a detailed investigation into Flava's business strategies and operational direction in recent years.

Joint Branding to Promote Large-puff Screened Disposables

In the second half of 2023, Flava launched two new flagship products. The first one, XTRE 10000, was released in September in collaboration with Hyperbar. This brand features dual mesh coils, with a 23% increase in heating speed and a 30% increase in smoke volume. The design highlights a futuristic feel, with e-liquid battery indicator lights that light up with each puff, presenting a sleek and modern style. It has partnered with top distributors and various social media content creators, including Viy Cortez, Mika Salamanca, Chad Kinis, and more.

In October, Flava teamed up with e-cigarette design experts and international brand Flonq to launch their latest high-end product, Max Smart, and held a high-profile physical launch event.

Max Smart is a large-puff disposable device that can hold up to 14 milliliters of e-liquid. Designed to deliver up to 10,000 puffs, it offers 14 different flavors to cater to local tastes, including Yakult, Nerds Candy, Melon Ice, Gummy Bears, and Lychee Ice. It features a rechargeable 650mAh battery.

It is worth noting that it has a large side screen that can display the battery percentage, similar to the popular disposable brand GEEK BAR in various markets. This product is still available for sale at online retail outlets and has entered the top sales rankings.

China's Highly-involved Supply Chain

Compared to the flashy and glamorous public relations campaigns on the ground, the upstream supply chain appears to be shrouded in mystery.

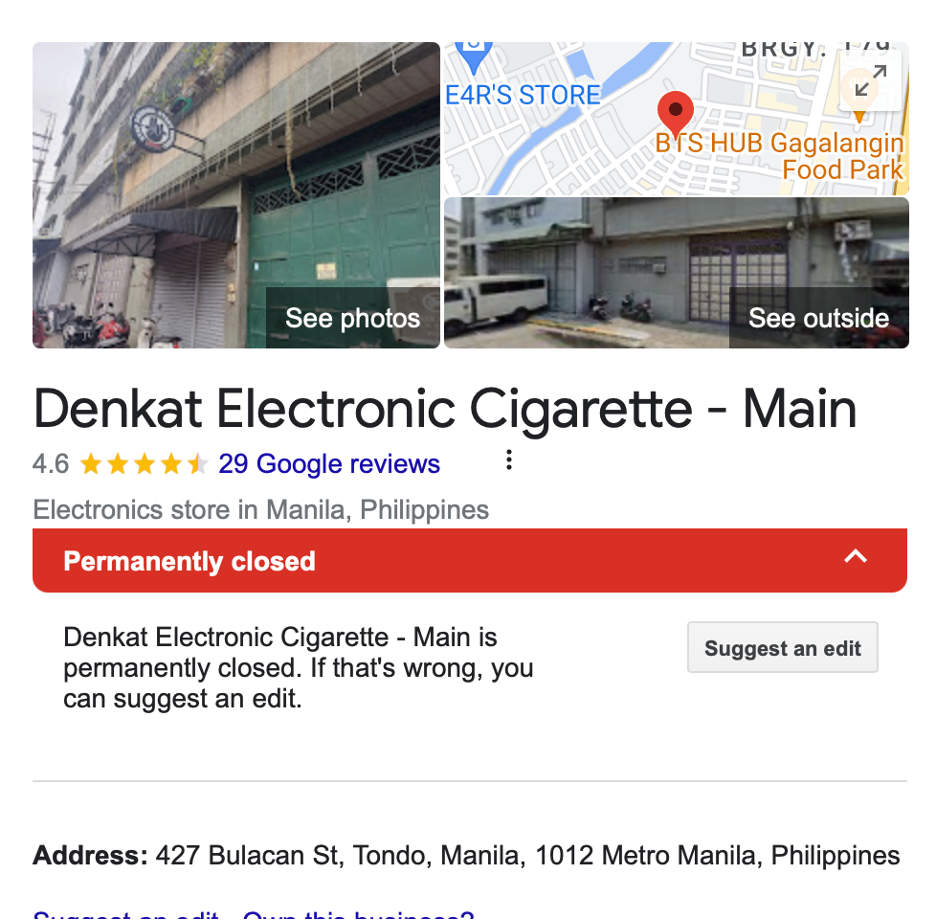

Flava claims that they purchased their e-cigarette brand from Denkat Philippines. However, 2FIRSTS discovered in publicly available information that Denkat Philippines is a local e-cigarette distributor in Manila, Philippines, but had permanently ceased operations on March 11th.

Contact was made with a spokesperson for Flava regarding the matter, however, they did not respond to questions related to the issue at the time of publication.

According to data from the China Trademark website, an incomplete statistic shows that there are commercial entities such as Shenzhen Zuomeirui Technology Co., Ltd., Shenzhen Dadao Si Jiuzhi Technology Co., Ltd., Shenzhen Aixingwang Electronic Technology Co., Ltd., and Shenzhen Wuchuang Electronic Technology Co., Ltd. that have registered trademarks similar to Flava. Wuchuang's largest contract manufacturing brand is MOSMO.

According to Made-in-China, a Shenzhen company called Wanna Group claims to be the manufacturer of the 2023 Flava Hyperbar Flavor 10000 disposable mouthpiece. The sample price is 1.5 US dollars. The company also has a brand called VEIIK.

Challenging Business Environment in the Philippines

In December 2023, Filipino Congressman Joey Salceda stated that as the market share of e-cigarettes continues to increase, tobacco excise tax revenue will further decline. Salceda pointed out that the internal revenue agency expects tobacco excise tax revenue to decrease by at least 11% this year.

The expected decrease in tax revenue has put pressure on the country's customs bureau to intensify its crackdown on illegal e-cigarette trading. Earlier in the same year, the Philippine customs bureau discovered 1.4 million tax-evading e-cigarettes hidden in a warehouse in Valenzuela, with the devices labeled as being manufactured by "Flava Corporation."

According to Tax Commissioner Romeo D. Lumagui, Jr. of the Philippines' Bureau of Internal Revenue, Memo No. 57-2023 states that there are currently 7 local cigarette manufacturers and 14 tobacco importers registered with the bureau. There are also 27 legal manufacturers and 26 importers of vaping products, as well as 11 importers of heated tobacco and 3 importers of new tobacco products. Flava is listed as a legal manufacturer.

They should have entered the domestic market through legitimate tax channels, but instead, they chose to enter using tax avoidance methods. According to industry insiders familiar with the Philippine market, Flava is positioned more as a distributor rather than a manufacturer. They place orders with upstream producers and distribute their branded products, focusing mainly on marketing efforts. This tax avoidance behavior is aimed at maximizing profits.

According to reports from the Philippine media, Robert Ace Barbers, the congressman from the 2nd District of Northern Samar, has called on the Bureau of Internal Revenue (BIR) to file a tax evasion case against the vape brand Flava for allegedly not paying 7.28 billion pesos in consumption taxes.

According to the country's tax law, taxpayers who owe consumption tax will be fined an amount at least 10 times the amount owed. Members of the House of Representatives also suggested that the Department of Trade and Industry and the Federal Tax Bureau revoke Flava's business license and production permit on the grounds of tax evasion and illegal marketing. If found guilty, Flava will face substantial fines and be unable to continue operating legally in the Philippines.

2FIRSTS will continue to monitor the performance of Flava in the Philippines market.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com