In February 2024, Wojciech Konieczny, the Deputy Minister of Health in Poland, stated that the sale of disposable e-cigarettes may be banned before the summer holidays. By July, the Polish government announced plans to pass an amendment to the Health Protection Act in the third quarter, aimed at banning the use of e-cigarettes by individuals under the age of 18.

The Polish Ministry of Health stated that these products pose a significant threat to public health, therefore it is necessary to prohibit the sale of all types of e-cigarettes and refill containers to individuals under the age of 18, regardless of whether the specific product contains nicotine.

Compared to the proposed ban on disposable e-cigarettes, the Polish government's plan for a "ban on nicotine-free sales to minors" seems to be all bark and no bite. According to the Ministry of Health, the stricter legislation will be delayed until next year due to EU scrutiny. The Polish Market Monitoring Center points out that the market share of "zero nicotine" e-cigarettes is very small, with the majority of sales being nicotine-containing products, meaning the Ministry of Health's new proposal only addresses a part of the issue.

Poland, the sixth largest economy in the European Union, is also one of the best performing countries in Eastern Europe. The country has a long history of cigarette use. The latest data shows that the smoking rate in Poland is around 26%, with approximately 8.4 million adults being smokers. In comparison, the EU average smoking rate is 19.7%. E-cigarettes, as an alternative to traditional tobacco smoking, have seen active development in Poland. What are the e-cigarette brands in the Polish market currently? Why did the Polish government's attitude towards disposable e-cigarettes worsen and then suddenly temporary compromise? What role does the international tobacco company play in this situation?

The Ignored Large Market

According to 2023 data from Chinese customs, Poland ranks fourteenth as a destination for Chinese e-cigarette exports, with an export value of $180 million. This places Poland behind the United Arab Emirates and ahead of France. However, the potential of the e-cigarette market in Poland has long been underestimated.

With the increase in health awareness and the growing demand for smoking cessation, more and more Polish people are starting to accept and use e-cigarette products. As a member of the European Union, the basic e-cigarette regulatory policies in Poland are derived from Chapter 20 of the EU Tobacco Products Directive (TPD), providing favorable conditions for the further development of e-cigarette products with relaxed regulation.

As e-cigarette consumption grows, traditional cigarette consumption in the country is also following the global trend by showing a decline.

Poland, along with countries such as Italy, Spain, and Greece, accounts for 99% of tobacco production in the European Union. The country is known for its low-priced tobacco products, but now these cheap prices are facing challenges. According to consultancy firm Euromonitor International, cigarette sales in Poland are expected to decrease by less than 1% in 2023, while price increases will lead to value growth. As cigarette sales decline, Euromonitor International analyst Lina Sidorenke believes:

E-cigarette products, heated tobacco products, and nicotine pouches are showing a significant increase in demand," she also stated, "Closed-system disposable devices are expected to be the strongest winners in growth by 2023.

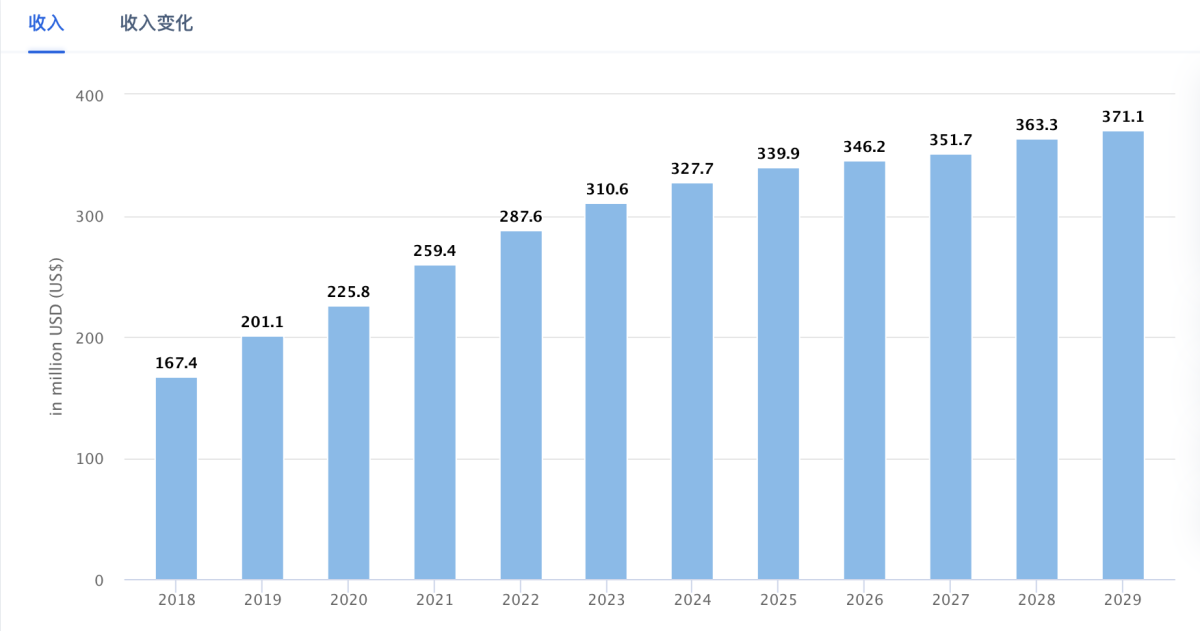

Another research firm, Statistic, predicts that the revenue of Poland's e-cigarette market will reach $3.277 billion in 2024.

Emerging markets are giving birth to new products and brands, such as the disposable e-cigarette brand AROMA KING, based in Warsaw, Poland, which has gained significant recognition in markets like the UK. Additionally, well-known disposable e-cigarette brands like VUSE GO, SMOK, SKE Crystal, and blu are also prevalent in offline markets.

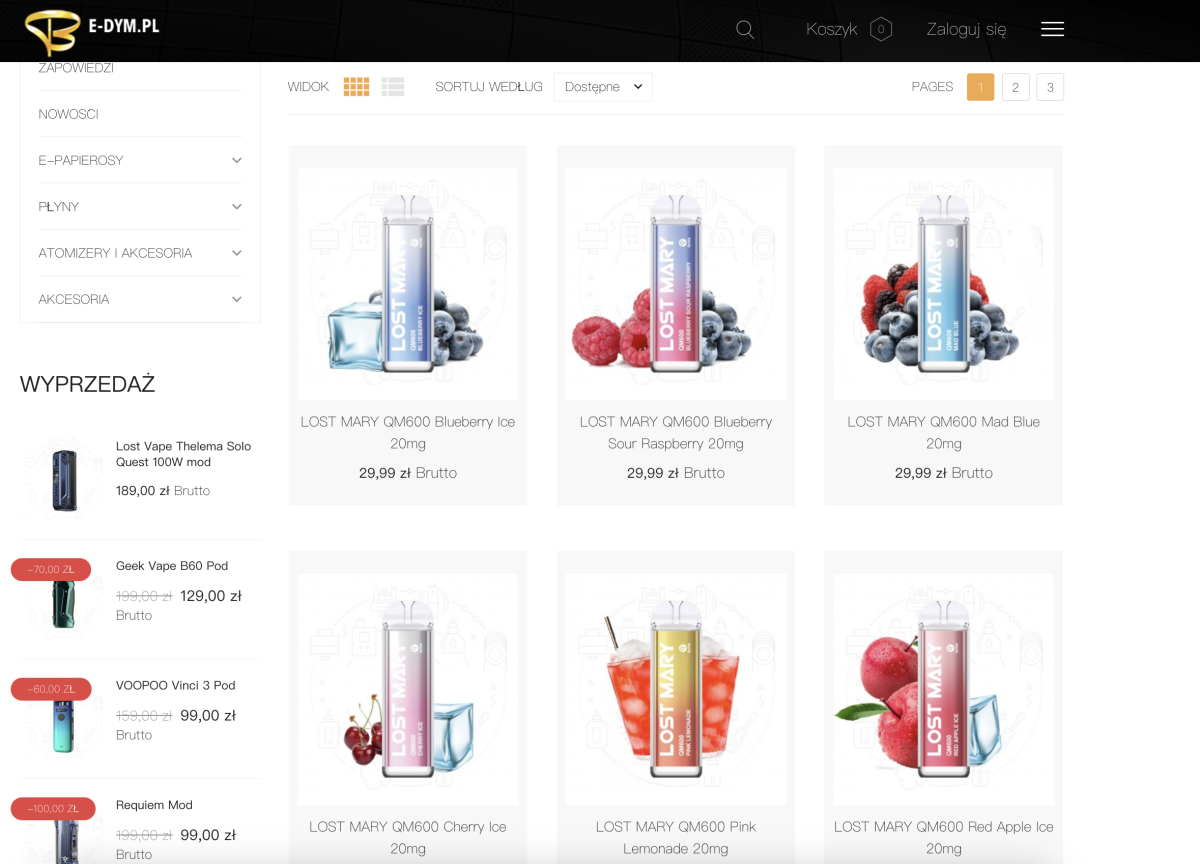

In the online market, brands like LOSTMARY, ELFBAR, SMOK, VOZOL, INSTAFILL, and others have entered numerous online e-cigarette stores.

Unanticipated Regulations

As sales of disposable e-cigarettes rapidly increase, Polish media and regulatory agencies have taken notice of the issue of youth e-cigarette usage, particularly with disposable e-cigarette products. In February of this year, Polish media outlet Rynekzdrowia reported that data showed disposable e-cigarette sales reached 32 million units in 2022, and had surpassed 100 million units by 2023.

Director of the Public Health Department Dariusz Poznański pointed out that Poland is among the top European Union countries for the usage of e-cigarettes among children and teenagers. Data shows that before the age of 18, one in every four individuals uses e-cigarettes. Even though Poland has clearly prohibited the sale of tobacco products, e-cigarettes, and refill containers to individuals under the age of 18 in the amendment to the "Health Protection from the Consequences of Tobacco and Tobacco Products Use" law, these measures seem to have had little effect.

Therefore, the Polish government's public health sector has begun strict regulations on this type of product, with signals indicating a ban. In February 2024, Health Minister Izabela Leszczyna announced that the sale of disposable e-cigarettes is being considered for prohibition.

Considering that as many as 64% of young people have had "exposure" to this product, there is hope to implement this measure through legislation as quickly as possible.

According to Sidorenko, an analyst at Euromonitor International, if Poland follows the lead of countries like the UK in implementing a ban on disposable e-cigarettes, it would have a significant impact on the overall e-cigarette market landscape.

Isabella's "measures" were supposed to be introduced in April for legislative work, but this legislation faced opposition from all sides, as the current ban on disposable products in other countries has not effectively addressed the issue of underage use. For example, in Australia, which was one of the first countries to implement strict tobacco policies internationally, a lack of enforcement has led to as many as 92% of e-cigarette users purchasing products from the black market.

The President of the Polish e-cigarette Employers' Alliance (ZPBV), Maciej Powroźnik, stated that public discussions about banning the sale of disposable e-cigarettes lack expertise, as most media reports tend to downplay the products and repeat unverified information.

He criticized that the media is ignoring the potential negative impacts on public health and the economy that the ban on e-cigarettes may bring, emphasizing that a complete ban on e-cigarettes could lead to government financial losses and force many legally operating companies to close, thereby restricting access to products that have been tested and meet safety requirements for adult consumers. This could lead to an increase in public health risks.

At the same time, he cited a study from the Yale School of Public Health indicating that restrictions on e-cigarette sales would not only lead to an increase in traditional tobacco product sales, but also foster dependence on conventional cigarettes.

At the same time, some opinions point out that there are about 8.4 million traditional tobacco product smokers in Poland, with nearly one third of adults smoking every day, while only 1% of people use e-cigarettes. Although e-cigarettes are growing in popularity, they are still not the mainstream tobacco product, as cigarettes are.

Tobacco Companies Wielding Influence

In the issue of e-cigarettes and minors, British American Tobacco (BAT) was the first to speak out. Blagoje Jovanovic, the company's general manager in Poland, stated that they have always been strongly against providing nicotine products to minors.

British American Tobacco (BAT) is calling on all sellers and their employees, including those selling e-cigarettes, heated tobacco products, smokeless tobacco pouches, nicotine e-liquids, and a variety of accessories used for consuming nicotine products, to take proactive and responsible action by refusing to sell to minors.

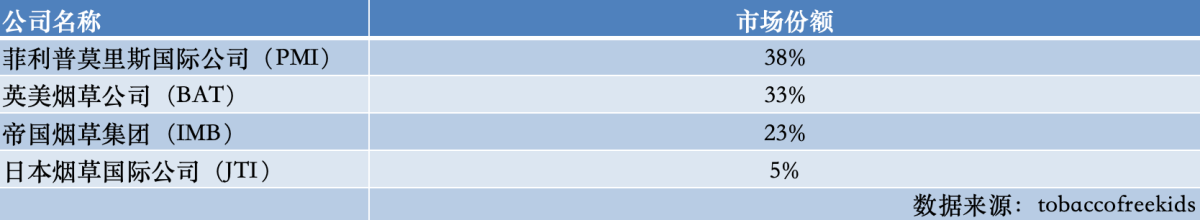

The four major international tobacco companies have subsidiaries and factories in Poland. According to the report "Tobacco Hazards in Poland" by the anti-smoking organization tobaccofreekids, international tobacco companies hold nearly 99% of the cigarette market share. Philip Morris International (PMI) holds 38% of the market share, followed by British American Tobacco (BAT) with 33%, Imperial Brands (IMB) with 23%, and Japan Tobacco International (JTI) with 5%.

These dominant companies in the tobacco market have shifted their focus toward emerging tobacco products, especially heated tobacco products with stronger patent barriers. According to Japan Tobacco International estimates, the heated tobacco products market in Poland is very active, currently accounting for over 10%. In Warsaw, this proportion has surpassed 25%, with a market value estimated at 4.8 billion zloty (approximately 1.2 billion dollars).

On September 13, 2023, PMI, the largest tobacco company in Poland, announced a new investment plan exceeding 1 billion zloty (approximately $2.31 billion) to be implemented in Poland. The investment will be used for production of the latest IQOS ILUMA heated tobacco pods at the factory in Krakow.

PMI's North and East Europe Regional President Michal Mierzejewski said:

Poland has always held an important position in our strategic plans.

Mielejevski said that since 1996, PMI has invested 25.5 billion zloty (about 5.8 billion USD) in Poland for continuous transformation of the factories in Krakow and upgrading of the Krakow research and development center.

On September 27, JTI announced that it will be increasing its investment in Poland to $1.3 billion, and promoting its heated tobacco device, PloomX. The innovative tobacco product factory located near Lodz in Stare Gostków is increasing the production of tobacco sticks for the PloomX device to meet the growing demand for these products in Poland and around the world.

Yan Sobolevskyy, Operations Director of JTI's factory in Poland, has stated that JTI is expected to further invest significantly in the production of innovative products and in the entire production center in the old town of Gostków.

On January 26th of this year, Sandra Magdziak, the General Manager of the Polish branch of the Imperial Tobacco Group, revealed that the company plans to further invest in achieving automation of equipment and sustainability goals.

Mandiaque pointed out that the company's total investment in the Talnef-Podgórzy factory has exceeded 1.5 billion złoty. This factory in Poznań is the largest among its 20 factories, and Imperial Tobacco has carried out large-scale modernization of the factory, including expanding the production workshop, building a brand new fully automated high-rack warehouse, and continuously improving the factory's production capacity.

In addition to the competition in heated tobacco products, these tobacco companies have also established standards for nicotine pouch products. As Poland has not yet introduced regulations on nicotine pouches and other products, in September 2023, British American Tobacco Trading Poland, Imperial Tobacco Poland, Philip Morris Distribution Poland, and Swedish Match signed market supervision guidelines for tobacco-free nicotine pouches, which standardized the standards for tobacco-free nicotine pouches.

The agreement includes: setting rules for marketing communication, applicable only to adults; recommending that the nicotine content per pouch does not exceed 20 milligrams; placing health warnings on packaging; and information on the packaging about product ingredients, nicotine content, pouch weight, and production date and shelf life, etc.

This guideline was signed by nicotine pouch manufacturers and is a spontaneous industry consensus. From the increased investment in heated tobacco to the joint construction of market supervision standards for nicotine pouches, international tobacco companies led by Philip Morris International are not only maintaining their advantage in the cigarette field but also grasping the discourse on future new products.

Governments that Impose High Taxes on Tobacco

Although Poland's legislation on disposable e-cigarettes has been postponed until next year, Izabela Lashchina, who is in charge of policy, seems to be a Health Minister who is pursuing a complete ban on disposable e-cigarette products.

Born in 1962, she graduated from Jagiellonian University and has been a Polish teacher since 1996. She entered politics in 2007 and has served as a Member of Parliament of the Republic of Poland for five consecutive terms. In 2013, she was selected by then-Prime Minister Donald Tusk to join the cabinet as the Vice Chairman of the Public Finance Committee of the 9th House of Representatives. In 2023, at Tusk's request, she served as the Minister of Health.

The plan to ban e-cigarettes proposed this time also involved the Ministry of Finance where she used to work, but her goal is to completely ban the sale of such e-cigarette products and to get the Council of Ministers to agree to her plan. It is worth noting that the power to ban the sale of e-cigarettes is not entirely in her hands; the Minister of Finance, Andrzej Domański, must also agree to this solution.

But for now, the Ministry of Finance and the Ministry of Health have reached a preliminary result on this issue. On July 4th, Izabela said on a TV program that she told the Minister of Finance that the consumption tax on alcohol and cigarettes should be increased. She added that the Ministry of Finance's analysis shows that cigarettes and spirits in Poland are the cheapest in Europe, trying to use tax and other means to curb the popularity of tobacco products in the country.

By July 9th, at an entrepreneurs' conference, participants from the Polish Ministry of Finance announced the upcoming implementation of plans to increase the consumption tax on cigarettes and other tobacco products from January 1, 2025.

The specific tax increase plan is as follows:

- Cigarettes: The consumption tax will increase by 25%

- Cigarette tobacco: The consumption tax will increase by 38%

- Innovative products (such as heated tobacco): The consumption tax will increase by 50%

- E-cigarettes: The consumption tax will increase by 75%

According to this plan, by 2025, the price of a pack of cigarettes will reach 20 złoty (5 USD). Entrepreneurs expressed surprise at the scale of the tax increase, with the largest increase for e-cigarettes, which will be 75% by 2025, 50% by 2026, and 25% by 2027, a total increase of 150%. Overall, in the next three years, the consumption tax for all tobacco products will increase as follows:

- Cigarettes: A total increase of 60% (25%, 20%, 15%)

- Cigarette tobacco: A total increase of 90% (38%, 30%, 22%)

- Innovative products (such as heated tobacco): A total increase of 85% (50%, 20%, 15%)

- E-cigarettes: A total increase of 150% (75%, 50%, 25%)

Cidorenko predicts that in the next five years, the tobacco and nicotine market is expected to develop towards the development of the next generation of novel products, at the expense of traditional cigarettes and smoking tobacco. However, in front of the slow trend, the Polish government is now ready to counter with higher taxes.

In an interview on July 4th, Izabela acknowledged that the legislative process for the ban on the sale of disposable e-cigarettes will take longer. She pointed out that the draft amendment to ban the sale of non-nicotine disposable and reusable e-cigarettes to children and adolescents under 18 has been included in the legislative and program work list of the Council of Ministers.

Her official added:

"In this bill, we will also ban the online sale of such e-cigarettes and their advertising. Children, adolescents, and even their parents must not think that they are inhaling a watermelon flavor when in fact they are inhaling toxic substances."

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com