In just four months from October 2023 to the present, FLAVA, the top e-cigarette distributor in the Philippines, has faced two major raids due to allegations of tax evasion and selling illegal e-cigarettes. Over 4.5 million e-cigarettes have been seized in total, and the company is facing hefty fines.

According to sources within the industry, after FLAVA was investigated for the second time, the company's CEO Gen Fabro announced during a live broadcast that the company had gone bankrupt, and he stated that he had already traveled to Hawaii.

However, despite the CEO of FLAVA declaring bankruptcy during a live broadcast, the company's official account on the social platform Instagram has remained active, suggesting that the company is still operating as usual. Therefore, some speculate that FLAVA may have the possibility of making a comeback and returning to its former glory.

However, in reality, FLAVA faced a fine of 7.3 billion pesos (approximately 940 million yuan, 130 million USD) when it was first confiscated, and a larger scale confiscation on the second time increased the amount of the fine even more drastically. More importantly, on March 14, the Philippine House of Representatives' committee on finance called on the Department of Trade and Industry and the Bureau of Internal Revenue to immediately revoke FLAVA's business license and production permit.

FLAVA's attempts to make a comeback will not be an easy task.

The old king has departed, and a new king has ascended. The crisis faced by FLAVA also signifies the beginning of a new round of restructuring in the Philippines' e-cigarette market.

"New King" SHFT

After FLAVA fell into deep trouble, two other well-known distributors in the Philippines, DENKAT and SHFT, immediately gained attention. Industry insiders believe that DENKAT and SHFT could potentially be the ultimate beneficiaries, with one even possibly becoming the "new king.

However, sources familiar with the e-cigarette market in the Philippines have stated that DENKAT's business style has always been "steady" and they have not taken much action following the FLAVA incident. Additionally, due to DENKAT's close partnership with FLAVA and suspicions of involvement in FLAVA's smuggling activities, they may currently be facing legal action from customs authorities. In contrast, SHFT was not implicated in the FLAVA incident and has instead actively expanded its distribution channels and shown strong growth momentum after FLAVA fell into trouble. Therefore, many industry insiders speculate that SHFT is likely to become its successor after FLAVA's decline.

It is reported that SHFT was founded by real estate developers and casino operators from the Philippines, with strong backing. In China, SHFT's manufacturing factory is an "unknown small factory," and the relationship between the two is very close. According to a trademark search, 2FIRSTS found that SHFT's trademark was registered in January 2021 by a Shenzhen e-cigarette company, Zhengde Hanyuan (Shenzhen) Technology Co., Ltd, which is likely the Chinese factory collaborating with SHFT.

Another point worth mentioning is that although it is commonly referred to as "SHIFT" within the industry, and its brand logo also resembles "SHIFT", its trademark name and official brand name are both "SHFT".

Will Brand Landscape be Disrupted?

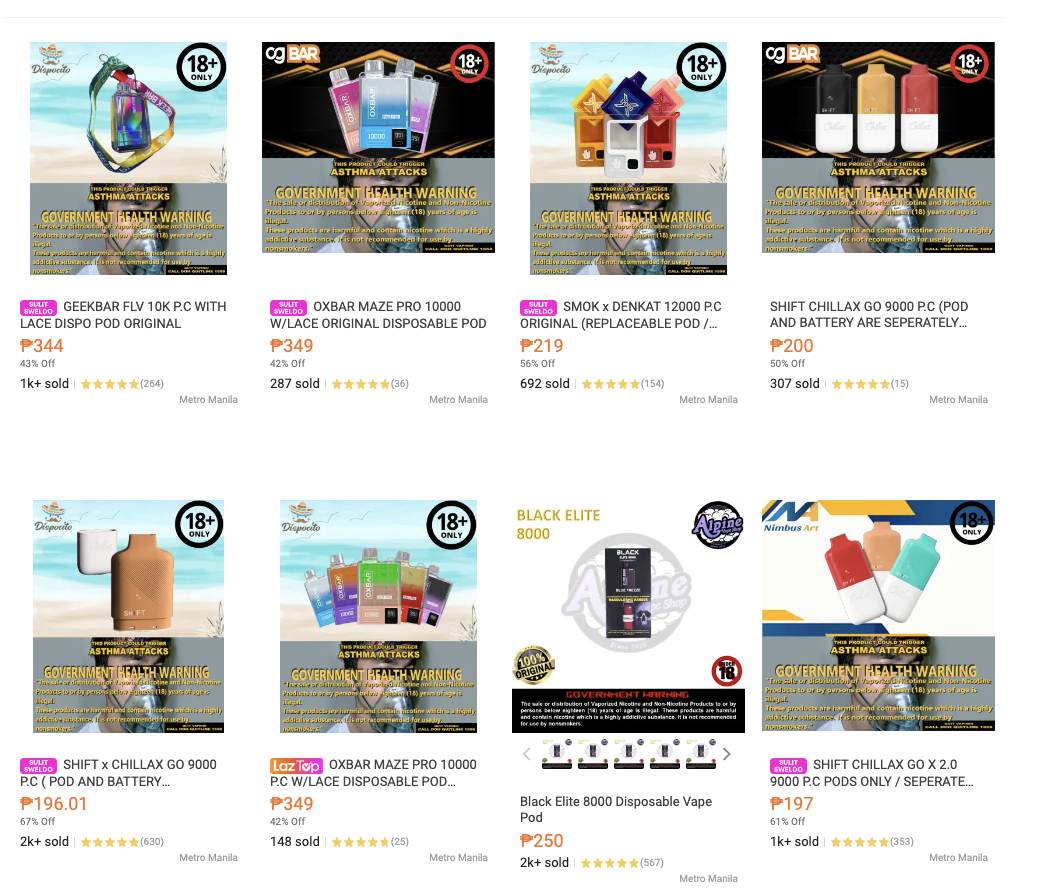

Brands entering the Philippine market include those cooperating with FLAVA such as OXVA, ROMIO, GEEK BAR, FLONQ, and NIMMBOX, as well as those collaborating with SHFT like LEVELBAR and FREEZY. Additionally, well-known brands like LOSTMARY, RELX, SMOK, and Snowplus have also entered the Philippine market.

However, in the Philippines market, the best-selling brands are not the stronger ones like LOST MARY, RELX, and SMOK, but rather OXBAR and ROMIO which are closely tied to FLAVA. Therefore, after FLAVA's troubles, brands closely associated with it will be significantly affected, leading to industry reshuffling.

Based on observations on the public platform of SHFT, it can be noted that the number of brands partnering with them is relatively few and their visibility is low. Some industry insiders have pointed out that these products may belong to the "white label" category, where they are manufactured by OEM factories and sold under the SHFT brand. Given the above situation, there are relatively more opportunities to collaborate with SHFT.

However, some e-cigarette brands have taken the lead in cooperating with SHFT. For example, the well-known e-cigarette brand Chillax in the Southeast Asian region announced on Facebook on January 18 that they have partnered with SHFT, with the SHFT brand logo also printed on their products.

Future Development

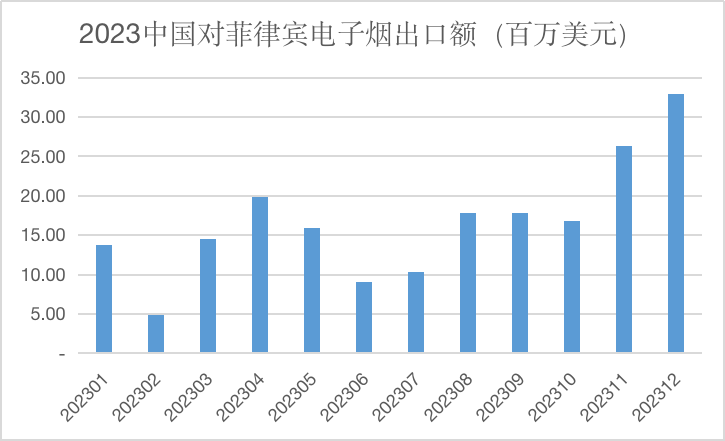

The Philippines is one of the countries with the highest number of smokers in Southeast Asia, with a population of up to 18 million smokers, ranking second in ASEAN and possessing huge market potential. Starting in November 2023, China's exports of e-cigarettes to the Philippines rapidly increased, with a month-on-month growth rate of 56.22%, and further increased by 25.16% in December, showing a continuous upward trend. In the full year of 2023, China's e-cigarette exports to the Philippines reached $200 million.

In July 2022, the Philippines enacted the "Vaporized Nicotine and Non-Nicotine Products Regulation Act" (RA 11900), making it one of the few countries in Southeast Asia with clear policies on e-cigarettes. Despite some restrictions on packaging and flavors, the Philippine government overall appears to have a relatively friendly attitude towards e-cigarette products.

It is worth mentioning that the Department of Trade and Industry in the Philippines previously called on tobacco companies to produce Heated Tobacco Products (HTP) in the country, demonstrating its openness to new tobacco products.

However, many stakeholders in the Philippine e-cigarette market generally believe that its future development still depends on the direction of policies.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com