In March 2024, during an interview with the Financial Times, Tadeu Marroco, the CEO of British American Tobacco (BAT), dismissed the idea of moving the company's listing from London to New York, calling it "a distraction." This comes after the top ten shareholders who had been pushing for this change have exited their holdings in the tobacco company.

Marroco told the Financial Times that changing the listing location "would create a lot of internal disruption," and he did not see the benefits outweighing these negative impacts. He added that there were "many other things" he needed to focus on, including revenue in the United States and new products.

His specific mention of the U.S. market led some industry observers to the trial launch of PMI's HNB product IQOS in the country this year. With the arrival of its old rival imminent, what moves will BAT make in the United States? 2FIRSTS has followed up on the capital market and the company's latest dynamics to find any clues.

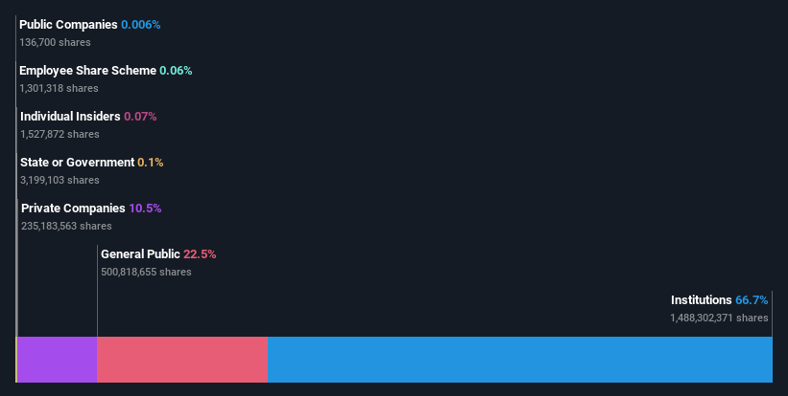

Capital Market: Continuously Valued by Institutional Investors

Over the past year, BAT's (LON.BATS) share price has fallen by about 21%, from 2,872.00 GBX (pence) on March 19, 2023, to 2,376.00 GBX on March 19, 2024. However, so far, the top 15 shareholders of BAT still hold 50% of the company's shares, and there have been significant purchases by insiders since March.

From publicly disclosed information, hedge funds do not hold much of BAT's shares. Capital Research and Management Company is the largest shareholder, holding 14% of the issued shares. The second-largest shareholder holds about 10% of the circulating shares, while the third-largest holds 8.6%. The large holdings of BAT's shares by these institutions mean they have a significant influence on the company's share price, and such institutional capital investment in the company is usually a huge vote of confidence in its future. Even though the share price has fallen over the past year, its future performance is still widely favored by institutions.

Relationship with PMI in NGP Field: Thawing the Ice or Continuing the Struggle?

The big news in the tobacco industry at the start of 2024 was undoubtedly the patent settlement between PMI and BAT in the heated tobacco field. On February 2, Eastern Time in the United States, both companies announced on their official websites that they had resolved intellectual property disputes related to heated tobacco and electronic cigarette products.

BAT is facing the challenge of reversing the decline in cigarette sales in its largest market, the United States. The company's spokesperson stated that this was mainly due to consumers switching to cheaper brands and new types of tobacco. However, BAT has always been lagging behind PMI in the new tobacco market, the latter having achieved great success with its heated tobacco product IQOS.

At the same time, Marroco admitted to the media that BAT "started late" in the field of heated tobacco products. This was the first time BAT had "shown weakness" in public. However, he stated that due to the company's market share base in the United States, the company has the capability to catch up in the future. "We have a huge business in the U.S. that can be used to sell (new tobacco products)."

BAT's goal is for revenue from alternative products (such as Vuse vapor e-cigarettes and Glo heated tobacco devices) to reach half of total revenue by 2035, eleven years from now. But in 2023, this figure was still at 16%. With PMI resolving patent issues and landing in the United States, if BAT wants to achieve its goal in the next ten years, it must compete head-to-head with PMI in the U.S. market.

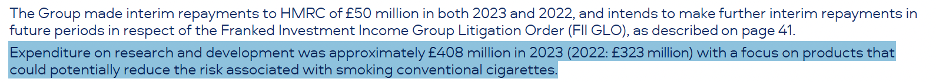

Increased investment in development shows BAT's determination to "fight to the end" with PMI in the new tobacco field. In March 2023, BAT opened an innovation center at its global R&D headquarters in Southampton, which will play a key role in the company's continued transformation and vision of a "better future." The facility, costing £30 million, provides nine specially designed technical spaces focused on developing nicotine pouches, vapor e-cigarettes, and more. Prior to this, in 2021, BAT had already opened innovation centers in Trieste, Italy, and Shenzhen, China, and invests £300 million annually in R&D for new category products.

According to financial reports, BAT spent about £408 million on R&D in 2023, a 26% increase from the £323 million in 2022, mainly invested in harm reduction products. BAT's financial report screenshot | Source: BAT

"Cutting Flesh" in Russia, Reducing Holdings in ITC: Capital Retreat and Diversified Investment

BAT recently sold shares in ITC worth about 17 billion Indian rupees. Before the sale, BAT held about 29% of the shares in ITC, making it the largest shareholder. BAT had two representatives on the ITC board and was often the only shareholder to raise opinions and questions about the company's operations.

CEO Marroco told analysts that because BAT "does not need to hold more than 25% of the shares in ITC to have strategic influence and veto power," the consideration for divestment was mainly based on "cost-effectiveness."

However, over the past year, BAT has also stumbled in selling and divesting. In September 2023, BAT, which had been looking to exit the Russian market, finally sold its assets to a consortium led by a local Russian management team, ending a transaction process that lasted for 18 months. However, in a later update on December 6, Marroco stated that BAT had suffered significant losses in the sale of its Russian and Belarusian assets, and that the proceeds BAT received accounted for only a small part of the true value of its businesses in Russia and Belarus.

2FIRSTS inquired with BAT's public relations staff in Singapore whether there were any more public divestment plans, but had not received a response by the time of publication. The losses from the sale of Russian and Belarusian businesses can be expected to make British American Tobacco act more cautiously in the following period.

In contrast to the contraction trend in tobacco business, BAT's investment arm, Btomorrow Ventures (BTV), is exploring more investment areas. Since its establishment in 2020, BTV has completed 25 investments, with funds mainly flowing to consumer-led innovative technology and sustainable development fields.

In addition, in 2023, BAT's subsidiary The Water Street Collective Ltd piloted a series of its own functional beverage brands Ryde in the Australian and Canadian markets; it also signed a joint venture agreement with Charlotte's Web through a subsidiary.

Whether BAT will gradually reduce its reliance on the tobacco sector in the capital market through diversified investments is worth watching.

2FIRSTS will continue to follow BAT's movements in the capital market and the market share of new types of products.